User Reviews

More

User comment

3

CommentsWrite a review

2022-12-06 09:52

2022-12-06 09:52

2022-11-29 14:13

2022-11-29 14:13

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.43

Risk Management Index0.00

Software Index4.00

License Index0.00

Single Core

1G

40G

More

Company Name

Destek Global Ltd

Company Abbreviation

Destek

Platform registered country and region

Bahamas

Company website

Company summary

Pyramid scheme complaint

Expose

| Palm Capital Review Summary | |

| Founded | 1995 |

| Registered Country/Region | Bahamas |

| Regulation | SCB (Suspicious clone) |

| Market Instruments | Forex, metals, indices, and commodities |

| Demo Account | ✅ |

| Leverage | Up to 1:200 |

| EUR/USD Spread | Average 1.57 pips (Standard account) |

| Trading Platform | MT4 |

| Minimum Deposit | $100 |

| Customer Support | Contact form |

| Phone: +44 203 1502654 | |

| Email: info@palmglobalcapital.com | |

| OPERATIVE ADDRESS: #3 Bayside Executive Park West Bay Street and Blake Road P.O. Box CB-12407, Nassau, Bahamas Palm Global Capital Ltd. | |

Palm Capital was founded in 1995 and is registered in the Bahamas. It offers trading in forex, metals, indices, and commodities with leverage up to 1:200 on most accounts. The broker supports MetaTrader 4 but not MetaTrader 5, provides a demo account, and various customer support options, but operates under a suspicious clone license.

| Pros | Cons |

| Various trading instruments | Suspicious clone regulation |

| Demo accounts available | Limited funding methods |

| MT4 platform |

Palm Capital claims to be regulated by the Securities Commission of the Bahamas (SCB), but it is suspicious clone.

| Regulatory Authority | Regulated by | Current Status | Licensed Institution | Licensed Type | Licensed Number |

| The Securities Commission of the Bahamas (SCB) | Bahamas | Suspicious clone | Palm Global Capital Ltd | Retail Forex License | SIA-F191 |

Palm Capital offers four main trading instruments: forex, metals, indices, and commodities.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Metals | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

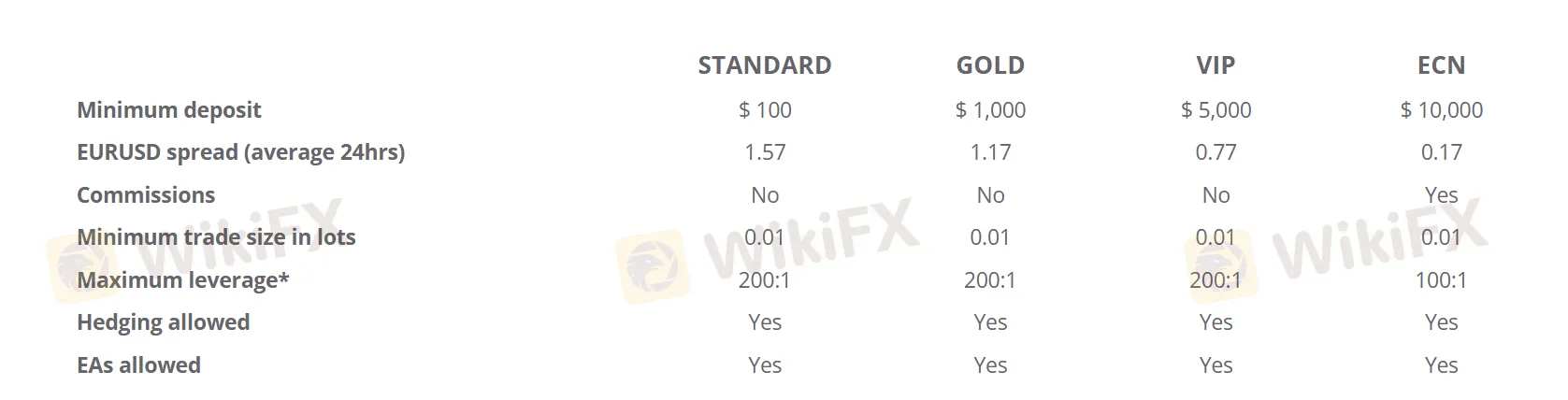

Palm Capital offers four main account types: Standard, Gold, VIP, and ECN.

| Account Type | Minimum Deposit | Maximum Leverage | Average EUR/USD Spread | Commission | Minimum Trade Size |

| Standard | $100 | 1:200 | 1.57 | ❌ | 0.01 lots |

| Gold | $1,000 | 1.17 | ❌ | ||

| VIP | $5,000 | 0.77 | ❌ | ||

| ECN | $10,000 | 1:100 | 0.17 | ✔ |

The maximum leverage at Palm Capital depends on the account type: the Standard, Gold, and VIP accounts offer up to 1:200 maximum leverage, while the ECN account provides a maximum leverage of 1:100. Note that higher leverage can improve profit potential while also increasing risk, therefore appropriate risk management is crucial.

Palm Capital supports the MetaTrader 4 platform but does not support MetaTrader 5.

| Trading Platform | Supported | Available Devices | Suitable for |

| MetaTrader 4 | ✔ | Windows, macOS, iOS, Android | Beginners |

| MetaTrader 5 | ❌ | / | Experienced Traders |

Palm Capital primarily processes deposits via bank transfers in USD, EUR, and GBP, with a minimum deposit of $150 and no maximum limit. Transactions can take up to 5 working days to process.

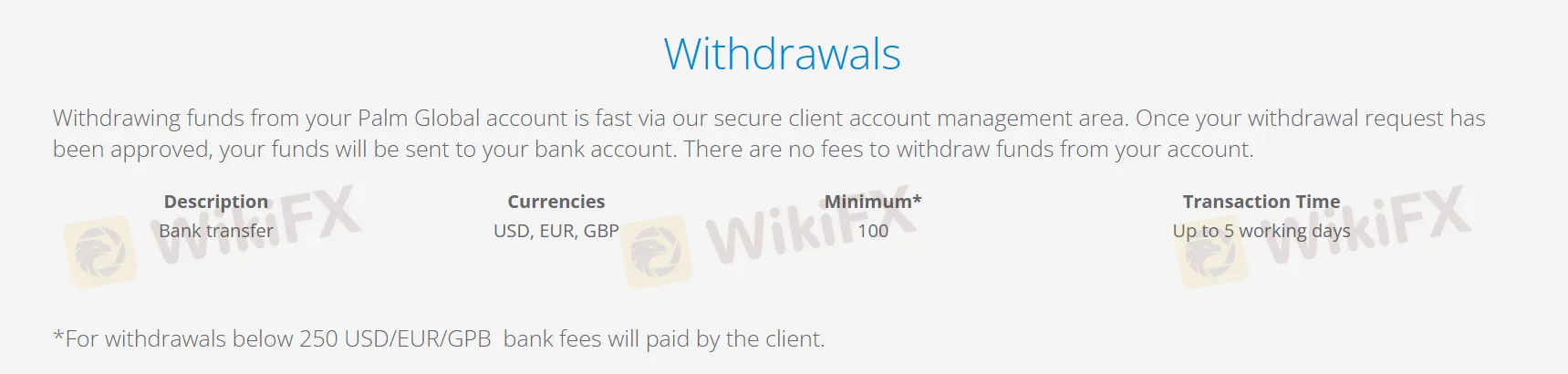

Withdrawals are also handled via bank transfer, with a minimum amount of $100. Palm Capital does not charge withdrawal fees, but clients are responsible for any bank fees on withdrawals below $250.

More

User comment

3

CommentsWrite a review

2022-12-06 09:52

2022-12-06 09:52

2022-11-29 14:13

2022-11-29 14:13