User Reviews

More

User comment

1

CommentsWrite a review

2025-09-05 14:32

2025-09-05 14:32

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Quantity 2

Exposure

Score

Regulatory Index0.00

Business Index7.43

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

Mercado Argentino de Valores S.A..

Company Abbreviation

Mercado

Platform registered country and region

Argentina

Company website

X

YouTube

Company summary

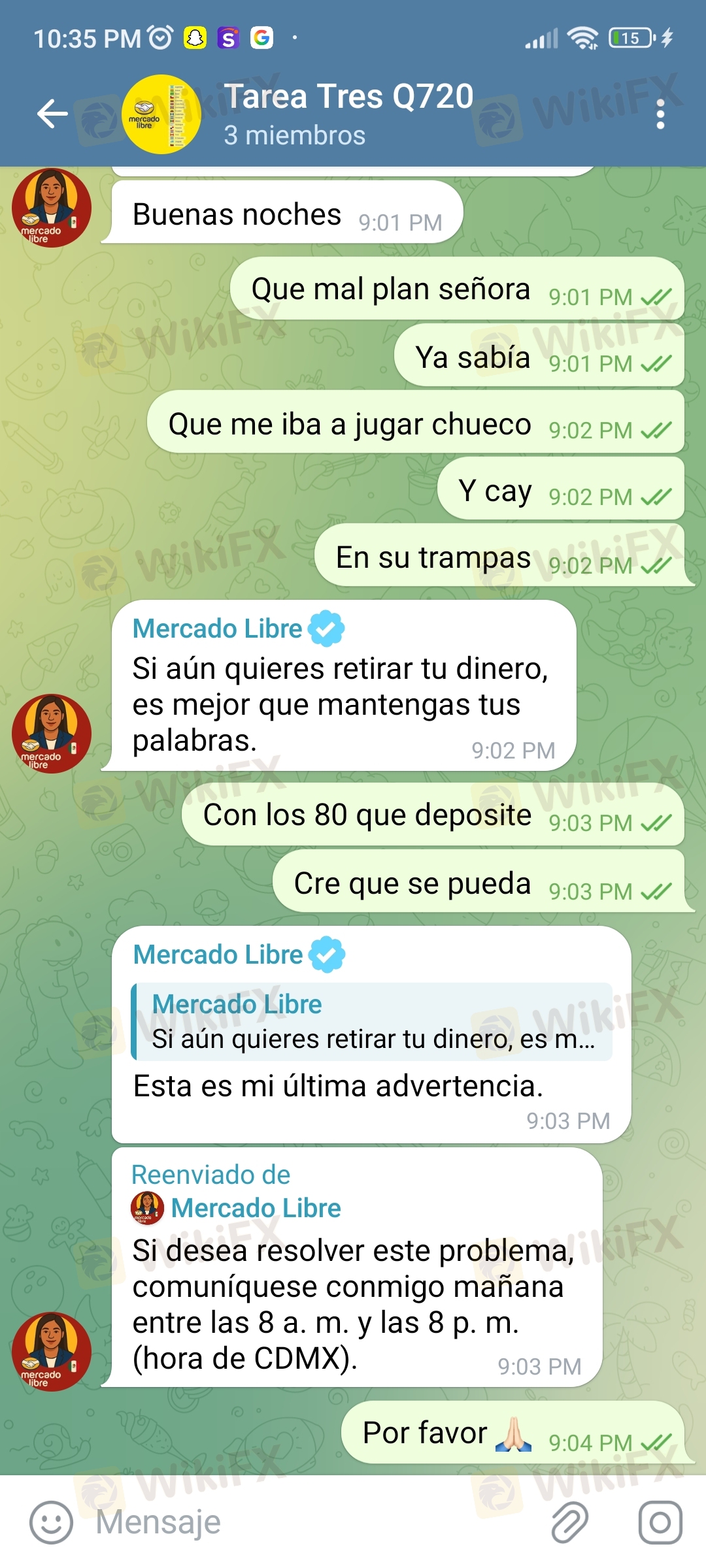

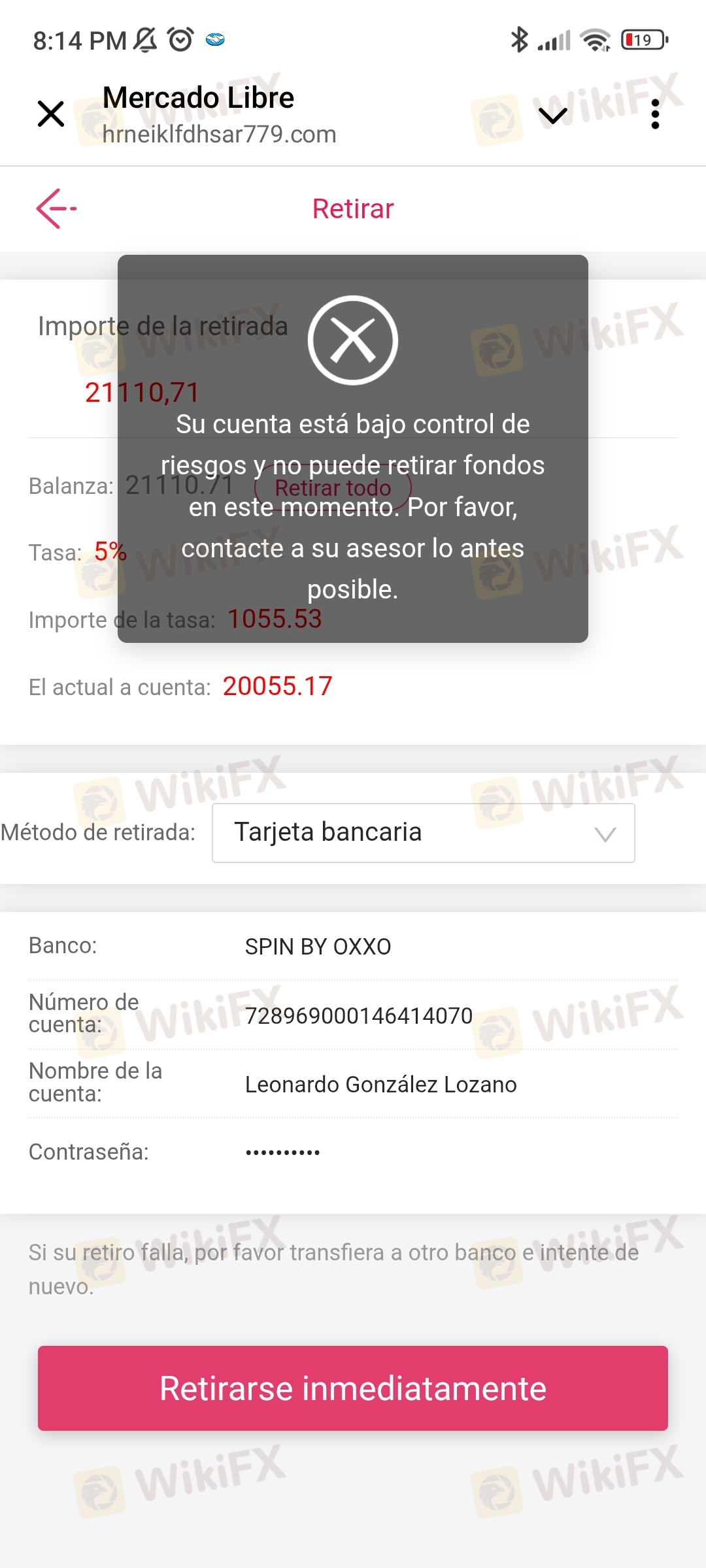

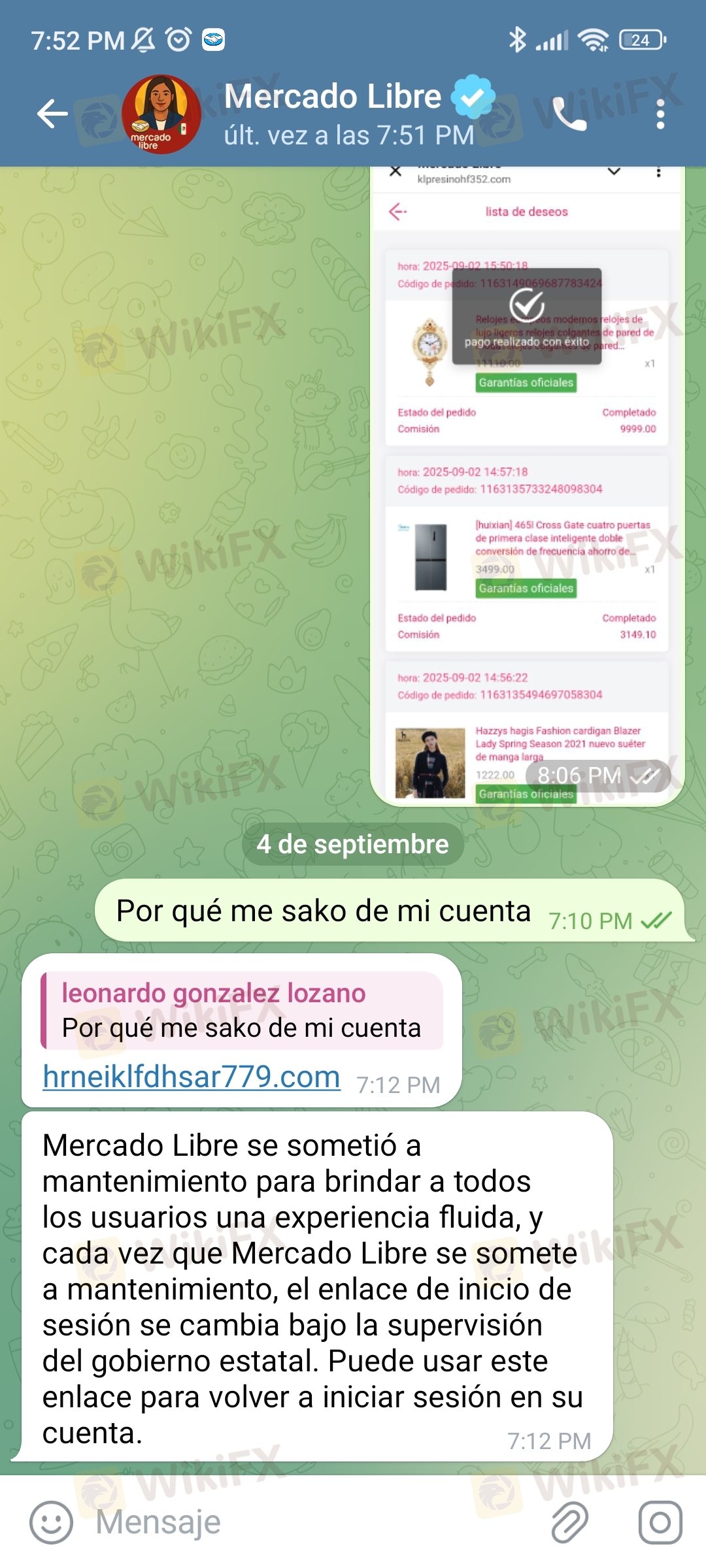

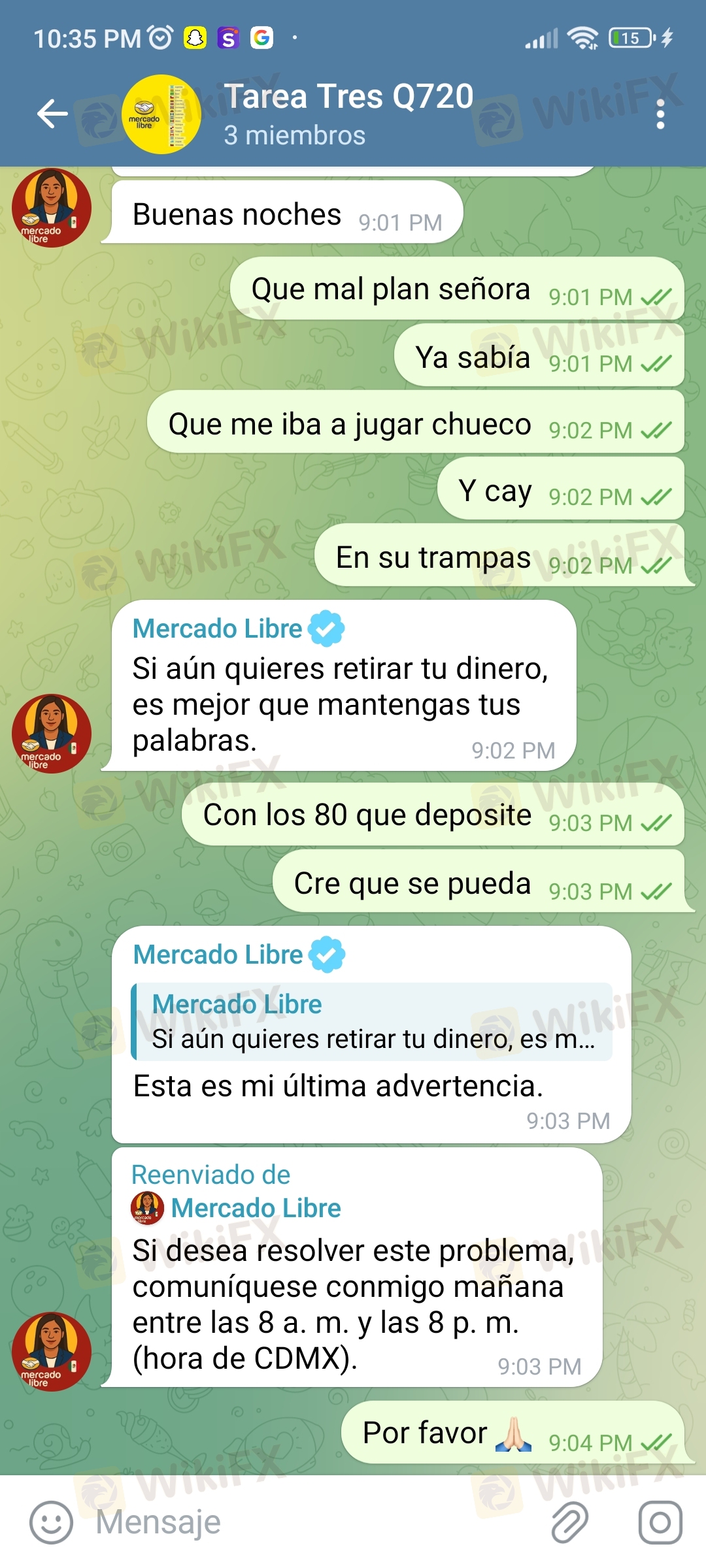

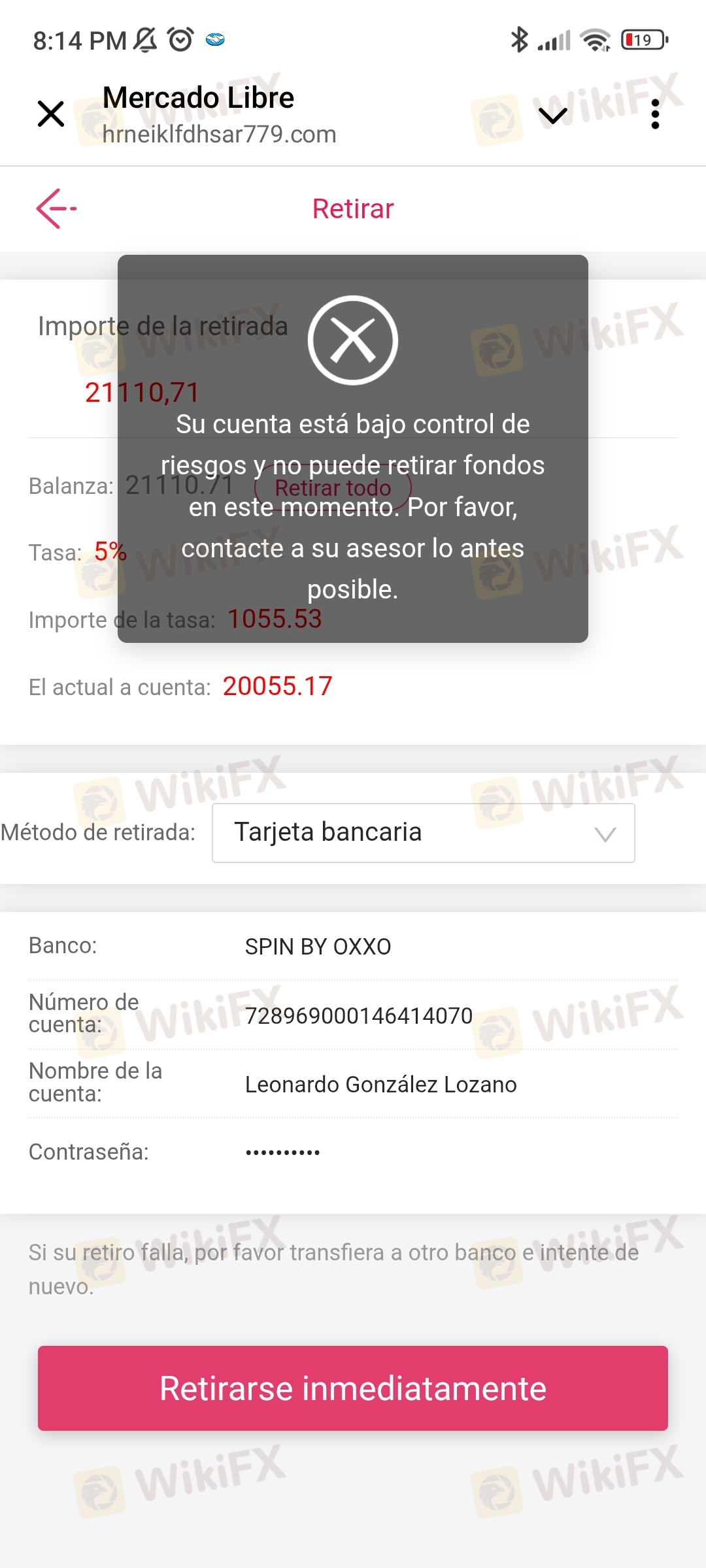

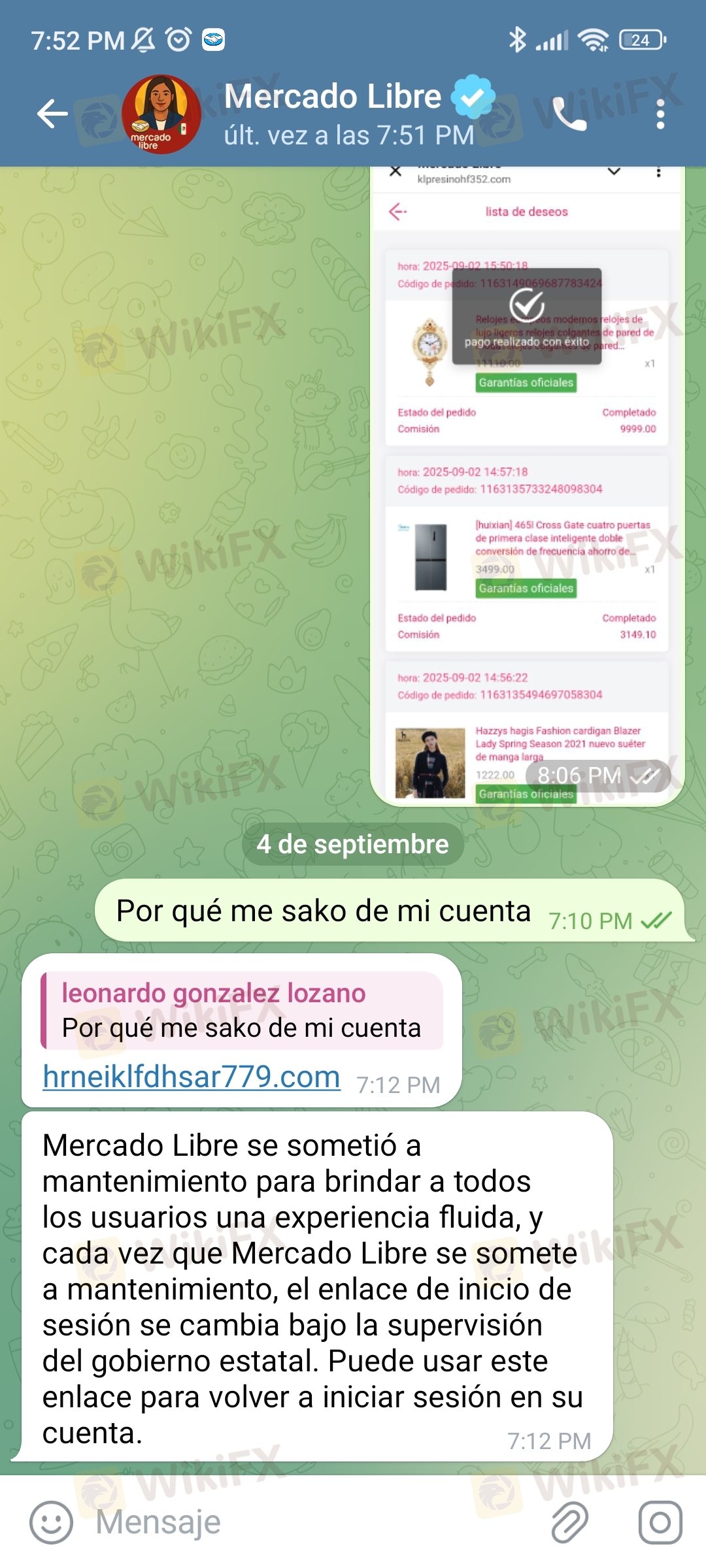

Pyramid scheme complaint

Expose

| Aspect | Information |

| Company Name | Mercado |

| Registered Country/Area | Argentina |

| Founded Year | 2015 |

| Regulation | Not regulated |

| Market Instruments | Stocks, Bonds, ETFs, Derivatives, and more |

| Trading Platforms | N/A |

| Customer Support | Phone (54 341 4469100) |

| Deposit & Withdrawal | N/A |

Mercado, founded in 2015 and based in Argentina, operates as an unregulated exchange. It offers a range of trading assets including stocks, bonds, ETFs, and derivatives. While it provides accessibility to various market instruments, Mercado operates without regulatory oversight. This lack of regulation can pose potential risks for traders, including limited legal protections and oversight.

However, the platform facilitates customer support via phone, providing assistance to users. Despite its advantages in offering a wide array of trading assets, potential users should consider the absence of regulation when deciding to engage with Mercado.

Mercado operates without regulation from any governing authority, potentially impacting transparency and oversight on the exchange. Unregulated platforms lack the protective measures and scrutiny provided by regulatory bodies, increasing the risk of fraud, market manipulation, and security vulnerabilities.

| Pros | Cons |

| Wide range of investment services | Lack of regulatory oversight |

| Limited educational resources | |

| Not available in some countries or regions |

Pros:

Wide range of investment services: Mercado offers an array of investment services, providing users with numerous options to suit their financial goals and preferences. Whether it's stocks, bonds, ETFs, or other financial instruments, Mercado serves a variety of investment needs.

Cons:

Lack of regulatory oversight: One of the potential drawbacks of Mercado is the lack of regulatory oversight. This can potentially expose users to higher risks, including fraud or market manipulation.

Limited educational resources: Mercado may have limited educational resources available to users. This could make it challenging for beginner investors to acquire the knowledge and skills necessary to make informed investment decisions. Access to comprehensive educational materials could help users navigate the complexities of the financial markets more effectively.

Not available in some countries or regions: Another limitation of Mercado is that it may not be available in all countries or regions. This could restrict access for potential users who are located in areas where Mercado does not operate. Availability limitations may hinder the platform's reach and accessibility to a wider audience.

Mercado offers a range of trading assets, including MAV (Argentine Stock Market) products, designed specifically for non-standardized products, with a focus on SMEs and regional economies. These products aim to provide new business alternatives for brokers and investors, fostering growth and development within these sectors.

Investing in products listed on the MAV is facilitated through Member Agents, who play a crucial role in connecting investors with expanding companies. The MAV develops exclusive segments tailored to the needs of these companies, offering investment opportunities and contributing to the overall expansion of the market.

Moreover, Mercado facilitates financing opportunities for small and medium-sized companies by connecting them with a wide community of investors. Through customized instruments and products, tailored to each region's specific requirements, companies can access funding to enhance their productive capital and support their growth initiatives. This approach not only benefits the companies themselves but also contributes to economic development and prosperity within the regions served by Mercado.

Mercado de Valores de Buenos Aires (MAV), commonly known as the Argentine Stock Market, specializes in non-standardized products tailored for small and medium-sized enterprises (SMEs) and regional economies. As the country's only market dedicated to financing for SMEs and non-standardized instruments, MAV serves as a vital platform for facilitating capital access and economic development. With 96% of all companies in Argentina classified as SMEs, MAV plays a crucial role in supporting the nation's economic growth.

MAV has modernized its platforms and operations to facilitate SMEs' access to capital markets. Through strategic partnerships and interconnection agreements with other markets like BYMA and MATBA ROFEX, MAV enhances liquidity and provides investment opportunities across different regions and sectors.

MAV offers a wide range of exclusive products, including Deferred Payment Checks, Echeq, Promissory Notes, Invoices, SME company shares, Negotiable Obligations, Financial Trusts, Passes, and municipal and provincial financing options. This comprehensive array of products not only fosters financial inclusion but also encourages investors from various regions to participate in the stock market, contributing to the diversification and growth of their investment portfolios.

Opening an account with Mercado is a straightforward process, outlined in six simple steps:

Visit the Mercado Website: Access the Mercado website and navigate to the “Open an Account” section.

Provide Personal Information: Fill out the online application form with your personal details, including your full name, date of birth, residential address, contact information, and identification documents.

Select Account Type: Choose the type of account you wish to open based on your investment goals and preferences. Mercado may offer different account options tailored to various investor profiles.

Submit Documentation: Upload the required documentation to verify your identity and address. This typically includes a copy of your identification card or passport, as well as proof of address, such as a utility bill or bank statement.

Agree to Terms and Conditions: Review and agree to Mercado's terms and conditions, including any relevant legal agreements or disclosures related to opening and maintaining an account with the platform.

Confirmation and Activation: Once your application and documents are submitted, await confirmation from Mercado regarding the approval and activation of your account. You may receive further instructions or notifications via email or through the online portal.

Mercado offers customer support through various channels, including its main office located at Paraguay 777, 8th Floor, Rosario, Santa Fe, Argentina. You can reach them at +54 341 4469100. Additionally, the company has commercial offices in CABA, Cordoba, and Mendoza. For inquiries or assistance, users can fill out the contact form on the website by providing their name, email address, message, and solving the captcha.

In conclusion, Mercado offers a wide range of investment services. Its extensive offerings provide users with ample opportunities to explore various investment options.

However, the platform lacks regulatory oversight, which may raise issues about transparency and investor protection. Additionally, the limited availability of educational resources could pose challenges for novice investors seeking to enhance their financial literacy.

Q: What investment services does Mercado offer?

A: Mercado offers a wide range of investment services, including trading in stocks, bonds, ETFs, derivatives, and more.

Q: Is Mercado regulated by any regulatory authority?

A: No, Mercado is not regulated by any regulatory authority.

Q: Can I access Mercado from any country or region?

A: Mercado may not be available in all countries or regions. Please check the platform's availability in your area.

Q: How can I contact Mercado's customer support?

A: You can contact Mercado's customer support team via phone and form.

More

User comment

1

CommentsWrite a review

2025-09-05 14:32

2025-09-05 14:32