User Reviews

More

User comment

1

CommentsWrite a review

2023-07-19 15:44

2023-07-19 15:44

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index5.74

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

EG Markets Limited

Company Abbreviation

EG Markets

Platform registered country and region

Australia

Company website

Company summary

Pyramid scheme complaint

Expose

Note: EG Markets' official website: https://www.egmarketslimited.com/ is currently inaccessible normally.

| EG Markets Review Summary | |

| Founded | / |

| Registered Country/Region | Australia |

| Regulation | Unregulated |

| Market Instruments | / |

| Demo Account | ❌ |

| Leverage | Up to 1:400 |

| Spread | From 1.6 pips (STP account) |

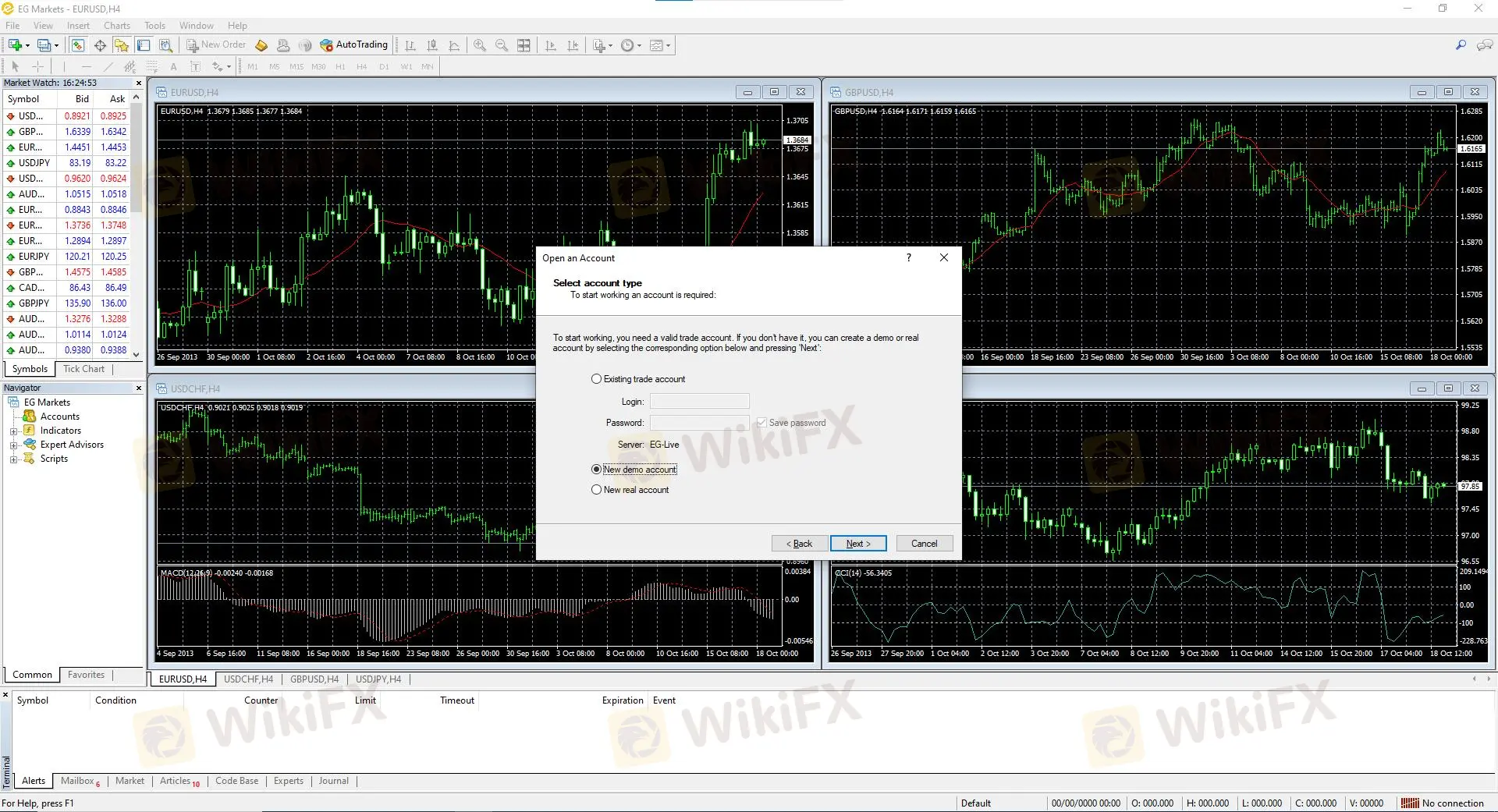

| Trading Platform | MT4 (Fake) |

| Min Deposit | $1,000 |

| Customer Support | Email: info@egmarketslimited.com |

| Address: 8 Phillip Street, Sydney, New South Wales, Australia | |

EG Markets is an unregulated financial services provider. It claims to provide different types of traders with account options like STP, ECN, and Elite, each requiring varying minimum deposits and offering different trading conditions such as spreads and leverage. EG Markets reportedly supports deposits and withdrawals through cryptocurrencies like Tether and Bitcoin, along with traditional wire transfers. However, there are many problems including unregulated status, inaccessible websites and so on.

| Pros | Cons |

| Multiple account types | Unlicensed, offshore CFD provider |

| Limited contact channels | |

| Website functionality issues | |

| No MT4/5 | |

| High minimum deposit | |

| Limited payment options |

Despite its claims regarding its regulation, the Securities and Exchange Commission of Mauritius (SMC) maintains a list of licensed brokers. Therefore, EG Markets is currently unregulated. Regulated financial service providers operate according to established standards and meet specific rules designed to safeguard investors and clients.

EG Markets offers three kinds of live accounts.

| Account Type | Min Deposit |

| STP | $1,000 |

| ECN | $5,000 |

| Elite | $30,000 |

Their minimum deposit requirement is much higher than regulated and safe brokers (most of them require $100 or less).

Besides, there are no demo options,so you cannot access the trading platform of EG Markets Limited before submitting a wealth of personal data.

EG Markets offers high maximum leverage of up to 1:400, which, while lucrative for experienced traders, also carries significant risk.

In terms of spreads,the STPaccount starts from 1.6 pips, which is average compared to other brokers.

The ECN account offers spreads from 0.6 pips.

The Elite account boasts the lowest spreads, starting from 0.1 pips,yet the high minimum deposit of $30,000 limits accessibility to only institutional or high-net-worth traders.

| Account Type | Spread |

| STP | From 1.6 pips |

| ECN | From 0.6 pips |

| Elite | From 0.1 pips |

EG Markets Limited stated that its clients would have access to MetaTrader 4, one of the most widely-used trading platforms globally. However, this was another false claim. The download link provided by the broker did not lead to MT4 but instead to another platform, the publisher of which was unverified.

EG Markets accepts crypto – Tether and Bitcoin and wire transfers.

More

User comment

1

CommentsWrite a review

2023-07-19 15:44

2023-07-19 15:44