User Reviews

More

User comment

26

CommentsWrite a review

2025-12-20 12:33

2025-12-20 12:33

2024-12-28 02:48

2024-12-28 02:48

Score

2-5 years

2-5 yearsRegulated in South Africa

Derivatives Trading License (EP)

MT5 Full License

High potential risk

Influence

Add brokers

Comparison

Quantity 3

Exposure

Score

Regulatory Index3.60

Business Index6.64

Risk Management Index0.00

Software Index9.13

License Index0.00

Single Core

1G

40G

More

Danger

Danger

Warning

More

Company Name

RAISE GLOBAL SA (PTY) LTD

Company Abbreviation

RaiseFX

Platform registered country and region

South Africa

Company website

X

Company summary

Pyramid scheme complaint

Expose

| RaiseFXReview Summary | |

| Founded | 2019-09-16 |

| Registered Country/Region | South Africa |

| Regulation | General Registration |

| Market Instruments | Forex, Commodities, Stocks, Cryptocurrencies, Indices |

| Demo Account | ✅ |

| Leverage | Up to 1:500 |

| Spread | Ultra tight |

| Trading Platform | MT5(PC, MacOS & Linux, Mobile, Tablet) |

| Min Deposit | 200€ |

| Customer Support(24/7) | Email: support.sea@raisefx.com |

| Phone: +44 2045798075 | |

| LinkedIn, Instagram | |

RaiseFX is a broker with 25 years of experience. RaiseFX specializes in various opportunities across 5 financial markets including forex, indices, crypto, stocks, and commodities. The broker also provides demo accounts, up to 500/1 max. Leverage, and 24/7 available support. Traders can also access MT5 to trade.

| Pros | Cons |

| Ultra tight spread | General Registration |

| Leverage up to 1:500 | Some negative voices |

| 24/7 customer support | |

| Demo and Islamic account available | |

| MT5 available |

RaiseFX is operated by Raise Global SA (Pty) LTD, Company Number: 2018/616118/07. Raise Global SA (Pty) LTD is an authorized Financial Service Provider (FSP) registered and regulated by the Financial Sector Conduct Authority (FSCA) of South Africa under license number 50506. However, RaiseFX is not regulated, and the 'General Registration' current status of FSCA is less safe than a regulated one.

RaiseFX offers 500 assets and 5+ classes of assets, including forex, indices, crypto, stocks, and commodities.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Stocks | ✔ |

| Cryptocurrencies | ✔ |

| Indices | ✔ |

RaiseFX provides traders with real accounts and demo accounts used to familiarize traders with the trading platform and for educational purposes only. Muslims are allowed to open Islamic accounts without swaps.

Spreads(EURUSD) approach 0, commissions are 0, and swaps are as low as 0. The lower the spread, the faster the liquidity.

| Symbol | Bid | Ask | Spread |

| EURUSD | 1.03254 | 1.03269 | 15 |

RaiseFX offers 1:20-1:500 leverage, depending on the asset options, 500x leverage is available for Forex and Commodity trading.

| FOREX | Indices | Crypto | Commodities | CFD Shares |

| 1:500 | 1:200 | 1:20 | 1:20 to 1:500 | 1:10 |

Traders can conduct financial activities in MT5 available on PC, MacOS & Linux, Mobile, and Tablet through RaiseFX. MT5 provides various trading strategies and implements EA systems. The platform is more suitable for experienced traders.

Copy trading is also available, a way for inexperienced traders or followers who dont have the time to do extensive research or want to diversify their portfolio to copy the trades of experienced traders (also known as money managers or copy trading gurus).

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | PC, MacOS & Linux, Mobile, Tablet | Experienced traders |

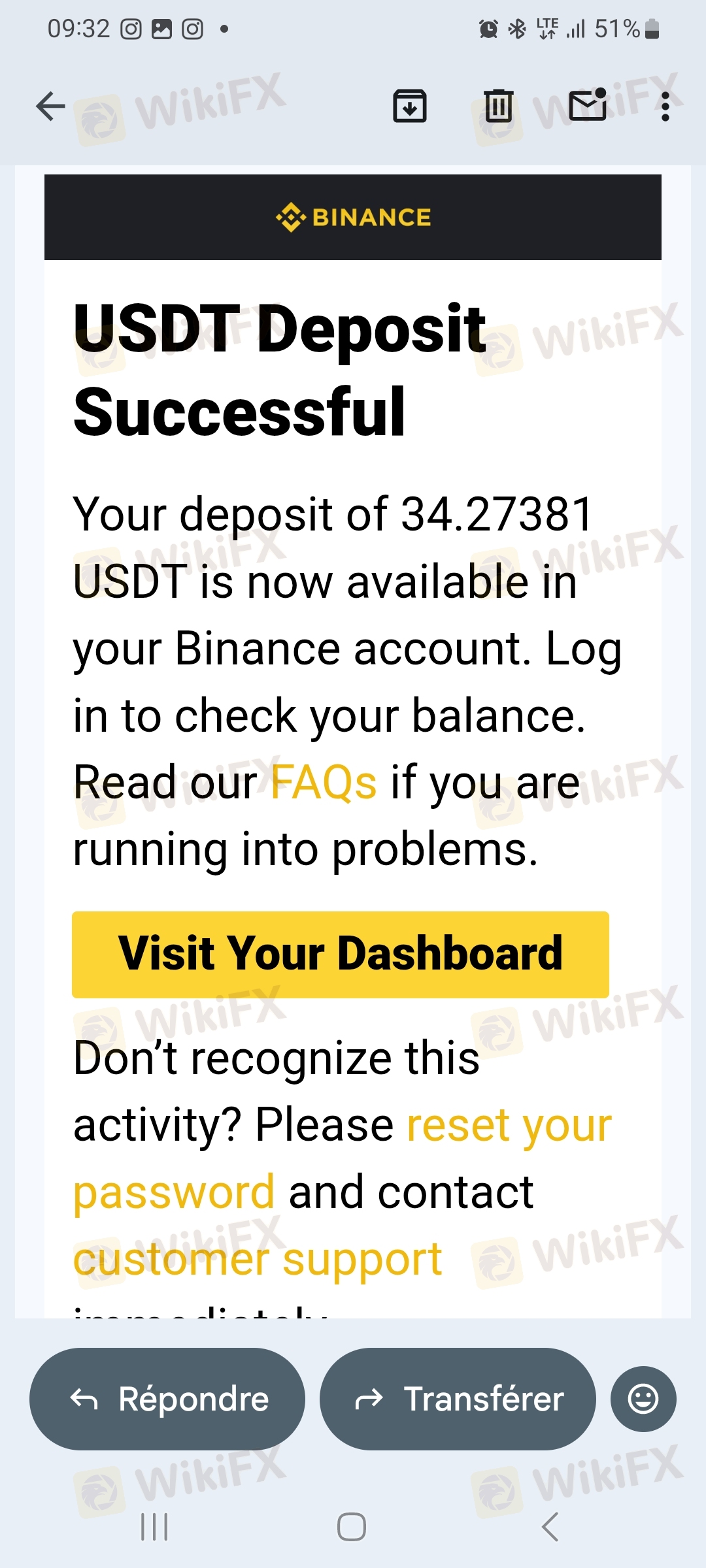

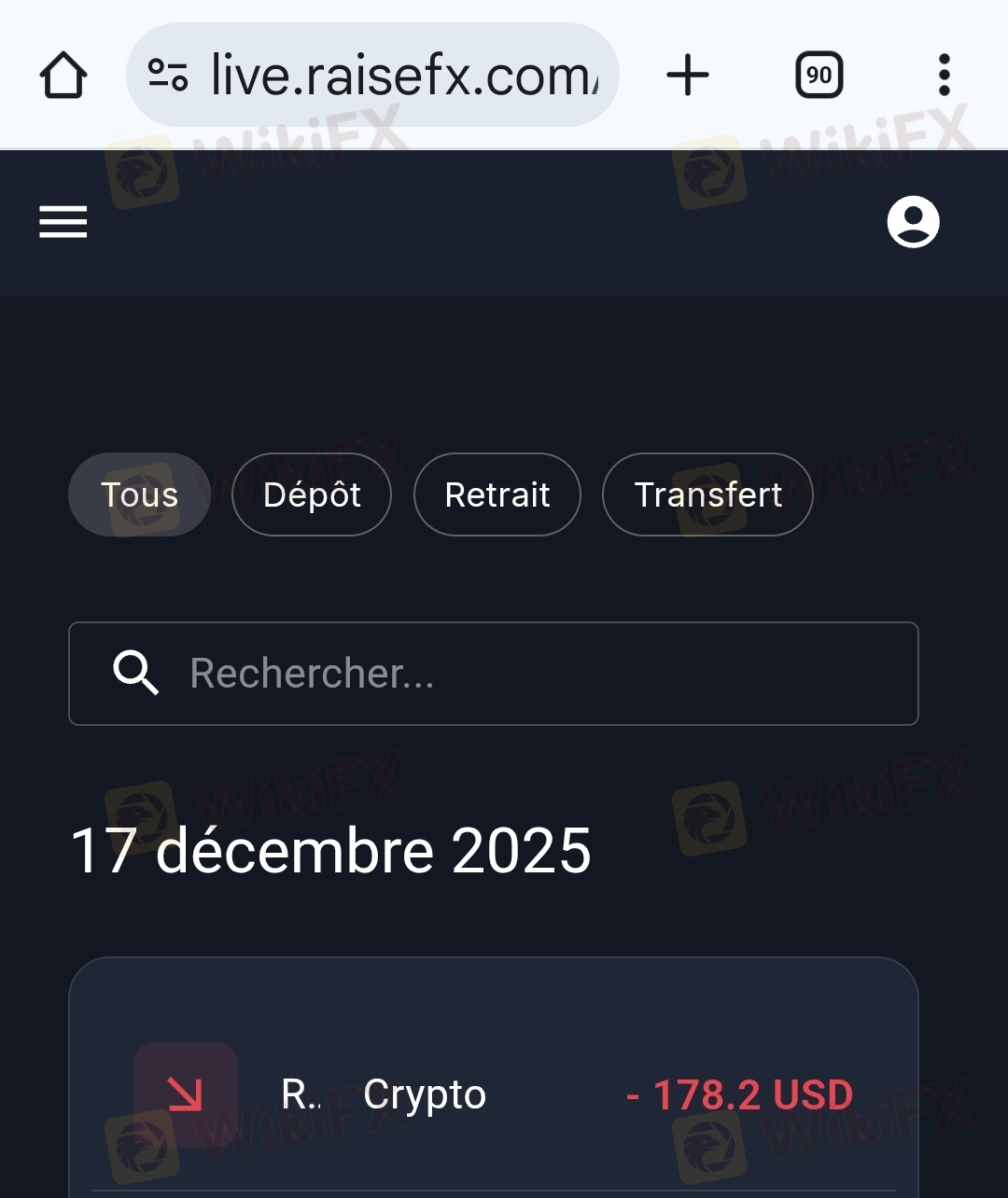

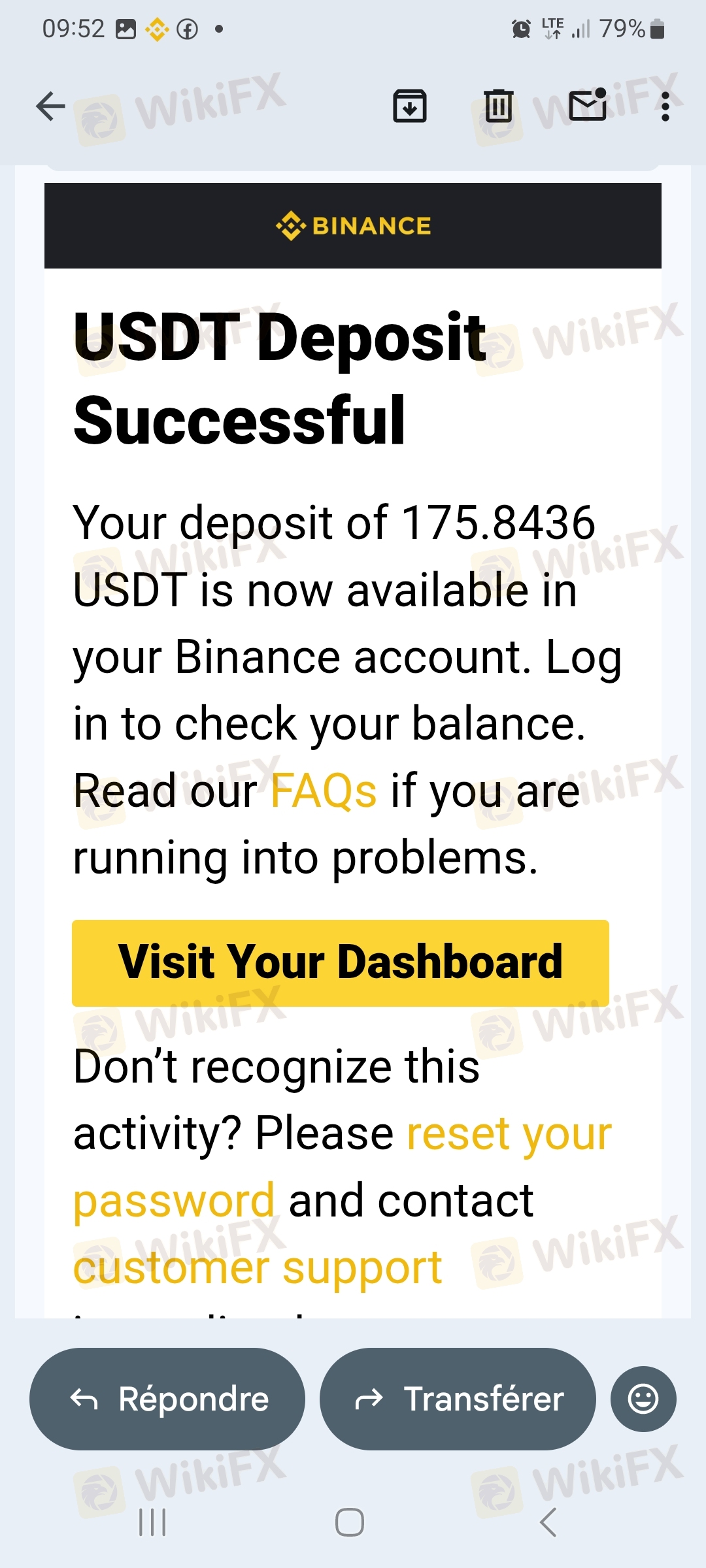

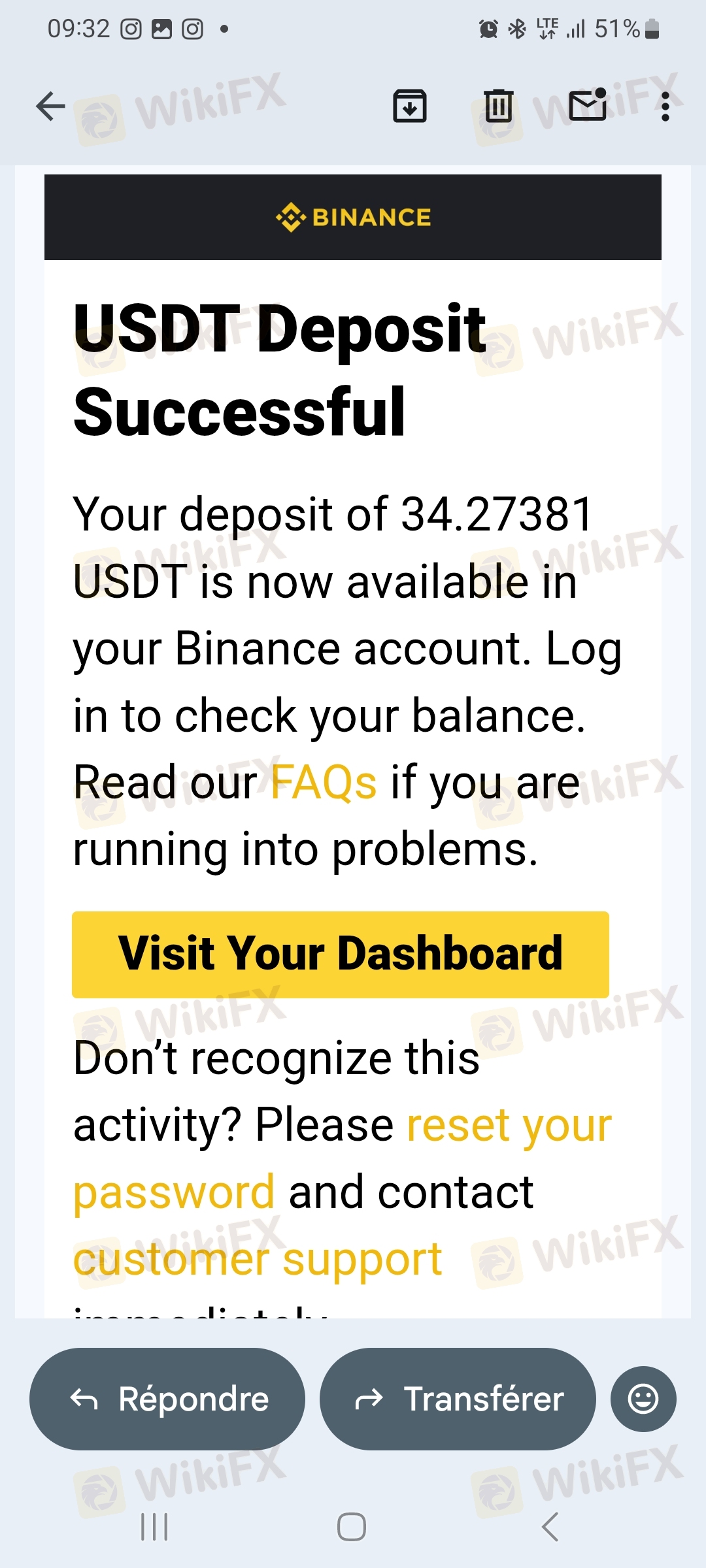

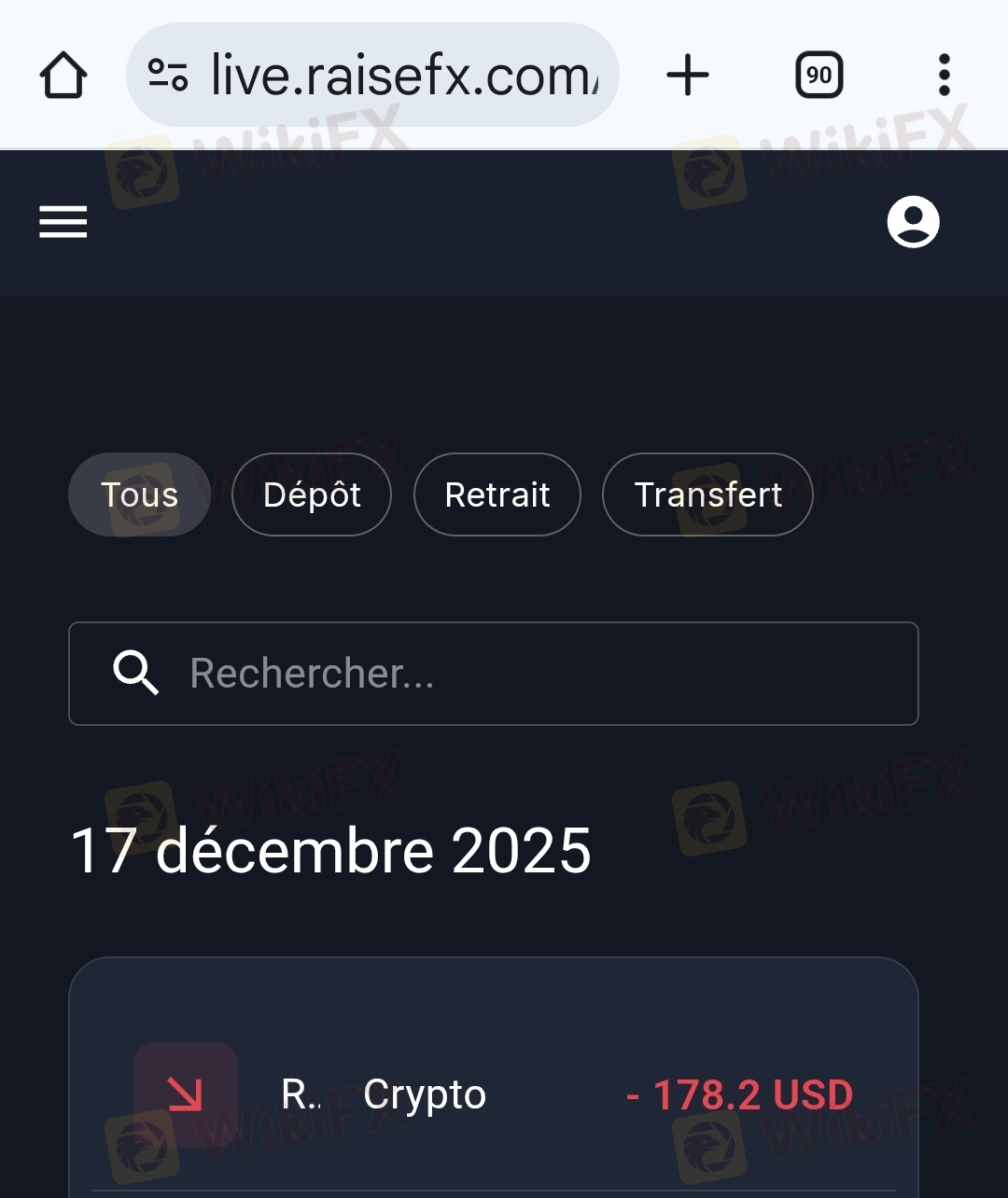

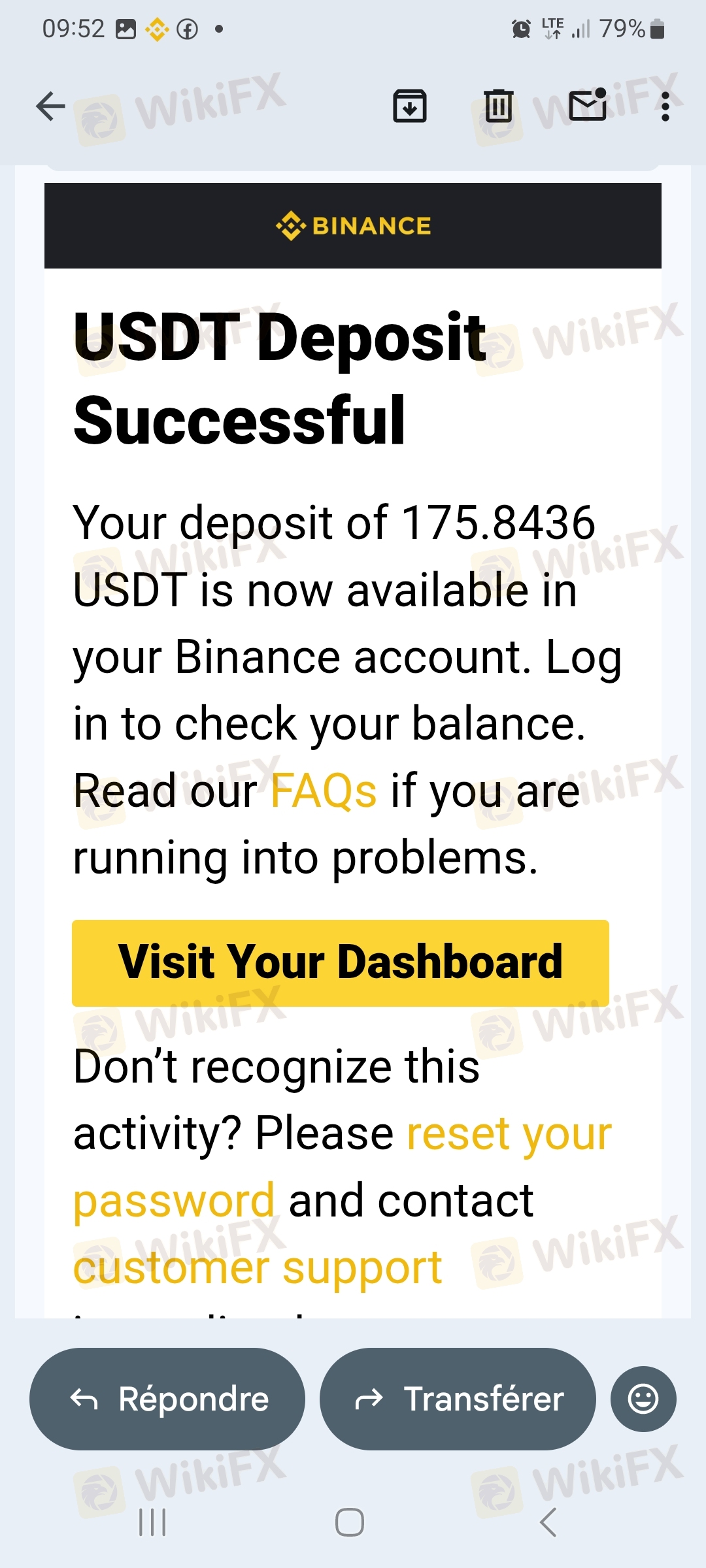

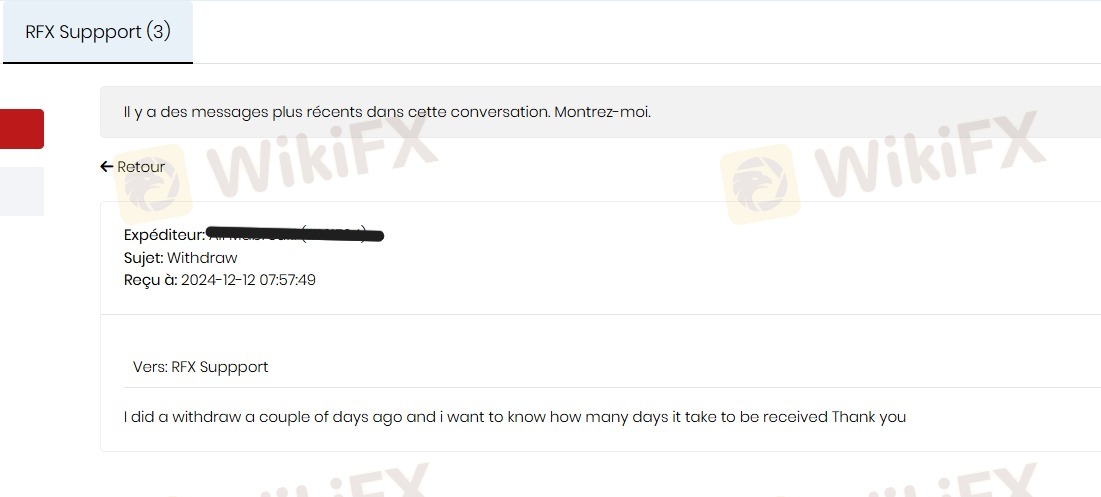

The first deposit amount must be 200€ or above. RaiseFX accepts Credit Cards (VISA and MasterCard), Wire Transfer, Cryptocurrencies(Bitcoin, Ethereum, Tether), Apple Pay, Google Pay (G Pay), OZOW and SwiffyEft for deposits. The deposit and withdrawal processing time is within 3 days. Except for WIRE transfer, most other deposit methods are processed instantly.

| Method | Processing time | Currencies |

| Credit Cards (VISA and MasterCard) | Instant | EUR, USD, AUD, GBP, JPY, SGD, NZD, CAD |

| Wire Transfer | 2-3 business days | EUR, USD, AUD, GBP, JPY, SGD, NZD, CAD |

| Cryptocurrencies (Bitcoin, Ethereum, Tether) | Instant | More than 80 cryptocurrencies |

| Apple Pay and Google Pay (G Pay) | Instant | EUR, USD, AUD, GBP, JPY, SGD, NZD, CAD |

| OZOW and SwiffyEft | Instant | EUR, USD, AUD, GBP, JPY, SGD, NZD, CAD |

If you are currently researching new trading platforms, RaiseFX might have appeared on your radar. Founded relatively recently in 2021 and headquartered in South Africa, this broker has established a presence in markets ranging from Argentina to Malaysia. However, flashy marketing often hides underlying risks that retail traders overlook until it is too late.

WikiFX

WikiFX

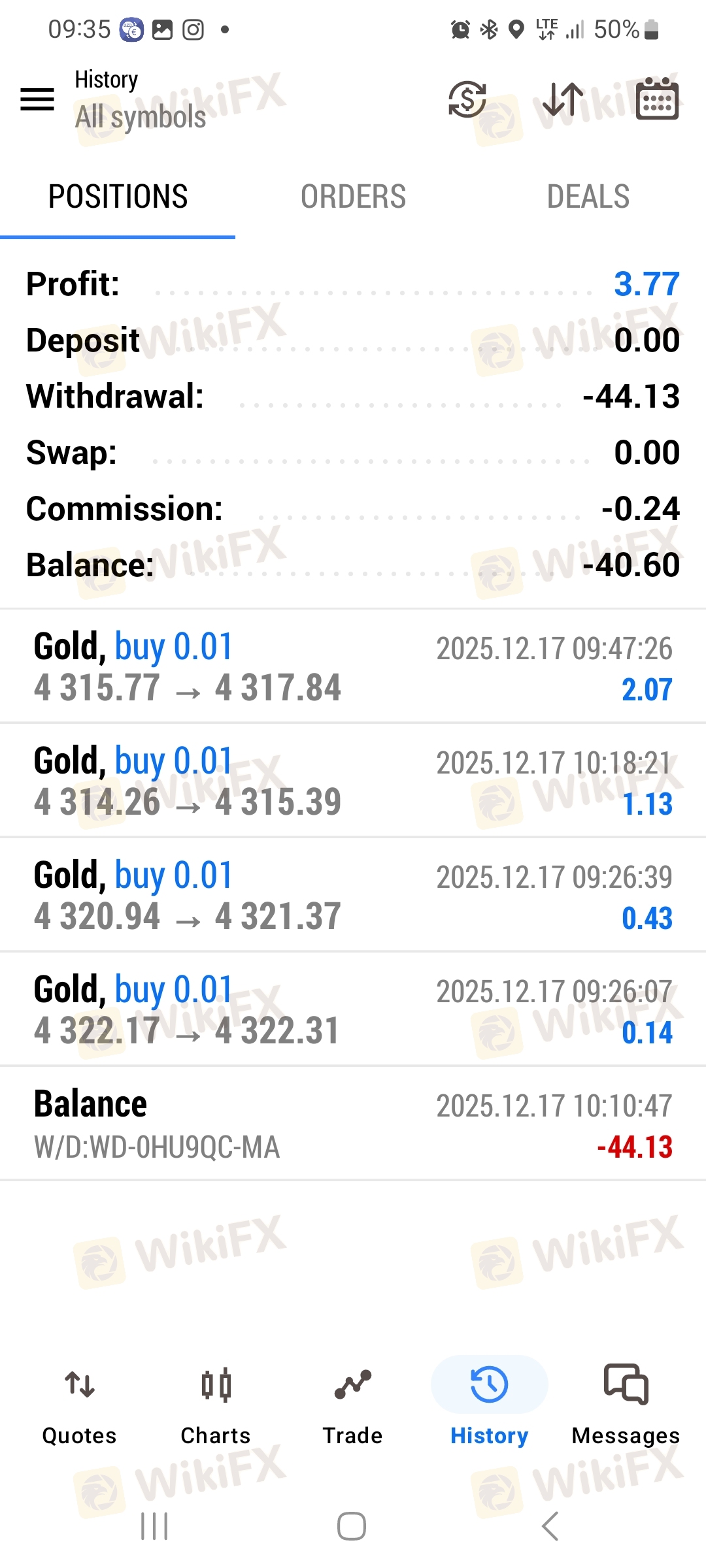

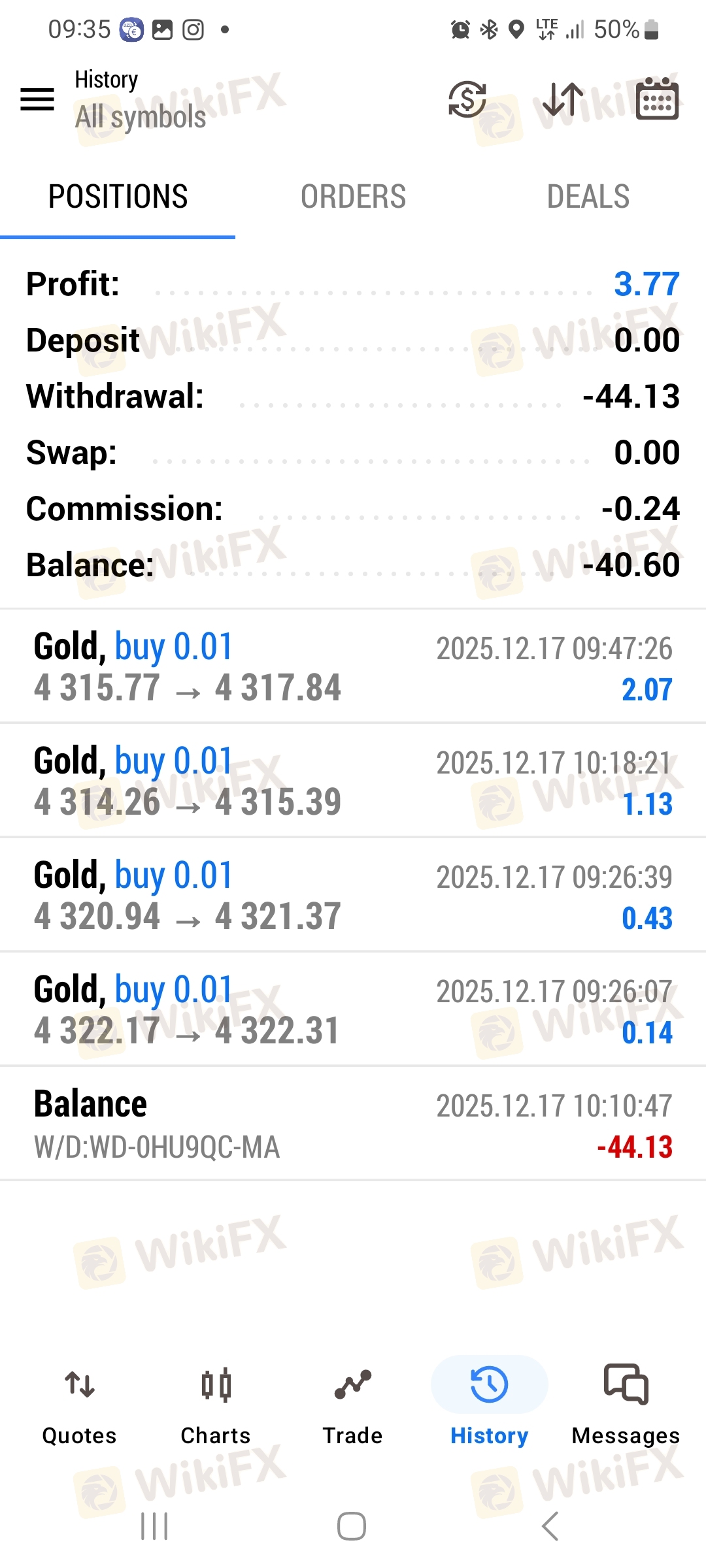

RaiseFX Review reveals low WikiFX score, hidden withdrawal fees, and serious doubts about its trustworthiness.

WikiFX

WikiFX

David Bottin, former Managing Director at AvaTrade and head of AvaTrade France, has launched a new offshore Retail FX and CFD broker brand called RaiseFX, at website raisefx.com.

WikiFX

WikiFX

More

User comment

26

CommentsWrite a review

2025-12-20 12:33

2025-12-20 12:33

2024-12-28 02:48

2024-12-28 02:48