User Reviews

More

User comment

5

CommentsWrite a review

2024-07-19 15:17

2024-07-19 15:17 2024-06-28 16:17

2024-06-28 16:17

Score

1-2 years

1-2 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Quantity 1

Exposure

Score

Regulatory Index0.00

Business Index4.82

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

Neith Capital Limited

Company Abbreviation

NeithFX

Platform registered country and region

Australia

Company website

Company summary

Pyramid scheme complaint

Expose

Note: NeithFXs official website: https://neithfx.com is currently inaccessible normally.

| NeithFX Review Summary | |

| Founded | 2024 |

| Registered Country/Region | Australia |

| Regulation | Labeled as a suspicious clone by the NFA |

| Market Instruments | Forex, Commodities, Stock Indices, Cryptocurrencies |

| Demo Account | ✅ |

| Leverage | Up to 1:100 |

| Spread | EURUSD: 0.7 pips, USDJPY: 1 pip, GBPUSD: 1 pip, AUDUSD: 0.8 pips, USDCAD: 1.1 pips |

| Trading Platform | Details not provided |

| Min Deposit | Not mentioned |

| Customer Support | Email: support@neithfx.com |

Founded in 2024 and registered in Australia, NeithFX offers over 60 forex, commodities, stock indices, and cryptocurrency trading products. The NFA labels the broker a suspicious clone despite competitive fees and a variety of tradable assets, generating major regulatory issues.

| Pros | Cons |

| Low fees, e.g., $11 per 100,000 currencies | Labeled as a suspicious clone by the NFA |

| Wide range of trading assets (60+ forex pairs) | Limited payment methods |

| Accessible customer support |

NeithFX is unregulated and does not hold licenses.

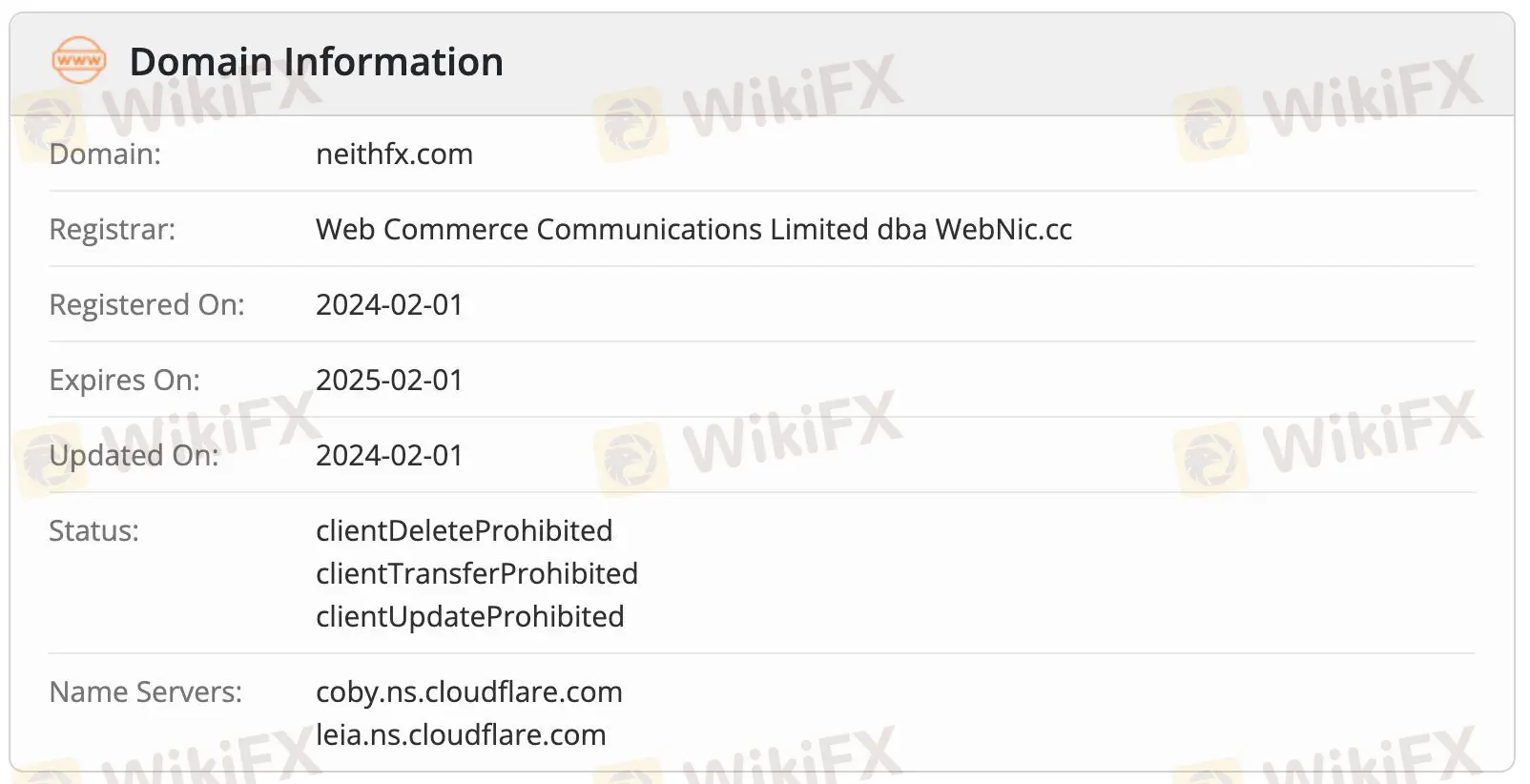

Neithfx.com was registered on February 1, 2024, and expired on February 1, 2025. Its last modification occurred on the registration date. Administrative protections like clientDeleteProhibited, clientTransferProhibited, and clientUpdateProhibited limit unauthorised changes and transfers.

NeithFX offers over 60 currency pairings, commodities, cryptocurrencies, CFDs, and indices.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Crypto | ✔ |

| CFD | ✔ |

| Indices | ✔ |

NeithFX offers Standard, Premium, and VIP accounts with increasing perks. Beginner demo accounts are supported, however Islamic accounts are not. To accommodate traders of all levels, the maximum leverage is 1:100.

NeithFX allows traders to control positions up to 100 times their initial investment with 1:100 leverage. This boosts profits but increases risk. Trade cautiously and use effective risk management.

Spreads: EURUSD: 0.7 pips, USDJPY: 1 pip, GBPUSD: 1 pip, AUDUSD: 0.8 pips, USDCAD: 1.1 pips.

Commission: $11 per 100,000 currencies (inclusive of taxes).

| Non-trading Fees | |

| Deposit Fee | Varies (e.g., USDT: 1 USDT + 3% fee) |

| Withdrawal Fee | Same as above |

| Inactivity Fee | Not mentioned |

NeithFX accepts only bank transfers and cryptocurrency [USDT].

| Method | Min Amount | Fees | Processing Time |

| Bank Transfer | Not mentioned | Customer bears the cost | Reflects within 1 business day |

| Cryptocurrency Remittance | Not mentioned | 1 USDT + 3% transaction fee | Within 15 minutes |

More

User comment

5

CommentsWrite a review

2024-07-19 15:17

2024-07-19 15:17 2024-06-28 16:17

2024-06-28 16:17