User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

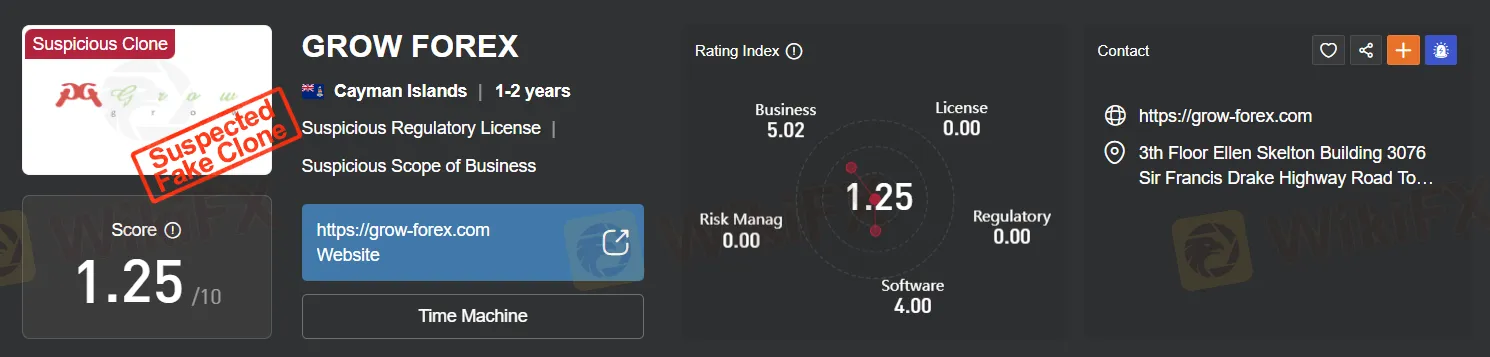

Regulatory Index0.00

Business Index6.46

Risk Management Index0.00

Software Index4.00

License Index0.00

Single Core

1G

40G

| Aspect | Information |

| Registered Country/Area | Not specified (Unregulated) |

| Company Name | GROW FOREX |

| Regulation | Unregulated |

| Minimum Deposit | 50 USD |

| Maximum Leverage | Up to 1:1000 (High Leverage Account) |

| Spreads | As low as 0.6 pips (ECN and Islamic Account) |

| Trading Platforms | GROW FOREX App, MetaTrader 5 (MT5) |

| Tradable Assets | Forex, Commodities, Indices, Stocks, Cryptocurrencies |

| Account Types | ECN Account, High Leverage Account, Islamic Account |

| Demo Account | Available |

| Islamic Account | Available with commission-based trading |

| Customer Support | Online chat support |

| Payment Methods | Online Banking Transfer, Mastercard, Mobile Banking Transfer, Cryptocurrency Payment |

| Educational Tools | Online courses, Educational videos |

GROW FOREX is an online trading platform that offers a range of features and services for traders. It operates without specific regulation and is based in an unspecified country or area. The company provides a variety of account types to suit different trading preferences, including an ECN Account, High Leverage Account, and Islamic Account. Traders can start with a minimum deposit of 50 USD and enjoy high leverage options of up to 1:1000, primarily available in the High Leverage Account. The platform offers competitive spreads as low as 0.6 pips on certain account types, such as the ECN and Islamic Account. Traders have access to educational resources in the form of online courses and educational videos to enhance their trading knowledge. GROW FOREX also offers a demo account for those looking to practice their trading strategies. Customer support is available through online chat, and traders can fund their accounts using various payment methods, including online banking transfers, Mastercard, mobile banking transfers, and cryptocurrency payments. The trading experience can be facilitated through the GROW FOREX App and the MetaTrader 5 (MT5) platform, allowing access to a wide range of tradable assets, including forex, commodities, indices, stocks, and cryptocurrencies. Additionally, the platform offers an Islamic Account option with commission-based trading for those adhering to Islamic finance principles.

Unregulated.The use of suspicious fake licenses by GROW FOREX as a broker raises serious concerns about the legitimacy and credibility of the company. Operating with fraudulent licenses not only undermines trust but also poses significant risks to investors. It is essential for anyone considering trading with a forex broker to thoroughly research and verify their credentials to ensure their investments are protected. Engaging with a broker that uses fake licenses can lead to financial losses and potential legal consequences, making it imperative for investors to exercise caution and due diligence when selecting a broker for their trading activities. It is advisable to choose a reputable and regulated broker to ensure a safe and secure trading experience.

GROW FOREX presents traders with a combination of advantages and disadvantages to consider before engaging with the platform. While it offers a diverse range of market instruments and multiple account types to cater to various trading preferences, its lack of regulation raises concerns about its legitimacy. The broker also provides educational resources and access to powerful trading platforms but falls short in terms of customer support options, offering only online chat.

Pros:

| Pros | Description |

|

GROW FOREX offers a wide range of trading instruments, including forex, commodities, indices, stocks, and cryptocurrencies. |

|

Traders can choose from three account types, each with its own set of features, allowing for flexibility based on individual preferences. |

|

The platform provides online courses and educational videos to support traders in enhancing their knowledge and trading skills. |

|

GROW FOREX offers a user-friendly trading app and the popular MetaTrader 5 platform, providing traders with advanced trading tools and analysis. |

Cons:

| Cons | Description |

|

|

|

|

In summary, GROW FOREX offers a diverse range of market instruments, account types, and educational resources. However, its lack of regulation raises concerns, and its customer support is limited to online chat. Traders should carefully consider these pros and cons when evaluating the platform for their trading needs.

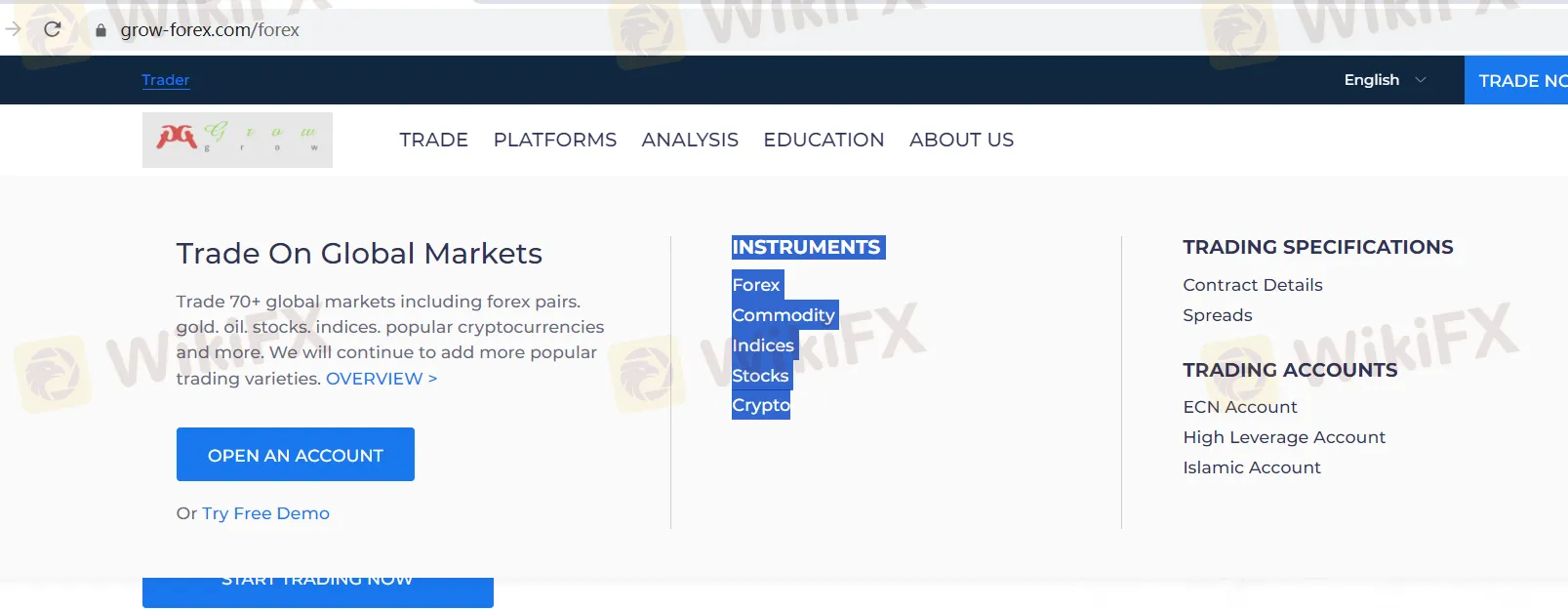

GROW FOREX offers a diverse range of market instruments to cater to the needs of traders with varying preferences and strategies. These instruments encompass the following categories:

Forex:

GROW FOREX provides access to the foreign exchange market, allowing traders to engage in currency trading. Forex trading involves the exchange of one currency for another, and it is one of the most popular and liquid markets globally. Traders can speculate on currency pairs, such as EUR/USD or GBP/JPY, taking advantage of price fluctuations to make profits.

Commodity:

The broker also offers commodities trading, which includes various raw materials and resources like oil, gold, silver, and agricultural products. Commodity trading allows investors to diversify their portfolios and hedge against inflation or economic uncertainties by trading contracts based on the price movements of these physical assets.

Indices:

GROW FOREX provides access to a wide range of global indices. These indices represent a basket of stocks from specific regions or industries and are used as indicators of overall market performance. Traders can speculate on the direction of indices like the S&P 500, FTSE 100, or Nikkei 225, providing opportunities for both short-term and long-term investments.

Stocks:

The broker offers a selection of individual company stocks from various stock exchanges around the world. Traders can invest in shares of companies they believe will perform well, or they can engage in stock trading strategies like day trading or long-term investing.

Crypto:

GROW FOREX also includes cryptocurrencies in its range of instruments. Cryptocurrencies like Bitcoin, Ethereum, and Ripple have gained significant popularity in recent years. Traders can speculate on the price movements of these digital assets, taking advantage of the volatility and potential for substantial returns in the cryptocurrency market.

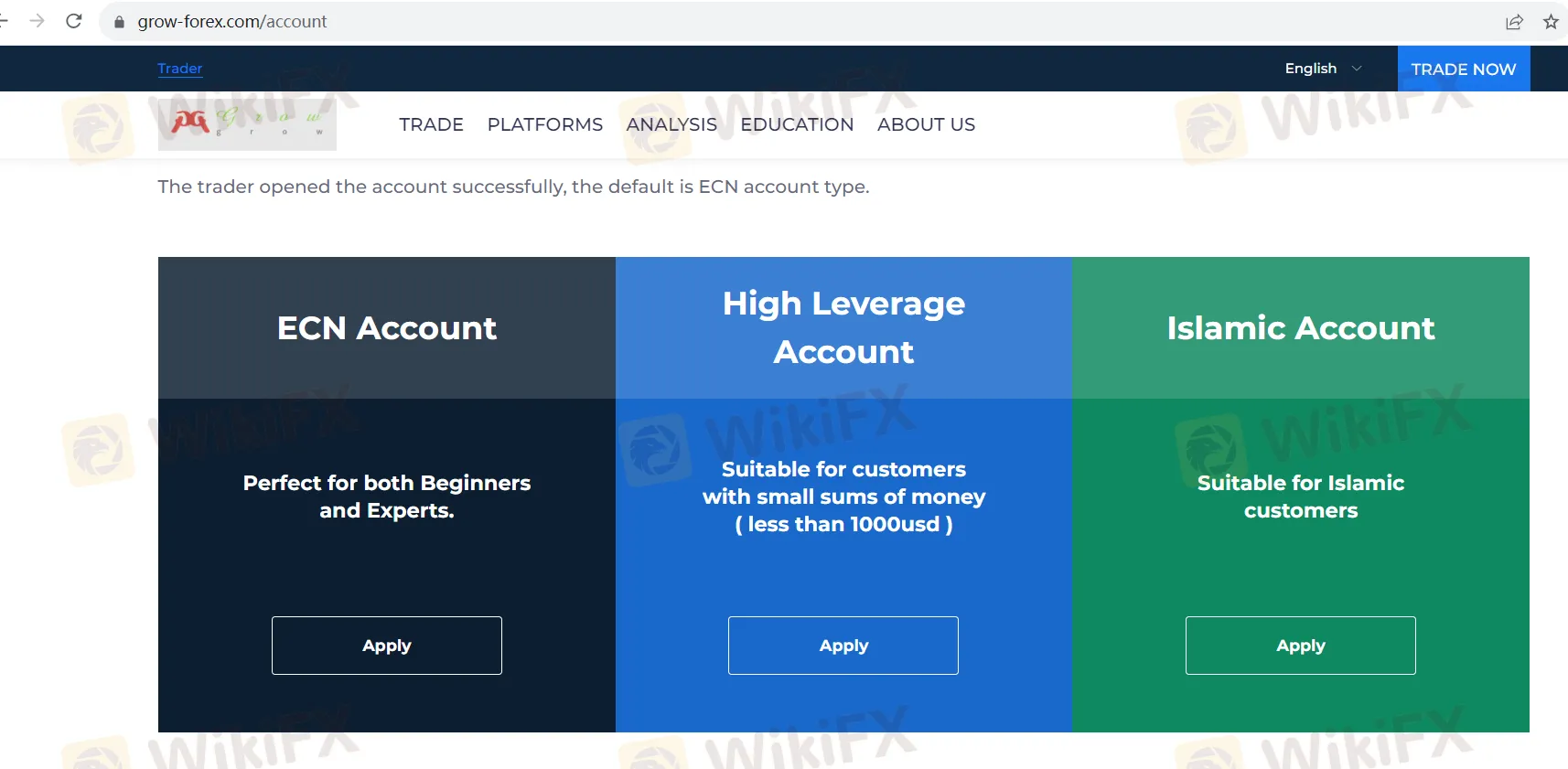

GROW FOREX offers three distinct account types tailored to meet the diverse needs and preferences of traders: the ECN Account, the High Leverage Account, and the Islamic Account.

ECN Account:

The ECN Account is designed for traders seeking competitive spreads and fast execution speeds. It operates with a base currency of USD and offers leverage options of 1:100 or 1:200, making it suitable for traders with varying risk appetites. With a low minimum deposit requirement of just 50 USD, it provides accessibility to traders of all levels. This account type comes with negative balance protection to safeguard traders from excessive losses. Traders can benefit from tight spreads on major currency pairs, starting as low as 0.6 pips, and execute trades swiftly, typically within one second. Additionally, clients have access to multilingual customer support and can utilize free regular trading strategies to enhance their trading experience.

High Leverage Account:

The High Leverage Account is designed for those who seek significant leverage in their trading activities. It operates in USD as the base currency and offers an exceptionally high leverage ratio of 1:1000. Similar to the ECN Account, it requires a minimum deposit of 50 USD and includes negative balance protection. While spreads on major currency pairs are slightly higher, starting at 1.0 pip, the High Leverage Account provides traders with the potential for substantial gains. Margin requirements vary significantly between weekdays and weekends, with 5% on weekdays and 500% on weekends, providing traders with flexibility in their trading strategies. This account type also offers quick execution and multilingual customer support, along with access to free regular trading strategies.

Islamic Account:

The Islamic Account is tailored to cater to traders who adhere to Islamic finance principles, which prohibit earning or paying interest (riba). Like the other account types, it operates with USD as the base currency and offers leverage options of 1:100 or 1:200, providing flexibility to traders. With a minimum deposit requirement of 50 USD, it ensures accessibility. The Islamic Account includes negative balance protection, ensuring that traders do not incur losses beyond their account balance. Spreads on major currency pairs start as low as 0.6 pips. Notably, this account type offers commission-based trading to comply with Islamic finance principles, and it does not involve overnight interest. Traders can take advantage of quick execution times, multilingual customer support, and free regular trading strategies to enhance their trading experience.

GROW FOREX offers a maximum trading leverage of 1:1000 for the High Leverage Account. This means traders can control a position worth up to 1000 times their account balance. However, it's crucial to use high leverage cautiously, as it amplifies both potential profits and risks. Risk management strategies are essential to protect capital and minimize potential losses when trading with such high leverage. Traders should choose their leverage level carefully based on their risk tolerance and trading experience.

GROW FOREX offers a flexible approach to spreads and commissions, with variations depending on the chosen trading account.

Spreads:

The broker provides competitive spreads on all major currency pairs, with rates starting as low as 0.6 pips for the ECN Account and Islamic Account. For the High Leverage Account, spreads on major currency pairs begin at 1.0 pip. Spreads represent the difference between the buying and selling prices of an asset and play a crucial role in determining trading costs. Lower spreads can benefit traders by reducing their trading expenses.

Commissions:

Commissions are applied differently across the account types. While the ECN and High Leverage Accounts do not involve commissions (indicated as “X”), the Islamic Account operates on a commission-based model (indicated as “√”). This means that traders using the Islamic Account will pay a commission for each trade instead of dealing with wider spreads. The commission-based approach aligns with the Islamic finance principles, which prohibit earning or paying interest (riba).

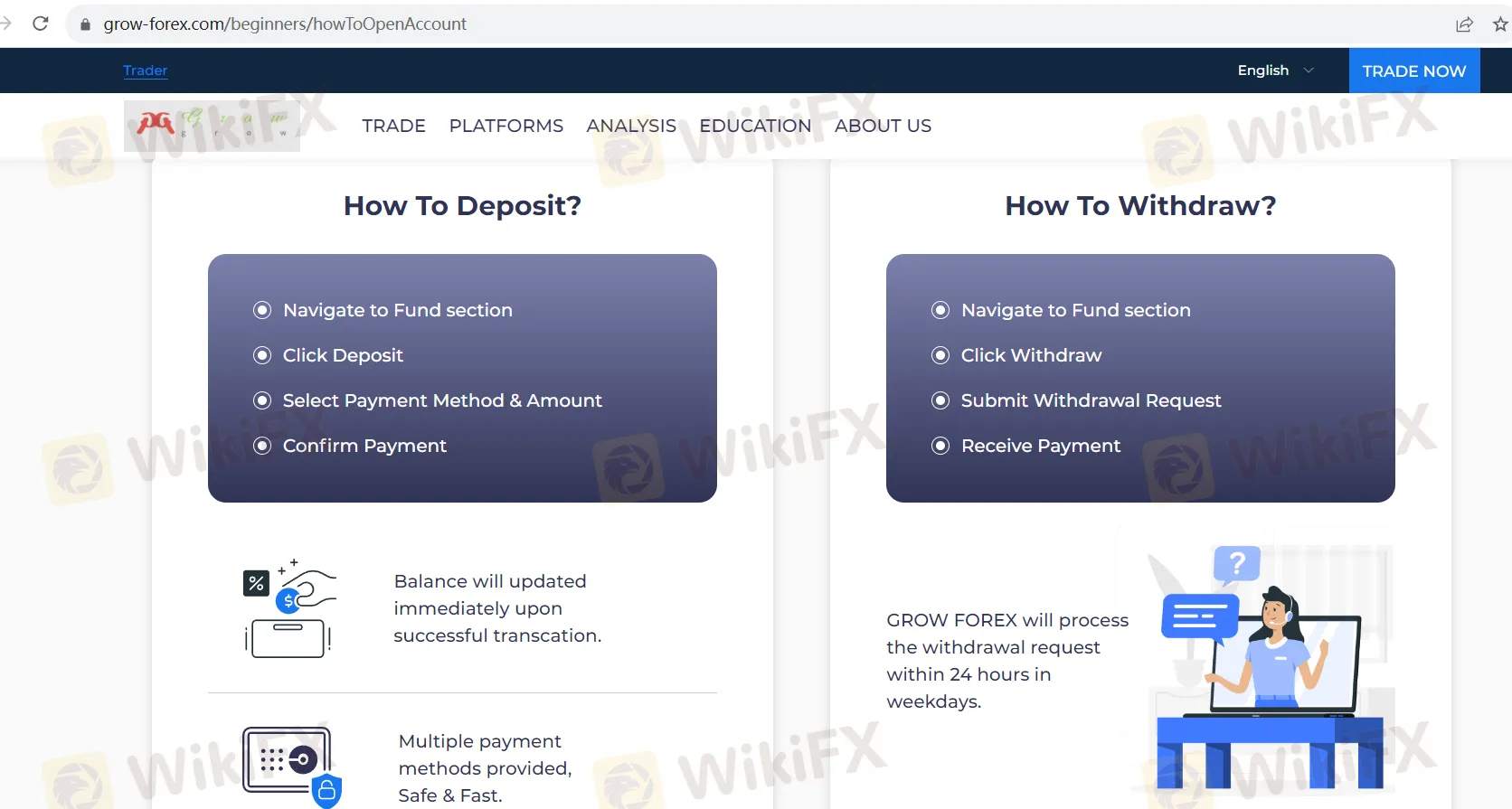

Deposit:

GROW FOREX simplifies the deposit process to ensure a hassle-free experience for its traders. To fund your trading account, start by navigating to the “Fund” section within the trading platform. Once there, click on the “Deposit” option. Here, you'll be presented with a choice of payment methods to suit your preferences. Select your preferred payment method and specify the amount you intend to deposit. After confirming the payment, your account balance will be promptly updated to reflect the deposited funds. GROW FOREX prides itself on offering a variety of secure and swift payment options to cater to the diverse needs of its clients, making the deposit process both safe and convenient.

Deposit Methods:

Investors have a variety of convenient options to deposit funds into their GROW FOREX trading accounts, including but not limited to the following:

Online Banking Transfer: With this option, funds typically arrive within approximately 10 minutes, allowing for swift deposits.

Mastercard: Deposits made using Mastercard also usually take around 10 minutes to reflect in the trading account.

Mobile Banking Transfer: This method provides another quick deposit option, with funds typically arriving within about 10 minutes.

Cryptocurrency Payment: Investors can opt for cryptocurrency deposits, and like the other methods, these typically take around 10 minutes to process.

Please note that while these deposit methods generally provide rapid funding, the specific time of arrival may depend on the processing speed of the investor's bank. Additionally, certain withdrawal methods may be limited to specific countries or regions, and for detailed information, investors are encouraged to review their trading account or contact GROW FOREX's Customer Support.

Withdrawal:

Withdrawing funds from your GROW FOREX account is just as straightforward as depositing. To initiate a withdrawal, head to the “Fund” section within the trading platform. Locate and click on the “Withdraw” option. Here, you can submit your withdrawal request, specifying the amount you wish to withdraw. Once your request is submitted, you'll need to await the processing of the withdrawal. GROW FOREX strives to process withdrawal requests swiftly, typically within 24 hours on weekdays. However, the actual time it takes for the withdrawn funds to reach your account may vary based on the chosen withdrawal method and the processing times of your financial institution. These user-friendly deposit and withdrawal procedures exemplify GROW FOREX's commitment to providing traders with a seamless and efficient financial experience.

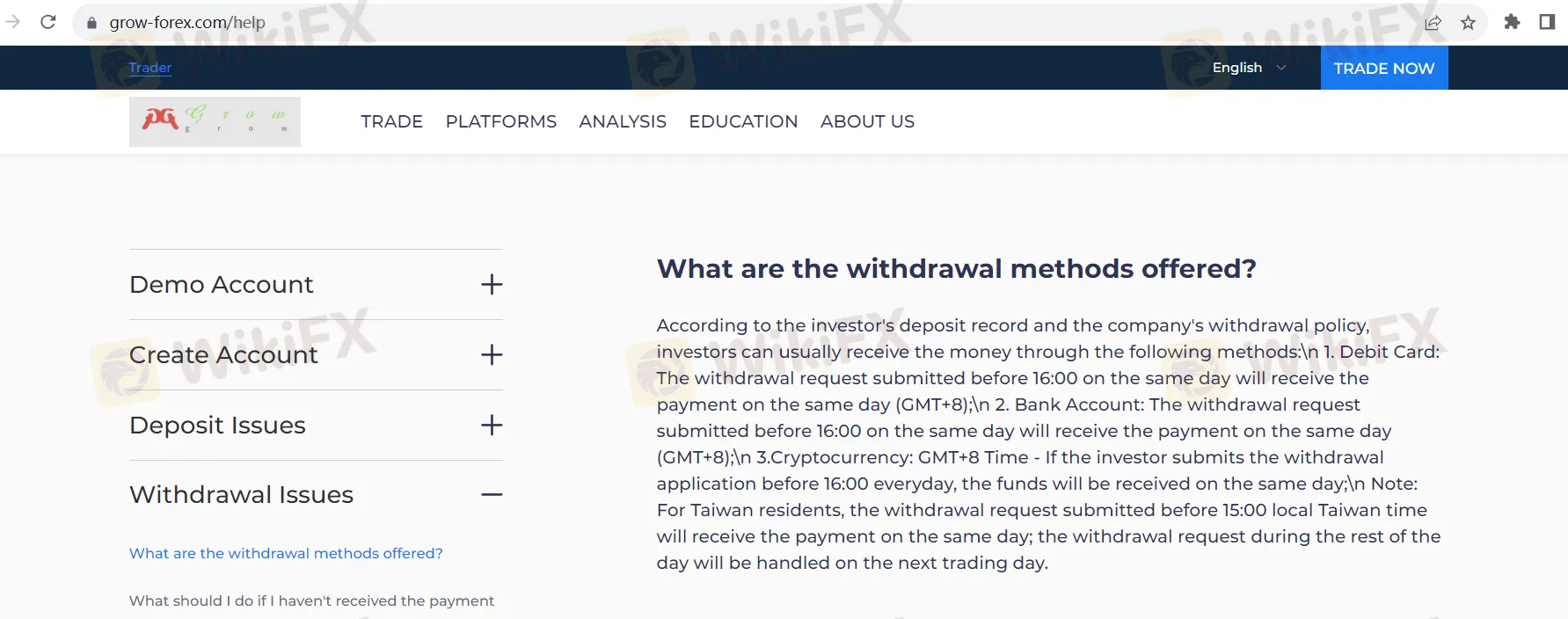

Withdrawal Methods:

Investors can typically receive their withdrawals through the following methods, subject to GROW FOREX's withdrawal policy and the timing of their requests:

Debit Card: Withdrawal requests submitted before 16:00 (GMT+8) on the same day usually result in same-day payments.

Bank Account: Similar to debit card withdrawals, requests made before 16:00 (GMT+8) on the same day generally lead to same-day payments.

Cryptocurrency: For investors operating on GMT+8 time, if withdrawal applications are submitted before 16:00 daily, funds are typically received on the same day.

For Taiwan residents, withdrawal requests submitted before 15:00 local Taiwan time will receive same-day payments, while requests made during the rest of the day will be processed on the next trading day.

These withdrawal methods demonstrate GROW FOREX's commitment to providing flexibility and timely financial transactions for its investors, ensuring a smooth and efficient experience.

GROW FOREX provides a suite of powerful trading platforms, including the GROW FOREX App and the MetaTrader 5 (MT5) platform, designed to cater to traders' diverse needs. The GROW FOREX App offers superior trading performance, free risk management tools, access to exclusive market data and analysis, and a user-friendly interface. It provides full trading functionality, allowing users to execute trades, perform technical analysis, and receive real-time market news and strategy tips from industry professionals. On the other hand, the MetaTrader 5 (MT5) platform, available on desktop and mobile (Android and iOS), is renowned for its flexibility in setting stop-profit/loss points, advanced technical analysis tools, and automated trading capabilities. It's a preferred choice for millions of Forex and stock traders worldwide, offering a comprehensive and feature-rich trading experience.

GROW FOREX's customer support, unfortunately, falls short in terms of accessibility and convenience. The only means of contacting their support is limited to online chat. This severely restricts the options available to customers seeking assistance or clarification on their trading activities. It can be frustrating for clients who may prefer alternative communication channels like phone or email, as online chat may not always be the most efficient or effective method for addressing complex or urgent issues. Additionally, the absence of phone or email support can leave traders feeling unsupported during critical moments, potentially eroding their trust in the company's commitment to customer service.

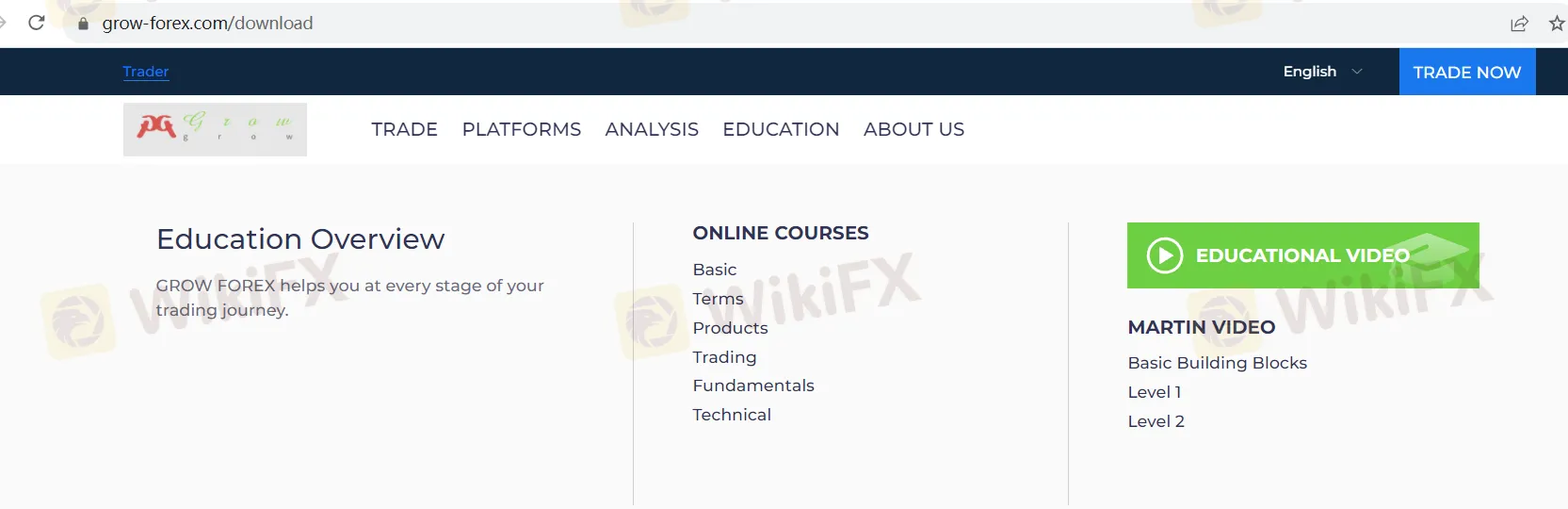

GROW FOREX offers a robust educational resource center aimed at supporting traders throughout their trading journey. This section includes both online courses and educational videos, ensuring a well-rounded learning experience.

Online Courses: GROW FOREX provides a structured curriculum covering various trading topics, from fundamental terms to technical analysis. The courses are designed to accommodate traders of all levels, allowing them to progressively enhance their trading knowledge.

Educational Videos: The platform also offers informative videos, including the “MARTIN VIDEO” series categorized into different levels. These videos provide engaging visual content that complements traditional learning, making complex trading concepts more accessible.

Overall, GROW FOREX's commitment to trader education empowers clients to build a strong foundation and refine their trading skills, ensuring they are well-prepared for success in the financial markets.

In summary, GROW FOREX is a forex broker that offers a range of trading instruments, account types, and trading platforms. However, its lack of regulation raises concerns about its legitimacy. On the positive side, GROW FOREX provides a diverse set of market instruments, including forex, commodities, indices, stocks, and cryptocurrencies. It offers various account types to cater to different trader preferences, with options for competitive spreads and high leverage. The broker also provides educational resources, including online courses and videos. While its trading platforms offer advanced features, the limited customer support options, relying solely on online chat, can be a drawback. Traders should exercise caution and conduct thorough research before engaging with GROW FOREX to ensure a safe and secure trading experience.

Q1: Is GROW FOREX a regulated broker?

A1: No, GROW FOREX is an unregulated broker, which can raise concerns about its credibility and safety for traders.

Q2: What market instruments can I trade with GROW FOREX?

A2: GROW FOREX offers a diverse range of instruments, including forex, commodities, indices, stocks, and cryptocurrencies.

Q3: What account types does GROW FOREX provide?

A3: GROW FOREX offers three account types: ECN Account, High Leverage Account, and Islamic Account, catering to various trader preferences.

Q4: What is the maximum leverage offered by GROW FOREX?

A4: GROW FOREX provides a maximum trading leverage of 1:1000 for the High Leverage Account, allowing traders to control larger positions with relatively less capital.

Q5: How can I contact GROW FOREX's customer support?

A5: GROW FOREX's customer support is accessible only via online chat, which may limit communication options for traders seeking assistance or information.

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment