User Reviews

More

User comment

1

CommentsWrite a review

2023-03-24 14:20

2023-03-24 14:20

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

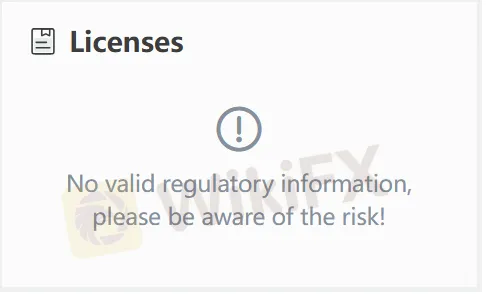

Regulatory Index0.00

Business Index7.37

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

| ARBReview Summary | |

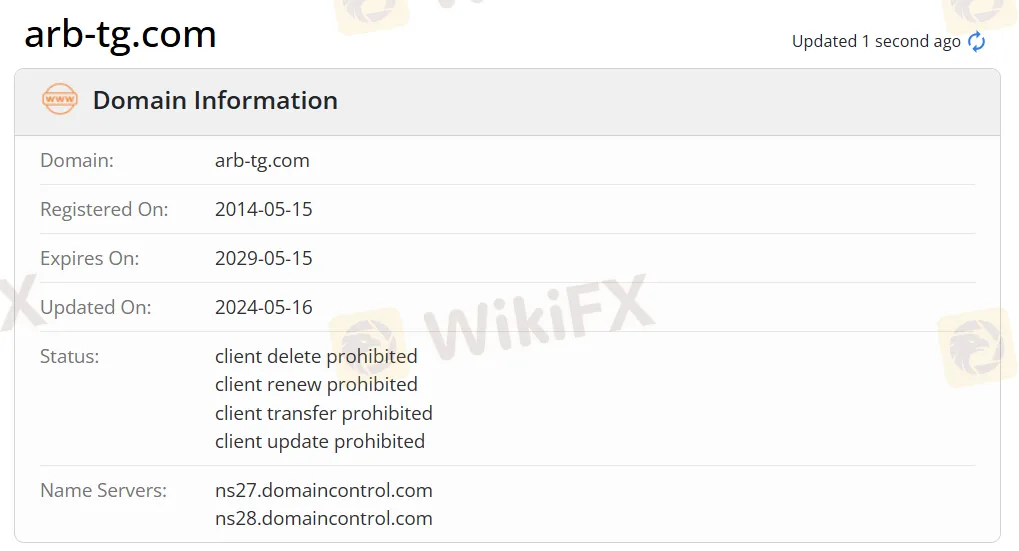

| Founded | 2014 |

| Registered Country/Region | United States |

| Regulation | No regulation |

| Market Instruments | Cryptos |

| Demo Account | ❌ |

| Leverage | / |

| Spread | / |

| Trading Platform | / |

| Minimum Deposit | / |

| Customer Support | Email: info@arb-tg.com |

| Facebook, LinkedIn | |

ARB is a broker which was registered in the United States. The tradable instruments include cryptos. The broker also provides global exchanges such as ASX, CBOE, CBOP, CME Group, EURONEXT, Ice, London Metal Exchange, NYSE, and more. However, ARB is still risky due to its unregulated status.

| Pros | Cons |

| 24/7 customer support | Unregulated |

| Global exchanges offered | Lack of transparency |

| Limited trading products |

ARB is not regulated, making it less safe than regulated brokers.

| Tradable Instruments | Supported |

| Cryptos | ✔ |

| Commodities | ❌ |

| Stocks | ❌ |

| Forex | ❌ |

| Futures | ❌ |

| ETFs | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

ARB continuously maintains a trading infrastructure to support trading strategies, optimal network performance, and superior technical oversight to remain compliant and competitive.

ARB accepts ASX, CBOE, CBOP, CME Group, EURONEXT, Ice, London Metal Exchange, NYSE, and more for global exchanges.

More

User comment

1

CommentsWrite a review

2023-03-24 14:20

2023-03-24 14:20