User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

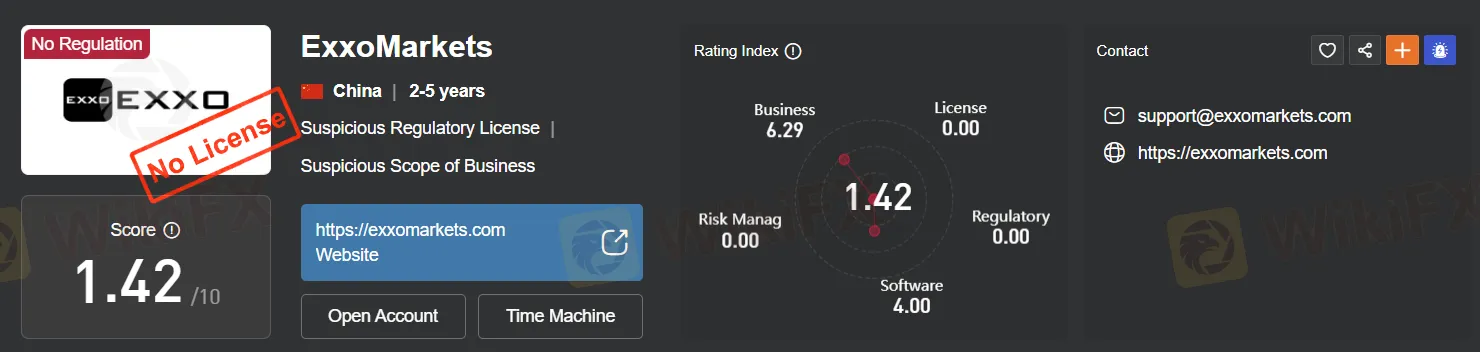

Regulatory Index0.00

Business Index7.15

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

| Aspect | Information |

| Registered Country/Area | China |

| Company Name | ExxoMarkets |

| Regulation | Unregulated |

| Minimum Deposit | $50 (Exxo Standard), $500 (Exxo Pro), $10,000 (Exxo MAM) |

| Maximum Leverage | Up to 1:1000 |

| Spreads | Not specified |

| Trading Platforms | Mobile, Desktop Trading Terminal, WebTrader |

| Tradable Assets | Forex, Indices, Stocks, Treasuries, Commodities, Cryptocurrencies |

| Account Types | Exxo Standard, Exxo Pro, Exxo MAM |

| Customer Support | 24/7 support via live chat, email ticket system, and callback service |

| Payment Methods | Wire transfer, Visa, Mastercard, Tether (USDT), Neteller, Skrill |

| Educational Tools | Not offered |

ExxoMarkets, a trading company based in China, operates as an unregulated broker, which means it lacks oversight from a financial regulatory authority. The broker offers multiple account types with varying minimum deposit requirements, starting at $50 for the Exxo Standard account, $500 for the Exxo Pro account, and $10,000 for the Exxo MAM account. Traders can access a maximum leverage of up to 1:1000 and have the flexibility to trade a wide range of assets, including Forex, indices, stocks, treasuries, commodities, and cryptocurrencies. The broker provides a choice of trading platforms, including mobile solutions, a desktop Trading Terminal, and the WebTrader platform. ExxoMarkets offers 24/7 customer support through live chat, an email ticket system, and a callback service. However, the broker does not provide educational resources to support traders in their learning journey. Payment methods include wire transfer, Visa, Mastercard, Tether (USDT), Neteller, and Skrill, making it convenient for traders to manage their accounts and transactions.

ExxoMarkets is an unregulated broker, which means it operates without oversight from a financial regulatory authority. Investing with unregulated brokers can pose significant risks, as there may be limited investor protection, transparency, or recourse in case of disputes or financial issues. It is advisable to exercise caution and consider reputable, regulated alternatives when engaging in financial activities.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

ExxoMarkets presents a mix of advantages and disadvantages. On the positive side, the broker offers a diverse array of market instruments for trading and provides multiple deposit and withdrawal methods, ensuring flexibility for traders. It also offers a high maximum leverage of up to 1:1000 and 24/7 customer support availability. Additionally, the Exxo Standard account is accessible with a low minimum deposit. However, there are notable drawbacks, including the fact that ExxoMarkets operates as an unregulated broker, lacking oversight from a regulatory authority. Furthermore, the absence of detailed information regarding spreads and commissions may pose challenges for traders seeking transparency. Lastly, ExxoMarkets does not offer educational resources to support traders in enhancing their knowledge and skills. Traders should carefully weigh these pros and cons when considering the broker.

ExxoMarkets offers a range of market instruments for trading, including:

Forex (Foreign Exchange): Traders can engage in Forex trading, which involves speculating on the relative strength of one currency against another. The Forex market is known for being the largest and most liquid financial market globally.

Indices: ExxoMarkets provides the opportunity to trade on indices, which are baskets of top shares that represent the performance of a specific country's economy. Traders can take positions on these indices to capitalize on changes in the broader economic landscape.

Stocks: Traders can take positions on individual stocks of some of the world's largest companies. This allows them to speculate on the performance of companies like Apple, Amazon, Rio Tinto, and RBS, among others.

Treasuries: ExxoMarkets offers the ability to take views on government bonds, gilts, and treasury notes. These instruments provide exposure to a specific region's economy, and traders can speculate on their price movements.

Commodities: ExxoMarkets allows traders to speculate on the price movements of popular commodities, including gold, silver, oil, and natural gas. Commodity trading can be used for portfolio diversification and hedging against inflation.

Cryptocurrencies: Traders can also speculate on the price movements of popular cryptocurrencies. Cryptocurrency trading has gained significant popularity in recent years, and ExxoMarkets likely offers a range of cryptocurrencies for trading.

ExxoMarkets offers three distinct trading account types, each tailored to cater to the specific needs and preferences of traders. Below, we provide a detailed description of each account type based on the information provided:

Exxo Standard:

Minimum Deposit: The Exxo Standard account allows traders to get started with a minimum deposit of $50, making it an accessible choice for those with limited initial capital.

Leverage: Traders on this account type can access leverage up to 1:1000, offering the potential for amplified gains (and losses) in their trades.

Expert Advisors (EA): The Exxo Standard account permits the use of Expert Advisors, enabling automated trading strategies.

Hedging: Hedging is allowed on this account, providing traders with flexibility in managing their positions.

Scalping Trading: Scalping strategies are welcomed, allowing traders to make quick and frequent trades.

Spread Type: The Exxo Standard account offers standard spreads, which may be suitable for a range of trading strategies.

Ultra Low Spread: Ultra-low spreads are not available on this account.

Private Support: Private support is not included in the Exxo Standard account.

Exxo Pro:

Minimum Deposit: Traders can choose the Exxo Pro account with a minimum deposit of $500. This account is designed for traders with a slightly higher initial capital requirement.

Leverage: Similar to the Exxo Standard account, Exxo Pro offers leverage up to 1:1000.

Expert Advisors (EA): EAs can be utilized for automated trading strategies on the Exxo Pro account.

Hedging: Hedging is allowed, providing risk management options.

Scalping Trading: Scalping trading strategies are supported.

Spread Type: Exxo Pro offers ultra-low spreads, which can be advantageous for cost-conscious traders.

Ultra Low Spread: Traders on the Exxo Pro account can take advantage of ultra-low spreads.

Private Support: Private support is not provided with the Exxo Pro account.

Exxo MAM (Multi-Account Manager):

Minimum Deposit: The Exxo MAM account is designed for more substantial capital investments, with a minimum deposit requirement of $10,000.

Leverage: Leverage of up to 1:1000 is available on this account type.

Expert Advisors (EA): EAs can be utilized for automated trading strategies on the Exxo MAM account.

Hedging: Hedging is allowed, providing traders with flexibility in managing their positions.

Scalping Trading: Scalping trading strategies are supported.

Spread Type: The Exxo MAM account does not specify a spread type, suggesting that the spread terms may vary.

Ultra Low Spread: Traders on the Exxo MAM account can take advantage of ultra-low spreads.

Private Support: Private support is available for clients on the Exxo MAM account, offering personalized assistance.

In summary, ExxoMarkets offers three distinct account types, each catering to traders with different capital levels and preferences. The Exxo Standard account is accessible with a low minimum deposit, while the Exxo Pro account offers ultra-low spreads for those with a slightly higher initial investment. The Exxo MAM account is designed for more substantial investments and includes private support for clients seeking a high level of personalized assistance. Traders can choose the account type that aligns with their specific trading goals and resources.

ExxoMarkets offers a maximum trading leverage of up to 1:1000. Leverage in the context of trading allows traders to control a larger position size in the market with a relatively smaller amount of capital. In this case, a leverage of 1:1000 means that for every $1 of the trader's capital, they can control a position size of up to $1000 in the market. While high leverage can amplify potential profits, it also increases the level of risk, as losses are also magnified. Traders should use leverage cautiously and be aware of its potential impact on their trading accounts. It's important to have a solid risk management strategy in place when trading with leverage to mitigate the potential for significant losses.

Unfortunately, specific details about spreads and commissions for ExxoMarkets are not provided in the information provided. Spreads refer to the difference between the buying (ask) price and the selling (bid) price of a financial instrument and can vary depending on the broker and the account type. Commissions, on the other hand, may be charged by the broker on certain types of trades or accounts and are usually a separate fee from spreads. The absence of these details makes it challenging to assess the cost structure associated with trading on the platform, and traders should consider reaching out directly to ExxoMarkets or consulting their official website for comprehensive information on spreads and commissions. Understanding these costs is essential for traders to make informed decisions and evaluate the overall affordability of trading with the broker.

ExxoMarkets offers a range of deposit and withdrawal methods to facilitate the movement of funds for traders. Here's a description of the deposit and withdrawal processes:

Deposits:

ExxoMarkets provides several convenient methods for traders to deposit funds into their trading accounts. The minimum deposit amounts and execution times for each method are as follows:

Wire Transfer: Traders can deposit a minimum of $500 via wire transfer, and the process typically takes around 30 minutes. Wire transfers are free of charge.

Visa: Visa deposits require a minimum of $50 and also take approximately 30 minutes to process. There are no fees associated with Visa deposits.

Mastercard: Like Visa, Mastercard deposits also have a minimum requirement of $50 and take around 30 minutes to process. No fees apply to Mastercard deposits.

Tether (USDT): Traders can deposit a minimum of $50 using Tether (USDT), and the process generally takes around 30 minutes. Tether deposits incur no fees.

Neteller: Neteller deposits require a minimum of $50 and have an execution time of approximately 30 minutes. Neteller deposits are free.

Skrill: Skrill deposits also have a minimum requirement of $50 and take about 30 minutes to process. There are no fees associated with Skrill deposits.

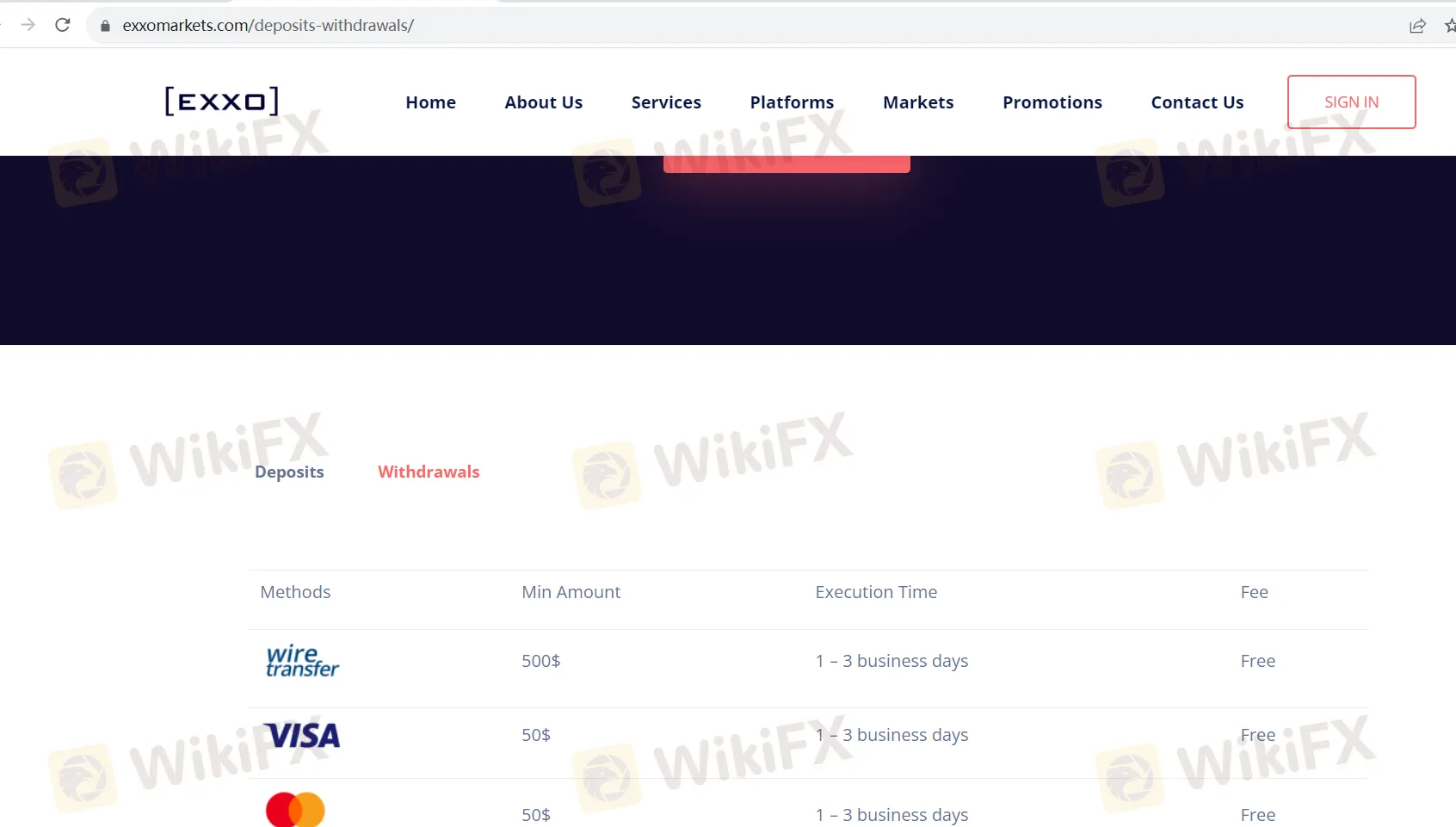

Withdrawals:

ExxoMarkets offers various withdrawal methods with specific minimum withdrawal amounts and execution times:

Wire Transfer: Traders can withdraw a minimum of $500 via wire transfer, and the process typically takes 1 to 3 business days. Wire transfer withdrawals are free of charge.

Visa: Visa withdrawals require a minimum of $50 and also take 1 to 3 business days to process. There are no fees for Visa withdrawals.

Mastercard: Similar to Visa, Mastercard withdrawals have a minimum requirement of $50 and take 1 to 3 business days to complete. No fees apply to Mastercard withdrawals.

Tether (USDT): Traders can withdraw a minimum of $50 using Tether (USDT), and the process generally takes 1 to 3 business days. Tether withdrawals do not incur fees.

Neteller: Neteller withdrawals require a minimum of $50 and have an execution time of 1 to 3 business days. Neteller withdrawals are free.

Skrill: Skrill withdrawals also have a minimum requirement of $50 and take about 1 to 3 business days to process. There are no fees associated with Skrill withdrawals.

Traders should consider these deposit and withdrawal options when managing their accounts and ensure they meet the specific requirements and preferences for their financial transactions on the ExxoMarkets platform.

ExxoMarkets offers a diverse range of trading platforms to cater to the varying preferences of traders:

Mobile Solutions: Traders can access their accounts and trade on the go using ExxoMarkets' mobile solutions, which are compatible with both iOS and Android devices, providing flexibility and accessibility.

Desktop Trading Terminal: For a comprehensive and feature-rich trading experience, ExxoMarkets offers a Trading Terminal designed by market makers. This platform is suitable for online trading across multiple asset classes, including stocks, commodities, futures, forex, bonds, and funds, making it ideal for desktop users.

WebTrader: ExxoMarkets' WebTrader is an HTML-based online trading platform. It offers an intuitive and easy-to-learn trading interface while still providing access to advanced trading features and tools. This platform is perfect for traders who prefer trading via a web browser.

With ExxoMarkets' commitment to technology integration, traders have the flexibility to choose the platform that best suits their needs, ensuring an efficient and seamless trading experience. Whether on mobile, desktop, or web, traders can optimize their trading strategies and workflows to meet their goals.

ExxoMarkets provides robust and accessible customer support to assist traders effectively. With a commitment to round-the-clock service, their 24/7 Customer Support team ensures that assistance is readily available whenever needed. Traders can seek help by simply asking questions through the live chat on the platform or utilizing the email ticket system within their Members Area. Additionally, ExxoMarkets offers a convenient “Callback” service where traders can input their phone number in the “Contact form” panel, allowing the company's specialists to promptly get in touch with them. This comprehensive support system underscores ExxoMarkets' dedication to ensuring traders have the assistance and guidance they require throughout their trading journey.

ExxoMarkets, unfortunately, does not offer educational resources for traders. While they provide trading platforms and support services, they do not provide educational materials such as tutorials, webinars, or educational articles to help traders enhance their knowledge and skills in the financial markets. Traders who seek educational resources may need to explore external sources or consider additional educational platforms to complement their trading experience with ExxoMarkets.

In summary, ExxoMarkets is an unregulated broker offering a variety of market instruments, including Forex, indices, stocks, treasuries, commodities, and cryptocurrencies. They provide three distinct account types, each catering to traders with different capital levels and preferences. While they offer a high maximum leverage of up to 1:1000, detailed information about spreads and commissions is not provided, which may require traders to contact the broker for clarification. ExxoMarkets provides multiple deposit and withdrawal methods with varying minimum amounts and execution times, ensuring flexibility for traders. They offer a range of trading platforms, including mobile solutions, a desktop trading terminal, and a web-based platform. Customer support is available 24/7 via live chat, email ticket system, and a callback service. However, it's worth noting that the broker does not offer educational resources to support traders in enhancing their knowledge and skills. Traders considering ExxoMarkets should exercise caution due to the lack of regulatory oversight and consider alternatives if they prioritize a regulated trading environment.

Q1: Is ExxoMarkets a regulated broker?

A1: No, ExxoMarkets is an unregulated broker, which means it operates without oversight from a financial regulatory authority.

Q2: What market instruments can I trade on ExxoMarkets?

A2: ExxoMarkets offers a variety of market instruments, including Forex, indices, stocks, treasuries, commodities, and cryptocurrencies.

Q3: What is the minimum deposit requirement for ExxoMarkets' Exxo Standard account?

A3: The Exxo Standard account has a minimum deposit requirement of $50, making it accessible to traders with limited initial capital.

Q4: Does ExxoMarkets provide educational resources for traders?

A4: Unfortunately, ExxoMarkets does not offer educational resources such as tutorials or webinars. Traders seeking educational materials may need to explore external sources.

Q5: How can I contact ExxoMarkets' customer support?

A5: You can contact ExxoMarkets' customer support through live chat on the platform, the email ticket system in your Members Area, or by using the “Callback” service where you input your phone number, and specialists will get in touch with you.

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment