User Reviews

More

User comment

2

CommentsWrite a review

2023-03-02 10:23

2023-03-02 10:23

2022-12-09 10:33

2022-12-09 10:33

Score

15-20 years

15-20 yearsSuspicious Regulatory License

Suspicious Scope of Business

Cyprus Market Making License (MM) Revoked

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index8.00

Risk Management Index0.00

Software Index4.00

License Index0.00

Single Core

1G

40G

More

Company Name

Xtrade Europe LTD

Company Abbreviation

OffersFX

Platform registered country and region

Cyprus

Company website

Company summary

Pyramid scheme complaint

Expose

| Aspect | Information |

| Company Name | OffersFX |

| Registered Country/Area | Cyprus |

| Founded Year | 5-10 years |

| Regulation | Cyprus Securities and Exchange Commission (CySEC) |

| Minimum Deposit | $200 |

| Maximum Leverage | Up to 30:1 |

| Spreads | Competitive fixed spreads (specific spreads may vary depending on account type and instrument) |

| Trading Platforms | OffersFX WebTrader, mobile trading app,tablet trading app |

| Tradable Assets | CFDs, Indices, Commodities, Shares, Forex |

| Account Types | Standard, Premium, Platinum, VIP |

| Customer Support | 24/5 customer support |

| Deposit & Withdrawal | Credit/debit cards,Bank transfers,Electronic wallets |

| Educational Resources | Extensive educational resources including training materials, courses, e-books, video tutorials, webinars, daily reports, signals, economic calendar, and more |

OffersFX is a brokerage firm operating out of Cyprus. While the exact founding year is 5-10 years ago, OffersFX is regulated by the Cyprus Securities and Exchange Commission (CySEC), which adds a layer of credibility and oversight to its operations.

Traders looking to start with OffersFX have various account types to choose from, including Standard, Premium, Platinum, and VIP. The minimum deposit required varies depending on the chosen account, with the Standard Account requiring $200 and the VIP Account necessitating a substantial $25,000 deposit.

Traders have access to a wide range of tradable assets, including Contracts for Difference (CFDs), indices, commodities, shares, and forex pairs. The broker offers a robust suite of educational resources, including training materials, courses, e-books, video tutorials, webinars, daily reports, signals, and an economic calendar to assist traders in enhancing their knowledge and skills.

OffersFX operates under the regulatory oversight of the Cyprus Securities and Exchange Commission (CySEC). As of its current status, OffersFX is a regulated entity, holding a Market Making (MM) license issued by CySEC under License No. 108/10.

The company, Merba Limited, is the licensed institution responsible for managing OffersFX. This regulation has been in effect since January 14, 2010, ensuring compliance with industry standards and investor protection.

| Pros | Cons |

| Competitive fixed spreads | Higher minimum deposits for some accounts |

| Regulated by CySEC | Lack of cryptocurrency trading |

| Plenty of educational resources | Risk of trading with leverage |

| Multiple account options | Limited market analysis and insights: |

| 24/5 customer support |

Pros:

Competitive Fixed Spreads: OffersFX provides competitive fixed spreads, which can be advantageous for traders as it allows for predictable and consistent trading costs. Fixed spreads mean that the difference between the buying and selling prices remains constant under normal market conditions.

Regulated by CySEC: Being regulated by the Cyprus Securities and Exchange Commission (CySEC) is a positive aspect, as it implies that OffersFX operates under the oversight of a reputable regulatory authority. This regulatory oversight can enhance the trust and security of traders.

Plenty of Educational Resources: OffersFX offers a wealth of educational resources, which can be beneficial for both novice and experienced traders. These resources may include training materials, courses, e-books, video tutorials, webinars, and more, helping traders improve their knowledge and skills.

Multiple Account Options: OffersFX provides various account types to cater to different trading preferences and experience levels. Multiple account options ensure that traders can choose the one that aligns best with their specific needs and goals.

24/5 Customer Support: Having access to customer support around the clock, five days a week, is valuable for traders. It means that assistance and guidance are available whenever traders need it, enhancing the overall trading experience.

Cons:

Higher Minimum Deposits for Some Accounts: While OffersFX offers multiple account types, some of them require higher minimum deposits. This might limit access for traders with smaller budgets, as they may not be able to meet the minimum deposit requirements for certain accounts.

Lack of Cryptocurrency Trading: OffersFX does not appear to offer cryptocurrency trading, which may be a limitation for traders interested in the cryptocurrency market. Cryptocurrencies have gained popularity as tradable assets, and their absence from the platform could deter some traders.

Risk of Trading with Leverage: OffersFX mentions the availability of leverage, which can magnify both profits and losses. While leverage can be a useful tool, it also increases the risk of significant capital loss if market movements go against the trader. Traders need to exercise caution and understand the risks associated with leverage.

Limited Market Analysis and Insights: The platform's offering of market analysis and insights appears to be limited. Comprehensive market analysis and insights can assist traders in making informed decisions, and a lack of such resources might be a drawback for some.

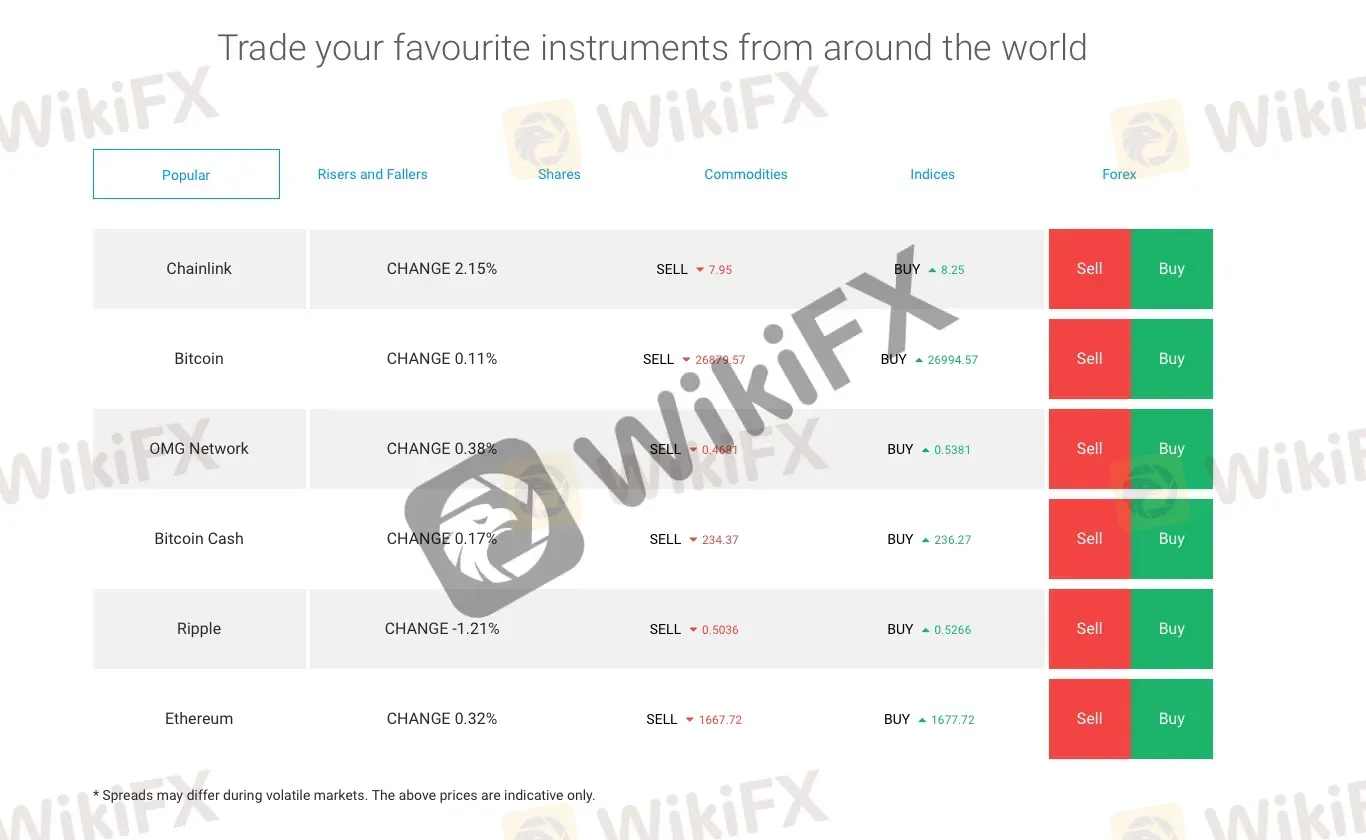

OffersFX offers a diverse range of financial products, including:

CFDs (Contracts for Difference): OffersFX provides CFDs, allowing traders to speculate on the price movements of various underlying assets without owning the assets themselves. This allows for potential profit from both rising and falling markets.

Indices: The company offers trading in indices, which are baskets of stocks representing a particular market or sector. Traders can speculate on the performance of these indices, providing exposure to broader market trends.

Commodities: OffersFX allows trading in commodities, such as precious metals (e.g., gold and silver) and energy resources (e.g., oil and natural gas). These commodities are popular choices for diversifying investment portfolios.

Shares: Traders have the opportunity to invest in shares of publicly traded companies. This enables them to participate in the performance of individual stocks from various industries and regions.

Forex (Foreign Exchange): OffersFX offers forex trading, allowing traders to engage in the foreign exchange market. This involves the buying and selling of currency pairs, providing opportunities to profit from changes in exchange rates.

These product offerings provide a wide range of options for traders looking to diversify their portfolios and engage in various financial markets, including stock indices, commodities, individual shares, and the forex market.

OffersFX offers a range of account types to cater to the diverse needs of traders. Here's a description of each account type:

Standard Account:The Standard Account at OffersFX requires a minimum deposit of $200, making it accessible to traders with varying levels of experience. Traders with this account benefit from commission-free deposits, providing a cost-effective way to fund their trading activities. While the fixed spreads for major currency pairs like EURUSD and GBPUSD are slightly wider at 5 pips, this account type still offers competitive trading conditions. Standard Account holders also have access to a demo account for practice, but personalized training and additional educational resources are not included.

Premium Account:For traders seeking a more enhanced trading experience, the Premium Account requires a minimum deposit of $1,000. This account type provides commission-free deposits, similar to the Standard Account, ensuring ease of funding. Premium Account holders enjoy tighter fixed spreads, with EURUSD and GBPUSD at 3 pips, making it a suitable choice for those who prefer more favorable trading conditions. Premium Account holders benefit from personalized training, courses, e-books, video tutorials, webinars, daily reports, signals, and access to an economic calendar, fostering a more comprehensive learning and trading environment.

Platinum Account:The Platinum Account caters to traders looking for even more advanced features and a higher level of service. With a minimum deposit requirement of $5,000, it offers commission-free deposits like the other account types. Platinum Account holders enjoy tighter fixed spreads, making trading more cost-effective, with EURUSD and GBPUSD at 3 pips. This account type provides a wealth of educational resources, including personalized training, courses, e-books, video tutorials, webinars, daily reports, signals, and access to an economic calendar. It's a suitable choice for traders who want to deepen their knowledge and trading skills.

VIP Account:

The VIP Account at OffersFX is tailored for seasoned traders and high-net-worth individuals, with a substantial minimum deposit of $25,000. Similar to other account types, it offers commission-free deposits. The VIP Account features the tightest fixed spreads, with EURUSD and GBPUSD at just 2 pips, providing highly competitive trading conditions. It offers a comprehensive educational experience, including personalized training, courses, e-books, video tutorials, webinars, daily reports, signals, and access to an economic calendar. The VIP Account is ideal for experienced traders who demand top-notch trading conditions and educational support.

| Offerings | Standard Account | Premium Account | Platinum Account | VIP Account |

| Minimum Deposit | $200 | $1,000 | $5,000 | $25,000 |

| Commission Free Deposits | Yes | Yes | Yes | Yes |

| Fixed Spread (EURUSD)* | 5 pips | 3 pips | 3 pips | 2 pips |

| Fixed Spread (GBPUSD)* | 5 pips | 4 pips | 3 pips | 3 pips |

| Fixed Spread (Germany 30)* | 500 points | 350 points | 300 points | 280 points |

| Fixed Spread (Gold)* | 100 points | 70 points | 60 points | 50 points |

| Fixed Spread (Coffee)* | 40 points | 30 points | 30 points | 25 points |

| Fixed Spread (Silver)* | 70 points | 60 points | 60 points | 50 points |

| Fixed Spread (Oil)* | 8 points | 6 points | 6 points | 5 points |

| Fixed Spread (Brent)* | 8 points | 7 points | 6 points | 5 points |

| Fixed Spread (USDCAD)* | 5 pips | 4 pips | 4 pips | 3 pips |

| Fixed Spread (USDCHF)* | 7 pips | 5 pips | 5 pips | 4 pips |

| Fixed Spread (USDJPY)* | 5 pips | 3 pips | 3 pips | 3 pips |

| Personalized Training | No | Yes | Yes | Yes |

Opening an account with OffersFX is a straightforward process. Here are the concrete steps to follow:

Visit the OffersFX Website: Start by visiting the OffersFX website using your preferred web browser.

Click on “Sign Up” or “Register”: Look for the “Sign Up” or “Register” button on the homepage or in the navigation menu and click on it.

Provide Personal Information: You will be prompted to fill out a registration form. This typically includes personal details such as your full name, date of birth, email address, and phone number. Ensure that you enter accurate information.

Choose an Account Type: OffersFX may offer different types of trading accounts (e.g., standard or demo). Select the account type that aligns with your trading preferences. If a demo account is available, you can use it for practice before trading with real funds.

Verify Your Identity: In compliance with regulatory requirements, OffersFX may ask you to provide identification documents. This usually includes a copy of your government-issued ID, proof of address (e.g., utility bill or bank statement), and sometimes a passport-sized photo. Follow the instructions to upload these documents securely.

Fund Your Account: Once your identity is verified, you can fund your trading account. OffersFX typically accepts various payment methods, such as credit/debit cards, bank transfers, and online payment processors. Choose your preferred method, enter the necessary details, and complete the transaction.

After completing these six steps, your OffersFX trading account should be set up and ready for use. Remember to review the terms and conditions, as well as the risk disclosure statement, before you start trading. It's essential to understand the platform and the risks associated with trading before you begin.

OffersFX provides leverage to traders, allowing them to initiate larger trade positions with a smaller margin deposit. The maximum leverage offered by OffersFX is up to 30:1, which means traders can control positions worth up to 30 times their initial margin deposit. For example, with a 10:1 leverage, a trader can trade currency pairs worth $10,000 using a margin deposit of $1,000. Leverage essentially enables traders to use credit to trade larger amounts than their initial deposit. However, it's important to note that higher leverage also comes with higher risk, as it can lead to significant losses if market movements go against the trader. Therefore, traders should exercise caution and use leverage wisely.

OffersFX also monitors traders' margin in real-time to ensure that they are aware of their account status at all times. The Maintenance Margin level represents the minimum amount of equity required to maintain an open position. If a trader's equity falls below this level, OffersFX will automatically execute a Margin Call trade and close any open positions until the account equity exceeds the Maintenance Margin requirement. This proactive approach helps protect traders from excessive losses.

OffersFX provides a transparent and straightforward fee structure for spreads and commissions, making it easier for traders to understand their trading costs. Here's a description of how spreads and commissions work with OffersFX:

Spreads:Spreads refer to the difference between the buying (ask) and selling (bid) prices of a financial instrument. At OffersFX, spreads are generally fixed, meaning that they remain constant under normal market conditions. The size of the spread may vary depending on the specific account type and the financial instrument being traded.

For the Standard Account, spreads tend to be wider, making it suitable for traders looking for cost-effective entry into the markets. For example, major currency pairs like EURUSD and GBPUSD may have spreads of 5 pips.

The Premium Account offers tighter spreads compared to the Standard Account. For instance, EURUSD and GBPUSD spreads can be as low as 3 pips, providing more favorable trading conditions.

The Platinum Account continues the trend of competitive trading conditions with 3-pip spreads for major currency pairs.

The VIP Account boasts the tightest spreads among all account types, with EURUSD and GBPUSD spreads as low as 2 pips. This makes it an excellent choice for traders who prioritize minimal trading costs.

Commissions:OffersFX typically offers commission-free trading, which means that traders do not incur additional charges based on the volume or value of their trades. Instead, the primary cost of trading is embedded within the spreads. This commission-free structure simplifies the cost calculation for traders and eliminates any surprises related to trading fees.

Traders should note that while OffersFX offers commission-free trading, the spread is the primary factor that affects the overall cost of trading. Therefore, traders should pay attention to the spread size, which may vary depending on the chosen account type and financial instrument. Tighter spreads are generally more favorable for traders, as they reduce the cost of entering and exiting positions.

OffersFX provides a versatile trading platform designed to cater to the needs of traders. Here is an objective overview of their trading platform:

OffersFX WebTrader: OffersFX offers a browser-based web platform that provides traders with a comprehensive set of features and trading tools. This platform allows for easy access to market analyses and enables quick trade execution and order placement. Notably, it requires no downloads, making it accessible from various devices. Users can register for this platform.

Mobile Trading App: For traders on the go, OffersFX offers a mobile trading app that supports multi-asset trading. It features real-time charting with leading technical indicators and a range of trading tools. The app provides alerts, notifications, and a user-friendly one-click navigation system. It also includes professional charting tools for enhanced analysis. Users can register for this mobile app.

Tablet Trading App: OffersFX extends its trading platform to tablet users, offering an advanced graphical interface. This platform provides swift transaction capabilities, easy deposit methods, a full activity report, intuitive navigation, and alerts setting. It aims to provide a user-friendly experience while delivering all the essential functionality traders require. Users can register for this tablet app.

Deposit and Withdrawal Methods

OffersFX offers a variety of deposit and withdrawal methods, including:

Credit/debit cards

Bank transfers

Electronic wallets

Deposit and Withdrawal Fees

OffersFX does not charge any deposit or withdrawal fees. This is another major advantage for traders, as it allows them to keep more of their profits.

Minimum Deposit and Withdrawal Amounts

The minimum deposit amount for OffersFX is $200. The minimum withdrawal amount is $100.

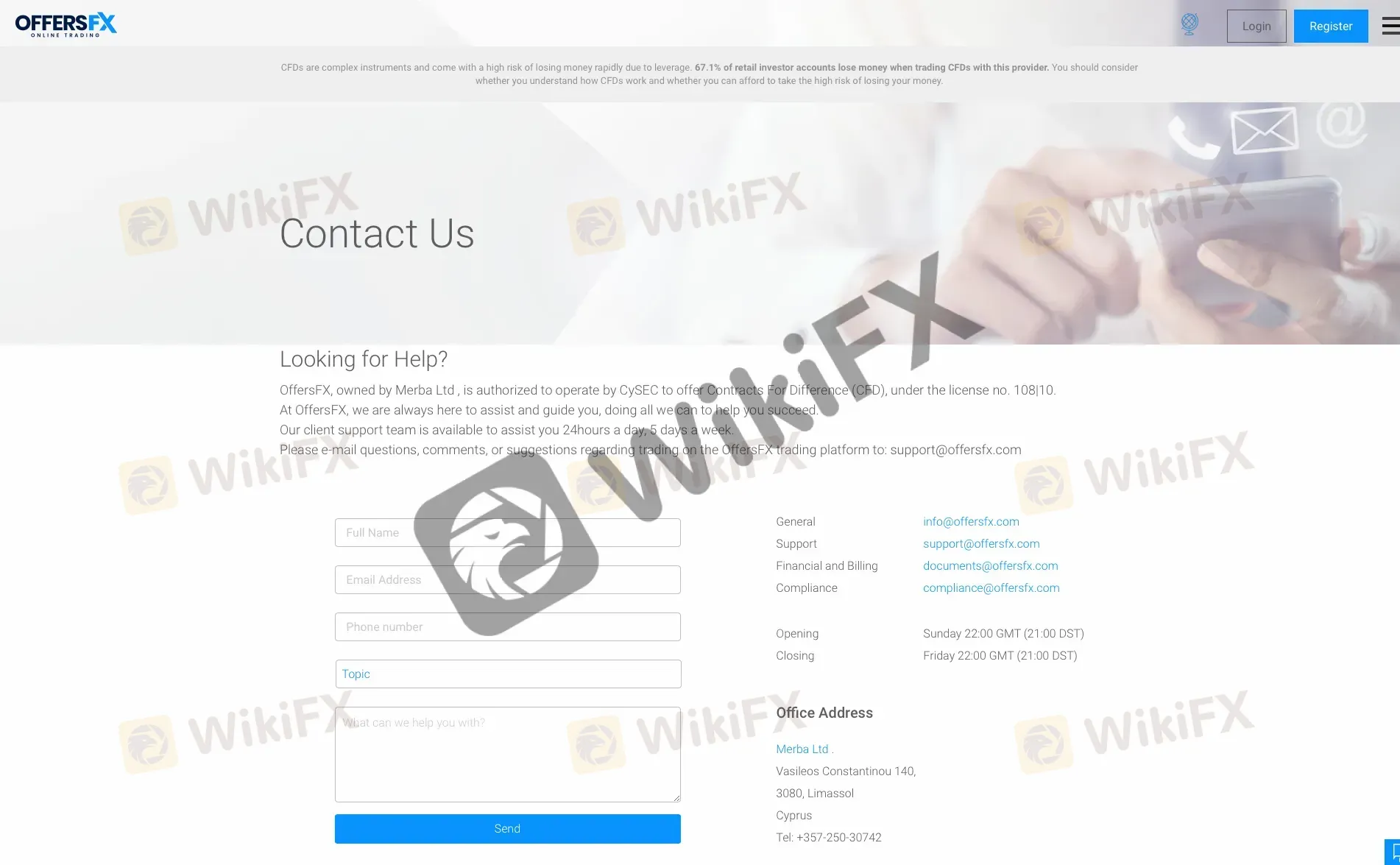

OffersFX takes customer support seriously, and they provide multiple avenues for assistance:

Contact Information: OffersFX, owned by Merba Ltd., is authorized by CySEC to offer CFDs under license no. 108|10. You can reach out to them for assistance and guidance. They offer several contact options:

Email Support: For questions, comments, or suggestions related to trading on the OffersFX platform, you can contact their client support team via email at support@offersfx.com. They have dedicated email addresses for various inquiries, ensuring your message reaches the right department (e.g., documents@offersfx.com for financial and billing inquiries, compliance@offersfx.com for compliance matters).

General Inquiries: If you have general inquiries unrelated to specific departments, you can email them at generalinfo@offersfx.com.

Financial and Billing: For financial and billing-related inquiries, you can contact them at documents@offersfx.com.

Compliance: If you have compliance-related concerns or questions, reach out to compliance@offersfx.com.

Operating Hours: OffersFX's customer support operates during specific hours:

Opening Hours: Sunday at 22:00 GMT (21:00 DST).

Closing Hours: Friday at 22:00 GMT (21:00 DST).

Phone Support: You can also contact OffersFX by phone at +357-250-30742.

Overall, OffersFX offers a range of contact options, including email and phone support, along with clear department-specific email addresses to ensure that you can get assistance with various aspects of your trading experience. Their extended operating hours during the trading week demonstrate their commitment to being available when traders may need assistance.

OffersFX provides a comprehensive Education Center with a wide range of courses and resources for traders at various levels. The advantages of their educational offerings include accessible introductory courses, in-depth materials covering trading tools, strategies, and market analysis, as well as informative eBooks that cover essential trading topics. These resources empower traders with knowledge and skills to enhance their trading experience.

However, it's worth noting that the sheer volume of lessons and materials may be overwhelming for some, and it could require significant time and commitment to complete the extensive courses offered. Nevertheless, OffersFX's commitment to education and support is evident, making it a valuable resource for those seeking to expand their trading knowledge.

In conclusion, OffersFX offers a competitive trading environment with its fixed spreads, regulatory oversight by CySEC, and an abundance of educational resources to support traders. Multiple account options cater to various experience levels, and the availability of 24/5 customer support enhances the overall user experience.

However, higher minimum deposits for some accounts could limit accessibility for traders with smaller budgets, and the absence of cryptocurrency trading might disappoint those interested in digital assets. Traders should be mindful of the risks associated with leverage and the relatively limited market analysis and insights provided by the platform when making their trading decisions.

Q: What is the minimum deposit required to open a Standard Account with OffersFX?

A: The minimum deposit for a Standard Account with OffersFX is $200.

Q: Is OffersFX regulated by any financial authorities?

A: Yes, OffersFX is regulated by the Cyprus Securities and Exchange Commission (CySEC).

Q: Does OffersFX offer cryptocurrency trading?

A: No, OffersFX does not offer cryptocurrency trading.

Q: What are the advantages of trading with fixed spreads?

A: Fixed spreads provide predictability in trading costs, ensuring that the difference between buying and selling prices remains constant under normal market conditions.

Q: Are there educational resources available for traders on OffersFX?

A: Yes, OffersFX offers a variety of educational resources, including training materials, courses, e-books, video tutorials, webinars, and more.

Q: Can I access customer support at any time?

A: OffersFX provides 24/5 customer support, available five days a week for assistance and guidance.

Q: What is the risk associated with trading using leverage?

A: Trading with leverage can magnify both profits and losses, increasing the risk of significant capital loss if market movements go against the trader. Traders should exercise caution when using leverage.

Q: Are there inactivity fees for OffersFX accounts?

A: Yes, some OffersFX accounts may have inactivity fees. It's important to review the specific terms and conditions for each account type to understand any associated fees.

Target shares closed towards the lower end of the S&P 500 on Friday, with a decline of 4%. Investors showed concern over the potential extended duration of higher interest rates and the lower-than-anticipated initial jobless claims data. The entire consumer sector experienced a downturn as investors are apprehensive about an impending recession, which could adversely affect consumer spending.

WikiFX

WikiFX

Asian markets ended mixed, but mostly higher as investors across the region reacted to the news that President Biden and U.S. lawmakers struck a tentative deal to raise the debt ceiling in the U.S. The deal will be voted on later this week and if passed will allow the U.S. government to avoid a potentially catastrophic financial scenario.

WikiFX

WikiFX

Bank stocks led a rally on Wall Street on Wednesday as investors regained confidence in the regional banking sector, while also seeing improved sentiment for big banks on optimism that a debt ceiling solution is forthcoming.

WikiFX

WikiFX

Gold prices extended gains on Wednesday morning, finding comfort above $2000 as caution reigned ahead of the US inflation data. The prices of the yellow metals were stimulated after Minneapolis Federal Reserve President Neel Kashkari indicated in a potential recession this year.

WikiFX

WikiFX

More

User comment

2

CommentsWrite a review

2023-03-02 10:23

2023-03-02 10:23

2022-12-09 10:33

2022-12-09 10:33