User Reviews

More

User comment

2

CommentsWrite a review

2023-04-23 17:52

2023-04-23 17:52

2022-12-08 10:19

2022-12-08 10:19

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

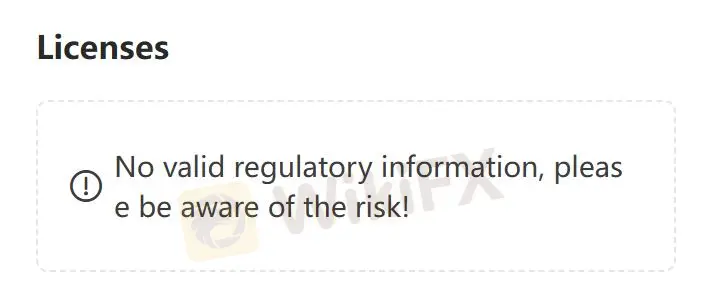

Regulatory Index0.00

Business Index7.00

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

Worldwide Fin Services LTD

Company Abbreviation

FXspace

Platform registered country and region

Estonia

Company website

Company summary

Pyramid scheme complaint

Expose

Note: FXspace's official website: https://fxspace.eu/ is currently inaccessible normally.

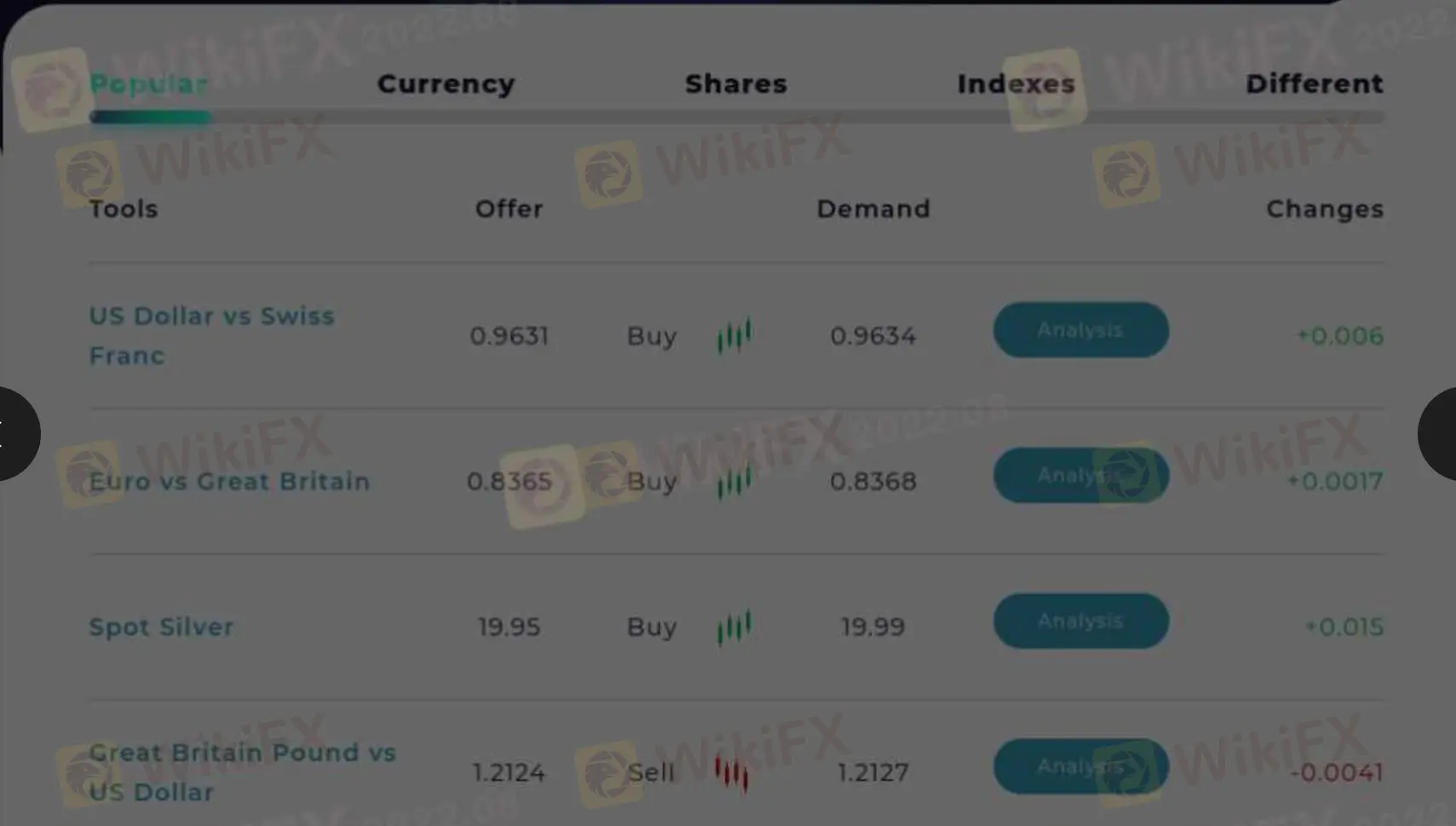

FXspace is an unregulated brokerage company registered in Estonia engaged in currency, shares, indexes, and others with its proprietary platform instead of authorities MT4/MT5. The broker leaves a phone number: +372 88 01 201 and provides PayPal, VISA, MasterCard, etc for traders to withdraw.

FXspace is not regulated, which will increase trading non-compliance and reduce traders investment security.

Traders cannot access FXspaces official website, which makes FXspace unreliable.

Since FXspace does not explain more transaction information, especially in terms of fees and services, this will bring huge risks and reduce transaction security.

FXspace is not regulated and will be less safe than a regulated broker.

Trading with FXspace will be exposed to the risk of property damage because of the unregulated status, inaccessible office website, and incomprehensive information. It is advisable to choose regulated brokers with transparent operations to ensure the safety of your investments and compliance with legal standards.

More

User comment

2

CommentsWrite a review

2023-04-23 17:52

2023-04-23 17:52

2022-12-08 10:19

2022-12-08 10:19