User Reviews

More

User comment

22

CommentsWrite a review

2026-02-19 17:10

2026-02-19 17:10

2025-09-06 20:29

2025-09-06 20:29

Score

2-5 years

2-5 yearsRegulated in South Africa

Derivatives Trading License (EP)

MT5 Full License

High potential risk

Influence

Add brokers

Comparison

Quantity 15

Exposure

Score

Regulatory Index3.60

Business Index6.38

Risk Management Index0.00

Software Index9.78

License Index3.60

Single Core

1G

40G

More

Company Name

EMA Markets (pty) Ltd

Company Abbreviation

EMAR MARKETS

Platform registered country and region

South Africa

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

Can't withdraw money from scam platform

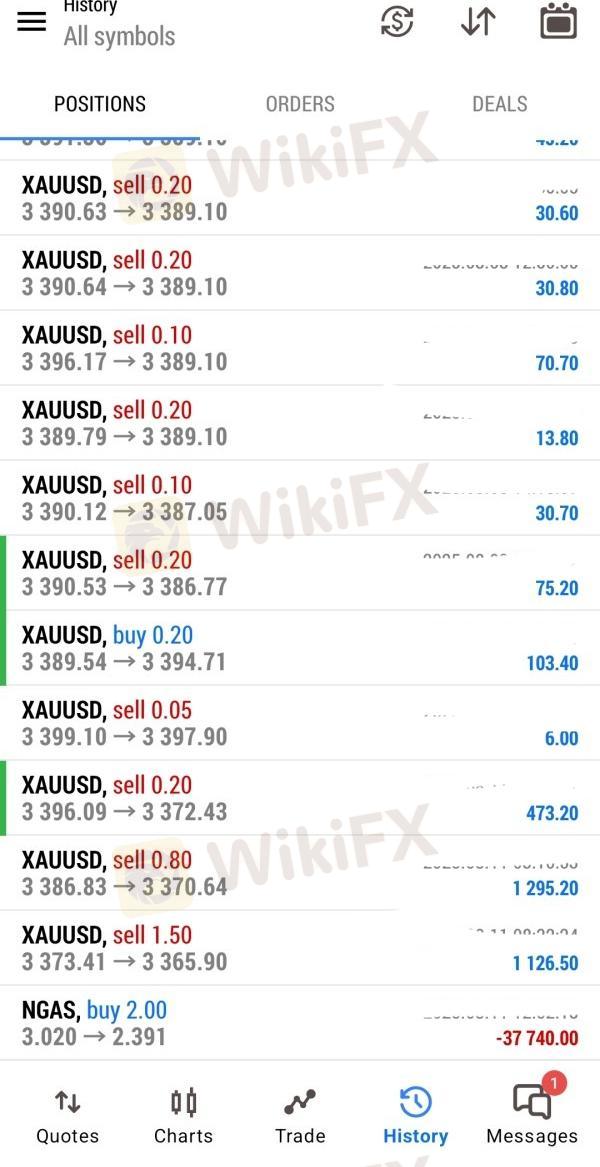

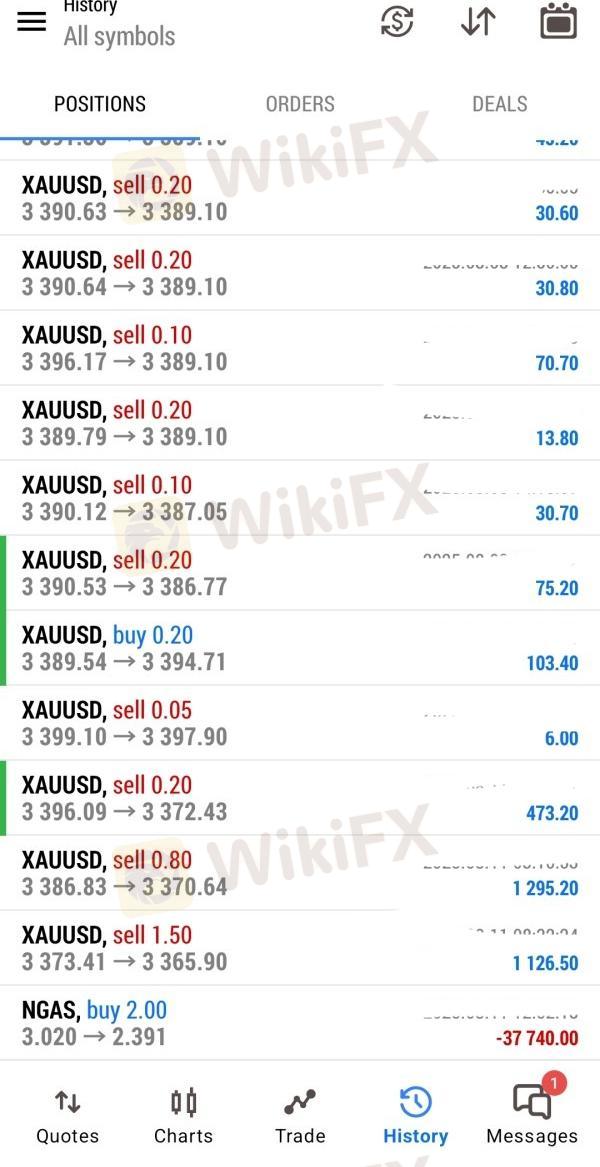

This broker deactivated my account claiming that I had operations that were not in accordance with the operator's rules, I have my own strategies, it's not my fault if I always manage to win, and now they don't want to refund my account balance, I don't know what else to do for her to refund my money, I have already contacted her via the email she provided, but to no avail, this discourages any trader, the broker should help us, but ends up hurting us!

When I first submitted a withdrawal request, the Malaysian customer service representative said, "The system detected that your account is only linked to a bank card, and the data correlation is insufficient." They then sent me a "data correlation rule," stating that the "value of the linked assets must be ≥ 1.5 times the withdrawal amount." They also threatened me, "If you don't link within three days, your account will be marked as 'high risk' and your principal will be frozen!" I argued with them, saying I didn't have any real estate or stocks, but the representative said, "You can first transfer 100,000 yuan to the platform's 'asset custody account' as a temporary correlation, and then refund it after you withdraw the funds!" Only then did I realize it was a scam! I asked for a direct withdrawal, but they bluntly said, "The data correlation requirements are not met, and your withdrawal request is rejected!"

I purchased their real-time data monitoring service in 2023. At the time, the Malaysian customer service representative said, "Anytime you have questions about the data, feel free to contact after-sales. We guarantee a response within an hour." Last Wednesday night, I discovered that the data displayed on the platform didn't match the real-time market data by a full 15 points. I quickly contacted after-sales, but no one responded! I waited all night, and the next day, a customer service representative replied, "After-sales staff are off duty. We'll talk when they get back." Because of this 15-point discrepancy and operational error, I lost over 30,000 yuan. Who will compensate me? I asked for an explanation, but the customer service representative impatiently said, "Occasional data deviations are normal. Don't make a big deal out of it!" They take the after-sales service money, then don't deliver, and then play dead when problems arise. This is their "data foundation."

I have a problem with the deposit not being included in my trader's acc.. the platform is very disappointing..

My withdrawal application was stuck under review for a full 17 days! Customer service always responded with a robotic "processing" response. Isn't your data system supposedly fully automated for risk control? Why is it suddenly manually reviewed when it comes to withdrawals? Account profits exceeding $5,000 trigger a so-called "risk review," during which all trading functions are locked. I can't control my transactions while watching the market fluctuate. Will you compensate me for my losses? Customer service even arrogantly claimed, "Excessive profits require additional verification." This is clearly a classic scam platform evasion tactic! Even more disgusting is that I submitted the so-called "verification materials" five or six times, and each time they claimed the documents were unclear, and then they simply disappeared without a response.

Initially, the Malaysian customer service sent me daily "real-time platform profit data," claiming that "many users follow the data and consistently earn 20% every month." They even calculated that "investing 80,000 yuan would earn 16,000 yuan per month, with a payback period of six months." I believed them and invested 80,000 yuan. In the first two weeks, my account showed a profit of over 3,000 yuan, but a few days later, when I logged in, all my profits were gone, showing a "loss of 50,000 yuan." I contacted customer service, and they said, "It was your own mistake; the data is clearly recorded, and it has nothing to do with the platform." I had never made a losing trade! I asked them to check my trading records, but they said, "The data is internal to the platform and cannot be shared with users." It was clear they had secretly tampered with my account data and were trying to steal my capital! Emar Markets' so-called "data base" is a joke.

When I first submitted a withdrawal request to Emar Markets, the Malaysian customer service representative said, "Your account data doesn't match your identity information very well. You can pass the verification by paying a 2,000 yuan verification fee, and the funds will be credited to your account within 12 hours." After waiting 24 hours with no response, I asked again, and they said, "Data verification is being upgraded, and you need to pay an additional 3,000 yuan advanced verification fee, otherwise your funds will be frozen!" Within two days, they added, "The system has detected traces of overseas data in your account. You must pay a 5,000 yuan cross-border verification fee, otherwise your withdrawal request will be permanently rejected!" I asked for a refund of the "verification fee," but they bluntly said, "The verification fee has been used for data verification and is non-refundable!" They also threatened, "If you cause trouble again, your account will be frozen!"

The broker scammed me and I made a withdrawal order 10 days ago and they did not approve the withdrawal request

Emar Markets is a complete money trap. I've been trading on the platform for six months, and the platform's outrageous slippage and shameless scams have left me devastated. I placed a long order at 1.0920 on the EUR/USD pair. At the time, market volatility was calm, but the order actually executed at 1.0968, a whopping 48 pips of slippage! Consider that compliant Malaysian forex platforms typically limit slippage to 6-12 pips under similar market conditions. Even more despairing was when, on the day of the Federal Reserve's interest rate hike this month, I set a stop-loss on the GBP/JPY pair at 152.30. However, when the market fluctuated, the stop-loss was actually executed at 153.15, a slippage of 85 pips, resulting in a loss of RM4,100 on that single trade. All Malaysian traders should avoid this platform, which exploits slippage to steal funds and lacks integrity.

My withdrawal applications were always delayed for half a month by "data review." The Malaysian customer service representative recommended that I open a "priority channel," saying, "Pay a 50,000 deposit, and the channel will be open, with data review completed in seconds and funds arriving within 2 hours." I believed them and transferred the 50,000 I was saving for my mortgage. After three days, the channel still wasn't open, and my withdrawal application was still stuck on "data review." I contacted customer service, and they said, "Your deposit data hasn't synced yet. Wait another three days." After another three days, still no response, I sent another message, only to find I'd been blocked! I couldn't reach the platform's complaint phone number, and no one responded to messages on the official website! I later learned there was no such thing as a "data-first withdrawal channel"—it was simply a scam to trick users into depositing more money.

Emar Markets is run entirely by Malays. They constantly boast about being "data-based," but the data they provide is completely false. I lost tens of thousands of dollars, and now my account has been frozen. Isn't this blatant robbery? I previously invested based on their "accurate data reports," claiming they analyzed real-time market data and guaranteed profits. I believed them and invested 50,000, only to lose all but 2,000 in just three days! I contacted the Malay customer service for an explanation, but not only did they refuse to admit their mistake, they also said, "The data is just a guide. Any losses are your fault!" What a reference! They boasted so much back then, and now they're blaming me for problems? Even worse, when I tried to withdraw the remaining 2,000, my account was frozen! I asked customer service why, and they said, "The system detected that you frequently questioned the data and identified you as a risky user." And questioning fake data is now my fault?

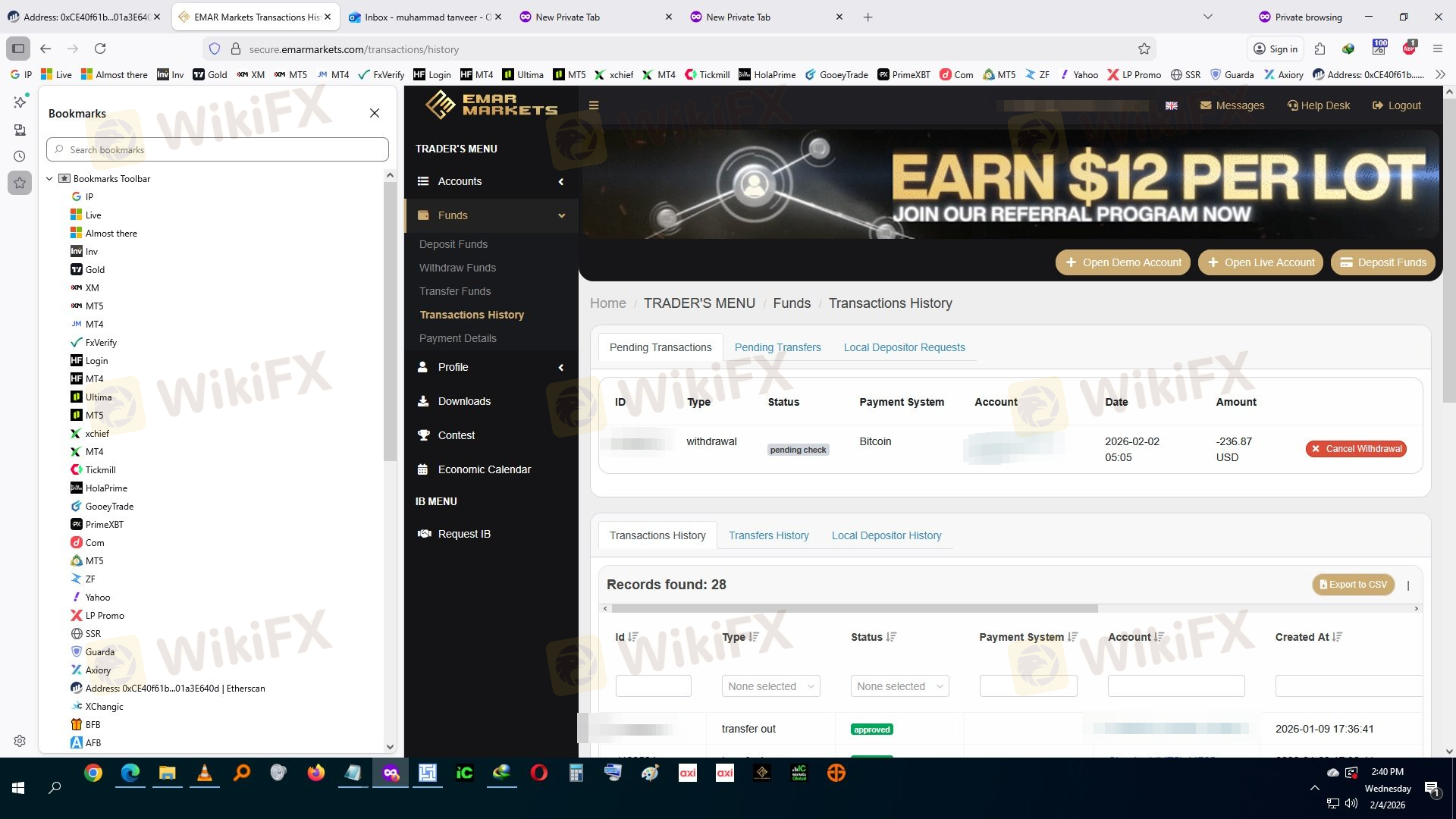

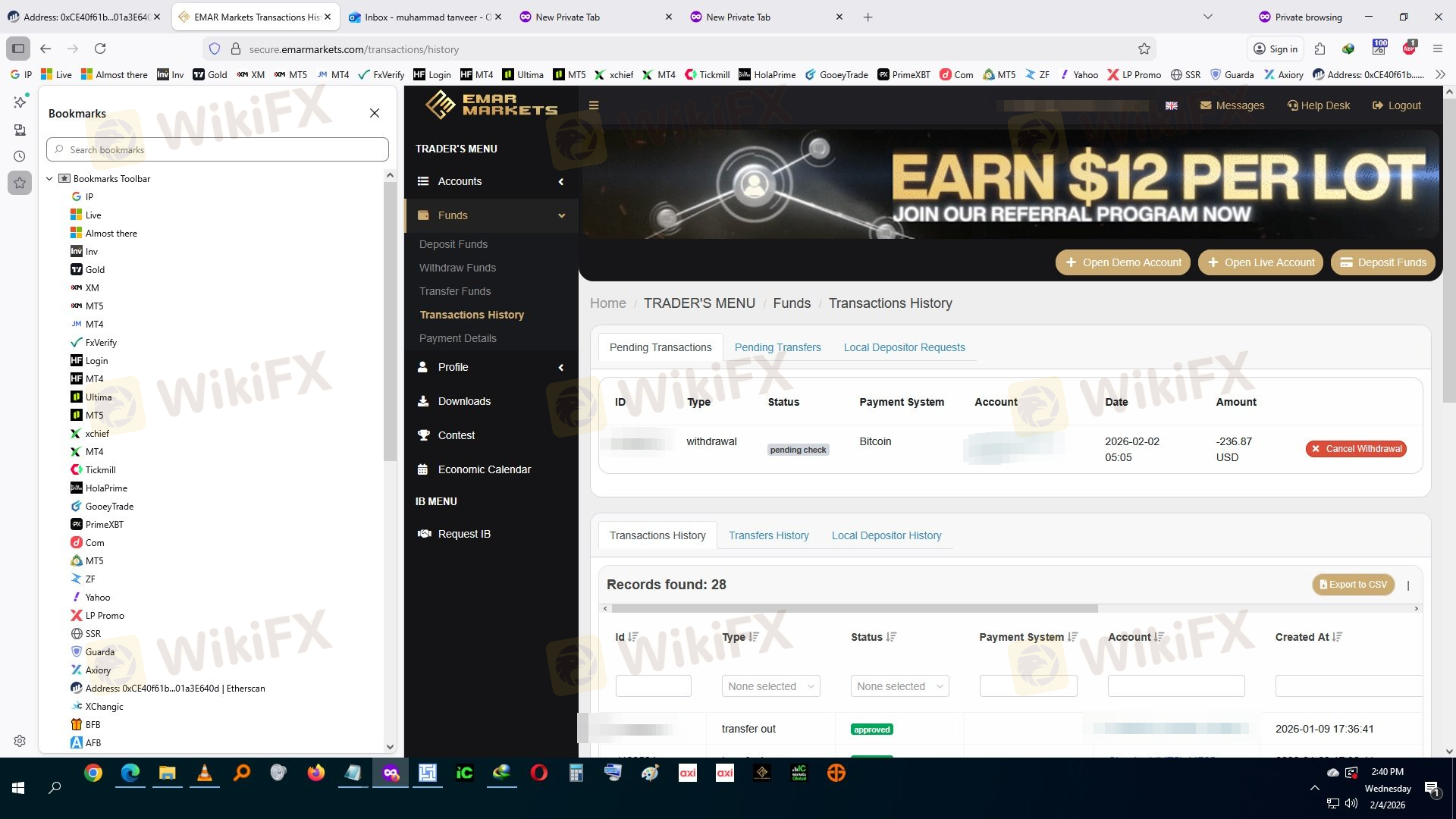

withdrawal. Amount: -236.87 USD Date: 2026-02-02 05:05 Fraud Company please be aware.. My funds has been stuck in the withdrawal. Its still pending since 9 days. And even not reply on the support ticket. 4 times i have submit my ticket but no any answer.

This platform constantly boasts about being "data-based, guaranteed withdrawals," but it's all just a scam. I've been applying for a withdrawal for almost a month now, and haven't seen a penny. This is money grabbing! I was initially deceived by their promises of "real-time data monitoring, withdrawals in 3 days," hoping to earn some income to help with my mortgage, but the moment I invested, they pocketed the money! The first time I applied for a withdrawal, the Malaysian customer service representative said, "Data verification takes 7 business days." I waited. After 7 days, when I asked about the status, they said, "There's a data delay with the financial integration. Wait another 5 days." I waited again. Now, a month later, when I contact them again, they've completely shut down, not responding to messages or calls, and only occasionally replying with a simple "your application is still under data review."

| Emar Markets Review Summary | |

| Registered | 2022 |

| Registered Country/Region | South Africa |

| Regulation | FSCA (Exceeded) |

| Market Instruments | Forex Pairs, Commodities, Indices, Cryptos |

| Demo Account | / |

| Leverage | Up to 1:3000 |

| Spread | From 0.1 pips |

| Trading Platform | MT5, cTrader |

| Minimum Deposit | $1 |

| Customer Support | Phone: +27105347518 |

| Email: support@emarmarkets.com | |

| Live Chat | |

| YouTube, Twitter, TikTok, Facebook, Instagram | |

| Physical Office: First Floor, Kildare Road and Main Street, Newlands, Cape Town 7550, Western Cape, South Africa. | |

Emar Markets is an online broker. It offers three MT5-based accounts (Cent, Standard, Pro) with $1-$100 minimum deposits, zero commissions, and spreads from 0.1 pips. Traders can access forex, commodities, indices, and cryptocurrencies, with leverage up to 1:3000. The platform supports MetaTrader 5 and cTrader, a $50 welcome bonus.

| Pros | Cons |

| Friendly to beginners ($1 deposit required) | Regulatory status marked as exceeded |

| Spread as low as 0.1 pips | Incomplete deposit/withdrawal information |

| MetaTrader 5 provided | No demo account |

| Multiple trading instruments | No MT4 |

| Live chat support | |

| No commission | |

| Bonus offered |

Emar Markets holds an FSCA certification, but its regulatory status is “Exceeded,” indicating low security.

| Regulated Authority | Current Status | Licensed Entity | Regulated Country | License Type | License No. |

| Financial Sector Conduct Authority (FSCA) | Exceeded | EMAR MARKETS(PTY)LTD | South Africa | Financial Service Corporate | 53070 |

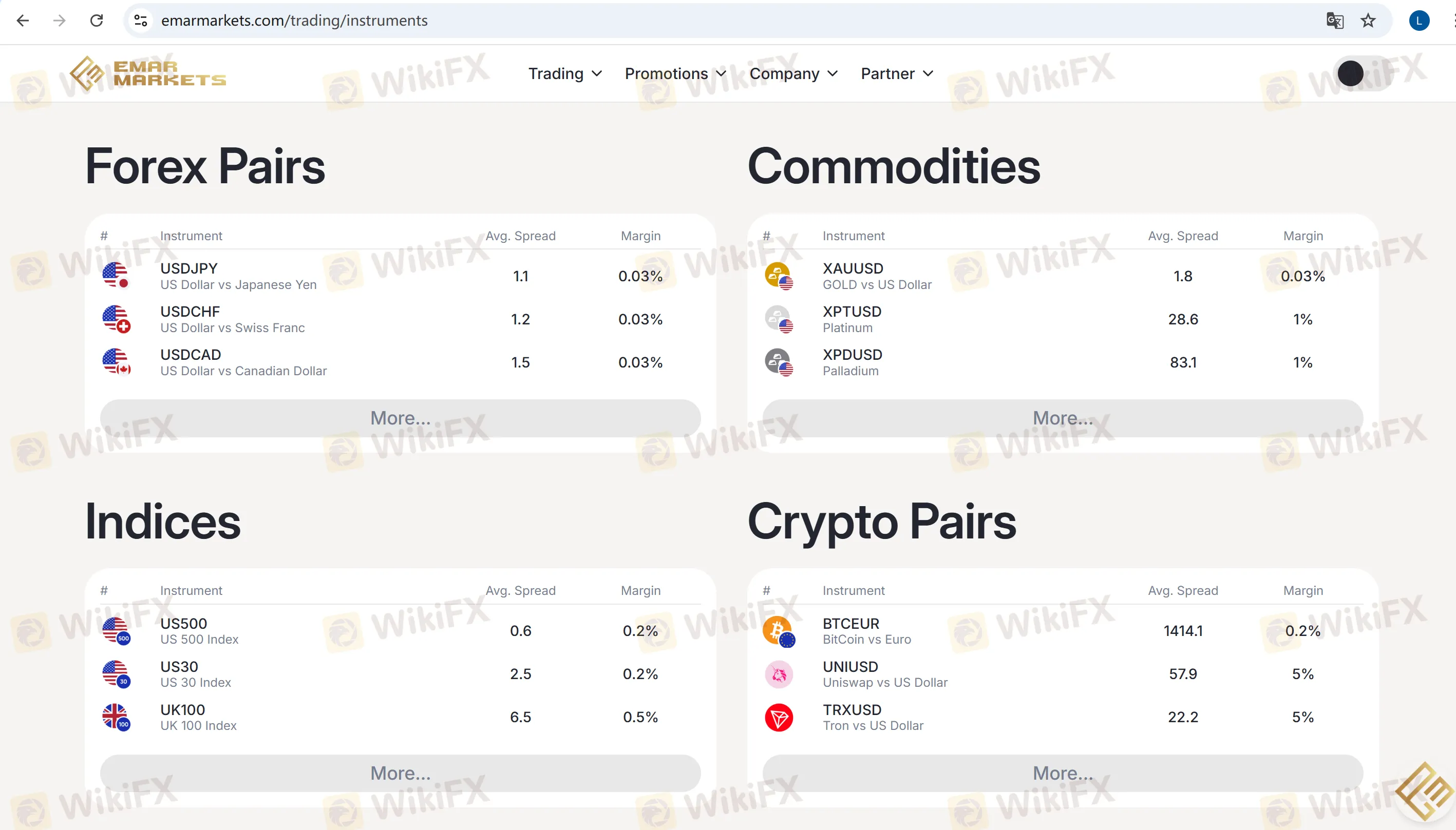

Emar Markets offers four major categories of trading instruments, including forex pairs suitable for short-term forex trading enthusiasts; commodities that can be used for asset hedging or long-term investment; indices; and cryptocurrencies suitable for cryptocurrency investors with a higher risk appetite.

| Tradable Instruments | Supported |

| Forex Pairs | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Cryptos | ✔ |

| Precious Metals | ❌ |

| Shares | ❌ |

| ETFs | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

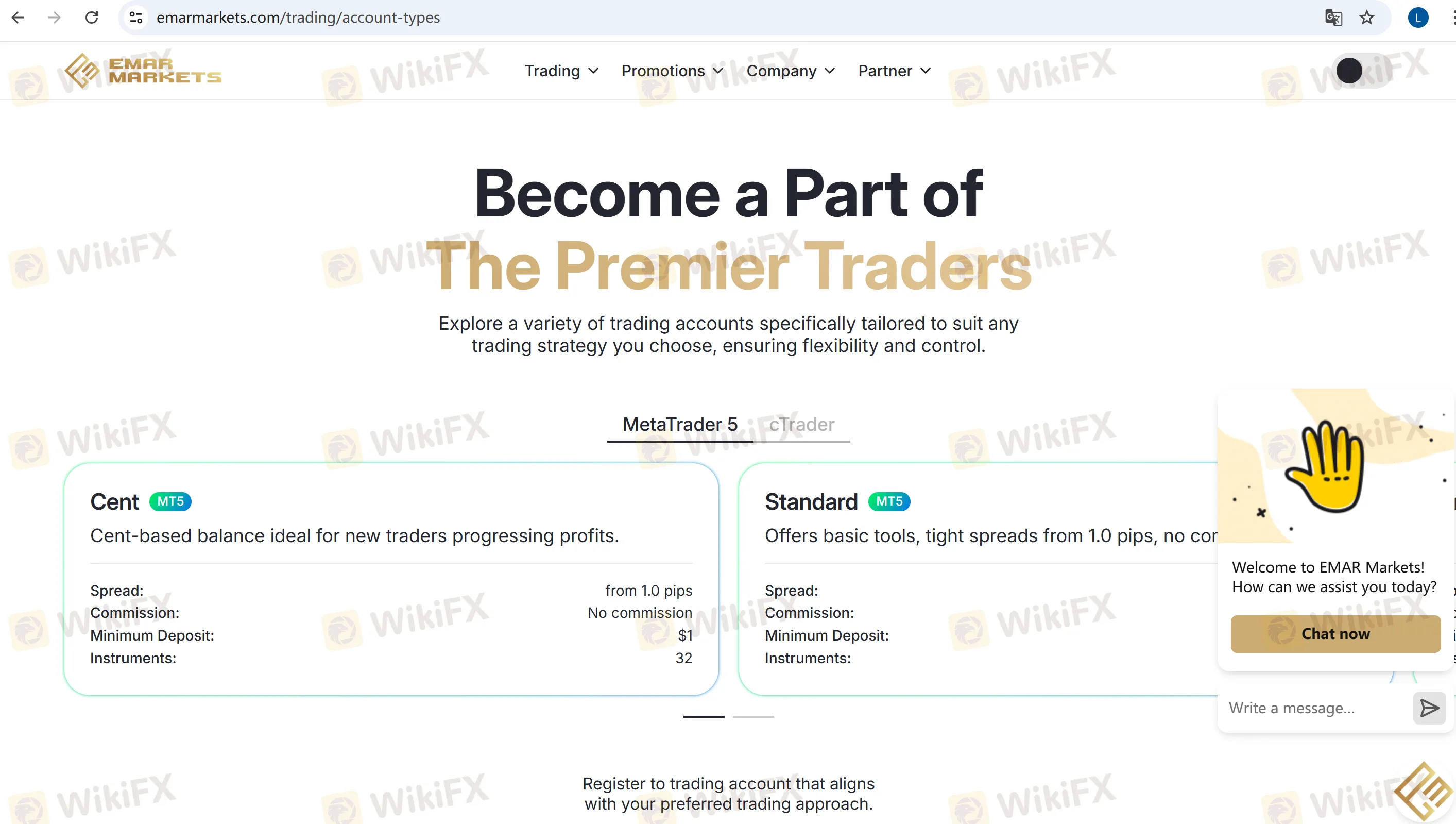

Emar Markets offers three types of trading accounts based on the MetaTrader 5 platform. The Cent Account is suitable for novice traders with limited capital and less experience to accumulate trading experience. There is also the Standard Account, and the Pro Account is specifically designed for experienced traders who pursue lower trading costs.

| Account Type | Cent | Standard | Pro |

| Minimum Deposit | $1 | $1 | $100 |

| Spread | From 1.0 pips | From 1.0 pips | From 0.1 pips |

| Instruments | 32 kinds | 147 kinds | 147 kinds |

| Commission | No commission | No commission | No commission |

The spread starts from 0.1 pips, and it does not charge any commission for three types of accounts.

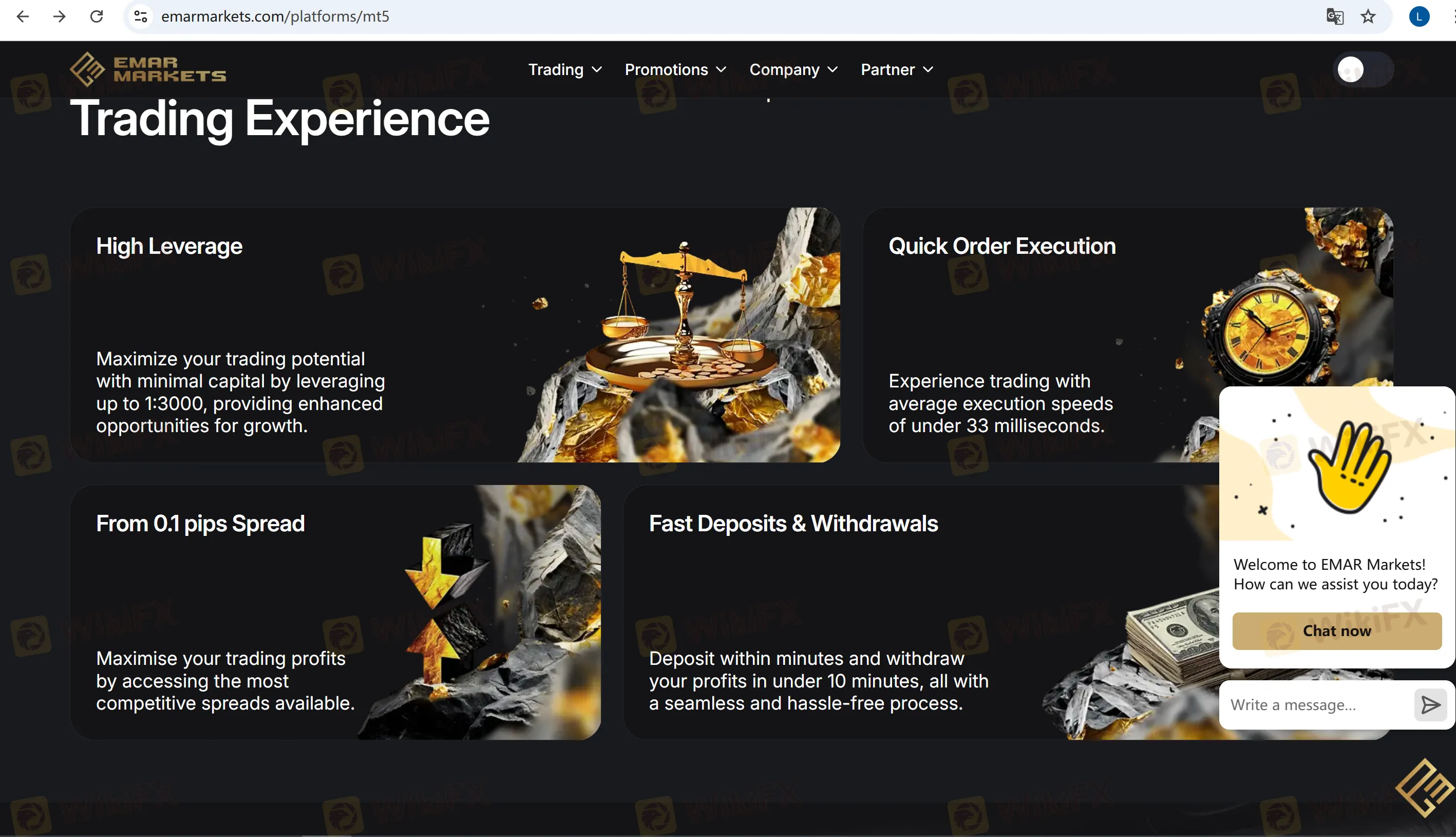

Emar Markets offers a maximum leverage ratio of up to 1:3000. Traders need to consider carefully before trading, since high leverage is likely to bring high potential risks.

The platform supports two major trading platforms, MetaTrader 5 and cTrader, which can be downloaded on Windows, macOS, and mobile devices (App Store).

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Windows, macOS, and mobile | Experienced Traders |

| cTrader | ✔ | Windows, macOS, and mobile | / |

| MT4 | ❌ | / | Beginners |

The minimum deposit is $1. Emar Markets processes withdrawal requests in less than 10 minutes, with no fees charged throughout the entire process.

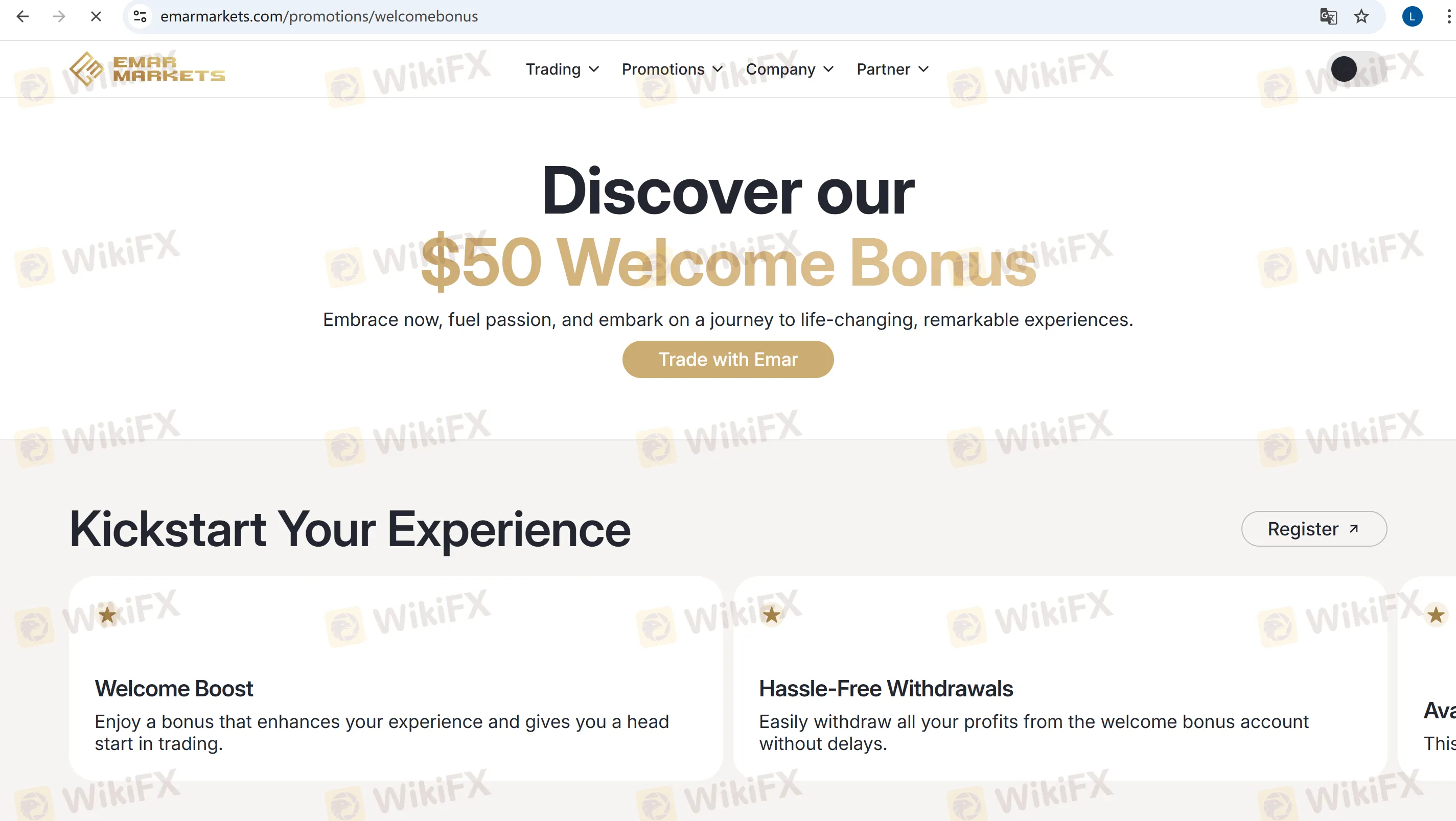

The platform offers a $50 registration welcome bonus. To claim it, you need to open a welcome bonus account within 30 days of registration, make a minimum deposit of $15, and pass identity verification (which takes 1-2 working hours for review). The bonus will then be directly credited to your account balance for trading.

EMAR MARKETS is a broker established in 2022, based in South Africa. Key WikiFX data shows they use the MT5 platform and offer multiple account types like Cent and Pro accounts.

WikiFX

WikiFX

Before working with any online broker, it’s important to check their licenses and how they operate. Emar Markets is one such broker that has come under review. Although it claims to be regulated in South Africa, further checks show some warning signs that traders should not ignore.

WikiFX

WikiFX

Emar Markets is a very young broker. It is an online forex broker offering various market instruments. WikiFX made a comprehension review on this broker to help you better understand the truth, we will analyze the reliability of this broker from specific information, regulation, exposure, etc. And you should never miss it.

WikiFX

WikiFX

More

User comment

22

CommentsWrite a review

2026-02-19 17:10

2026-02-19 17:10

2025-09-06 20:29

2025-09-06 20:29