User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

1-2 years

1-2 yearsSuspicious Regulatory License

Self-developed

Suspicious Scope of Business

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index4.95

Risk Management Index0.00

Software Index4.37

License Index0.00

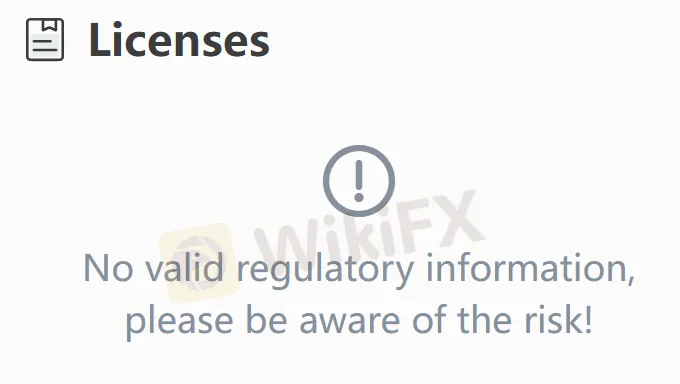

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

| FinecsaReview Summary | |

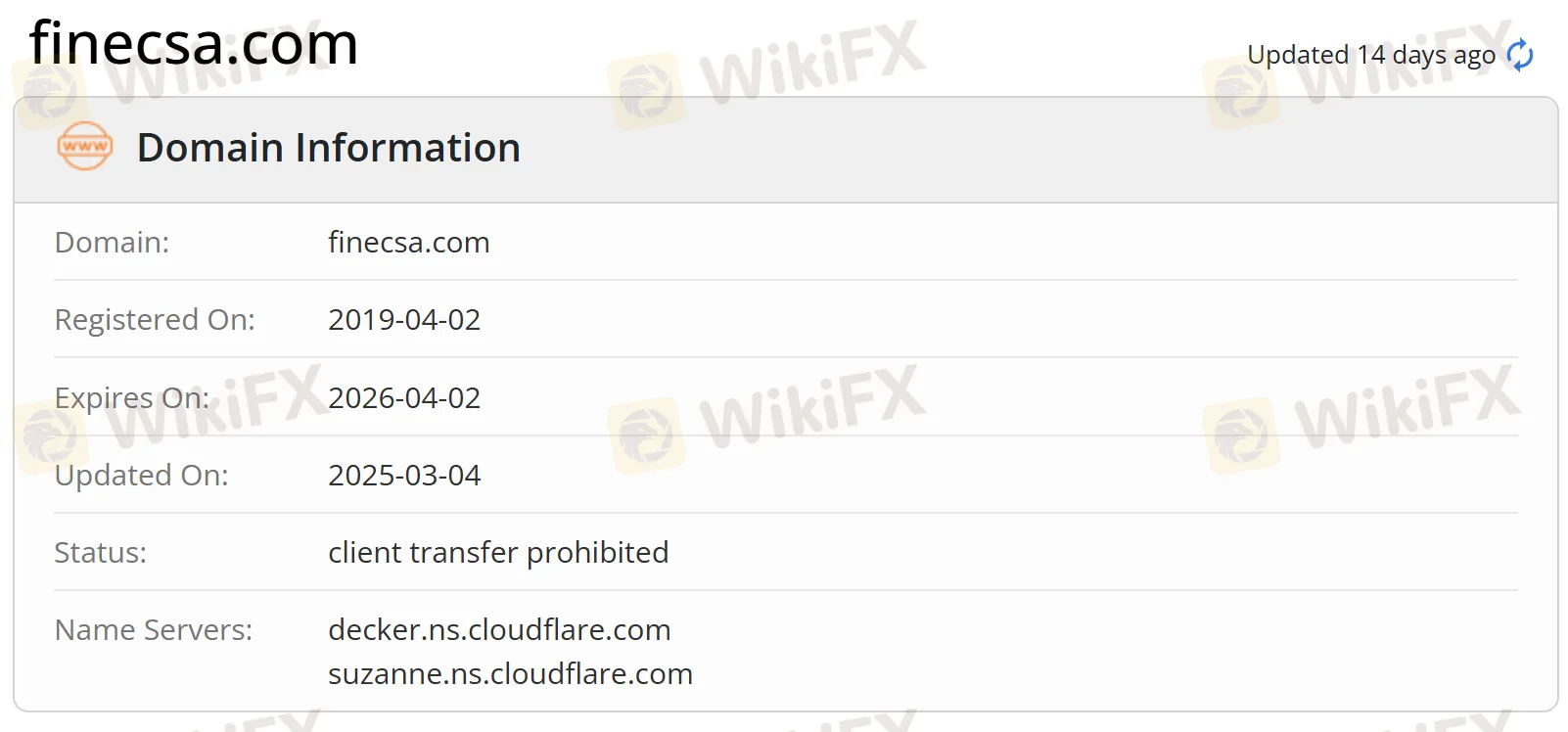

| Founded | 2019 |

| Registered Country/Region | Saint Lucia |

| Regulation | No regulation |

| Market Instruments | Cryptocurrencies, forex, CFDs, stocks, indexes, commodities |

| Demo Account | ❌ |

| Leverage | Up to 1:600 |

| Spread | Variable |

| Trading Platform | Web trader, mobile APP |

| Minimum Deposit | $500 |

| Customer Support | Contact form |

| Tel: +56232103517 (Chile); +525541663011 (Mexico City); +5078365562 (Panama City); +552135000556 (Brazil); +5117070409 (Peru); +50321131969 (El Salvador); +50223028469 (Guatemala City); +576015084298 (Colombia) | |

| Email: soporte@finecsa.com | |

| Address: Avenida Diagonal 511-521, Barcelona, 08014, Spain | |

Finecsa was registered in 2019 in Saint Lucia, specializing in cryptocurrencies, forex, CFDs, stocks, indexes, and commodities. It provides three types of accounts, with a minimum deposit of $500 and a maximum leverage of 1:600. However, it uses its own trading platforms and it is not regulated, which means potential risks still exist.

| Pros | Cons |

| Diverse tradable assets | Lack of regulation |

| Popular payment options | No demo accounts |

| Multiple channels for customer support | No MT4 or MT5 |

| No copy trading | |

| High minimum deposit |

No, Finecsa is not regulated by financial regulatory authorities in Saint Lucia, which means the company lacks regulation from its registration site. Please note the potential risks!

Finecsa provides several types of assets, including cryptocurrencies, forex, CFDs, stocks, indexes, and commodities.

| Tradable Instruments | Supported |

| Forex | ✔ |

| CFDs | ✔ |

| Commodities | ✔ |

| Indexes | ✔ |

| Stocks | ✔ |

| Cryptocurrencies | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

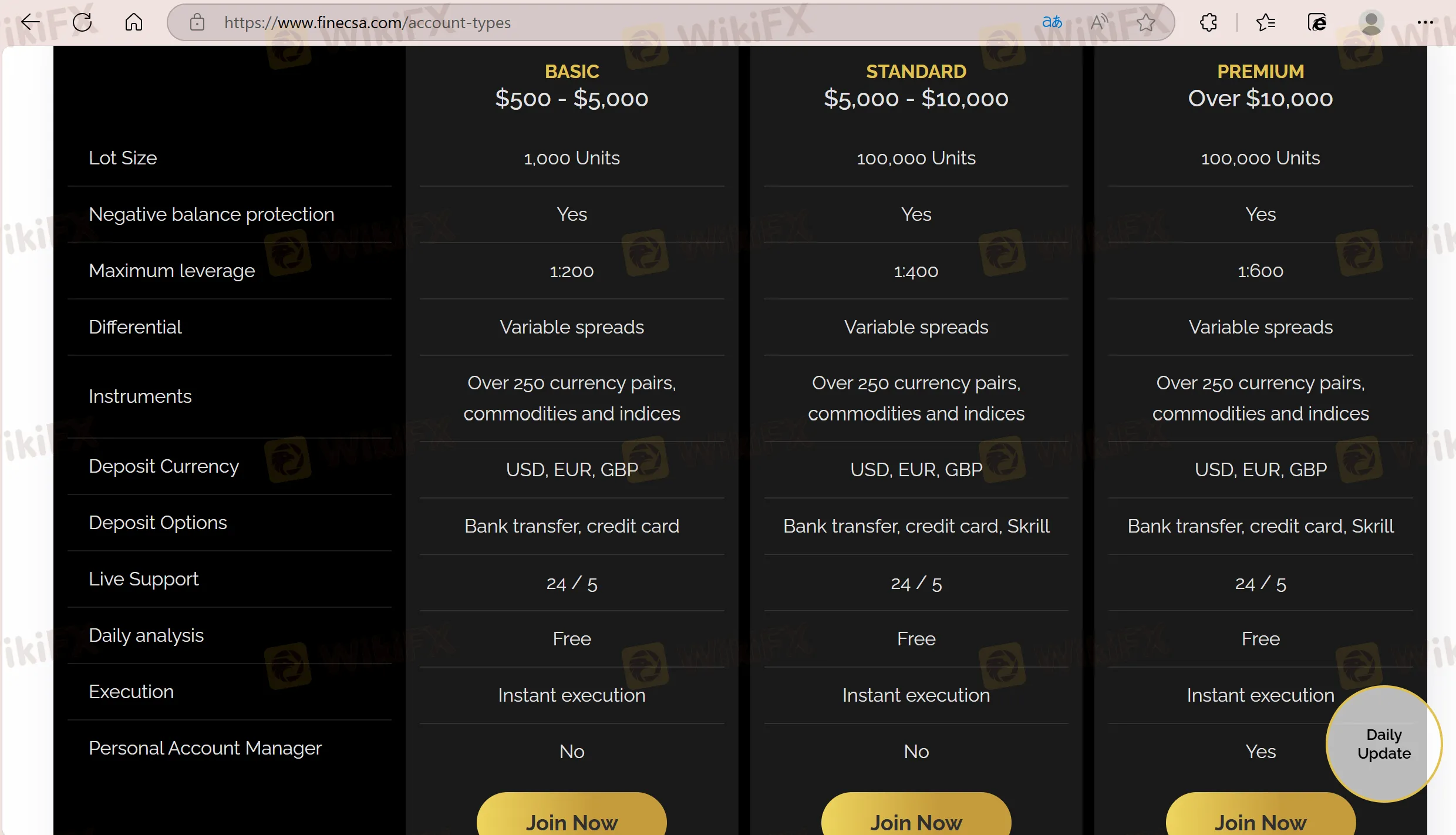

Finecsa offers three types of accounts: Basic, Standard, and Premium Account. However, it does not mention whether a demo account is available or not. Besides, the spread and commission fees are not clear.

| Account Type | Deposit Currency | Minimum Deposit | Maximum Leverage |

| Basic Account | USD, EUR, GBP | $500 | 1:200 |

| Standard Account | USD, EUR, GBP | $5,000 | 1:400 |

| Premium Account | USD, EUR, GBP | $10,000 | 1:600 |

The leverage can be up to 1:600, which is not low. Traders need to consider carefully before investing, because high leverage is likely to bring high potential risks

Finecsa uses its own trading platforms which are available on PC, web, and mobile devices. It does not support the commonly used platforms like MT4 or MT5.

| Trading Platform | Supported | Available Devices | Suitable for |

| Web Trader | ✔ | PC, web | / |

| Mobile APP | ✔ | Mobile | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

Finecsa supports different types of payment options: VISA, Maestro, MasterCard, Skrill, SWIFT, Neteller, and citibank. Besides, accepted currencies are USD, EUR, GBP. However, other details such as the processing time and commission fees are not clear.

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment