User Reviews

More

User comment

2

CommentsWrite a review

2024-06-27 11:58

2024-06-27 11:58

2024-04-17 14:00

2024-04-17 14:00

Score

2-5 years

2-5 yearsRegulated in United Arab Emirates

Forex Trading License (EP)

Suspicious Scope of Business

Medium potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index4.62

Business Index5.80

Risk Management Index8.90

Software Index4.16

License Index4.62

Single Core

1G

40G

Warning

More

Company Name

CMS Financial LLC

Company Abbreviation

CMS FINANCIAL

Platform registered country and region

United Arab Emirates

Company website

Company summary

Pyramid scheme complaint

Expose

| CMS Financial Review Summary | |

| Founded | 1999 |

| Registered Country/Region | United States |

| Regulation | Securities and Commodities Authority |

| Market Instruments | Forex, commodities, indices, and stock CFDs |

| Demo Account | Yes |

| Leverage | Up to 1:100 |

| Spread | Starting from 0.0 pips |

| Trading Platform | MT5 |

| Min Deposit | $5,000 |

| Customer Support | support@cmsfinancial.ae |

| +971 (4) 44 74 712 | |

CMS Financial is an online trading platform offering over 200 trading assets including Forex, commodities, indices, and stock CFDs. Regulated by the Securities and Commodities Authority, it offers three account types with no commissions, high leverage up to 1:100, and competitive spreads as low as 0 pips through MT5. However, it requires a high minimum deposit of $5,000.

| Pros | Cons |

|

|

|

|

| |

|

CMS Financial has a Retail Forex License regulated by the Securities and Commodities Authority in the United Arab Emirates with a license number of 20200000144.

| Regulatory Status | Regulated |

| Regulated by | Securities and Commodities Authority |

| Licensed Institution | CMS Financial LLC |

| Licensed Type | Retail Forex License |

| Licensed Number | 20200000144 |

CMS Financial offers 200+ tradable assets including Forex, commodities, indices, and stock CFDs.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Stock | ✔ |

| Indices | ✔ |

| Cryptocurrency | ❌ |

| Shares | ❌ |

| Metals | ❌ |

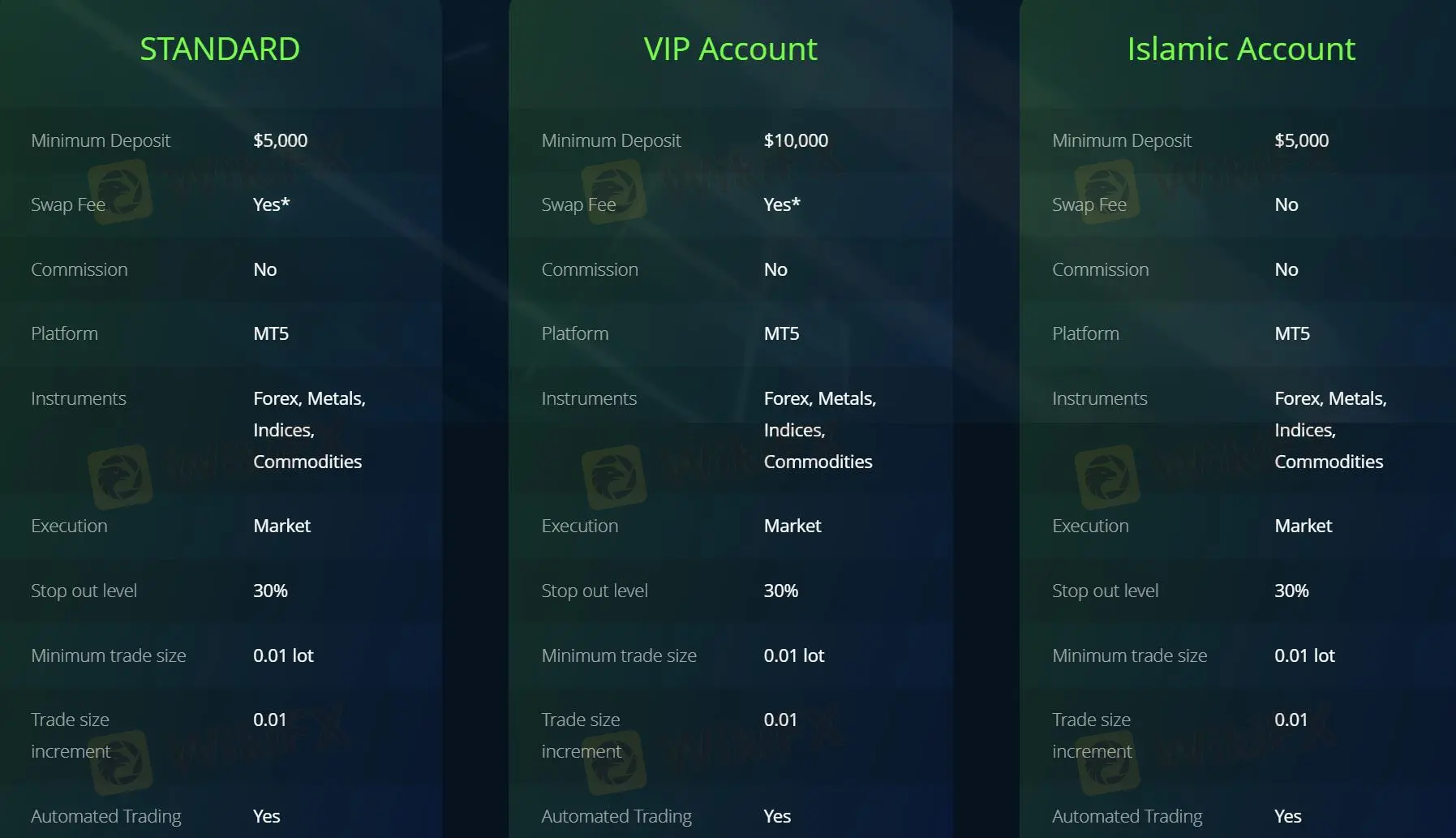

CMS Financial offers three types of accounts: Standard, VIP Account, and Islamic Account. You can refer to the table for details.

| Account Type | Minimum Deposit (USD) | Swap Fee | Commission | Stop Out Level | Minimum Trade Size | Trade Size Increment |

| Standard | 5,000 | Yes* | No | 30% | 0.01 lot | 0.01 |

| VIP Account | 10,000 | Yes* | No | 30% | 0.01 lot | 0.01 |

| Islamic Account | 5,000 | No | No | 30% | 0.01 lot | 0.01 |

CMS Financial offers spreads starting from 0.0 pips. It charges no commissions for all accounts.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | PC and Mobile | Investors of all experience levels |

CMS Financial requires a minimum deposit of $5,000 with no commissions.

More

User comment

2

CommentsWrite a review

2024-06-27 11:58

2024-06-27 11:58

2024-04-17 14:00

2024-04-17 14:00