User Reviews

More

User comment

3

CommentsWrite a review

2024-03-29 19:01

2024-03-29 19:01

2024-01-16 12:09

2024-01-16 12:09

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index6.97

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

| Aspect | Information |

| Registered Country/Area | Hong Kong |

| Company Name | GOLDEN 168 GROUP |

| Regulation | No valid regulation |

| Minimum Deposit | $25 - $100 (depending on account type and location) |

| Maximum Leverage | Up to 1:1000 (unverified information, varies by account type and instrument) |

| Spreads | Variable, potentially wider than established brokers |

| Trading Platforms | Web platform, Mobile App |

| Tradable Assets | Forex, CFDs, Cryptocurrencies, Precious Metals |

| Account Types | Micro, Standard, VIP |

| Demo Account | Yes |

| Customer Support | Online Chat, Email, Phone (reportedly limited responsiveness and unhelpful) |

| Payment Methods | Visa, Mastercard, Bank Transfer, e-wallets (Skrill, Neteller) |

| Educational Tools | Website articles, tutorials, videos, webinars (concerns about outdated information and promotional bias) |

Golden 168 Group is a Hong Kong-based online trading platform offering access to Forex, CFDs, cryptocurrencies, and precious metals. However, it's crucial to exercise extreme caution before considering them due to several concerning factors.

First and foremost, Golden 168 Group operates without valid regulation from any reputable financial authority. This lack of oversight raises significant red flags regarding the security of your funds and the fairness of their trading practices.

While they offer a variety of account types and trading platforms, reports suggest potentially wider spreads than established brokers, limited responsiveness from customer support, and concerns about the quality and bias of their educational resources.

Golden 168 Group operates without valid regulation, posing significant risks to funds and trading activities. The lack of oversight raises concerns about potential fraudulent practices and disputes resolution difficulties. Independent reviews highlight hidden fees, unresponsive customer support, and questionable trading conditions, indicating a lack of commitment to ethical business practices. Investing with an unregulated broker like Golden 168 Group carries substantial risks, emphasizing the importance of choosing reputable and regulated alternatives prioritizing transparency and user protection for financial well-being. Approach Golden 168 Group with extreme caution or consider regulated alternatives.

While Golden 168 Group offers a variety of features like a wide range of instruments, different account types, and various trading platforms, a significant red flag arises from numerous independent reviews. Concerns about legitimacy and regulatory oversight, coupled with reports of hidden fees, unresponsive customer support, and potentially misleading educational resources, should raise serious doubts about their trustworthiness.

Investing with Golden 168 Group carries considerable risks, potentially jeopardizing your financial security. Thorough research and extreme caution are crucial before considering them. Seeking reputable and regulated alternatives is highly recommended.

| Pros | Cons |

| - Wide range of instruments (Forex, CFDs, Crypto, Metals) | - Potentially wider spreads than established brokers |

| - Multiple account types for different experience levels | - Concerns about hidden fees and charges |

| - Web and mobile platforms available | - Reviews suggest outdated interface and limited features |

| - Various contact options (Chat, Email, Phone) | - Reviews report long wait times, unhelpful replies, and lack of responsiveness |

| - Articles, tutorials, webinars, demo accounts | - Concerns about outdated information, promotional bias, and limited access to advanced resources |

Forex: Major, minor, and exotic currency pairs are often available, albeit with potentially wider spreads compared to established brokers.

Contracts for Difference (CFDs): Golden 168 Group may offer CFDs on various assets, including indices, commodities, and individual stocks. However, remember CFDs leverage inherent risks due to potential margin calls and losses exceeding your initial investment.

Cryptocurrencies: Some reports suggest access to trading popular cryptocurrencies like Bitcoin and Ethereum. However, the crypto market is highly volatile and unregulated, increasing the risk of significant losses.

Precious Metals: Gold and silver might be available for trading, but be wary of hidden fees and leverage risks associated with trading precious metals.

GOLDEN 168 GROUP reportedly offers three main account types:

Micro Account: This is typically their most basic account with a lower minimum deposit and smaller trade sizes. It might be suitable for beginners, but the spreads and leverage might be less favorable compared to other accounts.

Standard Account: This is their mid-tier account with a higher minimum deposit and larger trade sizes compared to the Micro account. It might offer tighter spreads and higher leverage, but also carries greater risk.

VIP Account: This is their premium account with the highest minimum deposit, largest trade sizes, and potentially the most favorable trading conditions like tighter spreads and higher leverage. However, it's likely only suitable for experienced traders due to the increased risk and required capital.

Here's a general overview of the process, but please prioritize your financial safety by conducting further research:

Visit the GOLDEN 168 GROUP website: Navigate to their official website and locate the “Open Account” section.

Fill in the registration form: Provide your personal information, including name, email address, phone number, and country of residence.

Choose your account type: Select the type of account you want to open (Micro, Standard, or VIP).

Deposit funds: Choose your preferred deposit method and fund your account with the minimum required amount.

Verify your identity: Upload copies of your ID and proof of address to comply with KYC/AML regulations.

Start trading: Once your account is verified and funded, you can access the trading platform and begin trading.

GOLDEN 168 GROUP reportedly offers varying leverage levels depending on your account type and the asset you're trading. Some reports suggest leverage as high as 1:1000, which is considered extremely high and carries significant risk.

Here's a breakdown of potential leverage based on account type (unverified information):

Micro Account: Leverage might be limited to 1:100 or lower.

Standard Account: Leverage might range from 1:200 to 1:500.

VIP Account: Leverage might reach as high as 1:1000.

Overnight Interest Fees (Swaps):

Holding positions open overnight on leveraged forex or CFD trades may incur swap charges.

These fees can be positive or negative depending on the interest rate differential between the two currencies involved.

Golden 168 Group's swap rates might not be transparent or competitive, potentially impacting your profitability.

Deposit and Withdrawal Fees:

Some deposit and withdrawal methods might incur fees.

Be sure to check their fee schedule for specific charges associated with different payment options.

Reports suggest potentially high withdrawal fees, particularly for certain methods like wire transfers.

Inactivity Fees:

Golden 168 Group may charge fees if your account remains inactive for a prolonged period.

These fees can vary depending on the account type and inactivity duration.

Review their terms and conditions to understand the specific inactivity fee policy and potential charges.

Additional Charges:

Be mindful of potential hidden fees or charges not explicitly mentioned in their fee schedule.

Carefully review all terms and conditions before opening an account to avoid unexpected costs.

Here's an overview of Golden 168 Group's reportedly offered trading platforms:

Web Platform:

Accessible through your web browser, offering basic functionalities for trading various instruments.

Reviews suggest a potentially outdated interface and limited features compared to other platforms.

Be sure to test the platform thoroughly before committing any funds.

Mobile App:

Available for Android and iOS devices, allowing on-the-go trading.

Reviews raise concerns about stability issues, bugs, and limited functionality compared to the web platform.

Exercise caution when using the mobile app for critical trading activities.

Deposits:

Supported methods: Visa, Mastercard, bank transfer, e-wallets (Skrill, Neteller), and potentially others depending on your location.

Minimum deposit: Varies depending on the chosen method and account type. May range from $25 to $100.

Processing times: Usually instant for e-wallets and credit cards, but bank transfers might take 1-5 business days.

Withdrawals:

Supported methods: Similar to deposits, but some options might be limited for withdrawals.

Minimum withdrawal: Varies depending on the chosen method and account type. May range from $50 to $100.

Processing times: Reportedly longer than deposits, with some users experiencing delays of several days or even weeks.

Fees: Golden 168 Group may charge withdrawal fees, especially for certain methods like wire transfers. Be sure to check their fee schedule for specific charges.

Please note:

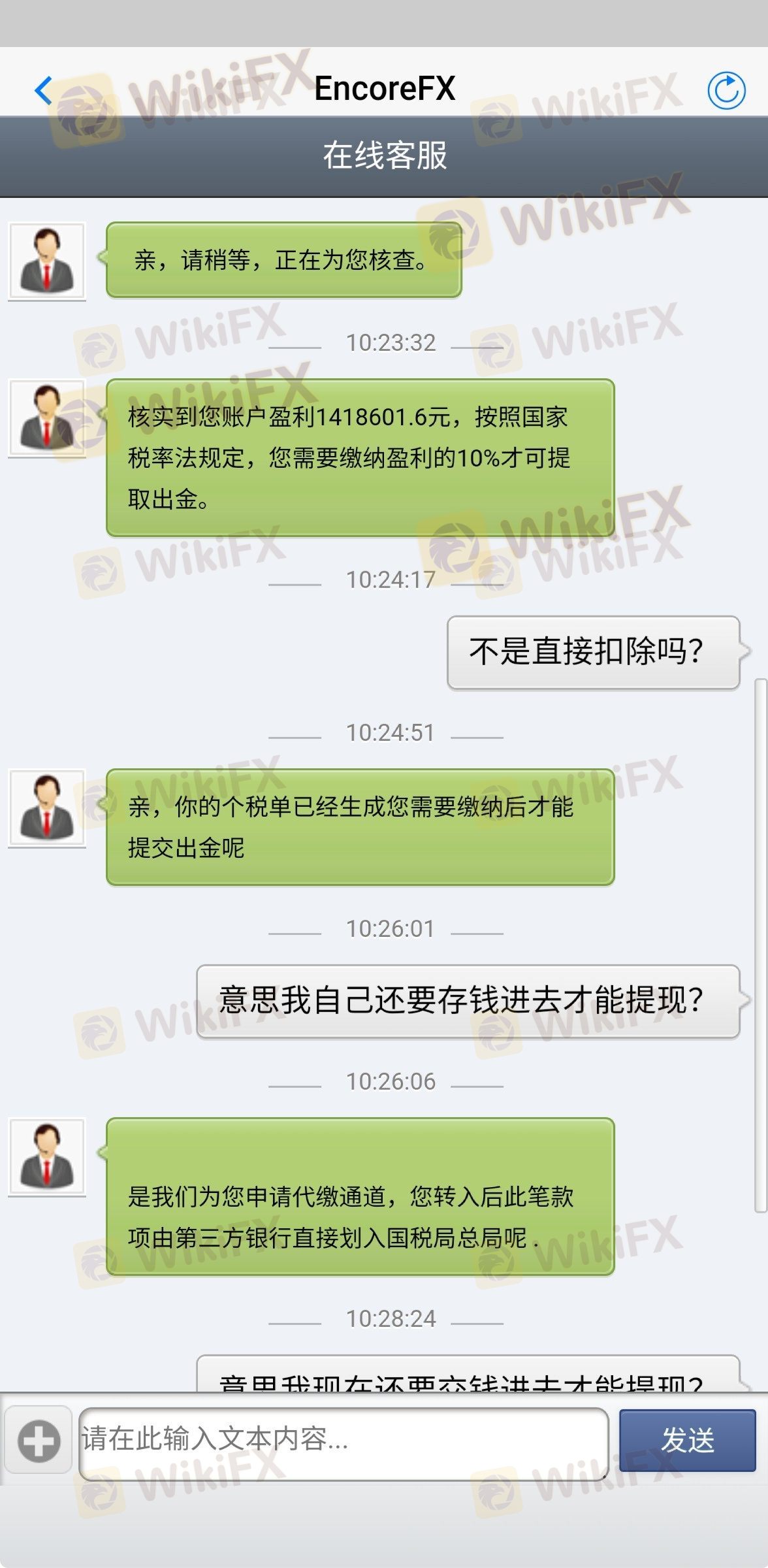

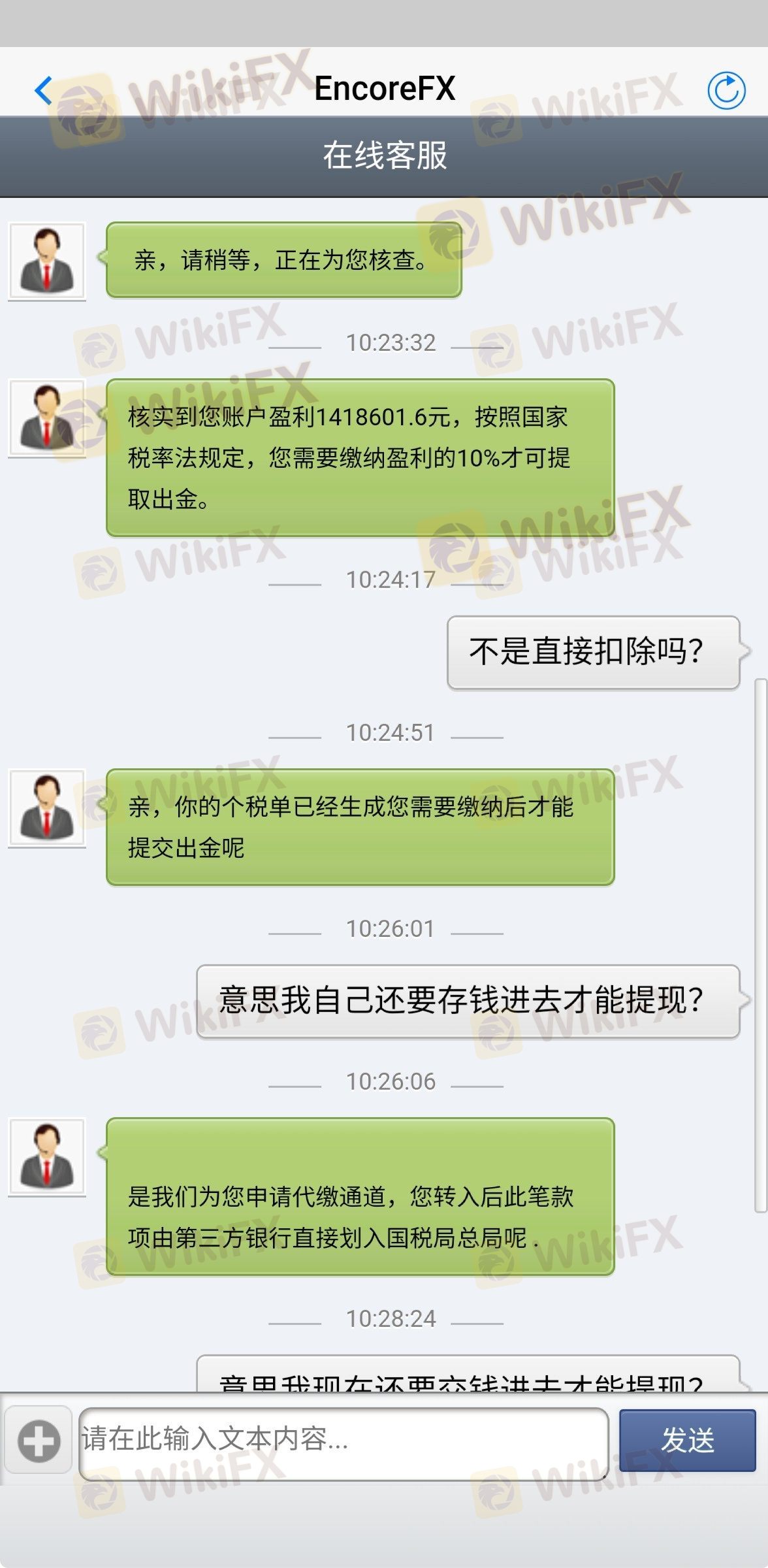

Independent reviews have raised concerns about difficulties withdrawing funds from Golden 168 Group. Some users report delays, technical issues, and unresponsiveness from customer support.

Hidden fees and charges have also been reported. Carefully review their terms and conditions before making a deposit to avoid unexpected costs.

Here's an overview of Golden 168 Group's reportedly available customer support channels:

Online Chat: Accessible through their website, offering real-time communication with support representatives.

Reviews suggest long wait times, limited responsiveness, and difficulty obtaining helpful solutions.

Be prepared for potential language barriers and automated responses.

Email:service@goldrunb.com;Available for submitting inquiries and requesting assistance.

Reviews report slow response times, generic replies, and lack of resolution for complex issues.

Consider email as a last resort, and document all communication for potential future reference.

Phone: Some reports suggest phone support availability, but information might be limited or inaccurate.

Reviews raise concerns about difficulties reaching representatives, long hold times, and potential disconnection issues.

Explore alternative channels first, and be prepared for potential language barriers.

Website content: Articles, tutorials, and video guides on various trading topics.

Reviews raise concerns about outdated information, lack of depth, and potential promotional bias.

Be wary of generic information and verify any advice against credible sources.

Webinars and seminars: Online and offline sessions hosted by Golden 168 Group representatives.

Reviews suggest heavy focus on promoting their platform and potentially misleading information.

Exercise critical thinking and be cautious about any investment recommendations provided.

Demo accounts: Practice platforms with virtual funds to simulate trading.

While demo accounts can be helpful for beginners, ensure the conditions accurately reflect real market dynamics.

Remember, practice doesn't guarantee success in live trading with potential risks involved.

Golden 168 Group presents a confusing picture. While it boasts a seemingly diverse array of features, ranging from multiple market instruments to various account types and platforms, a shadow of doubt shrouds its very foundation. The red flags are numerous and concerning: independent reviews raise questions about its legitimacy and regulatory status, highlighting potential risks to your financial security.

Reports of hidden fees, unresponsive customer support, and potentially misleading educational resources further bolster the doubts. These criticisms paint a picture of a platform that may not prioritize its users' well-being, potentially placing its own gain above transparency and fair practice.

Therefore, the conclusion regarding Golden 168 Group is clear: approach with extreme caution. The potential risks far outweigh any perceived benefits. Invest your time and resources in reputable and regulated alternatives. Prioritize your financial safety and choose platforms that have earned trust and demonstrate a commitment to ethical practices. Remember, it's better to be safe than sorry when it comes to your hard-earned money.

Q: Is Golden 168 Group legitimate?

A: Concerns have been raised about Golden 168 Group's legitimacy due to limited regulatory oversight and negative user reviews. It's recommended to conduct thorough research and exercise caution before considering them.

Q: What market instruments does Golden 168 Group offer?

A: They reportedly offer a wide range, including Forex, CFDs on various assets, cryptocurrencies, and precious metals. However, be mindful of potentially wider spreads and limited liquidity compared to established brokers.

Q: What account types does Golden 168 Group offer?

A: They typically offer Micro, Standard, and VIP accounts with varying minimum deposits and leverage. However, reviews raise concerns about hidden fees and charges associated with different account types.

Q: What trading platforms does Golden 168 Group offer?

A: They offer web and mobile platforms, but reviews suggest they might be outdated with limited features. Be prepared for potential stability issues and technical glitches.

Q: What is the quality of Golden 168 Group's customer support?

A: Reviews report long wait times, unhelpful responses, and difficulty obtaining assistance. Consider their customer support limited and unreliable.

Q: Does Golden 168 Group offer good educational resources?

A: Reviews raise concerns about outdated information, promotional bias, and limited access to advanced resources. Exercise caution and rely on established sources for your learning.

Q: Is Golden 168 Group a good choice for beginners?

A: Given the potential risks and concerns, Golden 168 Group is not recommended for beginners. Look for reputable and regulated platforms with user-friendly features and educational resources tailored for new traders.

More

User comment

3

CommentsWrite a review

2024-03-29 19:01

2024-03-29 19:01

2024-01-16 12:09

2024-01-16 12:09