User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

15-20 years

15-20 yearsRegulated in Hong Kong

Derivatives Trading License (AGN)

Suspicious Scope of Business

Medium potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index6.54

Business Index8.00

Risk Management Index8.22

Software Index5.89

License Index6.19

Single Core

1G

40G

| Telecom King SecuritiesReview Summary | |

| Founded | 2019 |

| Registered Country/Region | Hong Kong |

| Regulation | SFC |

| Market Instruments | Securities, Stocks |

| Demo Account | ❌ |

| Leverage | / |

| Spread | / |

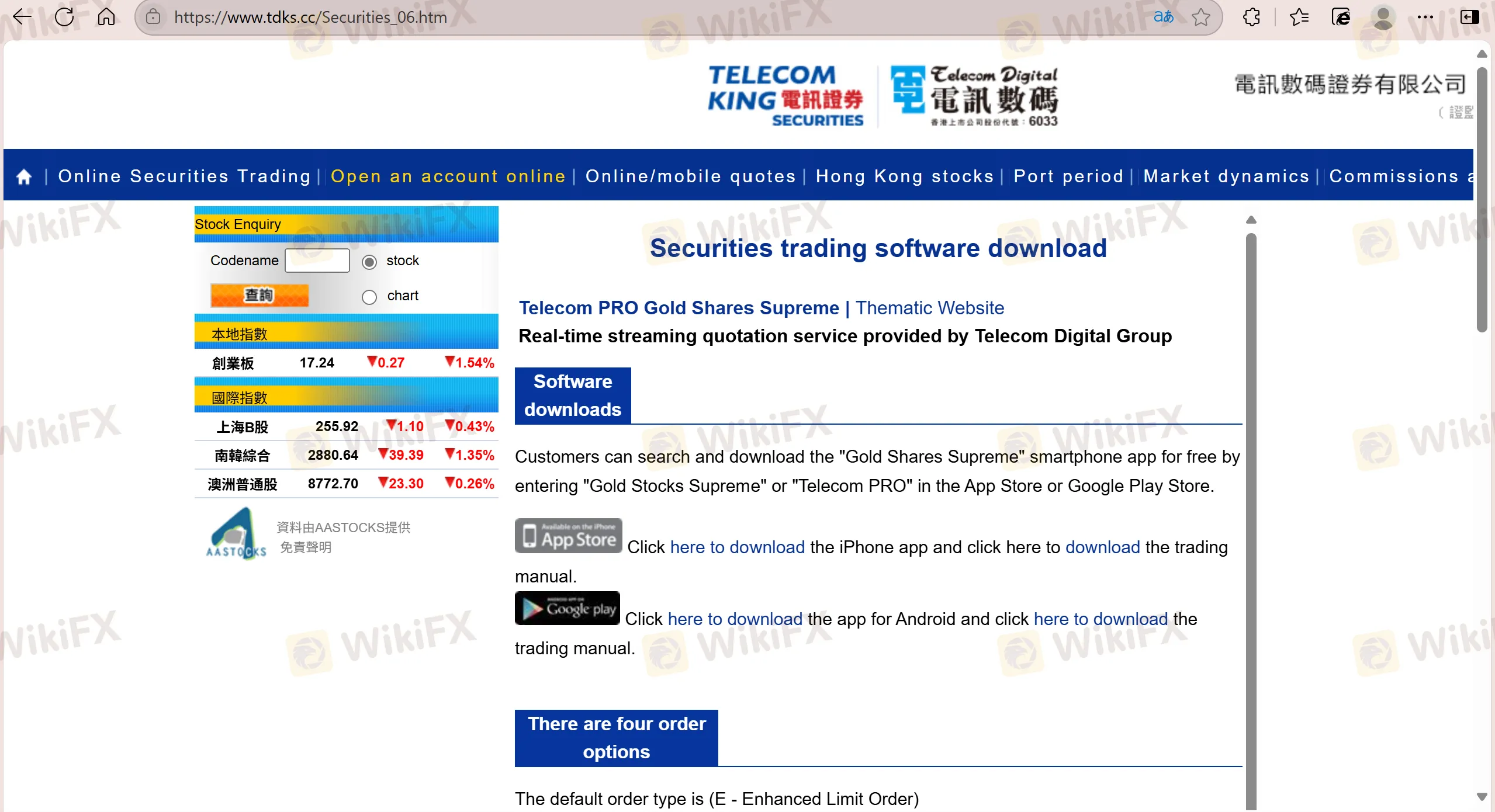

| Trading Platform | Telecom PRO |

| Minimum Deposit | / |

| Customer Support | Phone: (852) 8118-1133 or (852) 7333-1133 |

| Email: info@81181133.com | |

| Physical Address: Room 1202, 12 / F, Telecom Digital Building, 58 Chun Yip Street, Kwun Tong, Kowloon, Hong Kong | |

Telecom King Securities was registered and established in 2019. It supports trading securities and Hong Kong stocks and provides its own trading platform for traders. It is currently regulated by the SFC.

| Pros | Cons |

| Be regulated | No specific account information |

| Fees charged | |

| Limited trading products |

| Regulated Authority | Regulatory Status | Regulated Country/Region | Regulated Entity | License Type | License Number |

| Securities and Futures Commission of Hong Kong (SFC) | Regulated | Hong Kong | Telecom King Securities Limited | Dealing in futures contracts | API286 |

Telecom King Securities mainly supports your trading of securities and Hong Kong stocks.

| Tradable Instruments | Supported |

| Securities | ✔ |

| Stocks | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Bonds | ❌ |

| ETFs | ❌ |

Telecom King Securities did not provide specific account information.

| Item | Fee (HKD) | Remarks |

| Securities Trading Services | ||

| Brokerage Fee | Phone: 0.15% of each order transaction value<br>Online & Smart Watch: 0.05% of each order transaction value | Minimum fee \$50.00<br>Minimum fee \$25.00 |

| Stamp Duty (Hong Kong Government Levies) | 0.1% of each transaction value, less than \$1.00, also calculated as \$1.00 | |

| Transaction Fee (SFC Levies) | 0.0027% of each transaction value (rounded to the nearest cent) | |

| Transaction Fee (HKEX Levies) | 0.0056% of each transaction value (rounded to the nearest cent) | |

| Exchange Transaction Fee (Financial Services Bureau Levies) | 0.00015% of each transaction value (rounded to the nearest cent) | |

| Transaction Fee | 0.005% of each order transaction value (including 0.002% charged by HKEX)<br>Minimum charge \$5.00, maximum charge \$100.00 | |

| Physical Stock and Collection Services | ||

| Physical Stock Transfer Fee | \$5.00 per stock certificate | |

| Physical Stock Withdrawal | (i) Per share \$3.50 and<br>(ii) Handling fee \$100.00 | (i) Minimum charge \$30.00, fractional shares also count as one hand<br>(ii) Per withdrawal per stock charge \$500.00 |

| Transaction Instruction | Free for deposits, \$500.00 per withdrawal per stock per time | |

| Investor Transaction Instruction | Free for deposits, charge 0.01% of the closing price on the previous day for withdrawals | Minimum charge \$20.00, maximum charge \$500.00 |

Telecom King Securities offers its own trading platform Telecom PRO, which can be used on mobile devices.

| Trading Platform | Supported | Available Devices | Suitable for |

| Telecom PRO | ✔ | Mobile | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

The main deposit methods are as follows:

Traders can use EDDA to make quick deposits or transfer funds to Telecom Digital Securities Limited via a computer or mobile application.

Withdrawal method:

Traders must fill out the delivery check/check instruction form, obtain the withdrawal instruction form, and fax it to (852)811-0033/2418-2323 or email it to our company at (852)811-1133 for oral instructions. The automatic transfer or delivery check will be directly deposited into the trader's bank account.

Traders only need to complete and sign the customer withdrawal instructions, and bring them along with their passbooks to the company headquarters at (852)811-0033/2/418-2323 or go to the bank in person to handle it. They can either go to the bank in person or call the withdrawal instruction form on the date of registration to collect the check.

Traders can deposit or transfer stocks with the following instructions:

Traders can fill in the physical stock transfer deposit form and must sign the “Physical Stock Deposit Instruction Form” and the “Transfer Form” (stocks can only be traded after being instructed by the share registration company or receiving instructions, which takes eight working days).

Traders can sign the “Settlement Instruction/Investor Settlement Instruction Form”, return it or fax it to (852)811-0033/2418-2323, where the company's headquarters will handle it on their behalf.

Traders can withdraw or transfer stocks from the Company through the following channels:

Traders must sign the “Instruction Form for Withdrawing Physical Stocks”, return it to the bank or mail it to the bank for processing on their behalf. The application process takes approximately three working days. Once the procedures are completed, the client can withdraw the physical stocks with the deposited funds.

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment