User Reviews

More

User comment

1

CommentsWrite a review

2023-03-01 10:42

2023-03-01 10:42

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Quantity 3

Exposure

Score

Regulatory Index0.00

Business Index7.45

Risk Management Index0.00

Software Index4.00

License Index0.00

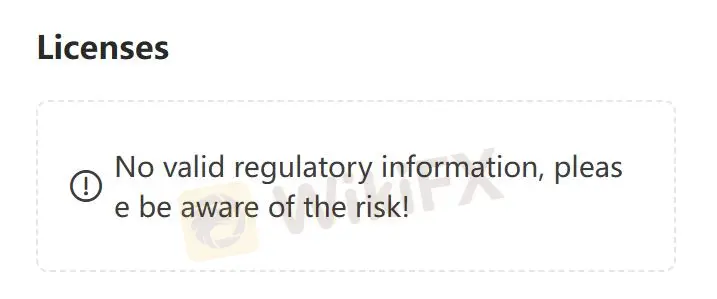

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

Warning

More

Company Name

MT4 TRADE

Company Abbreviation

MT4 TRADE

Platform registered country and region

United States

Company website

Company summary

Pyramid scheme complaint

Expose

Note: MT4 TRADE's official website: https://www.mt4-trade.com is normally inaccessible.

MT4 TRADE is an unregulated brokerage company registered in the United States engaged in forex and binary options investments. While the broker's official website has been closed, so traders cannot obtain more security information.

MT4 TRADE is not regulated, which will increase trading non-compliance and reduce traders investment security. Caution is advised when dealing with the company.

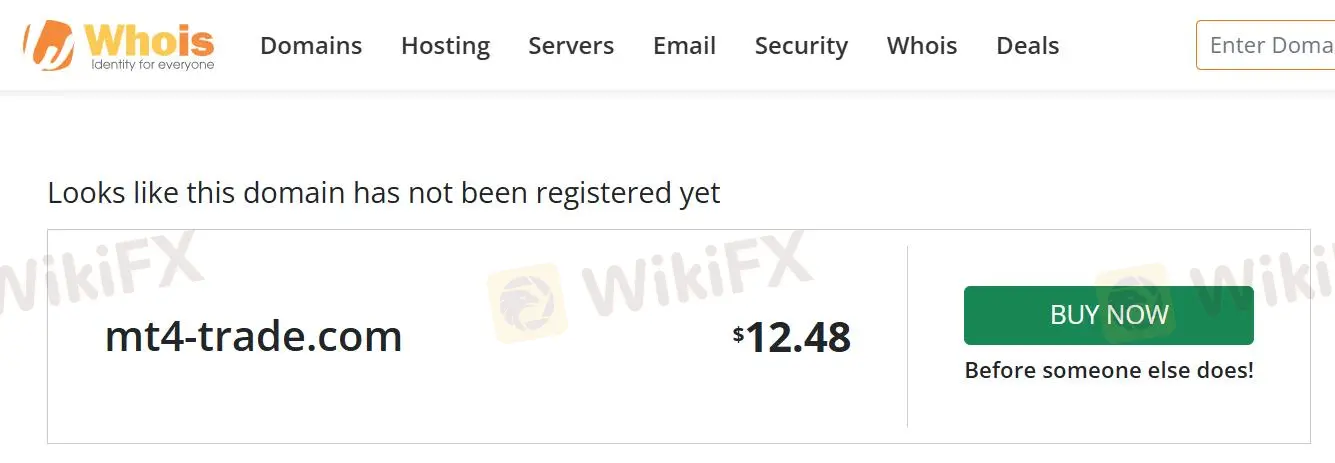

After a Whois query, we found that this company's domain name is for sale, which shows that this company has not registered it securely.

The website of MT4 TRADE is inaccessible, raising concerns about its reliability and accessibility.

Since MT4 TRADE does not explain more transaction information, especially regarding fees and services, this will bring huge risks and reduce transaction security.

MT4 TRADE is not regulated, which is less safe than a regulated one.

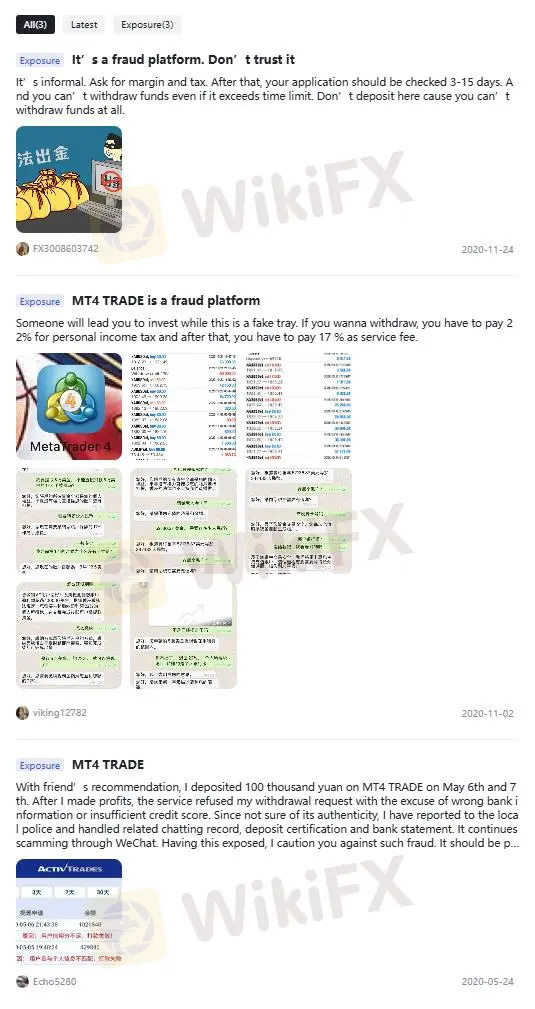

According to a report on WikiFX, users encountered significant difficulties with fund withdrawals. The issue remained unresolved despite the request being pending for a long time.

On WikiFX, “Exposure” is posted as a word of mouth received from users.

Traders must review the information and assess risks before trading on unregulated platforms. Please consult our platform for related details. Report fraudulent brokers in our Exposure section and our team will work to resolve any issues you encounter.

Currently, there are 3 pieces of MT4 TRADE exposure in total.

Exposure. Cannot withdraw

| Classification | Unable to Withdraw |

| Date | 2020 |

| Post Country | Hong Kong, China/Russia |

You may visit: https://www.wikifx.com/en/comments/detail/202011249982458672.html https://www.wikifx.com/en/comments/detail/202011025392935518.html https://www.wikifx.com/en/comments/detail/202005247842684135.html.

MT4 TRADE Since the official website cannot be opened, traders cannot get more information about security services. In addition, the unregulated status and unregistered domain name indicate that the trading risks of the broker are high. It is advisable to choose regulated brokers with transparent operations to ensure the safety of your investments and compliance with legal standards. Traders can learn more about other brokers through WikiFX. Information improves transaction security.

More

User comment

1

CommentsWrite a review

2023-03-01 10:42

2023-03-01 10:42