User Reviews

More

User comment

1

CommentsWrite a review

2024-02-29 13:32

2024-02-29 13:32

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index6.10

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

| Aspect | Information |

| Company Name | Royal Gold FX |

| Registered Country/Area | Marshall Island |

| Founded Year | 2021 |

| Regulation | Unregulated |

| Minimum Deposit | $200 |

| Spreads | 1.5%-13% |

| Trading Platforms | MT4,MT5 |

| Tradable Assets | Forex,commodities,indices |

| Account Types | personal account |

| Demo Account | Available |

| Customer Support | Phone, email,social media |

| Deposit & Withdrawal | Debit card,credit card,bank transfer |

Royal Gold FX, established in 2021, is a Forex broker located in Marshall Island. Offering a range of tradable assets including Forex, commodities, and indices, the company seeks to cater to traders with varying interests and investment strategies. The platform allows traders to engage in the market using renowned trading platforms MT4 and MT5.

With a minimum deposit requirement of $200, traders can open a personal account and explore trading opportunities in various markets. Additionally, a demo account is available to those who wish to practice trading without financial risk. The company supports different methods for deposit and withdrawal, and provides customer support through multiple channels including phone, email, and social media.

Royal Gold FX, an unregulated broker established in the Marshall Islands, presents various considerations and risks associated with its lack of oversight by any financial regulatory body. Without adherence to standardized protocols and practices typically mandated by regulatory entities, concerns regarding the safety of funds, operational transparency, dispute resolution, financial reporting, marketing practices, data protection, and compliance with Anti-Money Laundering (AML) standards come to the forefront.

Traders interacting with unregulated entities like Royal Gold FX should be mindful of these potential risks, exercising caution and conducting thorough due diligence to navigate through the speculative and potentially precarious trading environment that such platforms may offer.

Pros

Variety of MSG Assets:A wide range of tradable assets including Forex, commodities, and indices provides options and diversification opportunities for traders.

User-Friendly Trading Platforms:Provides access to MT4 and MT5, widely recognized and user-friendly trading platforms, ensuring a familiar trading environment for many forex traders.

Demo Account Availability:Offers a demo account, enabling traders to practice strategies and get accustomed to the platform without risking real money.

Multiple Support Channels:Offers various customer support channels, ensuring accessibility and assistance through phone, email, and social media.

Several Payment Methods:Accepts a range of payment and withdrawal methods, providing convenience in transacting with debit cards, credit cards, and bank transfers.

Cons

Lack of Regulation:Being unregulated presents significant risks as there is no external oversight to ensure fair and transparent operations.

High Spreads:Spreads ranging from 1.5% to 13% are comparatively high and may diminish profitability especially for short-term traders.

Limited Information:Limited available information about the companys operational history, practices, and strategies may make it difficult for traders to make informed decisions about utilizing the platform.

Single Account Type:Only offers a personal account type, which may not cater to the varied needs of different trader demographics, such as professionals or institutional traders.

Registered in a Known Offshore Location:Being registered in Marshall Island, known for being a tax haven and having a less stringent regulatory environment, might raise concerns about the safety of funds and the credibility of the platform.

| Pros | Cons |

| Variety of MSG Assets | Lack of Regulation |

| User-Friendly Trading Platforms | High Spreads |

| Demo Account Availability | Limited Information |

| Multiple Support Channels | Single Account Type |

| Several Payment Methods | Registered in a Known Offshore Location |

Royal Gold FX allows traders to engage with a selection of market instruments across various asset classes. Below is an overview of the market instruments accessible on the platform:

Forex (Foreign Exchange):

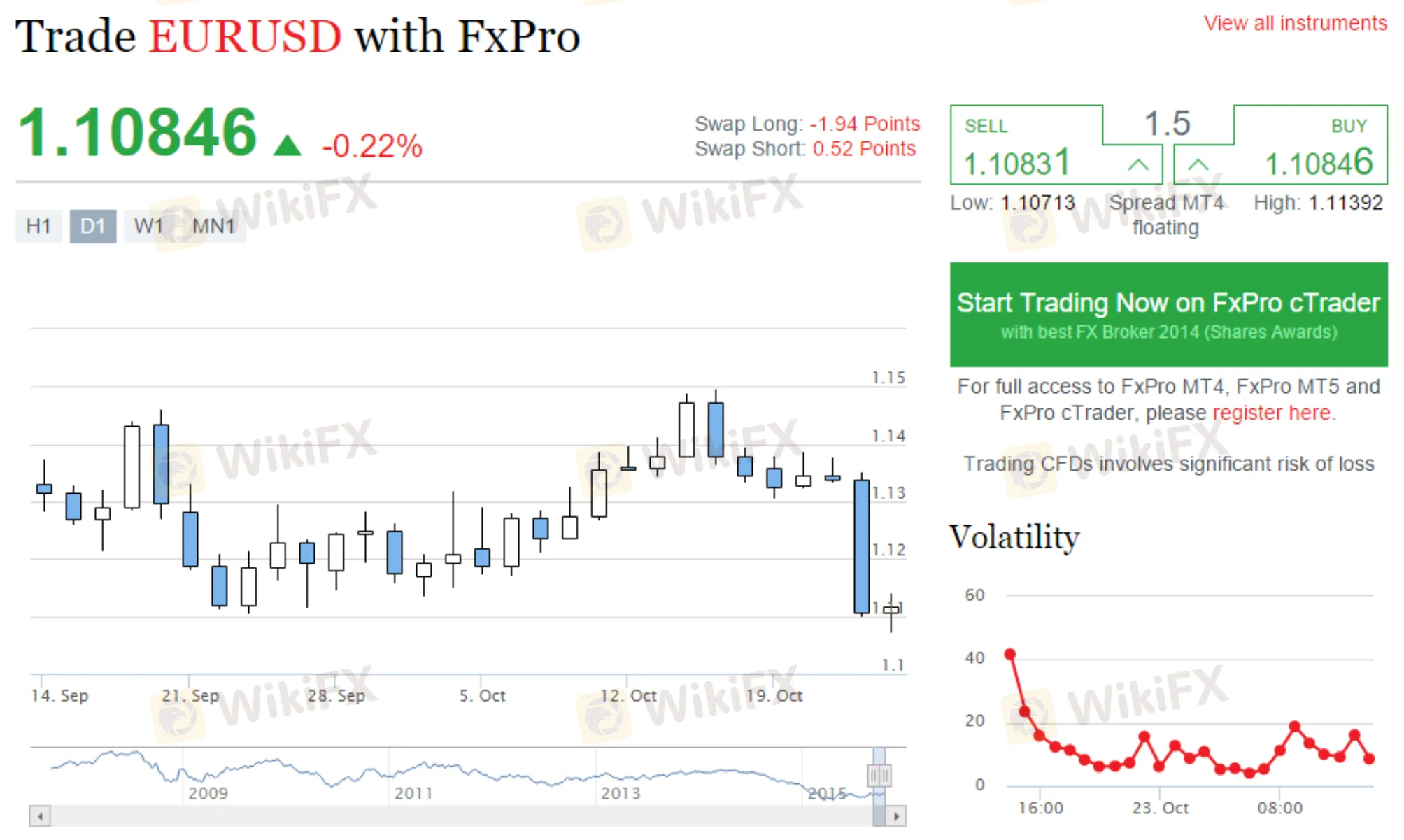

Major Pairs: Involves trading the world's most heavily traded currencies, typically paired with the US Dollar, like EUR/USD, GBP/USD, and USD/JPY.

Minor Pairs: Currency pairs that don't involve the US Dollar, such as EUR/AUD, GBP/JPY, etc.

Exotic Pairs: Involves one major currency paired with the currency of an emerging economy, e.g., USD/TRY, EUR/ZAR.

Commodities:

Precious Metals: Such as Gold, Silver, and possibly others, which are typically viewed as safe-haven assets.

Energy Commodities: Like Crude Oil and Natural Gas, which can be influenced by geopolitical and environmental factors.

Agricultural Commodities: Such as Wheat, Coffee, or Cotton, often impacted by weather conditions and global economic health.

Indices:

Global Indices: Indices that represent the performance of national stock markets, such as the S&P 500 (USA), FTSE 100 (UK), or Nikkei 225 (Japan).

Sector Indices: Reflecting the performance of specific market sectors, like technology, healthcare, or finance.

Emerging Market Indices: Representing markets from developing economies, which may offer high-reward scenarios albeit with elevated risk.

Royal Gold FX presents a Personal Account type, discernible for its $200 minimum deposit, aiming to cater to individual traders with varying levels of expertise.

Traders can engage with an array of market instruments such as Forex, commodities, and indices, making use of the reputable MT4 and MT5 trading platforms.

With customer support accessible through phone, email, and social media, users can seek assistance and inquiries, although cautious engagement is advised due to the brokers unregulated status, warranting a comprehensive examination and cautious trading activities on the platform.

Opening an account with Royal Gold FX involves a series of steps designed to establish your trading profile and secure your account. Here is a simplified 5-step guide:

Visit the Official Website:Navigate to the official website of Royal Gold FX.Locate and click on the “Open Account” or “Register” button, typically found on the homepage.

Complete the Registration Form:Fill out the registration form with accurate details, including your name, email address, phone number, and any other requested information.Set a secure password, adhering to any security guidelines provided (e.g., using a mix of letters, numbers, and special characters).

Verify Your Identity:To comply with common financial service guidelines, submit requested documentation to verify your identity and address. This may include:A government-issued ID (such as a passport or drivers license) for identity verification.A recent utility bill or bank statement as proof of residence.Await confirmation from Royal Gold FX that your documents have been received and verified.

Make a Deposit:Once verified, log into your new trading account.Navigate to the “Deposits” section and choose your preferred payment method (e.g., debit card, credit card, bank transfer).Enter the amount you wish to deposit, ensuring it meets or exceeds the minimum deposit requirement of $200.Confirm the transaction and wait for the funds to appear in your trading account.

Begin Trading:With your account funded, navigate to the trading platform (either MT4 or MT5) available via Royal Gold FX.Explore the available market instruments, such as Forex pairs, commodities, and indices.Utilize available tools and resources to analyze markets, and execute trades based on your trading strategy and risk tolerance.

Royal Gold FX operates with a spread that can range between 1.5% and 13%. The spreads, an essential aspect to consider when selecting a broker, represent the difference between the bid and ask price of a trading instrument and serve as a cost that traders must navigate when entering and exiting trades. These spreads can significantly influence short-term trading profitability, particularly in scalping or other high-frequency strategies. It's worth noting that spreads which range up to 13% are substantially high compared to industry averages, especially in the Forex market, and can considerably impact trading costs and potential profitability.

Regarding commissions, no explicit price has been provided. Therefore, it is imperative for potential traders to delve into a thorough examination of the platforms fee structure. Prospective users should explore whether Royal Gold FX charges additional commissions on trades or any other forms of fees, such as inactivity fees or withdrawal fees, which could further impact trading costs and overall returns.

Royal Gold FX provides its traders with two prominent trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). MT4 is renowned for its user-friendly interface, robust technical analysis tools, and automated trading capabilities via Expert Advisors. Conversely, MT5 brings advanced functionalities, an expanded asset range, and improved charting tools to the table, along with enhanced strategic options through hedging capabilities. Both platforms ensure accessibility across various devices and operating systems, offering traders flexibility and a range of tools to navigate financial markets. When engaging with these platforms on Royal Gold FX, considering the broker's unregulated status and understanding the platforms functionalities through a demo account is crucial before venturing into live trading.

Royal Gold FX establishes a minimum deposit of $200, setting its entry threshold for traders keen on embarking upon their trading exploits on the platform. While the initial details illustrate that transactions can be performed via debit/credit cards and bank transfers, the granularities enveloping the procedural and policy aspects of deposits and withdrawals appear to be thinly detailed.

The explicit mention of applicable transactional mechanisms is noted, but vital specifics such as transaction processing times, potential fees associated with transactions, and potential alternative payment methods are not vividly clarified. A crisp, unambiguous, and user-friendly process in managing financial transactions, particularly in deposits and withdrawals, is paramount in ensuring a seamless trading experience and safeguarding traders from unexpected hurdles or complications.

Royal Gold FX, with its operational framework housed within the Marshall Islands, orchestrates its customer support primarily through phone and email channels.

Traders and interested parties can reach out via phone at +44 203 807 71 90 for more direct and immediate inquiries or assistance. Alternatively, for non-urgent matters or detailed queries, communication can be facilitated through their customer service email at help@yourmaintenance.net.

The official website, https://royalgoldfx.org/, may house additional resources or guides for traders.

With its inception in 2021, Royal Gold FX, an unregulated broker registered in the Marshall Islands, extends its financial trading platform to traders with offerings such as Forex, commodities, and indices, through the widely utilized MT4 and MT5 platforms.

Notwithstanding the accessible customer support via email and phone, and the availability of a personal account type, potential traders must navigate this platform with acute caution. The noted spreads, ranging from 1.5% to a substantial 13%, coupled with the lack of regulatory oversight, spotlight significant areas of risk and potential concern.

Accordingly, prospective users should meticulously investigate, employ prudent risk management, and possibly seek independent financial advice before engagement with Royal Gold FX to navigate through the potential financial hazards associated with trading, especially on an unregulated platform.

Q: Which Trading Platforms Does Royal Gold FX Offer?

A: Royal Gold FX offers its traders the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms.

Q: What is the Minimum Deposit Required at Royal Gold FX?

A: The minimum deposit required to commence trading with Royal Gold FX is $200. This initial investment allows traders to access trading on their platform, subject to their terms and conditions.

Q: What Assets Can Be Traded on Royal Gold FX?

A: Traders on Royal Gold FX have the opportunity to engage with a variety of market instruments, including Forex, commodities, and indices, through the available trading platforms.

Q: Is Royal Gold FX Regulated?

A: No, Royal Gold FX is not regulated. It is registered in the Marshall Islands, and potential traders should approach with caution and conduct thorough due diligence, considering the enhanced risks associated with unregulated brokers.

Q: How Can I Contact Royal Gold FX Customer Support?

A: Royal Gold FX provides customer support via phone at +44 203 807 71 90 and through email at help@yourmaintenance.net.

More

User comment

1

CommentsWrite a review

2024-02-29 13:32

2024-02-29 13:32