User Reviews

More

User comment

2

CommentsWrite a review

2024-08-22 23:31

2024-08-22 23:31

2024-07-22 10:39

2024-07-22 10:39

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Quantity 6

Exposure

Score

Regulatory Index0.00

Business Index5.40

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

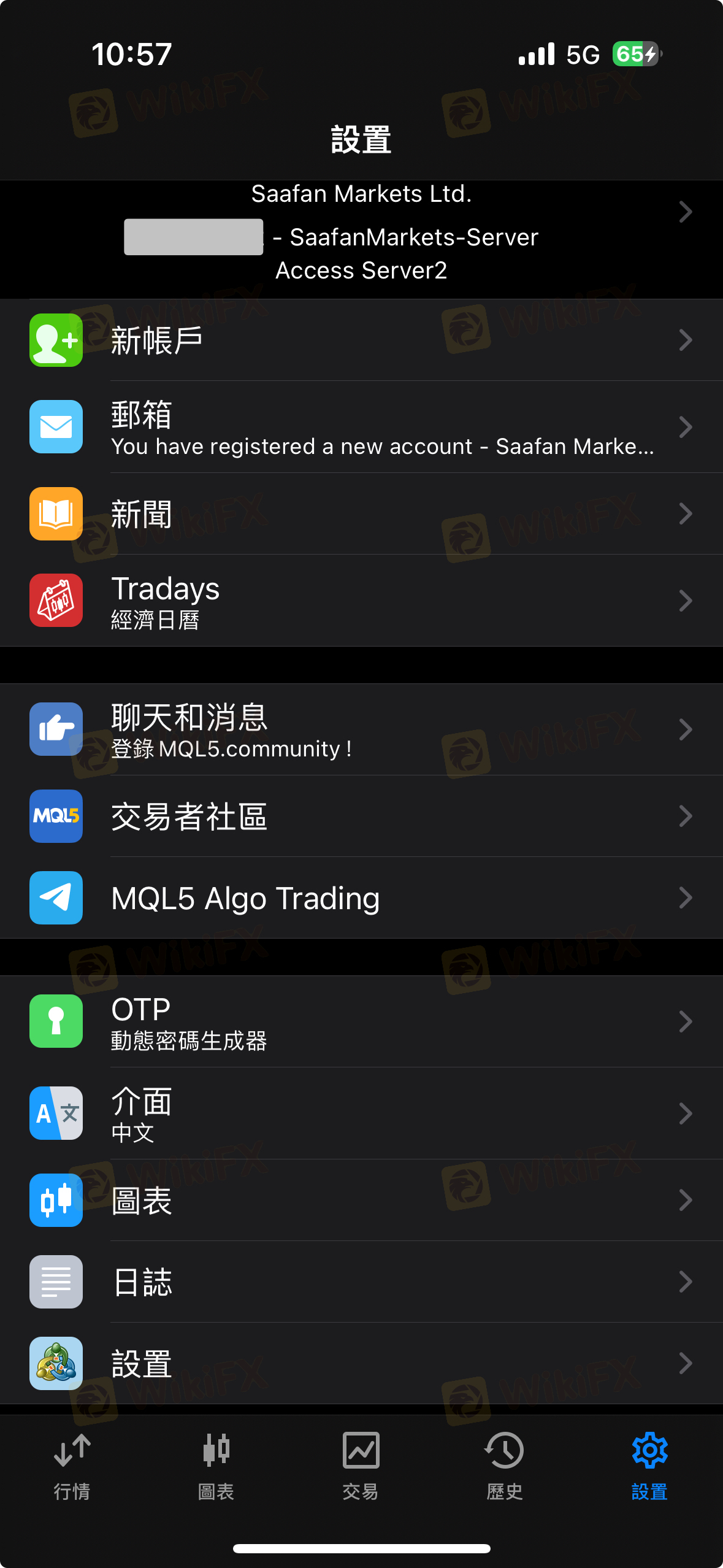

Saafan Markets Ltd.

Company Abbreviation

Saafan Markets

Platform registered country and region

Saint Lucia

Company website

Company summary

Pyramid scheme complaint

Expose

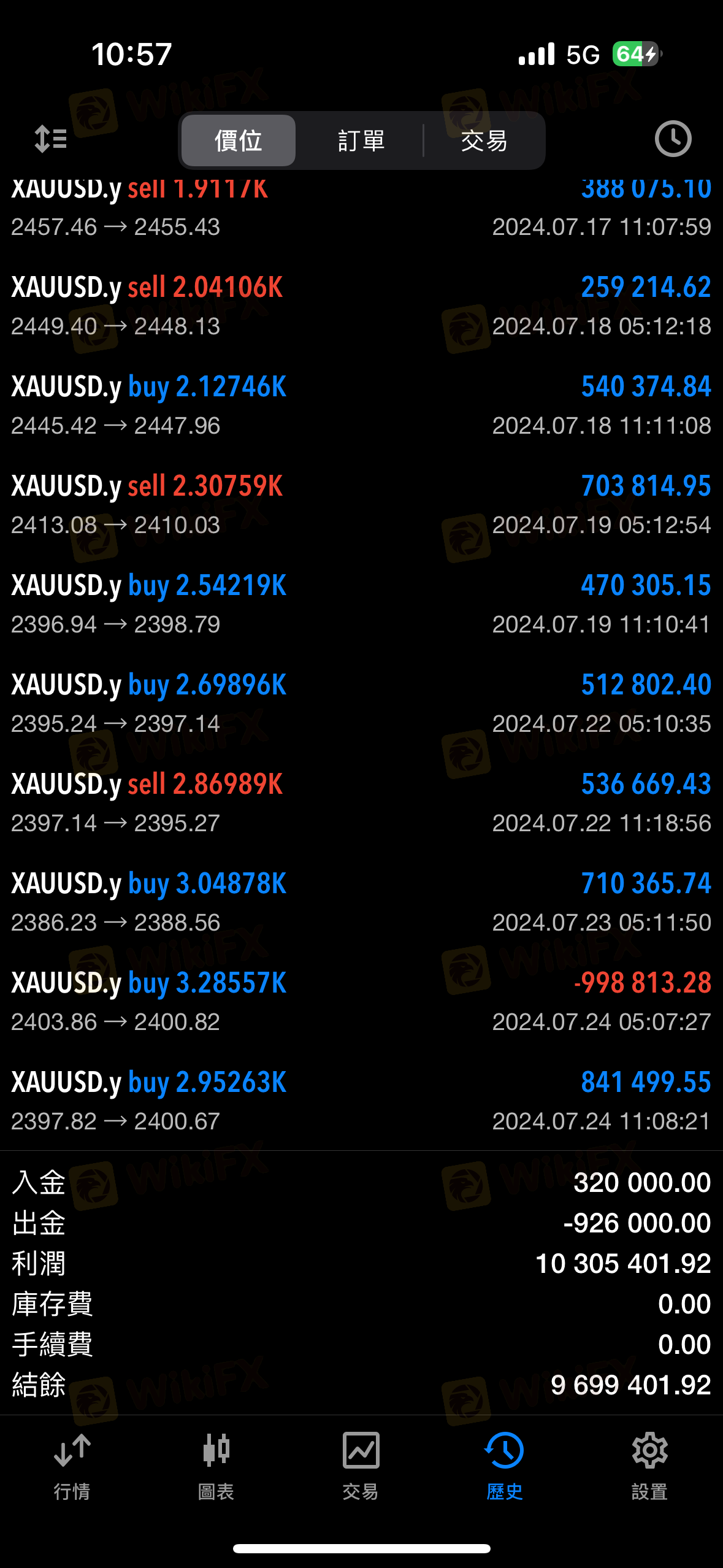

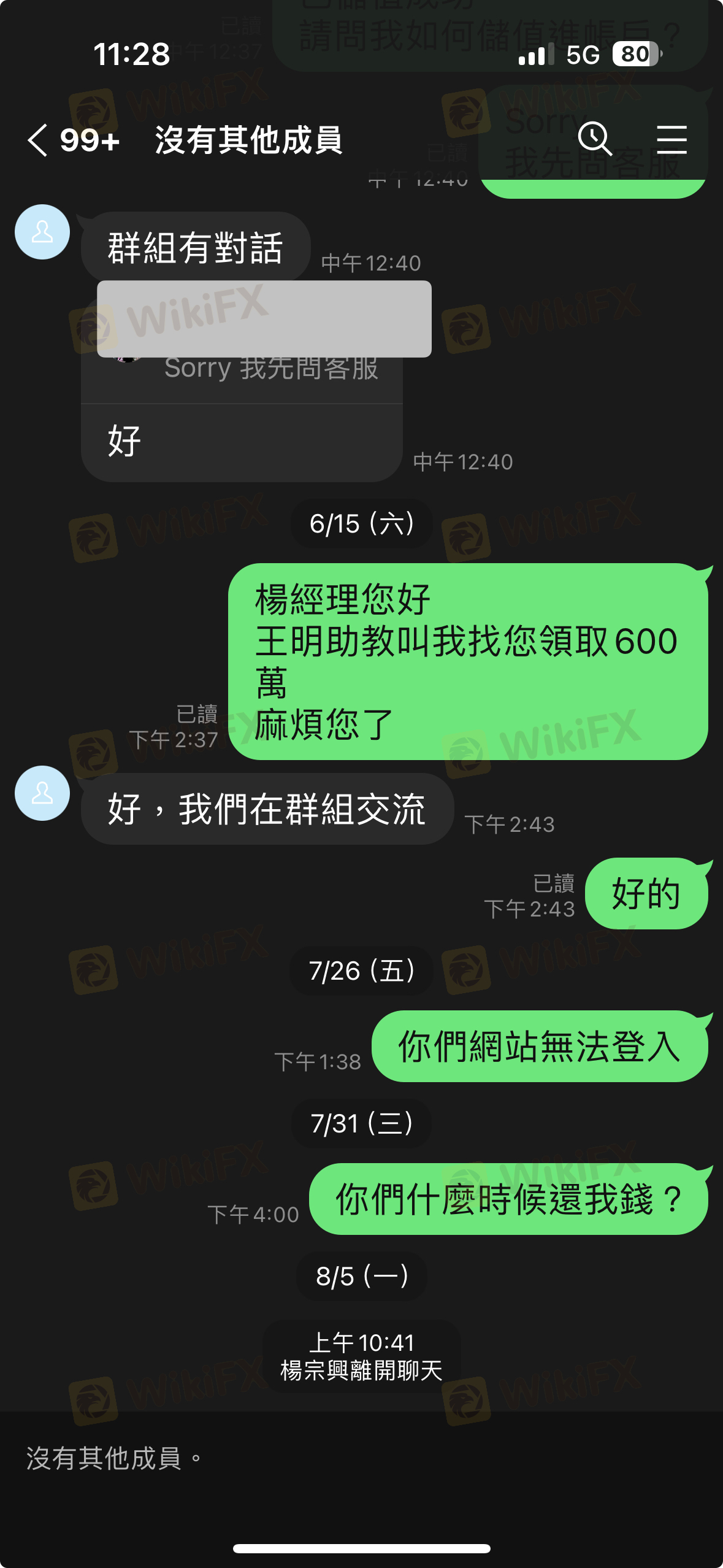

The foreign exchange dealer Yang Zongxing used the line group to attract investors. The platform had caused investors to suffer serious losses instantly. Later, the deposit and withdrawal website was closed without warning, no new website was provided, and no response was given to investors. The line group had also kicked out investors. There is no way to withdraw the balance on the account.

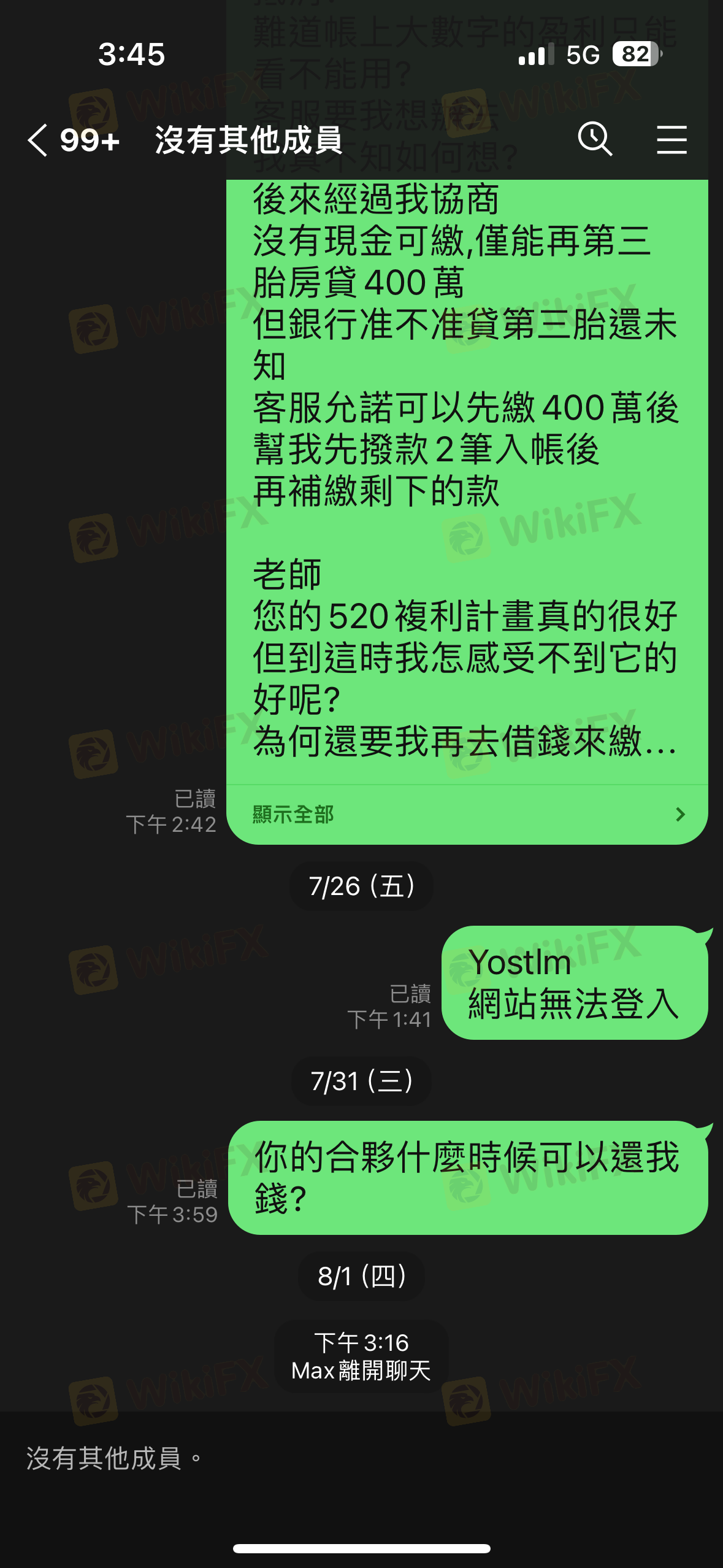

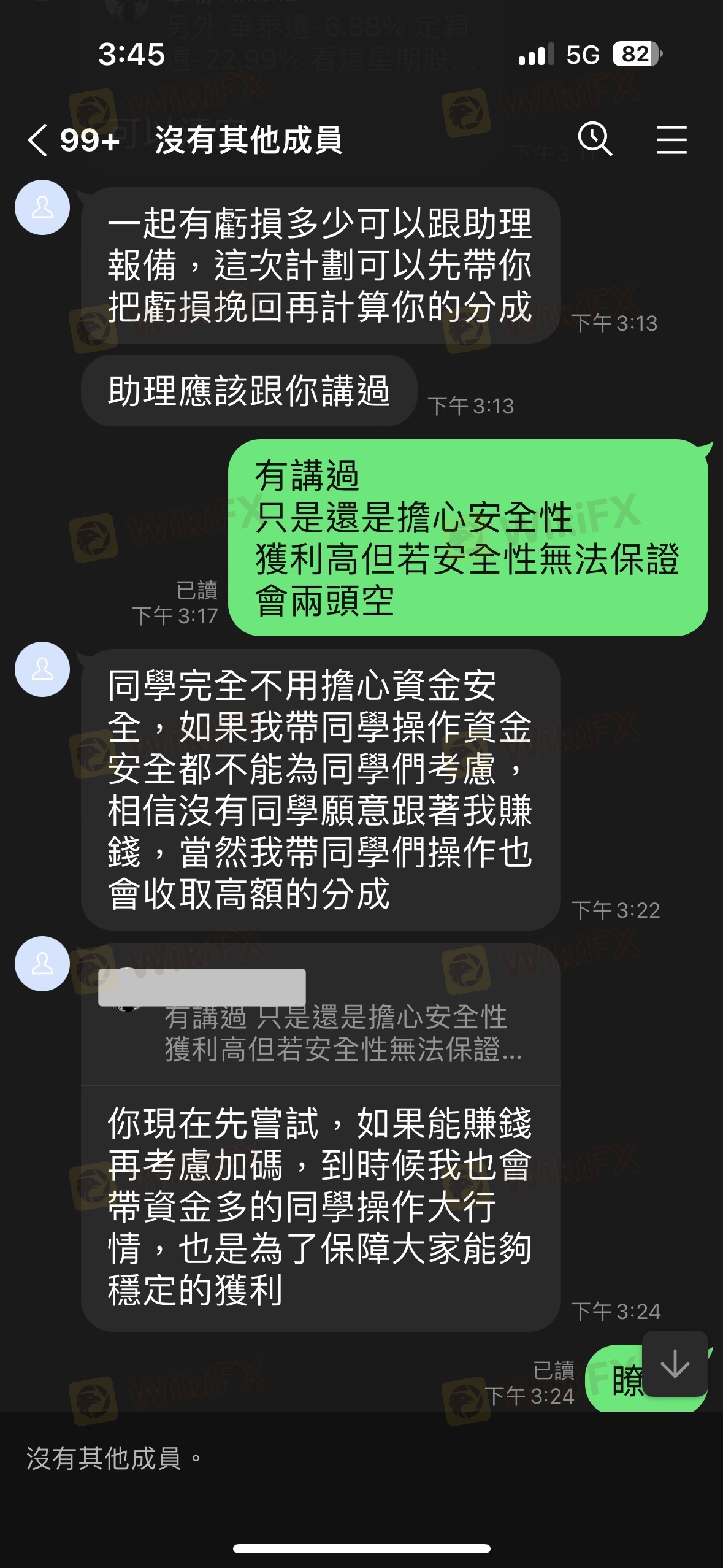

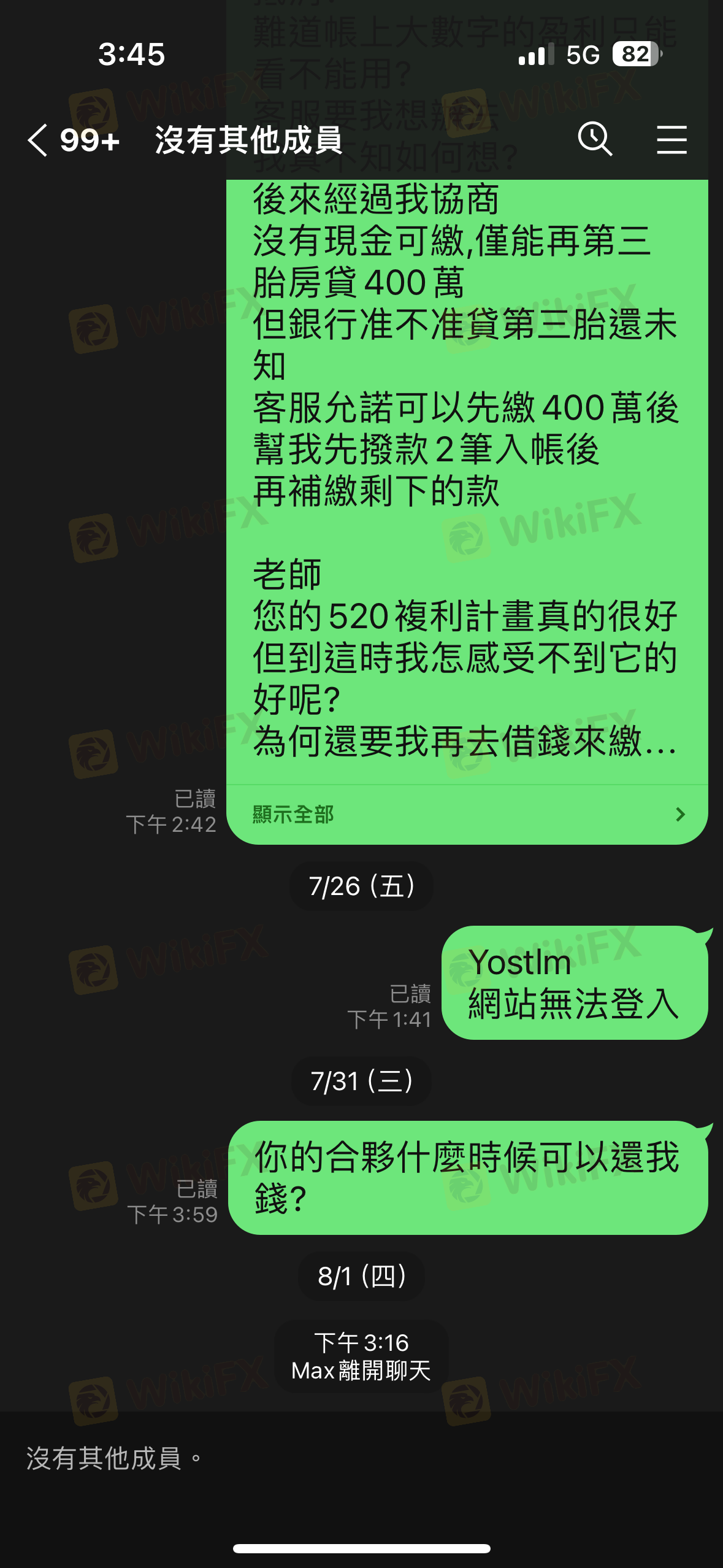

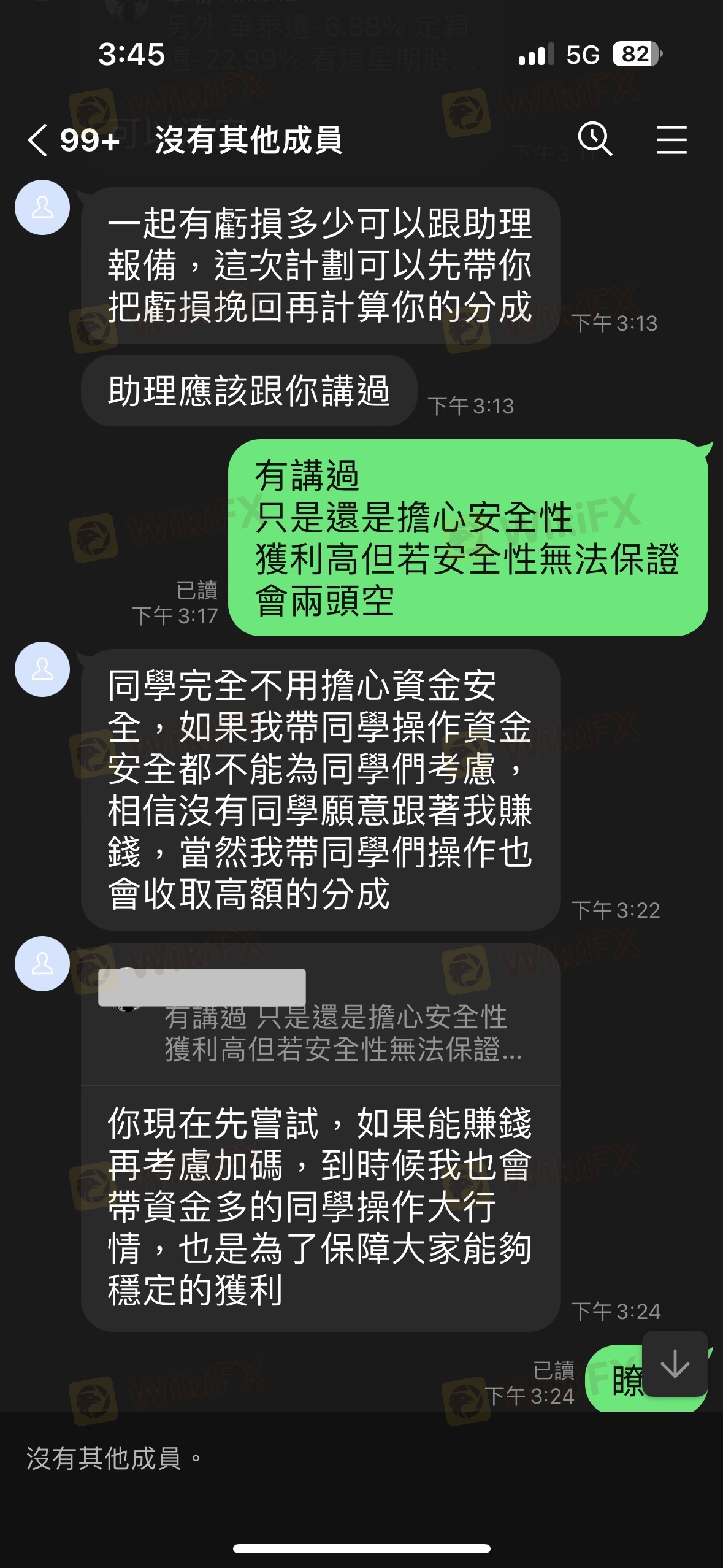

In April, I joined a Line group called "Soaring High," which included a teacher named Max and two assistants, XX Ying and XX Qiang. Initially, it was a stock group; from Monday to Friday, they would recommend a soaring stock to buy daily. Of course, there were both gains and losses. As we approached May 20th, they mentioned that the stock market outlook was not good and introduced a new investment plan called the "May 20th Compounding Plan." They invited their friend from the Piper Sandler institution, Mr. Yang Zongxing, to join. To participate, one needed to exchange cash for USDT through a broker to make deposits. After depositing, operations on gold trading (both selling and buying) would take place around 12:00 PM and 6:00 PM from Monday to Friday. Initially, the agreement was to pay the profit share after making withdrawals. However, when I wanted to withdraw, they changed the rule, stating that some students did not pay their share after withdrawing. Therefore, they shifted to requiring payment before withdrawal! This arbitrary change of rules also involved asking you to borrow money for the payment. Isn’t it supposed to be simple as making a withdrawal? I continuously communicated with them to let me withdraw first and promised immediate payment of my share once the money was withdrawn. But they insisted on receiving the profit share before allowing any withdrawals! A legitimate operator would want us to earn money as well as earn a share of the profits themselves. Their main interest seemed in earning this profit share, even encouraging others to take loans or use credit for investment! When I finished paying off the credit but couldn't withdraw, I realized it was a scam and stopped depositing more money! They threaten to freeze accounts if one cannot pay the share and unexpectedly retract links without warning! They expelled investors from the group making it impossible for them to withdraw their funds!

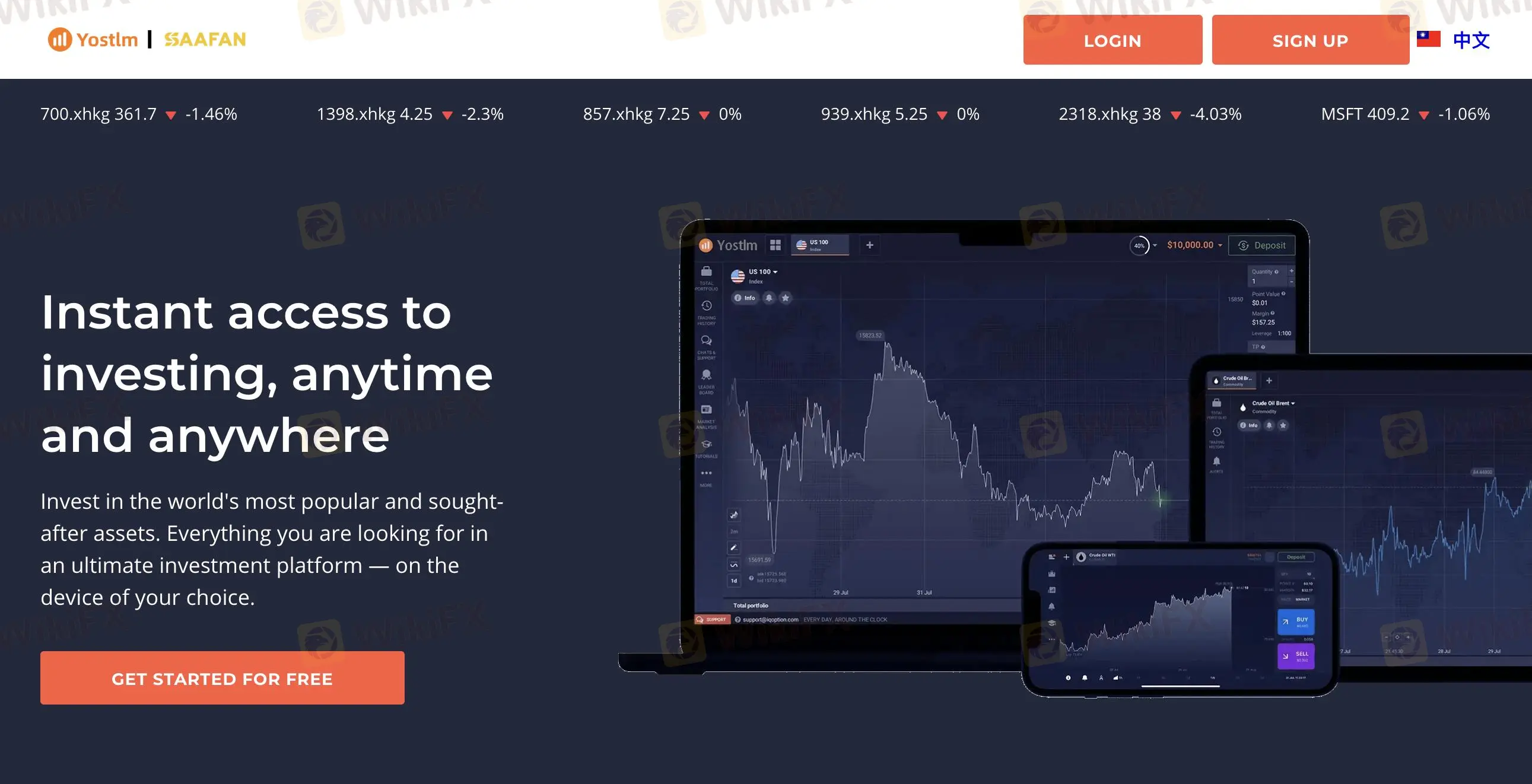

The international forex broker (yostlm Saafan Marktes) claimed that it had recently held a so-called gold price difference compound interest investment (CFD) with a Taiwanese investment consulting company (Huanyu). The platform was registered in Saint Lucia on May 15, 2024, and it is not an NFA member for less than a year. As for the domestic investment consulting company (Huanyu), I learned through a phone call that the company does not have a so-called line group and compound interest investment plan, and is not a domestic legal futures trader. However, the international forex broker (yostlm) stated that the implementation of the plan requires face-to-face cash payment with the exchanger to obtain USDT virtual US dollars in order to trade foreign exchange on Meta Trader5. The minimum deposit amount is NT$100,000, and nearly half of the profit is required to be given to the forex broker. The platform did not set a negative balance protection, so the position was liquidated (more than US$5,000 and a margin of US$3,200). Now the forex broker (Yang Zongxing) requires the negative balance to be filled, otherwise it will sue in the name of the company (yostlm Saafan Marktes)... At the same time, I sent a letter to the Securities and Futures Bureau for verification. The domestic investment consulting company (Huanyu) has issued a statement on May 2, 2013 to clarify that the company will not conduct any advertising activities through social media, websites, television, radio, etc., to recruit members, recommend domestic and foreign stocks, and foreign exchange, and to operate on behalf of others. Therefore, it is determined that this foreign exchange platform is a platform with a very high risk of fraud.

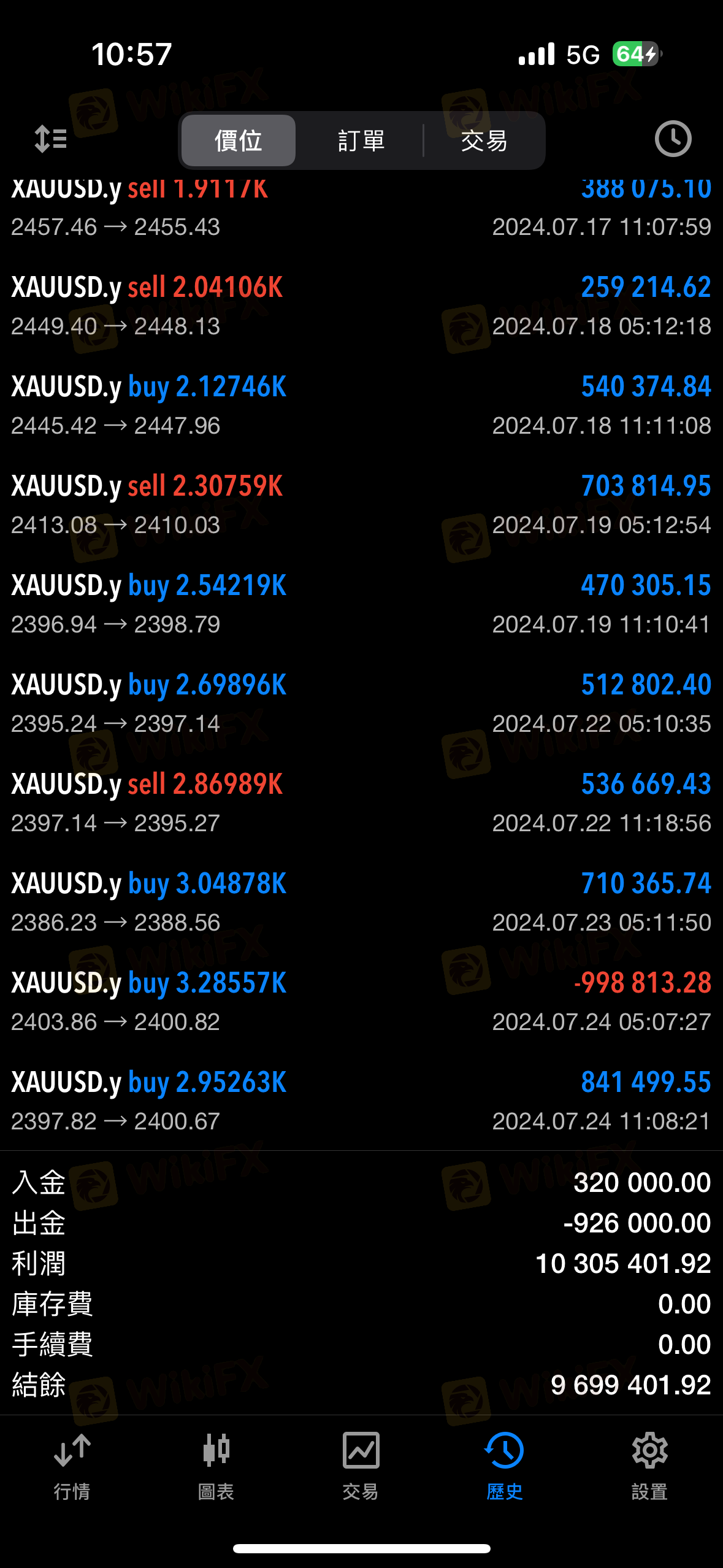

The group's teacher is Max, let everyone participate in the "520 Compound Profit Project", said with Piper Sandler organization and yostlm cooperation The foreign exchange trader Yang Zongxing (yostlm) said that the operation of the project must be with the exchange merchant (Currency Shengke) to pay cash in person to obtain the virtual USD USD in order to be able to Meta Trader5 to operate foreign exchange, and the minimum amount of money to deposit! The minimum deposit is $100,000 and the requirement to share nearly half of the profits to the foreign exchange trader Each time the operation is notified by the group assistant coach Mika Liao, in the operation, because it is suspected that it is designed to be more than one transaction and instantly caused by the penetration of the position, the first time the anomaly said that it was the tiredness of the network I pressed more than once, I can only admit that I was unlucky, but after that I was divided into two orders, the first unit and the second are different, but the third extra is the same as the first unit, this should not be a problem of tiredness, it should not be a problem of the network. I guess it is not a problem with the progressive cells! (I lost 23,000 USD in total and still have a negative balance of 500 USD), now the foreign exchange trader (Yeung Chung Hing) demanded to make up the negative balance, otherwise it will result in a default of delivery.

There was this chat group created by Max and teaching assistant Chen Xhan. Later, they invited Mr. Yang to join the cooperation and persuade everyone to participate in the compound interest plan. One day I told my teaching assistant Chen ZhiX that I wanted to withdraw money, and she said she would contact Mr. Yang to pay the share, but after the share was paid, the backend webpage could not be opened. Mr. Yang said that the account was checked for tax evasion, but in the end he said that I had to pay 30% income tax on the withdrawal amount before I could restore the backend login of the webpage. I felt like I was scammed.

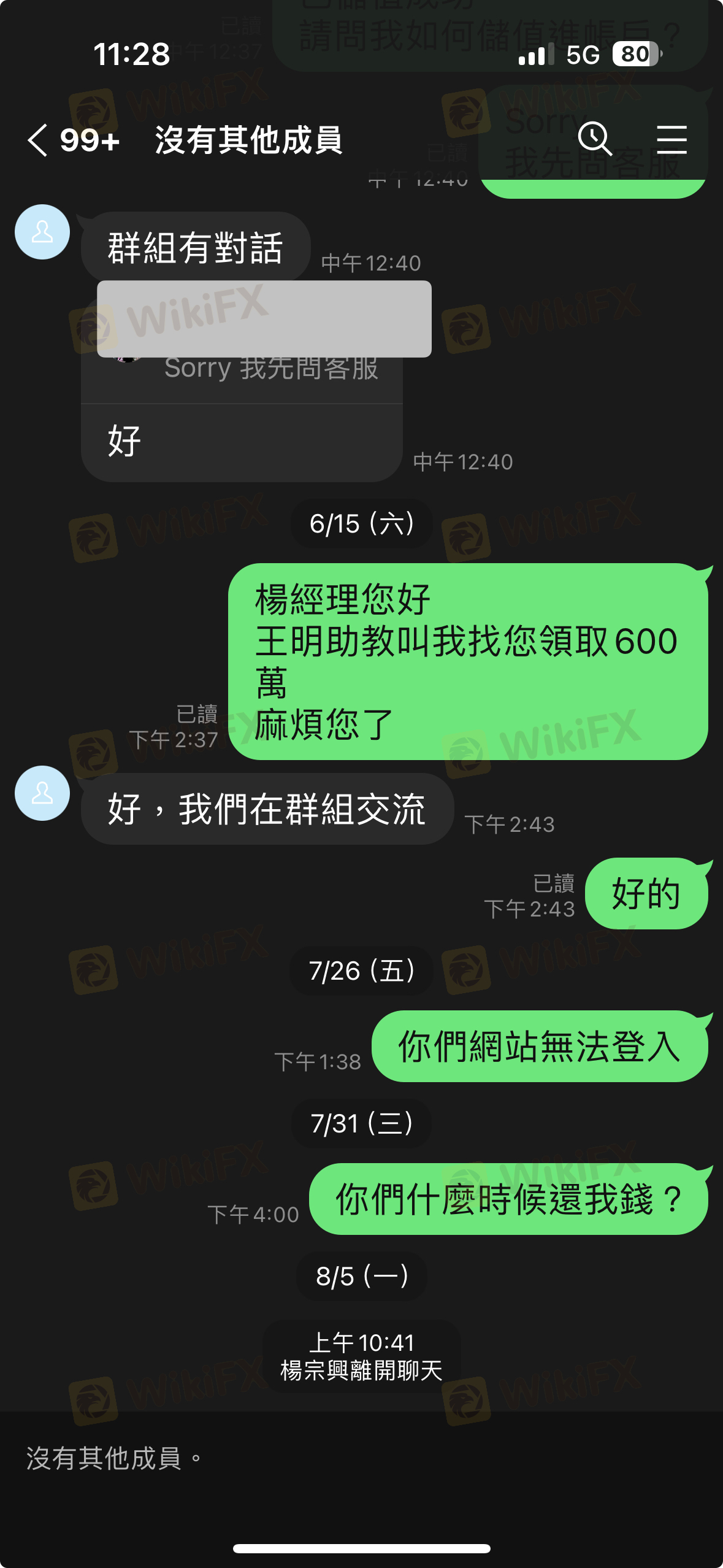

1. On FB Messenger, Guo Xiaofeng sends a message to Max, who then communicates with his assistant Wang Ming via Line to provide information on strong stock operations. 2. They entice joining the "520 Compound Interest Plan" for gold price difference operations to earn substantial profits. All losses from stock sales are added up for more operations (Max promises that profits will first cover the amount lost from stock sales before splitting; profits from the first two weeks of trading are not shared). During this period, two small group sessions (likely accomplices) led Bitcoin operations that resulted in a blow-up, one ending with a balance of zero, and another with a balance of -12,949 USDT. Wang Ming states: "You must cover the negative losses within two days, or it will affect your credit. It's hard to recover losses with too little capital; it could take two to three months. You could borrow another 3 million, I guarantee to help you recover your losses within a week." He urged me to find ways to increase capital by borrowing more money (already invested NT$2 million during this period). 3. The only option was to take out a mortgage loan. Wang Ming said he consulted with the teacher and proactively offered a credit of NT$6 million, allowing me to join major market operations without any cost, provided I repay within half a month but restricted withdrawals until then. Not wanting to owe anyone and keeping my word, I repaid the NT$6 million credit and added another NT$2 million. 4. After repaying the credit with the bank mortgage loan, withdrawal requests were denied despite records showing 926,000 USDT had been withdrawn in the account; however, no funds were actually transferred to my bank account. They demanded a 30% capital gains tax for withdrawal. All my money including an NT$8 million mortgage was already invested; I had no funds left to pay further. Customer service claimed I owed taxes and forcibly removed me from the customer service group; Max and Yang Zongxing also left the Line chat, assistant Wang Ming stopped responding entirely, and I was forcibly removed from both the main and small groups (turns out they were all in it together). 5. My principal of NT$10 million along with all trading profits were withheld by this group; losses from stock sales incurred between June and August left me without any income. Now I have to pay an NT$8 million monthly mortgage interest—how can just one word "tragic" describe this?

Note: Saafan Markets's official website: https://www.yostlm.com/en.html is currently inaccessible normally.

| Saafan MarketsReview Summary | |

| Founded | 2024 |

| Registered Country/Region | Saint Lucia |

| Regulation | No regulation |

| Market Instruments | Gold |

| Demo Account | ❌ |

| Leverage | / |

| Spread | / |

| Trading Platform | MT4 |

| Min Deposit | / |

| Customer Support | Physical Address: Ground Floor, The Sotheby Building, Rodney Village, Gros-lslet, Rodney Bay, Saint Lucia LC01401 |

Saafan Markets Ltd. is a newly established trading platform headquartered in Saint Lucia, offering trading services exclusively in gold. Despite operating without regulatory oversight, Saafan Markets provides trading through the widely recognized MT4 platform. The company does not impose minimum deposits, leverage, spreads, or commissions, but also lacks account variety, educational resources, and bonus offerings. Customer support is available at their office in Saint Lucia.

The search revealed that Saafan Markets registered its website in 2024, but as of now, it is no longer accessible. Saafan Markets is also being left unregulated.

| Pros | Cons |

|

|

|

|

|

|

Saafan Markets specializes exclusively in gold trading, providing a focused market instrument for investors interested in precious metals. This singular asset focus allows traders to capitalize on market movements in gold, a widely regarded safe-haven asset. However, the lack of diversification into other tradable assets might limit opportunities for those seeking to spread risk across different markets.

| Tradable Instruments | Supported |

| Gold | ✔ |

| Forex | ❌ |

| Indices | ❌ |

| Stocks | ❌ |

| Bonds | ❌ |

| ETF | ❌ |

Saafan Markets says it supports commission-free trading.

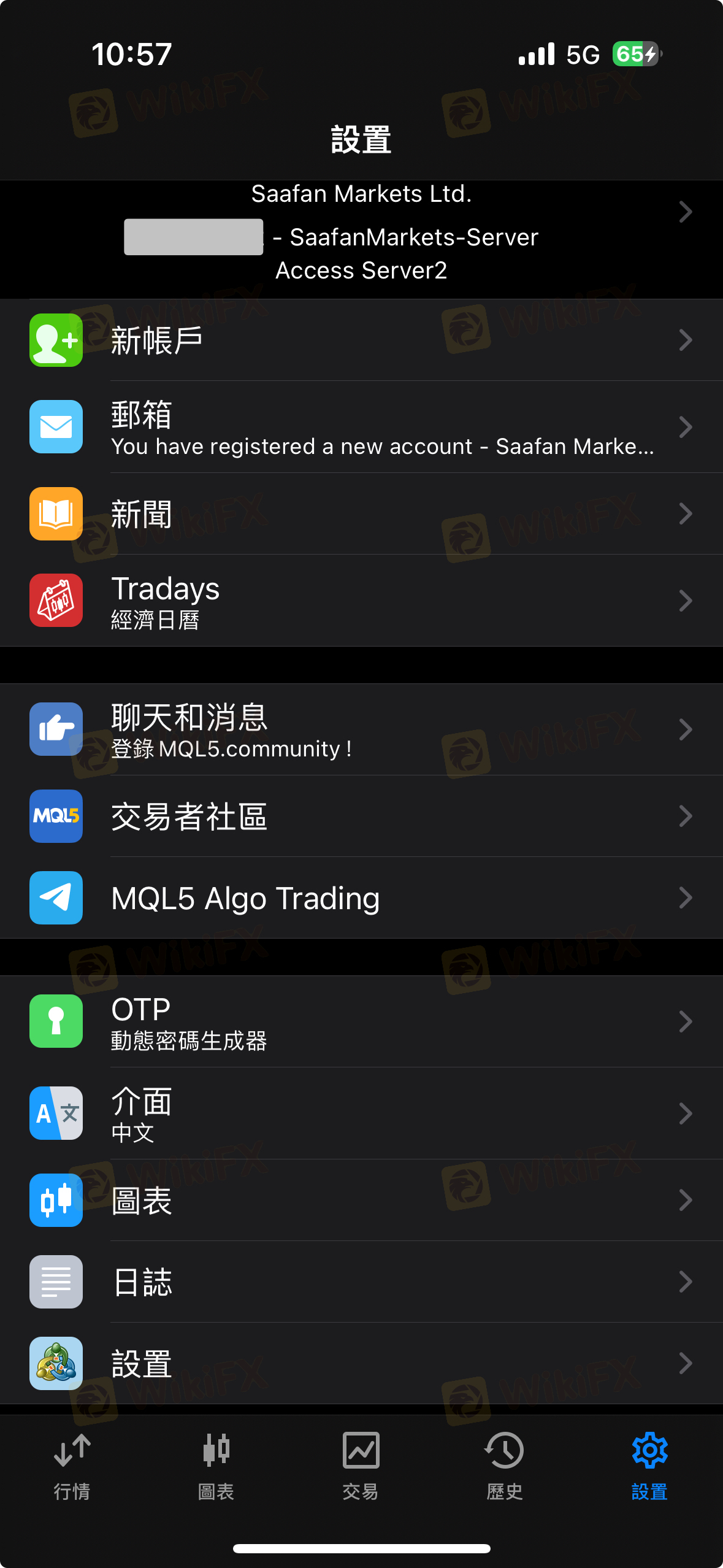

Saafan Markets offers MT4 trading platform to traders.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Beginner | |

| MT5 | ❌ |

Clients can contact this broker through the following contact channels:

Address: Ground Floor, The Sotheby Building, Rodney Village, Gros-Islet, RodneyBay, Saint Lucia LC01401.

More

User comment

2

CommentsWrite a review

2024-08-22 23:31

2024-08-22 23:31

2024-07-22 10:39

2024-07-22 10:39