User Reviews

More

User comment

6

CommentsWrite a review

2025-03-23 15:42

2025-03-23 15:42

2024-07-11 10:25

2024-07-11 10:25

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Quantity 1

Exposure

Score

Regulatory Index0.00

Business Index6.19

Risk Management Index0.00

Software Index4.00

License Index0.00

Single Core

1G

40G

More

Company Name

Mabicon (PTY) Ltd

Company Abbreviation

Mabicon

Platform registered country and region

South Africa

Company website

Company summary

Pyramid scheme complaint

Expose

| MabiconReview Summary | |

| Founded | 2022 |

| Registered Country/Region | South Africa |

| Regulation | Regulated |

| Market Instruments | CurrenciesPrecious metals & CommoditiesCFDs IndicesCryptocurrencies |

| Demo Account | ✅ |

| Leverage | Up to 1:5000 |

| Spread | From 0 |

| Trading Platform | MT5 |

| Min Deposit | $100 |

| Customer Support | Phone: +27760854566 |

| Email: info@mabiconfx.com | |

| Online Chat: 24/7 | |

| Social Media: Facebook, Linkedin | |

| Physical Address: Alice Lane, Phase 3, 4th Floor, Alice Lane, Sandhurst, Sandton, Gauteng, 2146, Johanesburg, ZA | |

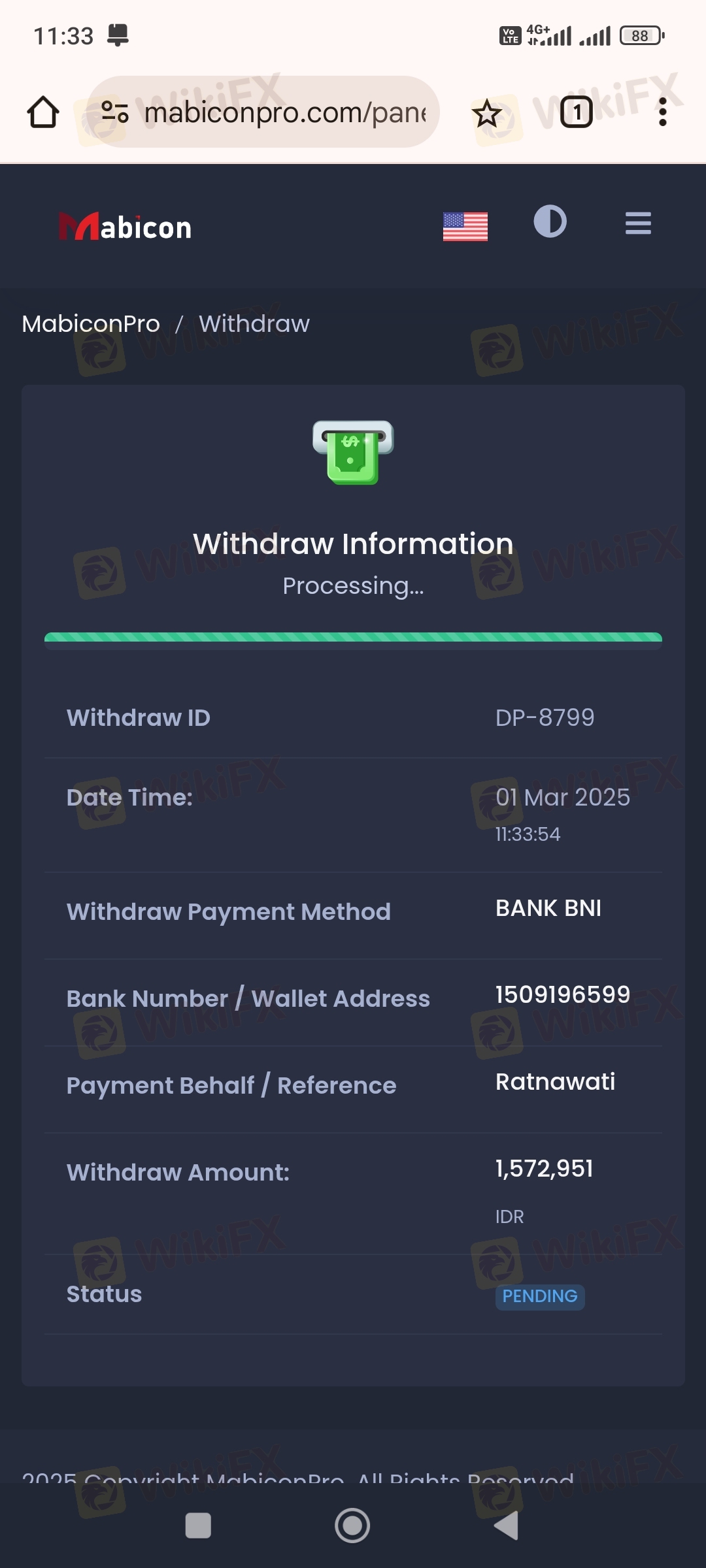

Mabicon is a brokerage incorporated in South Africa in 2022. It is regulated by the FSCA and offers traders 1700+ market trading opportunities, supports MT5, plus 4 account types, supports spreads from 0 and no commission. At present, the information of the deposit and withdrawal of this brokerage is not available.

| Pros | Cons |

| Well regulated | No deposit and withdrawal information |

| 4 kinds of accounts | |

| The spread starts at 0 | |

| No commissions | |

| Support MT5 |

| Regulated Country/Region |  |

| Regulated Authority | FSCA |

| Regulated Entity | Mabicon (PTY) Ltd |

| License Type | Financial Service |

| License Number | 52698 |

| Current Status | Regulated |

Mabicon says it offers 1,700 + markets. Over 60+ currency pairs; Metals and commodities; CFD indices, including FTSE 100, Dow Jones, DAX, NASDAQ 100, Nikkei 225, CAC 40, etc.; Cryptocurrencies include Bitcoin, Ethereum, Ripple, Litecoin, and others.

| Tradable Instruments | Supported |

| Currencies | ✔ |

| Precious metals & Commodities | ✔ |

| CFDs Indices | ✔ |

| Cryptocurrencies | ✔ |

| Stocks | ❌ |

| Bonds | ❌ |

| ETF | ❌ |

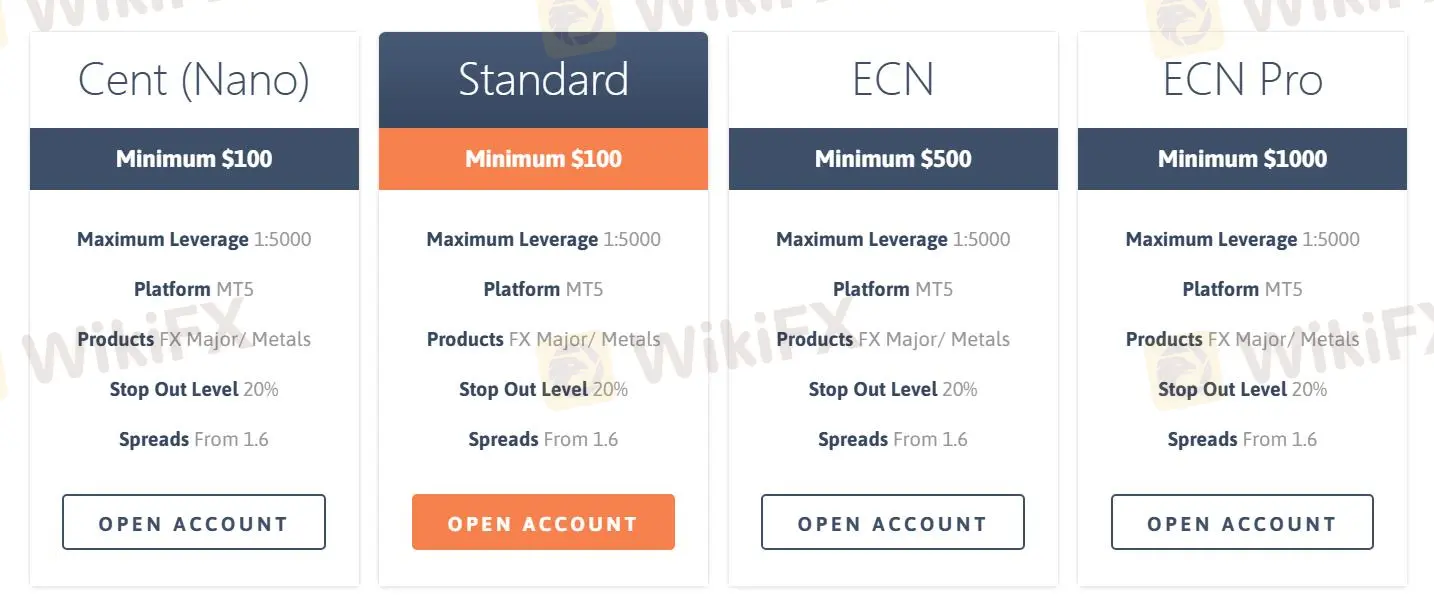

Mabicon has 4 types of accounts : Cent (Nano),Standard,ECN,ECN Pro. Among them, the minimum deposit requirement is $100, the leverage is unified at 1:5000, and the MT5 is also supported.

| Account Types | Cent (Nano) | Standard | ECN | ECN Pro |

| Minimum Deposit | $100 | $100 | $500 | $1,000 |

| Maximum Leverage | 1:5000 | 1:5000 | 1:5000 | 1:5000 |

| Trading Platform | MT5 | MT5 | MT5 | MT5 |

| Products | FX Major/ Metals | FX Major/ Metals | FX Major/ Metals | FX Major/ Metals |

| Stop Out Level | 20% | 20% | 20% | 20% |

| Spreads From | 1.6 | 1.6 | 1.6 | 1.6 |

Mabicon's accounts all have spread starting at 1.6. In addition, it claims that it supports spreads from 0 and no commission.

Mabicon offers the MT5 trading platform, which can be traded on the web, desktop and mobile versions.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Web, Desktop, Mobile | Skilled Traders |

| MT4 | ❌ |

More

User comment

6

CommentsWrite a review

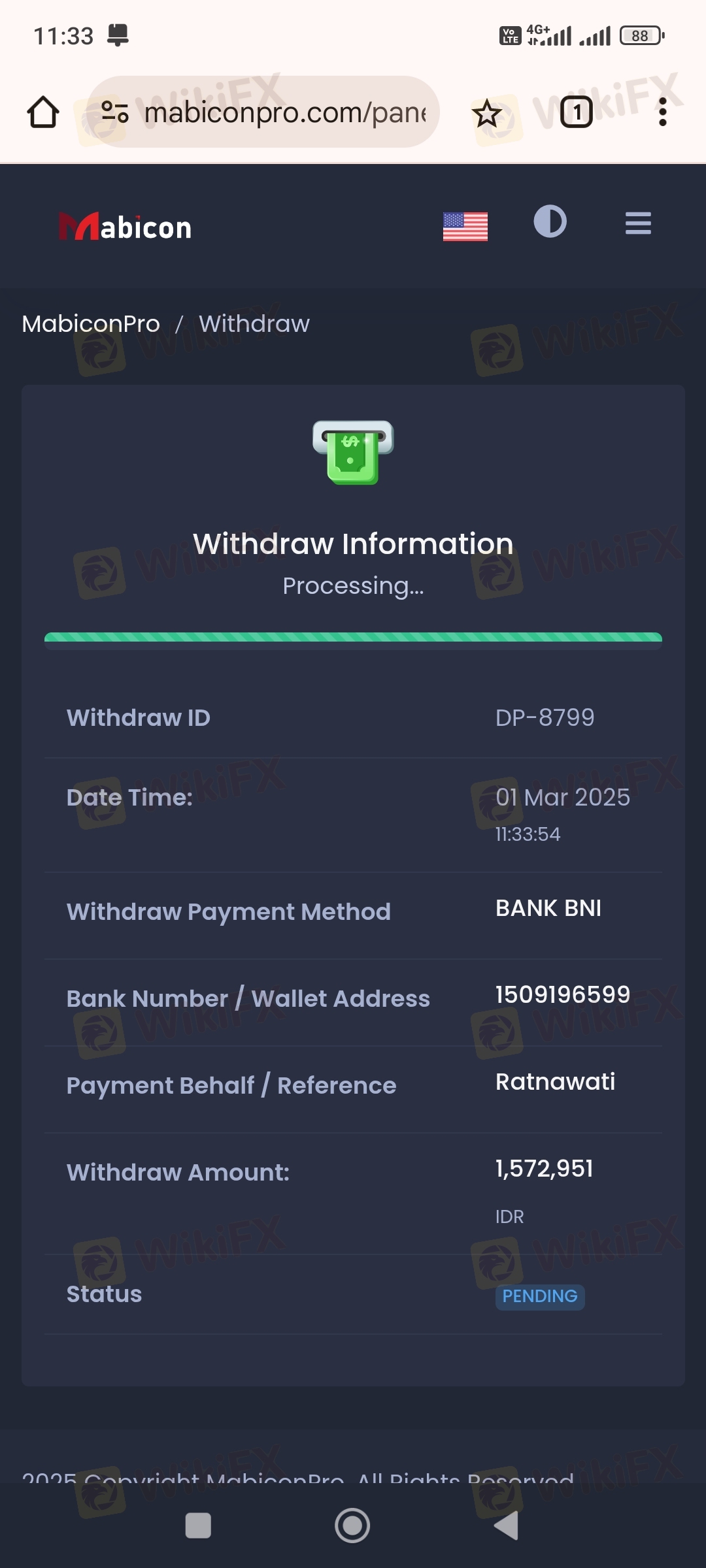

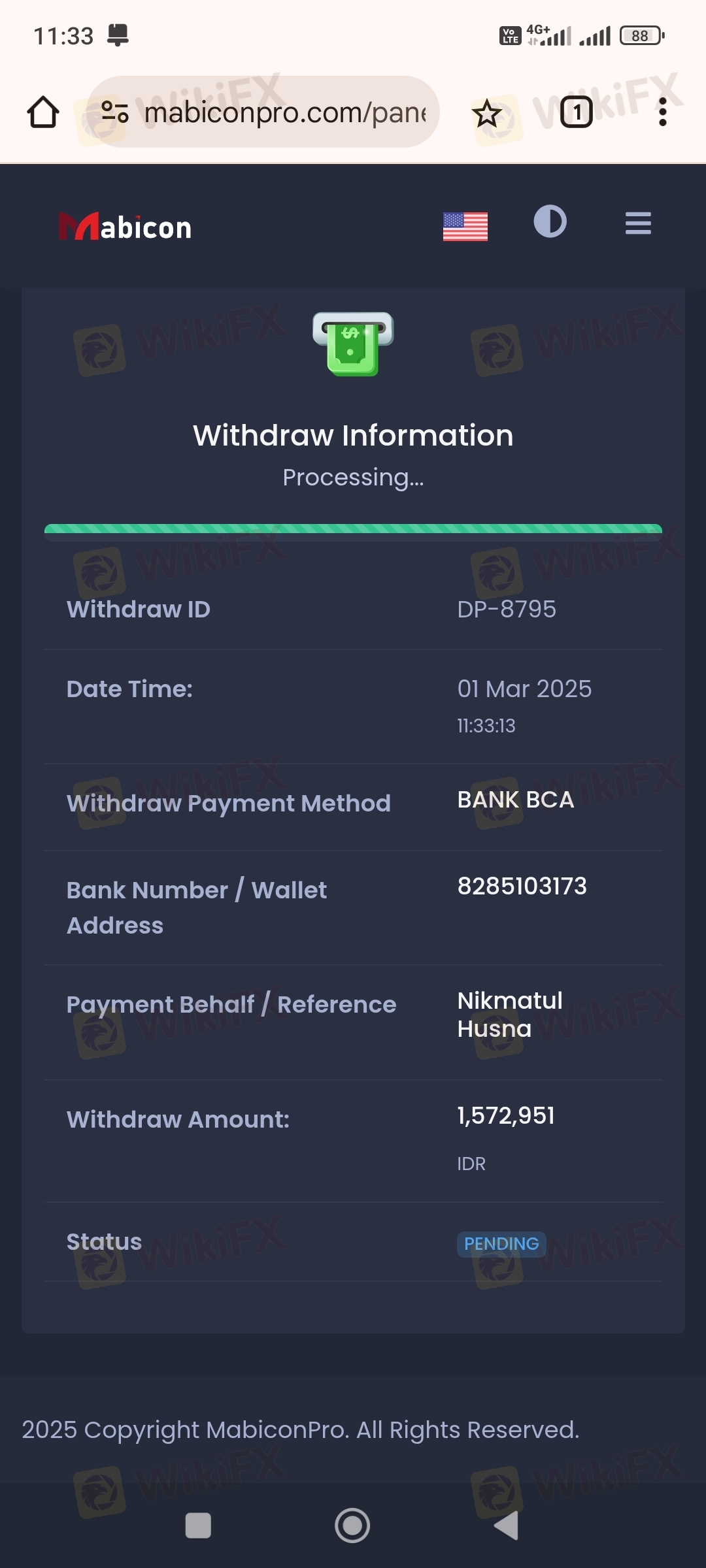

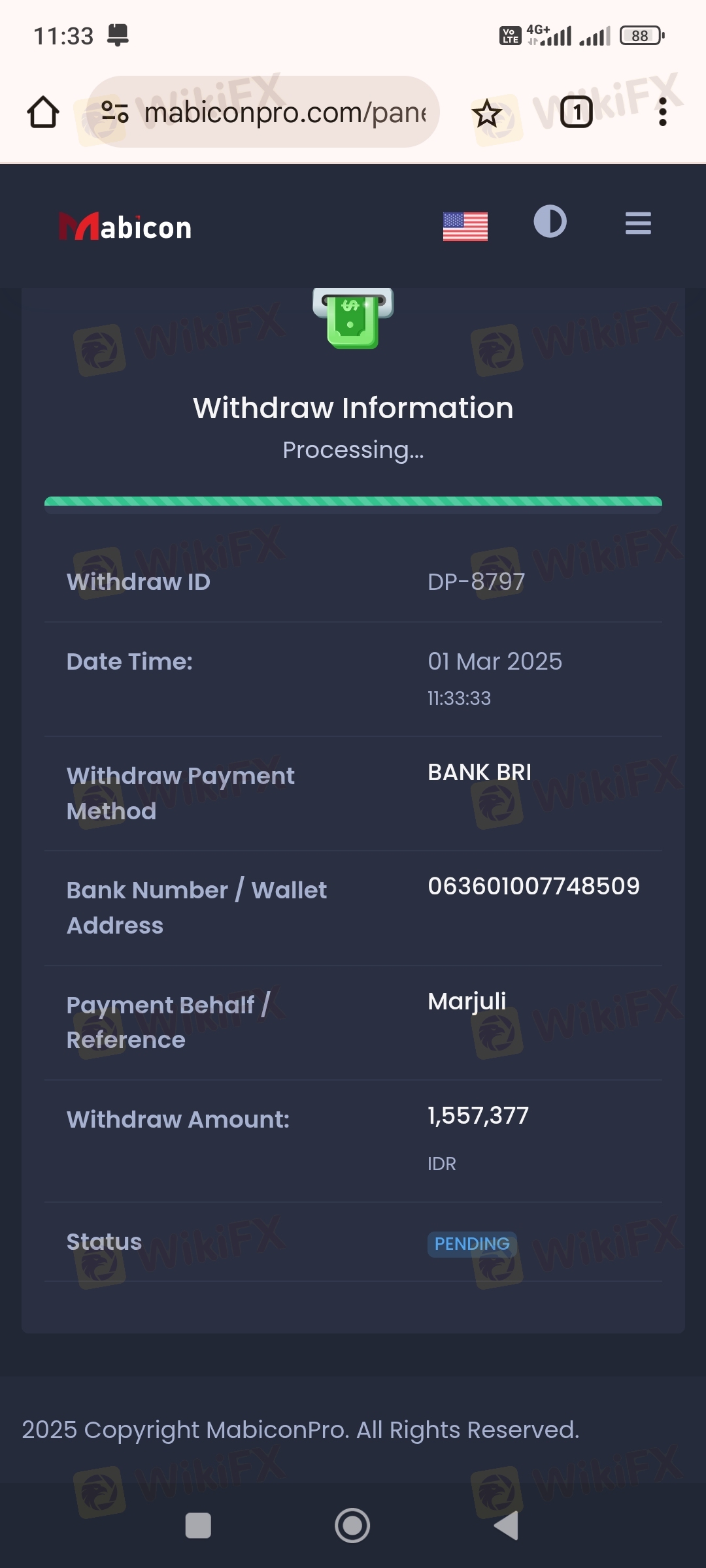

2025-03-23 15:42

2025-03-23 15:42

2024-07-11 10:25

2024-07-11 10:25