User Reviews

More

User comment

12

CommentsWrite a review

2025-06-12 23:23

2025-06-12 23:23

2024-08-05 10:14

2024-08-05 10:14

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Influence

Add brokers

Comparison

Quantity 1

Exposure

Score

Regulatory Index0.00

Business Index6.07

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

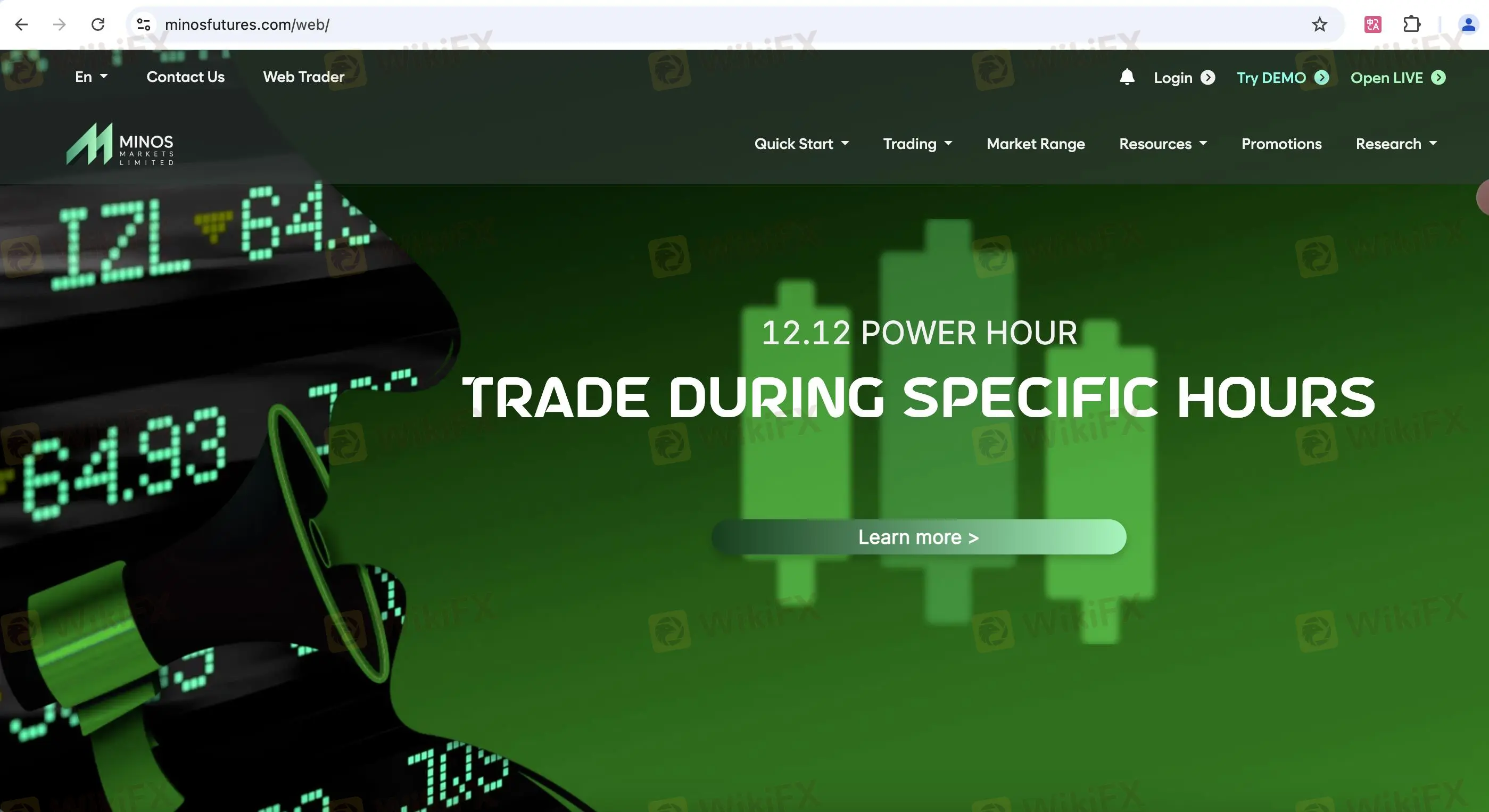

Minos Limited

Company Abbreviation

Minos Limited

Platform registered country and region

Saint Vincent and the Grenadines

Company website

Company summary

Pyramid scheme complaint

Expose

| Minos Limited Review Summary | |

| Founded | 2022 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | Not regulated |

| Market Instruments | Commodities, grains, precious metals and energies |

| Demo Account | ✅ |

| Leverage | Up to 1:500 |

| Spread | From 2.0 pips (Standard account) |

| Trading Platform | cTrader |

| Min Deposit | $100 |

| Customer Support | 24/5 support |

| Tel: +971 4 362 2222 | |

| Email: support@minosfutures.com | |

| Address: 1 Commercial Road, Georgetown, St Vincent & the Grenadines, 116th floor Burj Khalifa, Corporate Suites, Downtown - Dubai - United Arab Emirates | |

Founded in 2022, Minos is an unregulated broker registered in Saint Vincent and the Grenadines. It provides many trading assets, like commodities, grains, precious metals and energies with leverage up to 1:500 and spread from 2.0 pips on the Standard account throught cTrader platform. Demo accounts are available and the minimum deposit requirement is $100.

| Pros | Cons |

| Various trading assets | Not regulated |

| Demo accounts offered | Wide spreads |

| Multiple account types | No MT4/5 |

| cTrader platform | No popular payment options |

| Deposit and withdrawal fee charged |

No, Minos Limited operates without regulation. It also claims it is regulated by FSA and NFA. However, there is no information on the two websites. It means Minos Limited is not supervised by any financial authorities. Please be aware of the risk!

| Tradable Instruments | Supported |

| Commodities | ✔ |

| Grains | ✔ |

| Precious metals | ✔ |

| Energies | ✔ |

| Forex | ❌ |

| Indices | ❌ |

| Stocks | ❌ |

| Cryptos | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

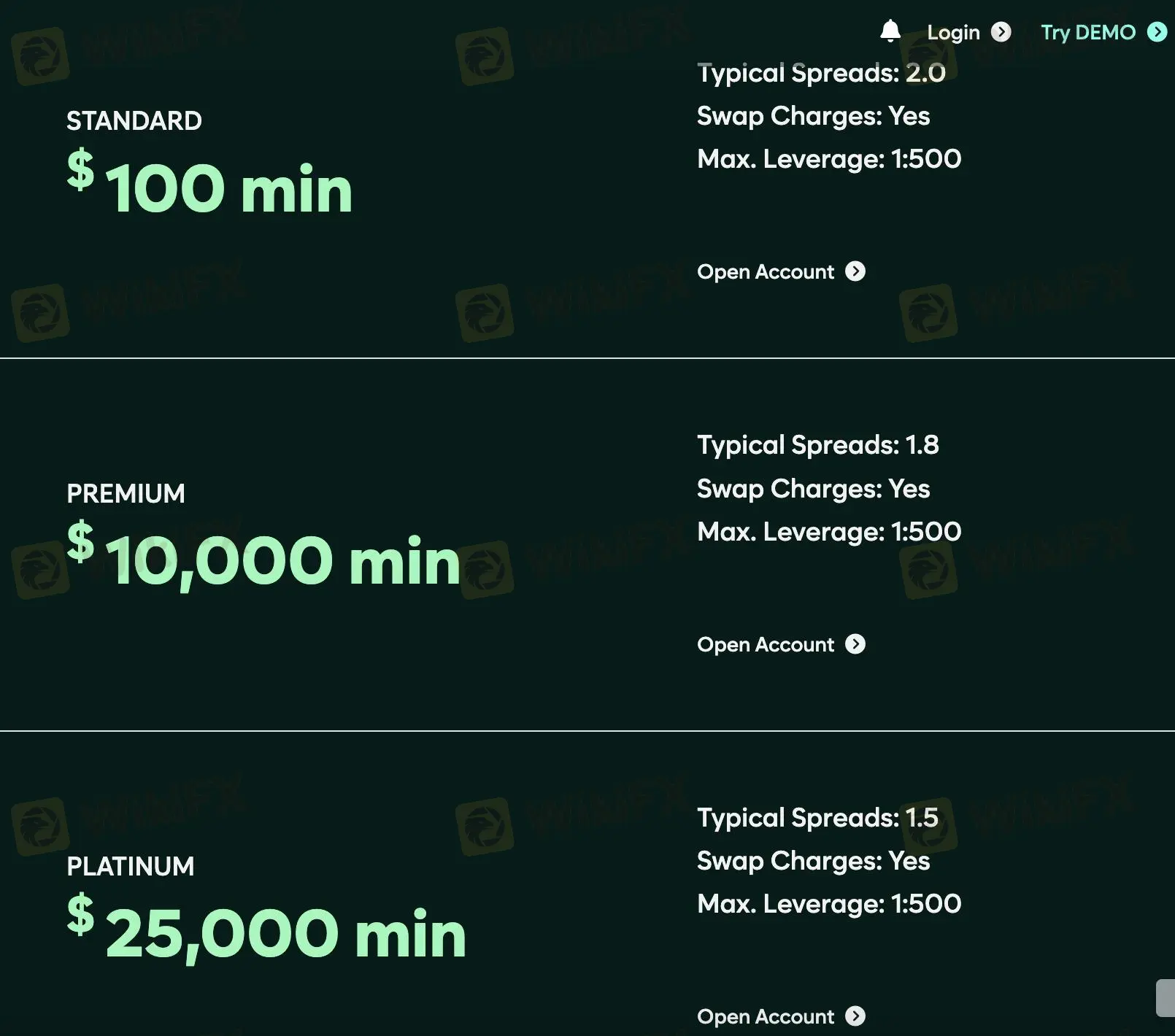

Minos Limited offers three account types: Standard, Premium and Platinum.

| Account Type | Min Deposit |

| Standard | $100 |

| Premium | $10 000 |

| Platinum | $25 000 |

Minos Limited's leverage is up to 1:500. The higher the leverage, the more the returns and losses.

Minos Limited's spreads varies by the accounts. The standard account's spread starts from 2.0 pips, the premium starts from 1.8 pips and the platinum starts from 1.5 pips.

Besides, commission can be reduced to $35 per $1million traded.

| Account Type | Spread |

| Standard | From 2.0 pips |

| Premium | From 1.8 pips |

| Platinum | From 1.5 pips |

| Trading Platform | Supported | Available Devices | Suitable for |

| cTrader | ✔ | Desktop, Mobile & Tablets and Web | Experienced traders |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

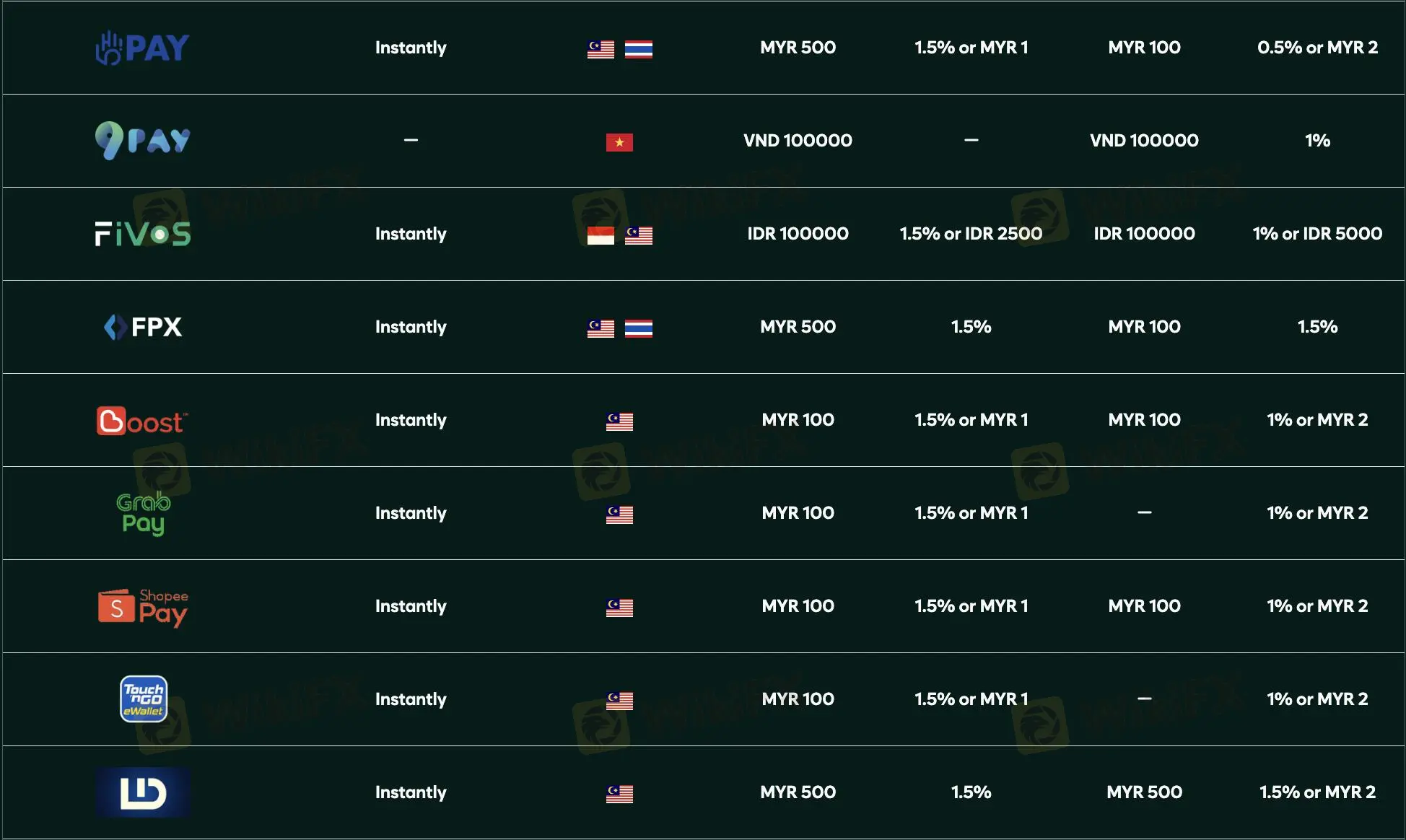

Minos Limited supports deposits and withdrawals via 9pay, 5pay, ewallet, shopee pay, grab pay and FPX.

| Payment Option | Min Deposit | Deposit Fee | Min Withdraw | Withdrawal Fee | Processing Time |

| 9pay | VND 100 000 | / | VND 100 000 | 1% | / |

| 5pay | MYR 500 | 1.5% or MYR 1 | MYR 100 | 0.5% or MYR 2 | Instantly |

| Ewallet | MYR 100 | 1.5% or MYR 1 | / | 1% or MYR 2 | |

| Shopee pay | MYR 100 | ||||

| Grab pay | / | ||||

| FPX | MYR 500 | 1.5% | MYR 100 | 1.5% |

More

User comment

12

CommentsWrite a review

2025-06-12 23:23

2025-06-12 23:23

2024-08-05 10:14

2024-08-05 10:14