User Reviews

More

User comment

2

CommentsWrite a review

2023-03-29 09:13

2023-03-29 09:13

2023-03-09 17:10

2023-03-09 17:10

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.56

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

| GMCU Review Summary | |

| Founded | 1985 |

| Registered Country/Region | Australia |

| Regulation | ASIC (Exceeded) |

| Services | Loans, banking accounts, term deposits, insurance |

| Demo Account | ❌ |

| Trading Platform | Mobile Banking App |

| Customer Support | Phone: 1800 694 628 |

| Email: info@gmcu.com.au | |

| Mail Address: PO Box 860, Shepparton, VIC 3632 | |

GMCU (Goulburn Murray Credit Union Co-Operative Ltd) was founded in 1985 and is regulated under ASIC with license No. 241364, though the status is listed as “Exceeded.” The institution provides standard financial services such as home loans, personal banking accounts, and insurance products, but does not offer other trading services or demo accounts.

| Pros | Cons |

| Various contact channels | Exceeded ASIC license |

| Wide range of traditional banking services | |

| Multiple account choices | |

| Long operation time |

Yes, Goulburn Murray Credit Union Co-Operative Ltd (GMCU) is regulated. It holds an Investment Advisory License issued by the Australia Securities & Investments Commission (ASIC) under license number 241364. However, its regulatory status is marked as Exceeded, which may indicate the license is no longer valid or has surpassed its intended scope.

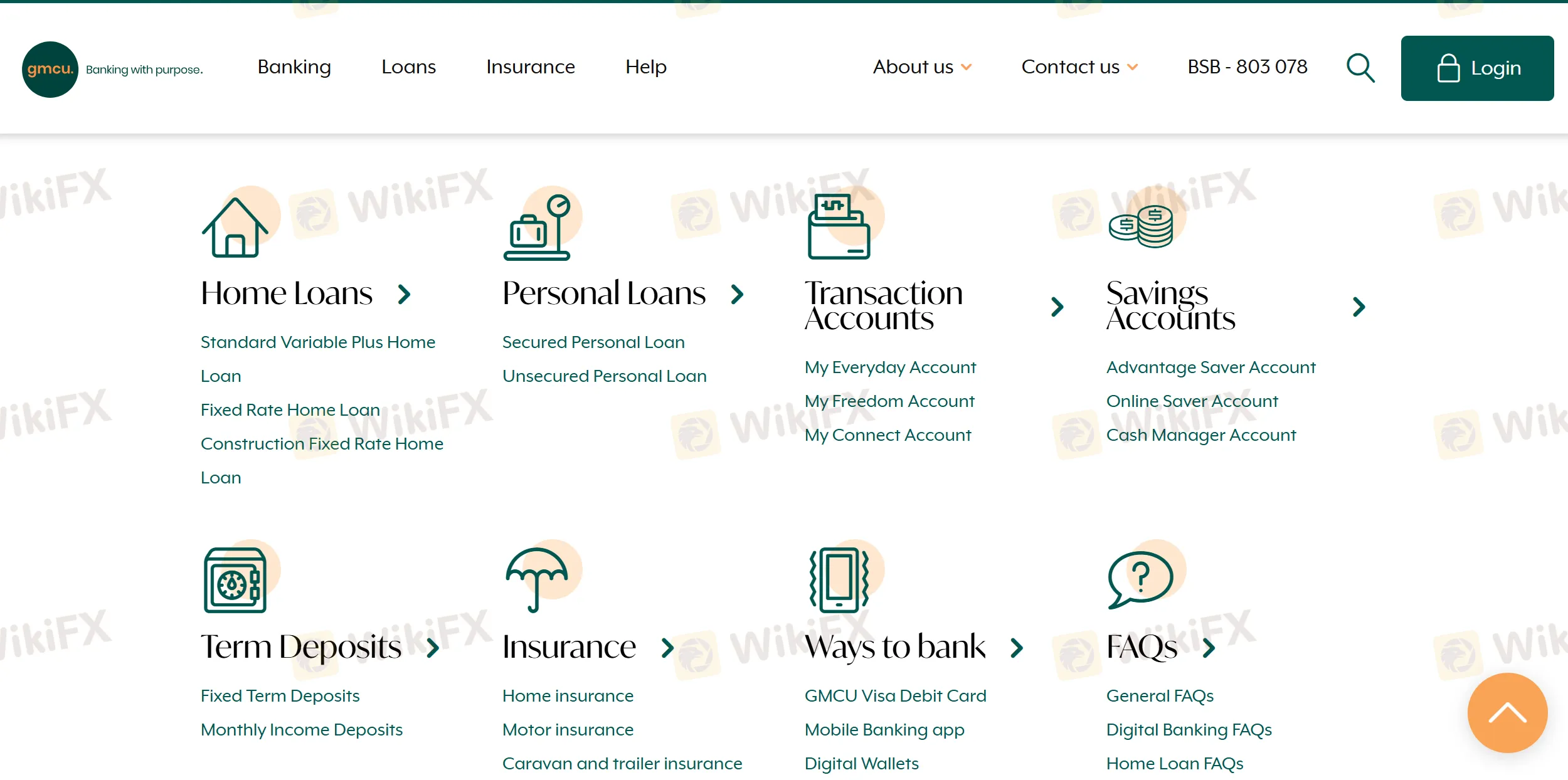

GMCU offers a broad range of retail banking services including home and personal loans, various account types, term deposits, and insurance options.

| Category | Services |

| Home Loans | Standard Variable Plus, Fixed Rate, Construction Fixed Rate |

| Personal Loans | Secured Personal Loan, Unsecured Personal Loan |

| Transaction Accounts | My Everyday Account, My Freedom Account, My Connect Account |

| Savings Accounts | Advantage Saver, Online Saver, Cash Manager Account |

| Term Deposits | Fixed Term Deposits, Monthly Income Deposits |

| Insurance | Home, Motor, Caravan & Trailer, Landlord Insurance |

GMCU offers several types of real (live) accounts tailored to everyday banking needs, including personal transaction and savings accounts.

| Account Type | Suitable for |

| My Everyday Account | Individuals needing a general transaction account |

| My Freedom Account | Students or concession card holders seeking fee waivers |

| My Connect Account | People who prefer digital banking with no branch access |

| Advantage Saver Account | Regular savers wanting bonus interest |

| Online Saver Account | Online-focused savers |

| Cash Manager Account | Members managing larger cash flows |

GMCU's fees are moderate to high compared to industry standards, particularly for unsecured lending products like personal loans and overdrafts.

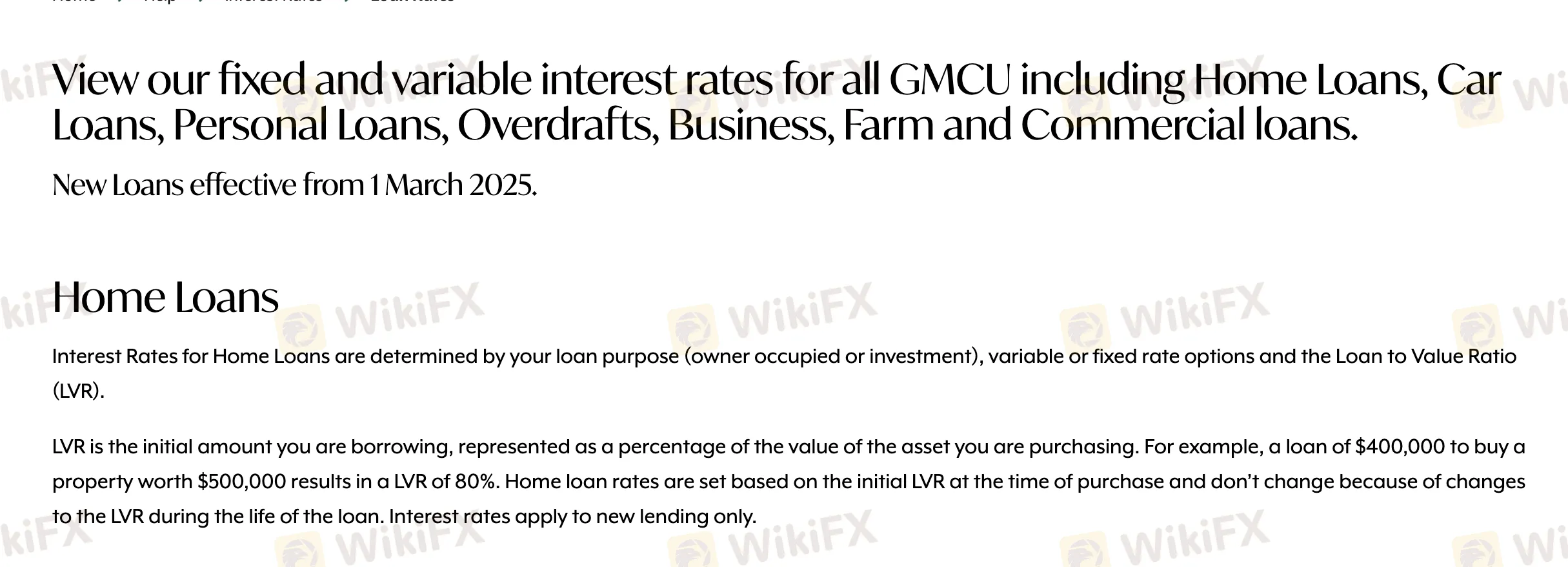

| Loan Type | Interest Rate (p.a.) |

| Home Loan (Owner Occupied, <80% LVR) | 5.94% - 5.79% |

| Home Loan (Owner Occupied, >80%-95% LVR) | 6.34% - 5.79% |

| Home Loan (Investment, <80% LVR) | 6.14% - 6.09% |

| Home Loan (Investment, >80%-95% LVR) | 6.54% - 6.09% |

| Personal Loan (Secured) | 7.79% |

| Personal Loan (Unsecured) | 14.95% |

| Overdraft (Secured) | 9.99% - 10.60% |

| Overdraft (Unsecured) | 17.69% |

| Business/Farm Loan (Secured) | 10.54% - 12.00% |

| Business/Farm Loan (Unsecured) | 18.75% |

| Trading Platform | Supported | Available Devices |

| Mobile Banking App | ✔ | iOS, Android |

GMCU does not explicitly mention charging fees for deposits or withdrawals.

| Payment Method | Fees | Processing Time |

| Direct Entry Credit | / | Typically same-day |

| Direct Entry Debit | Dishonour fees may apply if insufficient funds | Based on supplier schedule |

| Periodical Payments | / | As scheduled |

| Internet/Mobile Banking | / | Instant or same-day |

| In-branch Deposit | / | Instant or by end of day |

More

User comment

2

CommentsWrite a review

2023-03-29 09:13

2023-03-29 09:13

2023-03-09 17:10

2023-03-09 17:10