User Reviews

More

User comment

5

CommentsWrite a review

2024-07-22 14:35

2024-07-22 14:35

2024-06-21 10:26

2024-06-21 10:26

Score

Score

Regulatory Index0.00

Business Index5.54

Risk Management Index0.00

Software Index7.73

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

| UE Capital Review Summary | |

| Founded | 2023 |

| Registered Country/Region | Saint Lucia |

| Regulation | No Regulation |

| Market Instruments | Forex, Indices, Shares, Commodities, Metals, Cryptos |

| Demo Account | ✅ |

| Leverage | Up to 1:500 |

| Spread | From 0 pips (Classic account) |

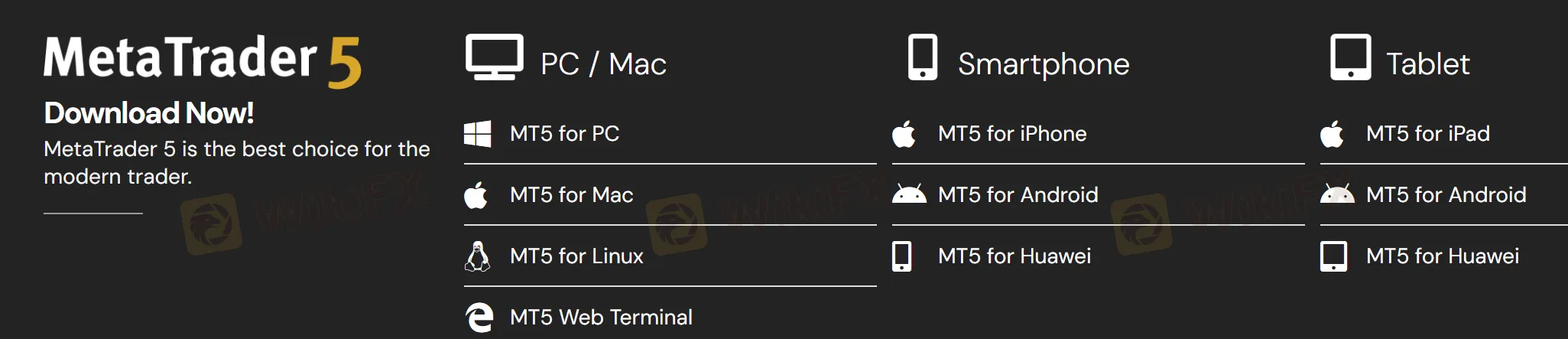

| Trading Platform | MT5 |

| Minimum Deposit | $50 |

| Customer Support | 24/7 support, contact form |

| Email: support@ue.capital | |

| Address: Ground Floor, The Sotheby Building, Rodney Village, Rodney Bay, Gros-Islet, Saint Lucia. | |

| LinkedIn, Facebook, Instagram, YouTube, WhatsApp, Telegram | |

UE Capital is an unregulated financial firm established in 2023 and registered in Saint Lucia. It offers diverse products: Forex, commodities (metals), indices, cryptocurrencies, and shares. The firm provides a demo account and Real Accounts (Classic, NoCom, Institutional) with a minimum deposit requirement of just $50 and high leverage up to 1:500. What's more, UE Capital supports the MetaTrader 5 (MT5) platform.

| Pros | Cons |

| Demo accounts available | No regulation |

| A wide range of trading products | Limited payment options |

| Diverse account types | |

| 24/7 customer support | |

| Low minimum deposit | |

| MT5 platform |

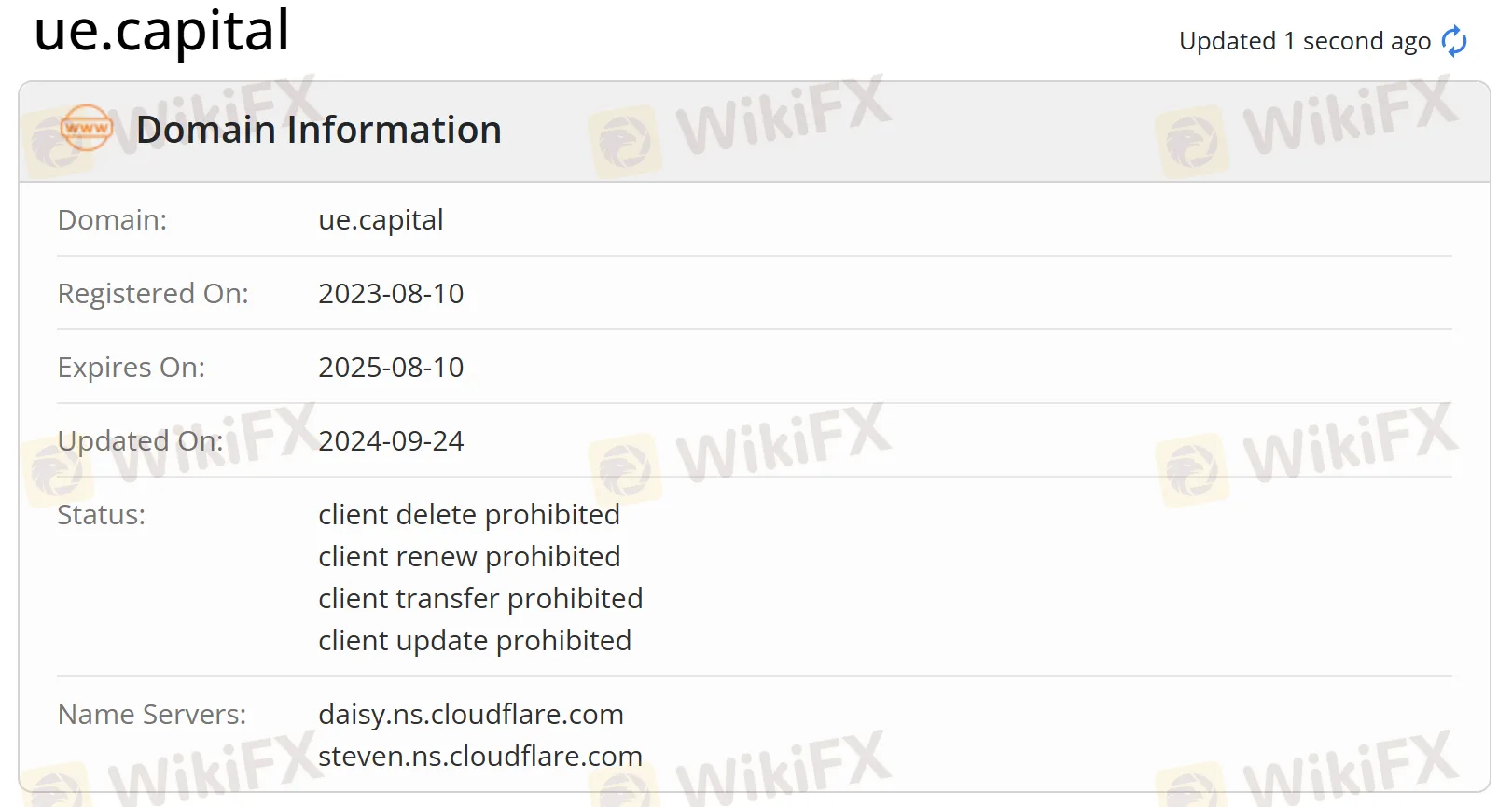

At present, UE Capital lacks valid regulation. Its domain was registered on Aug 10, 2023, and the current status is “client delete prohibited, client renew prohibited, client transfer prohibited, client update prohibited”. Please pay high attention to the safety of your funds if you choose this broker.

On UE Capital, you can trade with Forex, Indices, Shares, Commodities, Metals, and Cryptos.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Metals | ✔ |

| Indices | ✔ |

| Shares | ✔ |

| Cryptocurrencies | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

| Mutual Funds | ❌ |

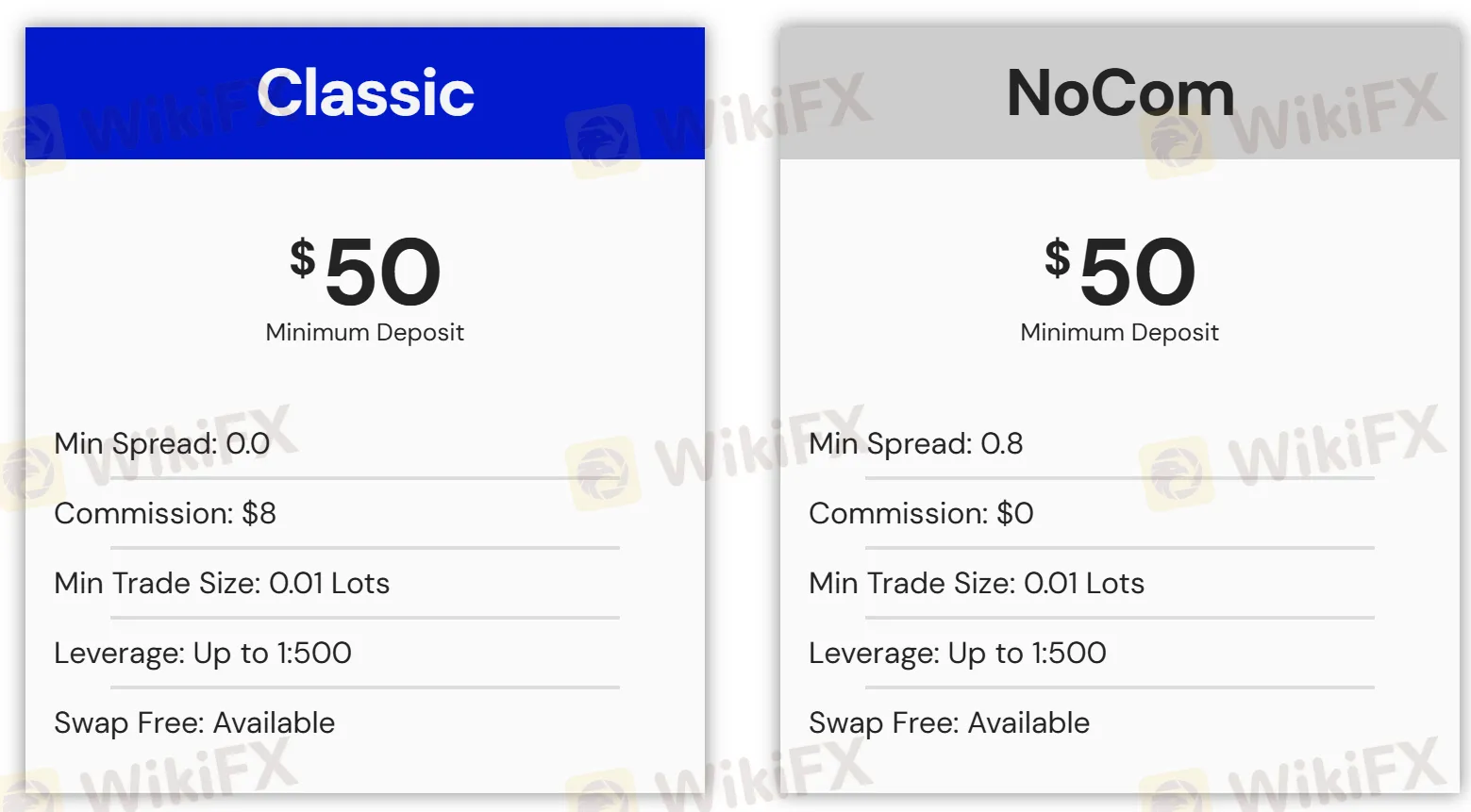

UE Capital provides a Demo Account and Real Accounts (Classic, NoCom, Institutional). The minimum deposit requirement is $50.

The maximum leverage is up to 1:500. However, note that high leverage can amplify both profits and losses.

| Account Type | Minimum Spread | Commission |

| Classic | 0 | $8 |

| NoCom | 0.8 | $0 |

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | PC, Mac, Linux, Web Terminal, iPhone/iPad, Android, Huawei | Experienced traders |

| MT4 | ❌ | / | Beginners |

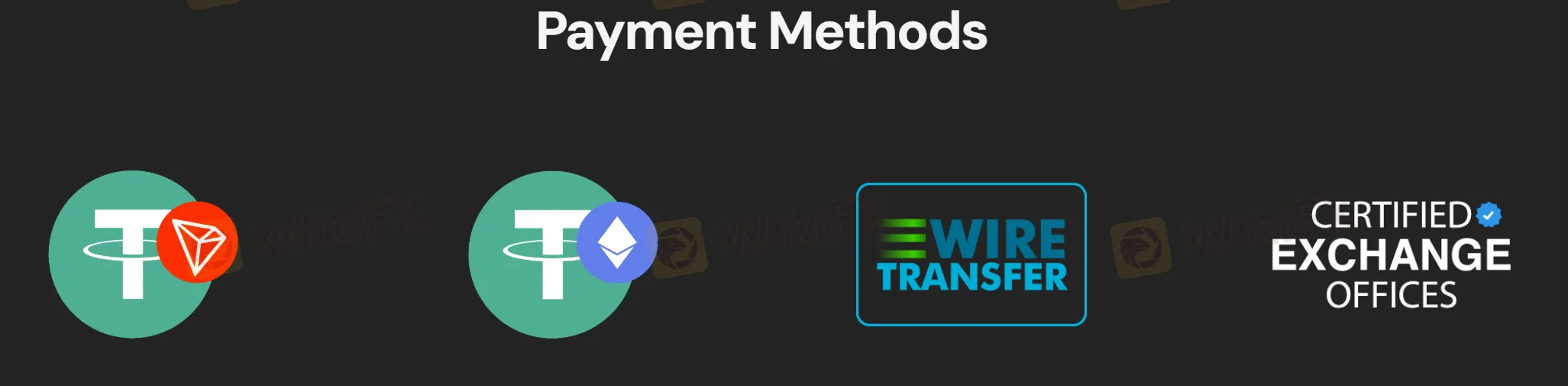

UE Capital supports payments through Tether (TRON), Tether (Ethereum), Wire Transfer, and Certified Exchange Offices. However, specific info like deposit and withdrawal processing time and associated fees is not revealed.

More

User comment

5

CommentsWrite a review

2024-07-22 14:35

2024-07-22 14:35

2024-06-21 10:26

2024-06-21 10:26