User Reviews

More

User comment

4

CommentsWrite a review

2024-03-25 00:46

2024-03-25 00:46

2024-02-01 10:22

2024-02-01 10:22

Score

2-5 years

2-5 yearsRegulated in Germany

Derivatives Trading License (EP)

Self-developed

Global Business

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index6.02

Business Index6.83

Risk Management Index9.57

Software Index5.42

License Index6.08

Single Core

1G

40G

More

Company Name

TRADE REPUBLIC BANK

Company Abbreviation

TRADE REPUBLIC

Platform registered country and region

Germany

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

| TRADE REPUBLIC Review Summary | |

| Founded | 2015 |

| Registered Country/Region | Germany |

| Regulation | BaFin (Exceeded) |

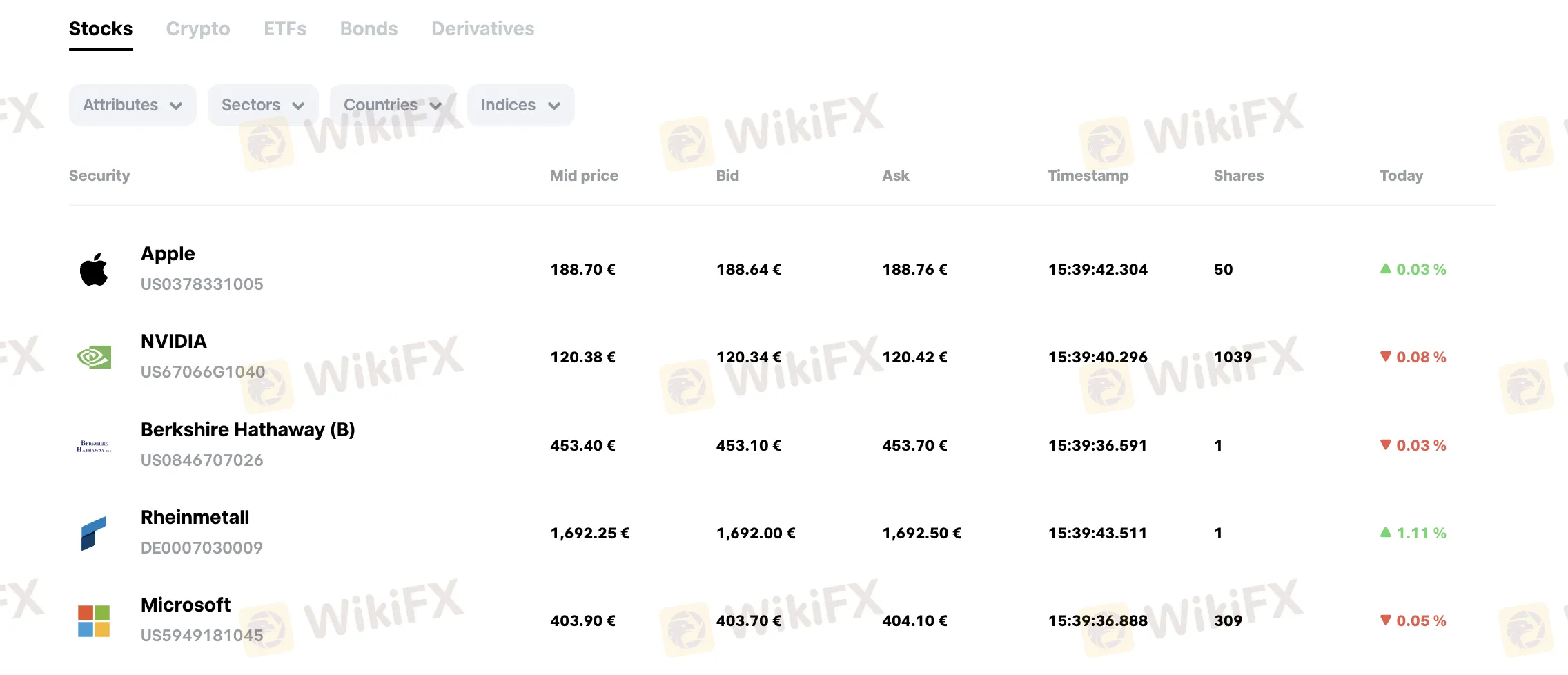

| Market Instruments | Stocks, ETFs, Bonds, Cryptos, Derivatives |

| Demo Account | ❌ |

| Trading Platform | Mobile App |

| Minimum Deposit | €1 |

| Customer Support | APP online chat |

Trade Republic, a BaFin-regulated neobroker based in Germany, was established in 2015. It provides an all-in-one platform for banking, investing, and saving. Users can trade bonds, cryptos, ETFs, stocks with cheap costs, earn interest on cash, and benefit from in-app help and tools. Its license status, though, is marked “Exceeded”, suggesting perhaps action outside the authorized range of its regulatory license.

| Pros | Cons |

| Supports cryptos, ETFs, stocks, bonds, and derivatives trading | Exceeded BaFin license |

| Low fees | Mobile-only platform (no desktop version) |

| Low minimum deposit | No access to forex or commodities |

Yes, Trade Republic Bank GmbH is a regulated financial institution. It has a Common Financial Service License from BaFin (Federal Financial Supervisory Authority) in Germany. Its present regulatory status, however, is “Exceeded”.

Trade Republic provides a complete one-stop site for investing, saving, and spending. Users can trade futures, cryptocurrencies, bonds, ETFs, stocks, and equities, earn interest on cash, and access spending tools like Saveback rewards.

| Tradable Instruments | Supported |

| Stocks | ✔ |

| ETFs | ✔ |

| Bonds | ✔ |

| Cryptos | ✔ |

| Derivatives | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Options | ❌ |

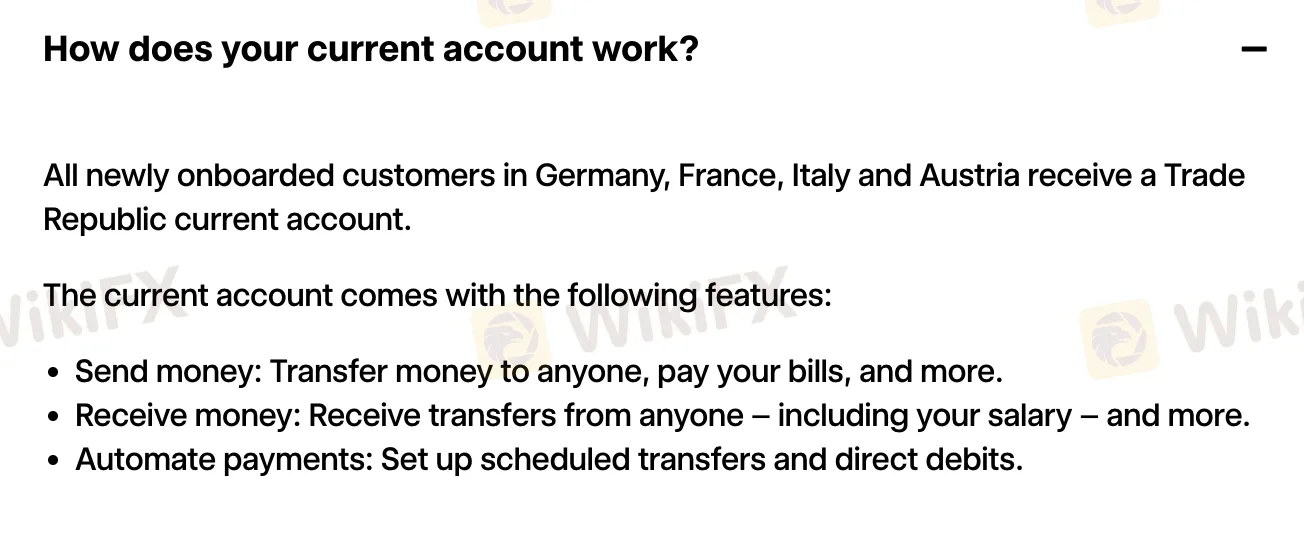

Trade Republic now offers one single unified account type: the current account, which combines banking, investment, and saving capabilities. Customers in Germany, France, Italy, and Austria automatically open it.

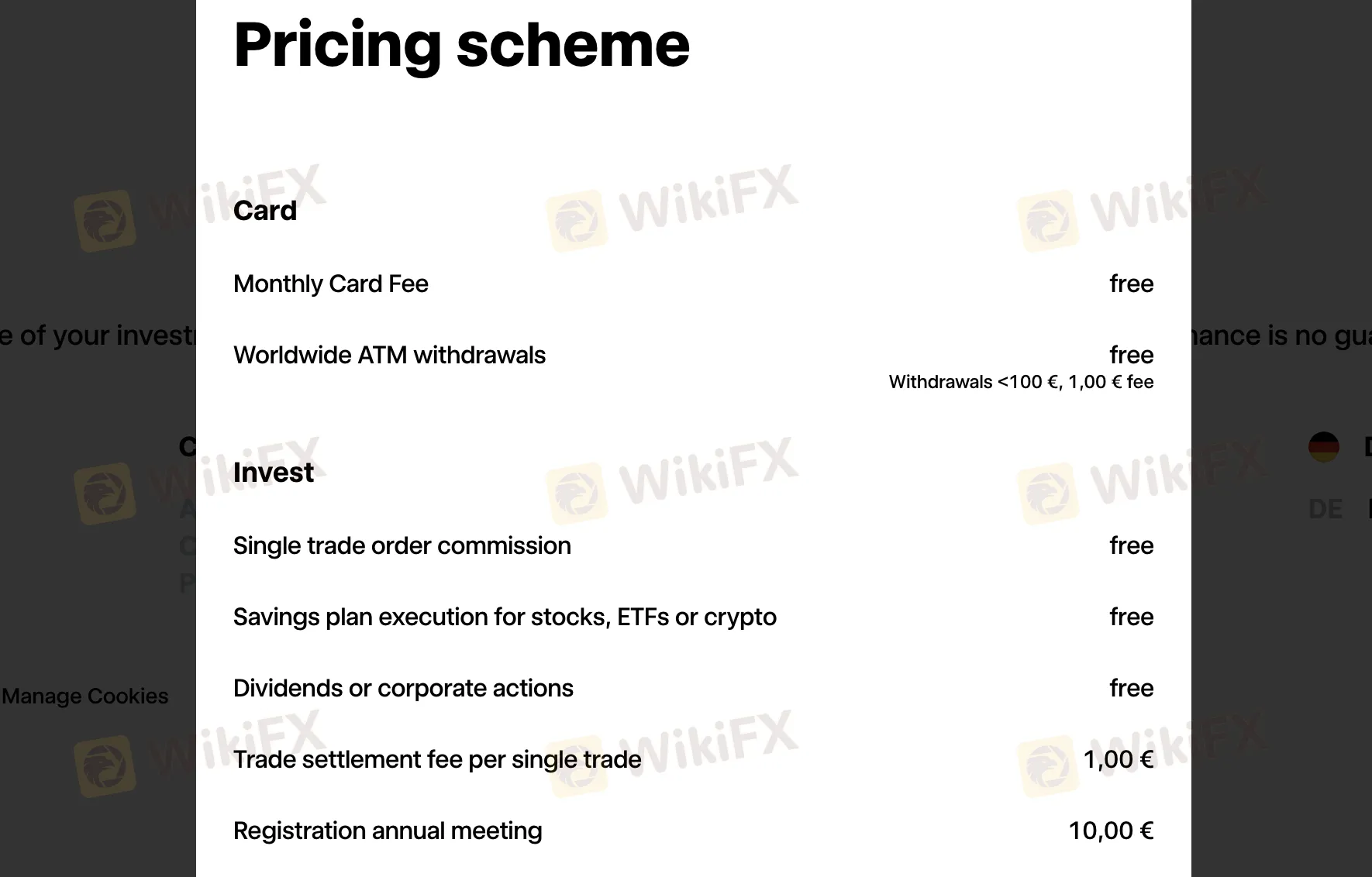

Especially for retail investors, Trade Republic's costs are quite modest in comparison to industry norms. With just tiny withdrawal and trade resolution costs, most fundamental services—including trades, savings programs, and dividends—are free.

| Service | Fee |

| Monthly Card Fee | ❌ |

| Worldwide ATM Withdrawals | ❌ |

| Single Trade Order Commission | ❌ |

| Savings Plan Execution (stocks, ETFs, crypto) | ❌ |

| Dividends or Corporate Actions | ❌ |

| Trade Settlement Fee (per trade) | €1.00 |

| Registration for Annual Meeting | €10.00 |

Trade Republic offers a mobile-first trading platform with integrated support. Users can access instant answers, multilingual live chat, and helpful articles directly within the app—making it easy to manage investments and get help when needed.

Trade Republic offers a seamless deposit and withdrawal experience through its integrated current account. Users can send and receive money easily, earn 2.25% interest on cash, and withdraw funds worldwide for free (100 € minimum). Spending also rewards users via 1% Saveback, and deposits start from just €1 for investments.

More

User comment

4

CommentsWrite a review

2024-03-25 00:46

2024-03-25 00:46

2024-02-01 10:22

2024-02-01 10:22