User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

5-10 years

5-10 yearsRegulated in Japan

Market Making License (MM)

Suspicious Scope of Business

Medium potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index7.83

Business Index7.85

Risk Management Index8.90

Software Index7.05

License Index7.83

Single Core

1G

40G

| 77 Securities Review Summary | |

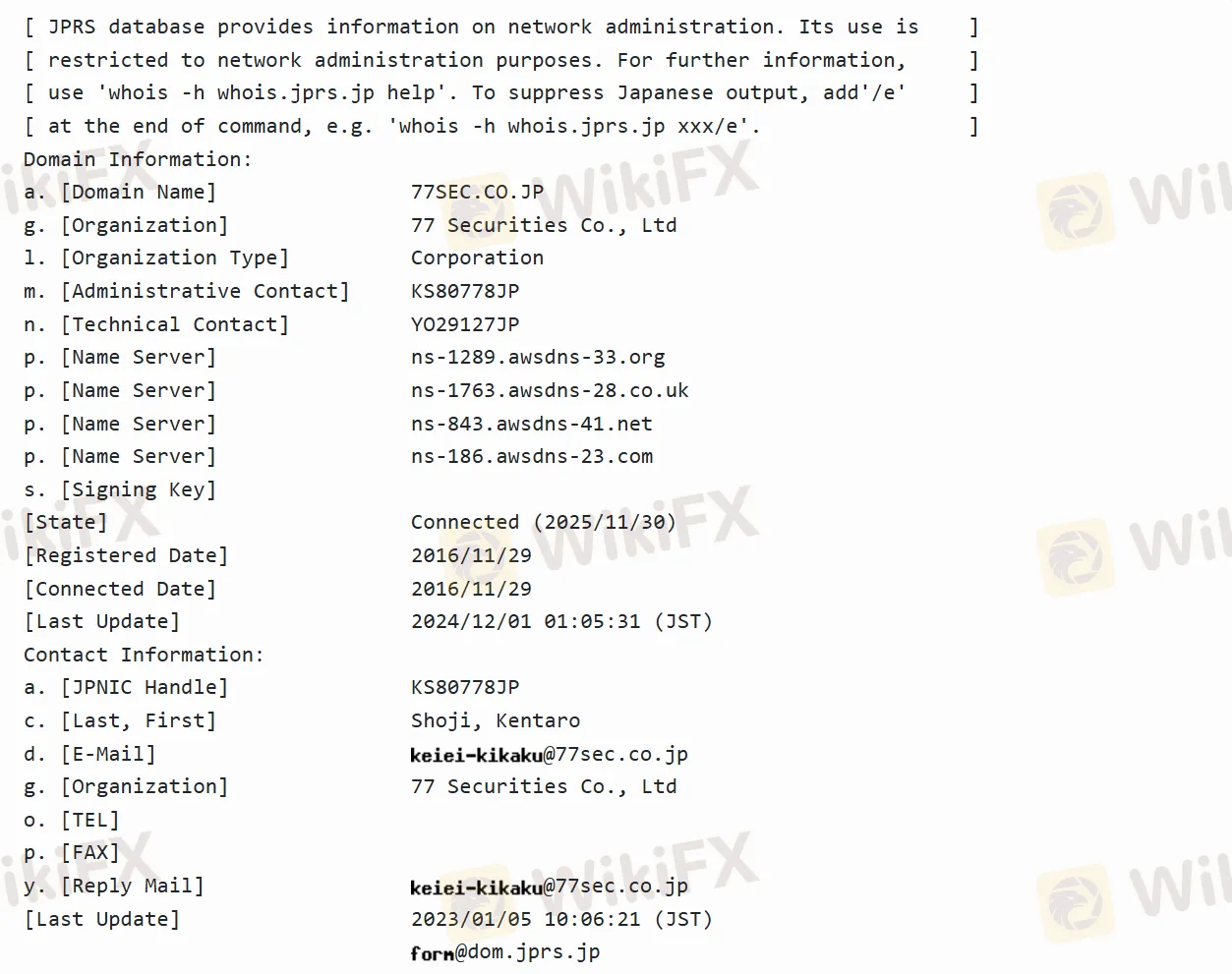

| Founded | 2016/11/29 |

| Registered Country/Region | Japan |

| Regulation | Regulated |

| Market Instruments | Investment Trusts, Bonds, and Stocks |

| Trading Platform | 77 Securities Online Service (computers, tablets, and smartphones) |

| Customer Support | 022-398-3977 |

| 0120-430-772 | |

77 Securities (Shichijushichi Securities) is a Japanese securities brokerage firm. It was established on July 27, 2016, and is 100% owned by 77 Bank. Its headquarters are located in Aoba-ku, Sendai City, Miyagi Prefecture. It provides various financial product trading services, covering diversified financial products such as stocks, bonds, and investment trusts, and supports online trading via computers, tablets, and mobile phones. Its advantages include that the handling fee for purchasing domestic investment trusts online is 20% lower than that of over-the-counter transactions, and the tax handling of specific accounts is convenient, etc.

| Pros | Cons |

| Regulated | Complex handling fees for foreign transactions |

| Various financial instruments | Limited services for legal entities |

| Multiple online trading devices | Investment risk reminder (not covered by the deposit insurance system, and the principal is not guaranteed) |

| Advantages in handling fees (20% lower than over-the-counter transactions) | |

| Tax advantages of specific accounts | |

77 Securities is a legal and compliant securities brokerage firm. It is registered in the financial products trading industry, with the registration number being No. 37 issued by the Director of the Tohoku Regional Finance Bureau (Financial Merchants), and it has joined the Japan Securities Dealers Association.

77 Securities provides trading instruments that include stocks. It allows trading of domestic listed stocks, ETFs, REITs, and some selected foreign stocks listed in the United States. In addition, it also includes bonds, covering domestic bonds, foreign bonds, and structured bonds. Besides, investors also have the option of domestic investment trusts and foreign investment trusts products.

| Tradable Instruments | Supported |

| Investment trusts | ✔ |

| Bonds | ✔ |

| Stocks | ✔ |

77 Securities offers a comprehensive securities account and a specific account. The comprehensive securities account provides customers with one-stop services ranging from asset utilization to asset management. When purchasing securities, the funds are automatically converted from Mitsubishi UFJ MRF for payment, and the proceeds from selling securities are automatically used to purchase MRF.

The main advantage of the specific account lies in reducing the burden of the “determined declaration” on customers. For some transactions within the specific account, there is no need for a detailed declaration, which facilitates tax handling.

For investors, the commission for entrusting the purchase and sale of domestic stocks is at least 2,750 yen and at most 275,000 yen. If it is a foreign entrusted transaction, the commission includes the domestic collection commission, the local entrusted commission, and so on. In the case of securities custody transactions, the commission needs to be calculated according to the type and quantity of securities. The commission for requesting the written delivery of materials for the general meeting of shareholders is 330 yen per security.

77 Securities provides an online trading platform called “77 Securities Online Service”, which supports operations on computers, tablets, and smartphones. The platform has various functions, such as the inquiry of various asset information (including the appraised value of held assets, transaction records, order placement status, dividend records, etc.), the placement of buy and sell orders for domestic investment trusts, instructions for fund deposits and withdrawals, as well as the electronic delivery of documents such as transaction reports. The service hours are from 6 a.m. every day until 2 a.m. the next day.

For 77 Securities, the deposit is mainly made through bank transfer. Customers are required to use a dedicated account for the transfer, and the remitter must be in the name of the person who owns the securities account. Customers who use the “Real-time Account Transfer Service” can transfer Japanese yen funds from their deposit accounts in 77 Bank to their securities accounts.

As for the withdrawal, it is within the scope of the MRF (Money Reserve Fund) and the pre-deposited amount. The withdrawal time depends on the notification time, and customers can also make withdrawals on their own through the 77 Securities Online Service.

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment