User Reviews

More

User comment

10

CommentsWrite a review

2025-12-10 02:32

2025-12-10 02:32

2025-12-10 02:00

2025-12-10 02:00

Score

1-2 years

1-2 yearsSuspicious Regulatory License

MT5 Full License

Regional Brokers

High potential risk

Influence

Add brokers

Comparison

Quantity 4

Exposure

Score

Regulatory Index0.00

Business Index5.09

Risk Management Index0.00

Software Index7.40

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

NXG Markets Limited

Company Abbreviation

NXG MARKETS

Platform registered country and region

Comoros

Company website

X

YouTube

61480037361

Company summary

Pyramid scheme complaint

Expose

| NXG Markets | Basic Information |

| Company Name | NXG Markets |

| Founded | 2024 |

| Headquarters | Australia |

| Regulations | ASIC |

| Tradable Assets | 100+ Trading Instruments, including Forex, Metals, Crypto, Indices, Stocks |

| Account Types | Start, Pro, Prime, ECN |

| Minimum Deposit | $25 (Start), $1500 (Pro), $2500 (Prime), $5000 (ECN) |

| Maximum Leverage | 1:1000 |

| Spreads | From 0.0 pips |

| Commission | None (Start, Pro, Prime), Yes (ECN) |

| Deposit Methods | Ethereum, Altcoins, Perfect Money, Net Banking, Neteller, Skrill, UPI, Bank Transfer |

| Trading Platforms | MetaTrader 5 (MT5), cTrader |

| Customer Support | Multiple addresses, phone(+043432219), messaging(+61-480-037-361), email(info@nxgmarkets.com), online chat |

| Education Resources | Videos, webinars, seminars |

| Bonus Offerings | Amazon shopping vouchers up to $1000 |

NXG Markets is an innovative online trading broker established in 2024 and headquartered in Australia, providing a wide range of financial services under the regulation of the Australian Securities & Investment Commission (ASIC). The broker offers diverse tradable assets including forex, cryptocurrencies, metals, indices, and stocks, and caters to all types of traders with multiple account types, from beginners to professionals. NXG Markets emphasizes advanced trading technology by featuring platforms like MetaTrader 5 and cTrader.

NXG Markets operates as an Appointed Representative (AR) regulated by the Australian Securities & Investment Commission (ASIC). The attribution of a license number (001308207) further confirms NXG Markets' regulated status within the Australian financial landscape.

| Pros | Cons |

|

|

| |

| |

|

NXG Markets offers a comprehensive suite of trading instruments encompassing forex currency pairs, commodities, global indices, shares, and cryptocurrencies.

Account Types

NXG Markets offers a variety of account types tailored to meet the needs of different traders:

1. Start Account: This account is designed for newcomers, requiring a minimum deposit of just $25. It features spreads starting from 2 pips and offers leverage up to 1:500. This account does not charge commissions and includes the option for a swap-free account, making it accessible and cost-effective for those new to trading.

2. Pro Account: Targeting more experienced traders, the Pro Account requires a $1500 minimum deposit and improves on the Start Account by offering tighter spreads starting from 1.2 pips. It maintains a high leverage of up to 1:500 and also operates without commission. Like the Start Account, it provides a swap-free option.

3. Prime Account: With a minimum deposit of $2500, the Prime Account caters to serious traders looking for even better trading conditions. Spreads begin at 0.6 pips, and the leverage offered is up to 1:300. This account also features no commission charges and includes a swap-free option.

4. ECN Account: Ideal for professional and institutional traders, the ECN Account requires a minimum deposit of $5000 but offers the most competitive trading environment with spreads starting from 0 pips. It includes a commission for trading, reflecting its direct access to market prices. The leverage is slightly lower at 1:200, suitable for high-volume trading that requires precise execution.

All accounts offer instant execution and support trading with a minimum volume of 0.01 lots. They are all available in USD and come with a margin call set at 100% and a stop out level at 80%, ensuring a range of choices for traders at all levels.

To open an account with NXG Markets, follow these steps.

NXG Markets offers varying leverage levels across its account types, allowing traders flexibility based on their risk appetite and trading strategy. Leverage ranges from 1:200 for the ECN Account, which is geared towards professional traders, up to 1:500 available in both the Start and Pro Accounts, catering to those seeking higher risk-reward ratios. The Prime Account offers a moderate leverage of 1:300, balancing risk and potential gains for serious traders.

NXG Markets provides a range of spreads and commission structures across its account types:

- Start Account: Spreads start from 2 pips, with no commission.

- Pro Account: Offers tighter spreads starting from 1.2 pips, also without commission.

- Prime Account: Features even lower spreads beginning at 0.6 pips, commission-free.

- ECN Account: Provides the tightest spreads from 0 pips, but includes a commission on trades to offer direct market pricing.

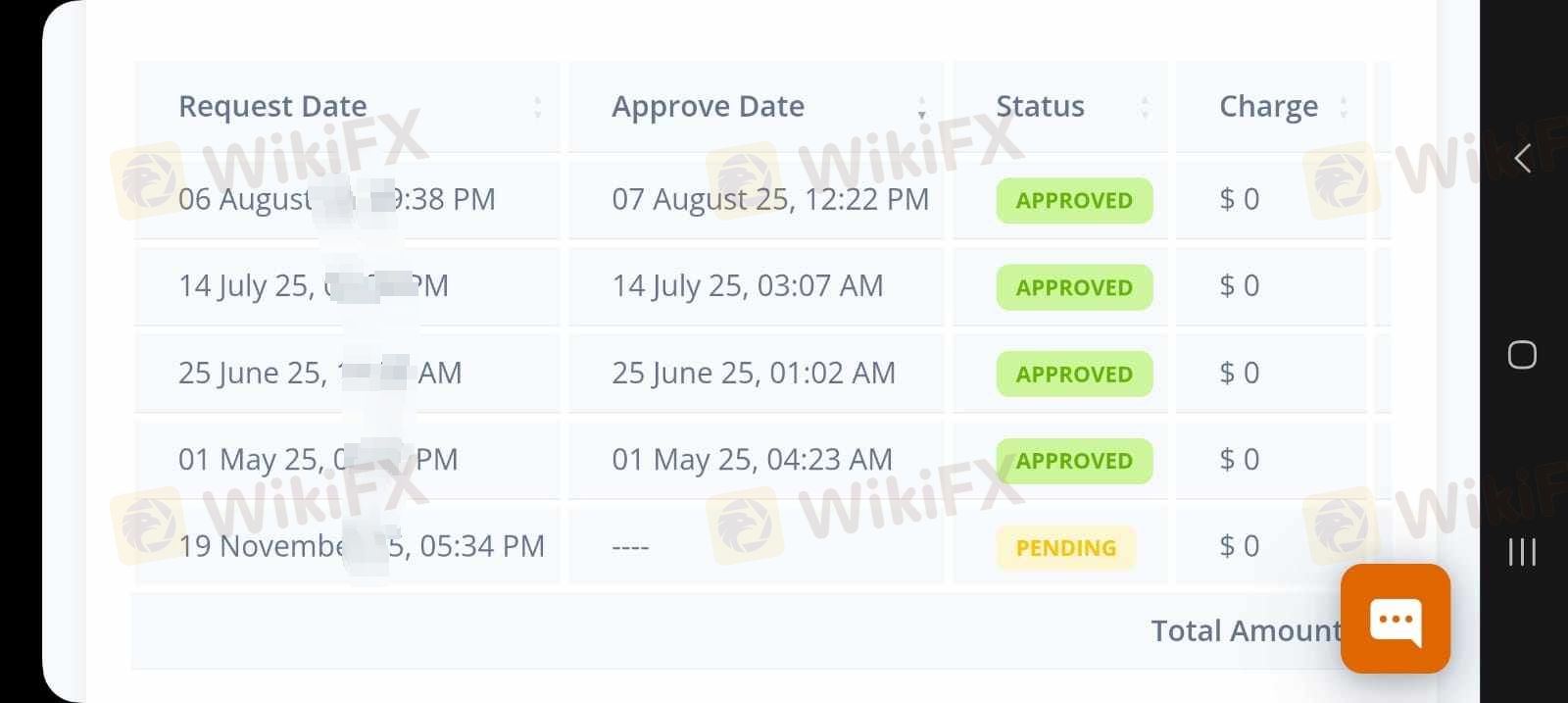

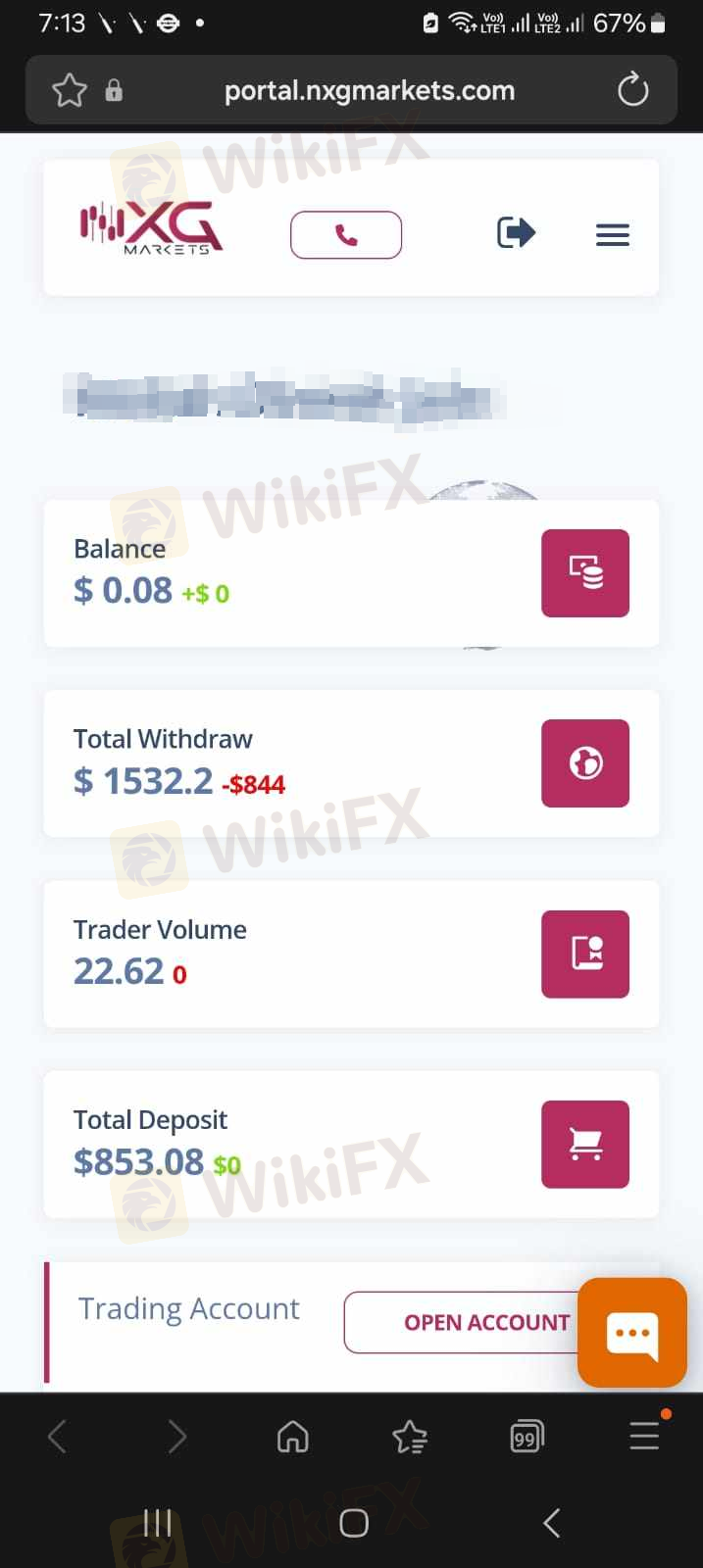

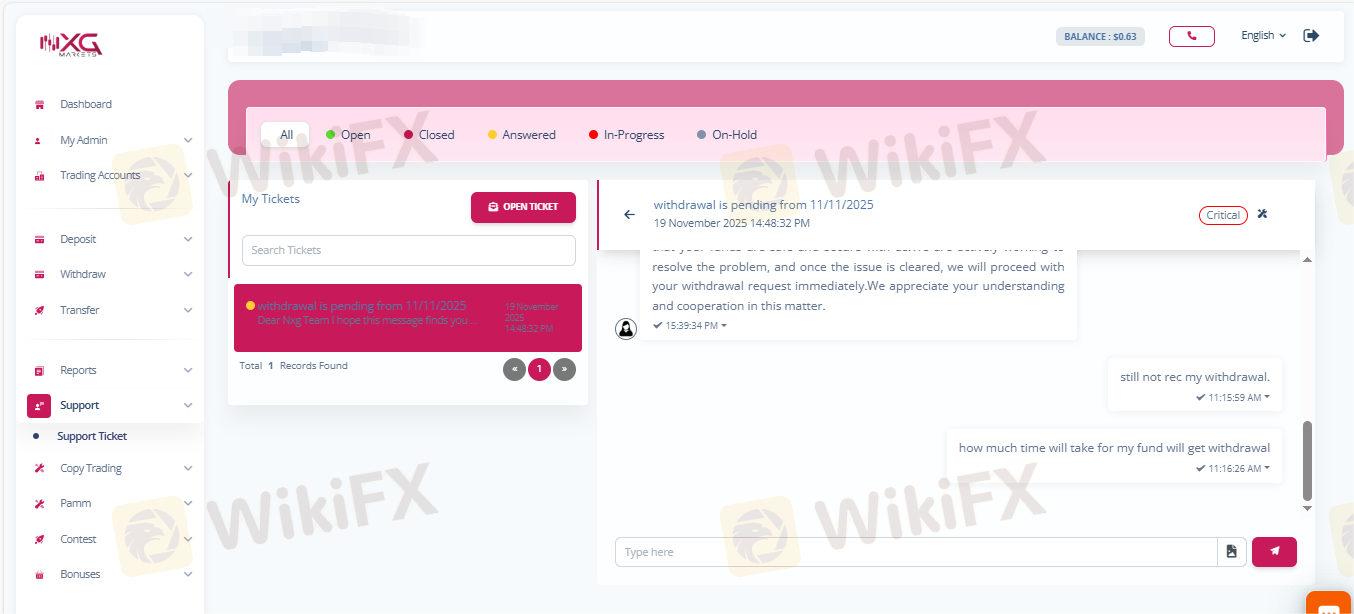

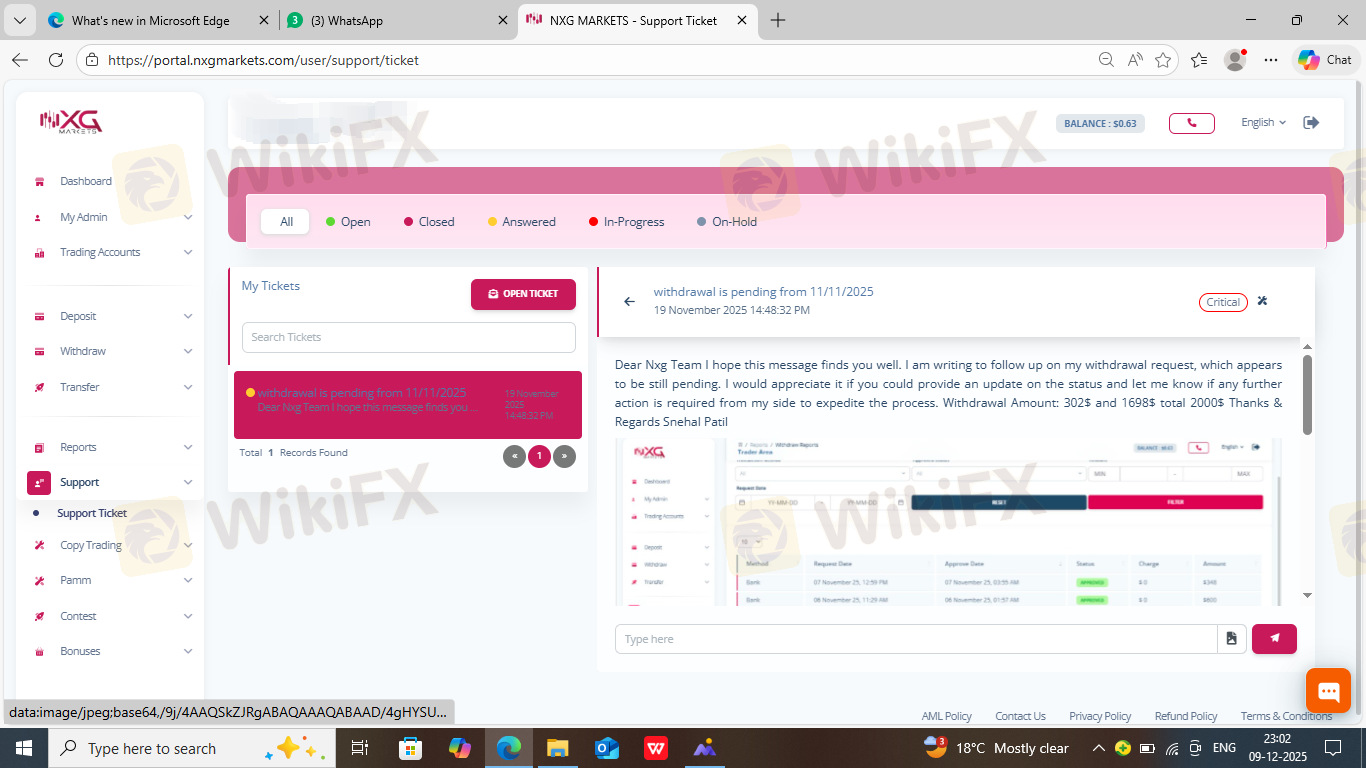

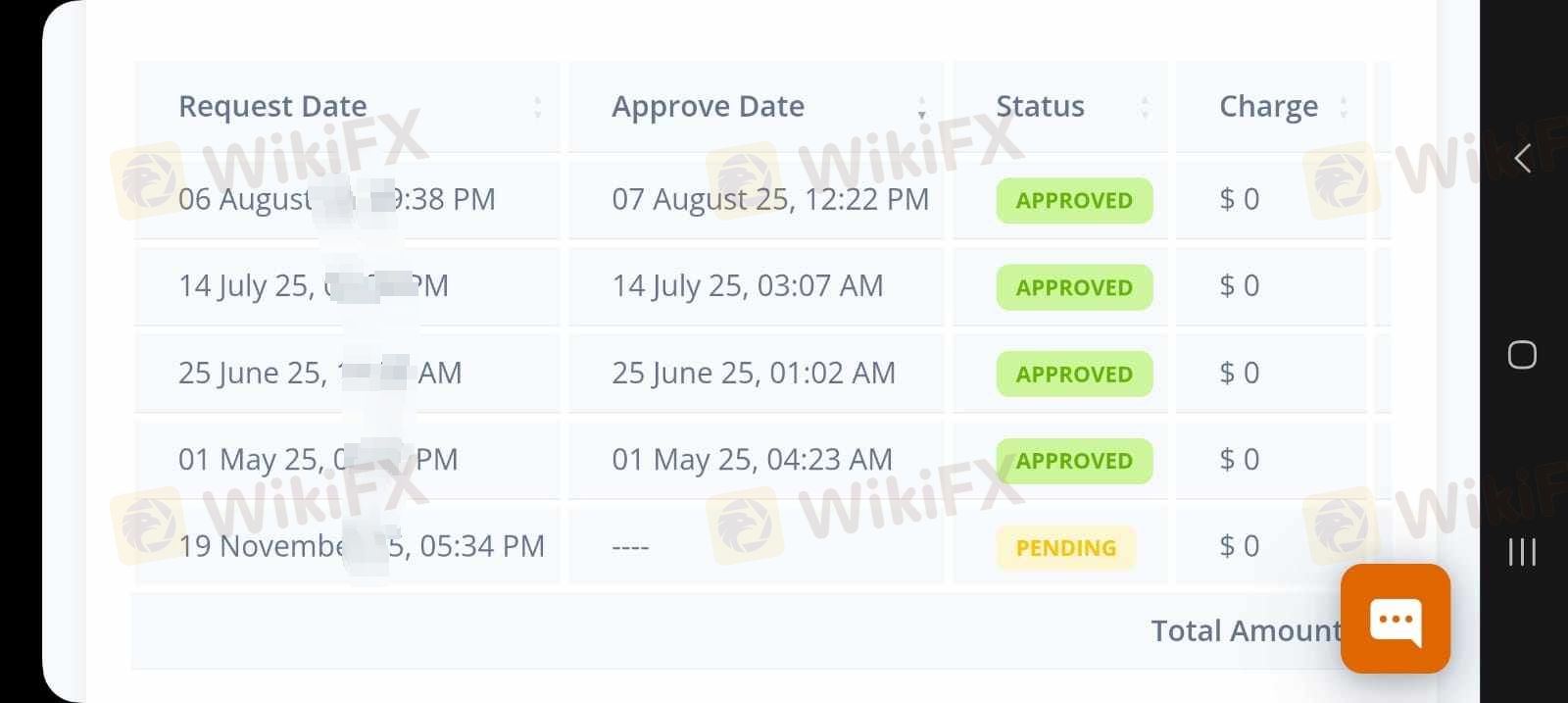

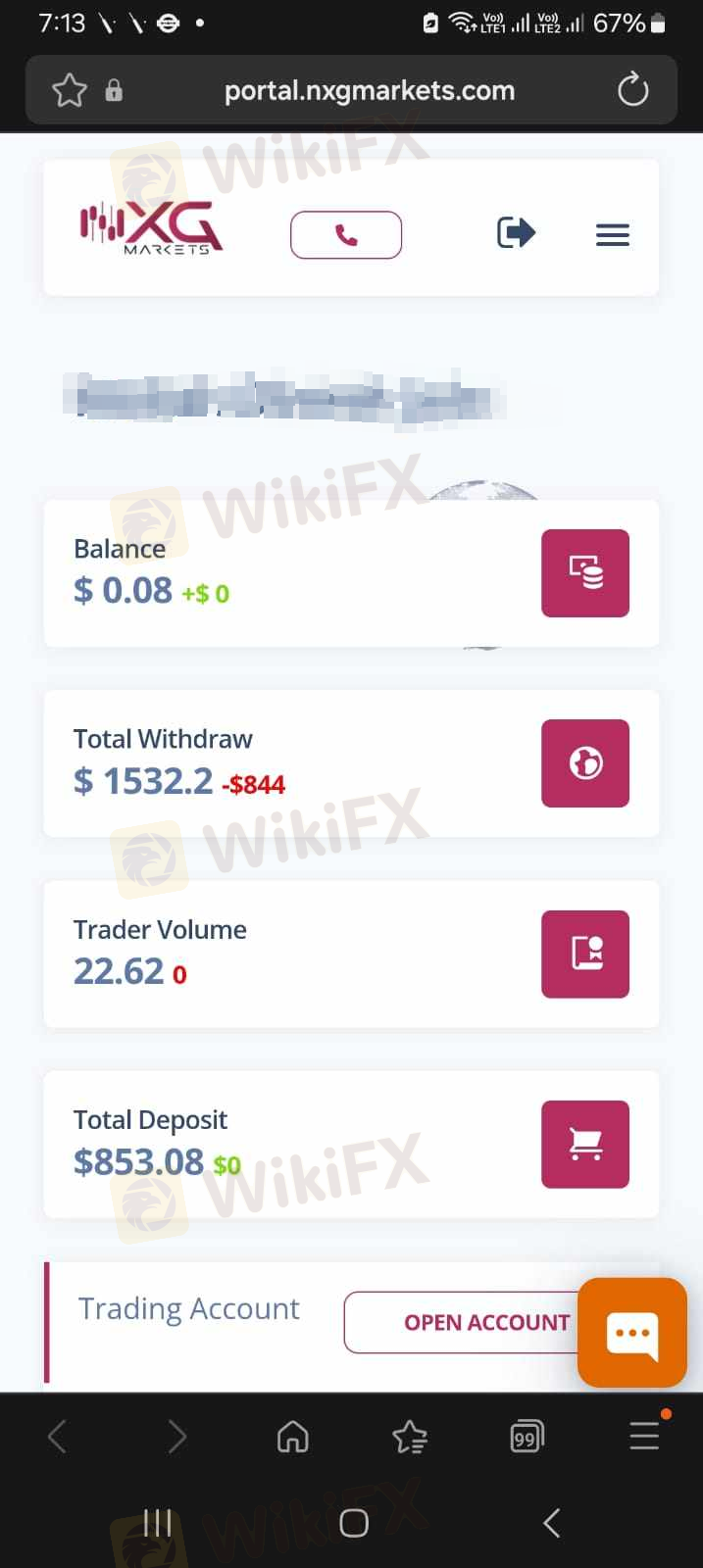

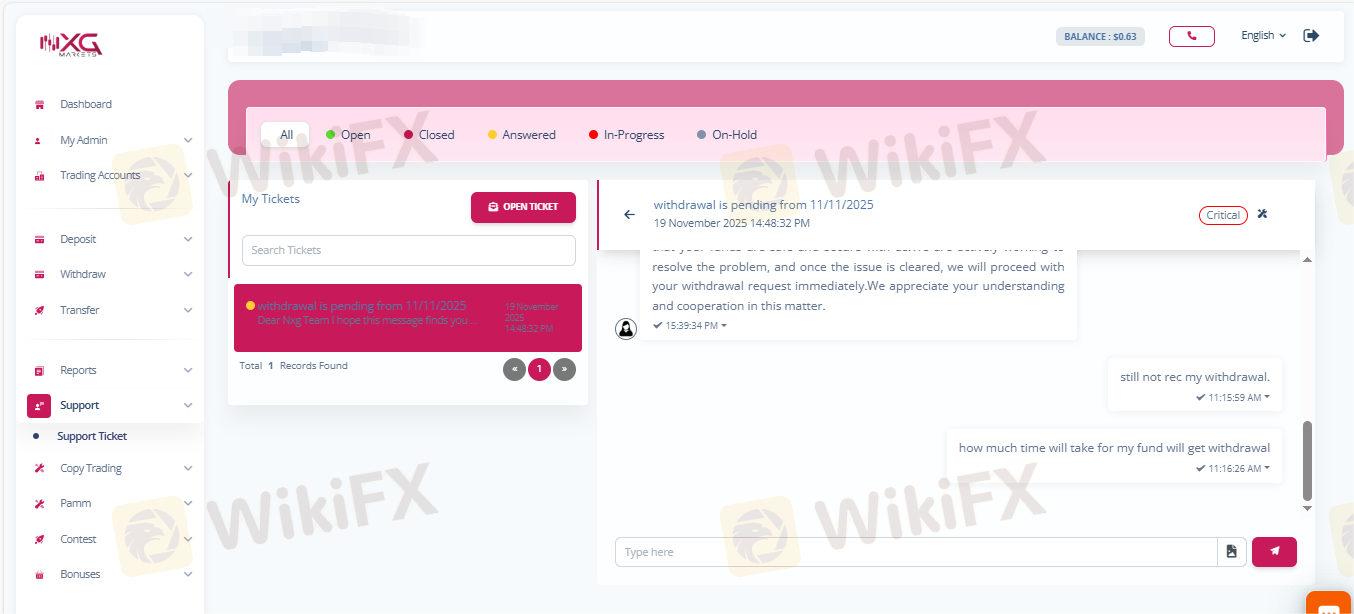

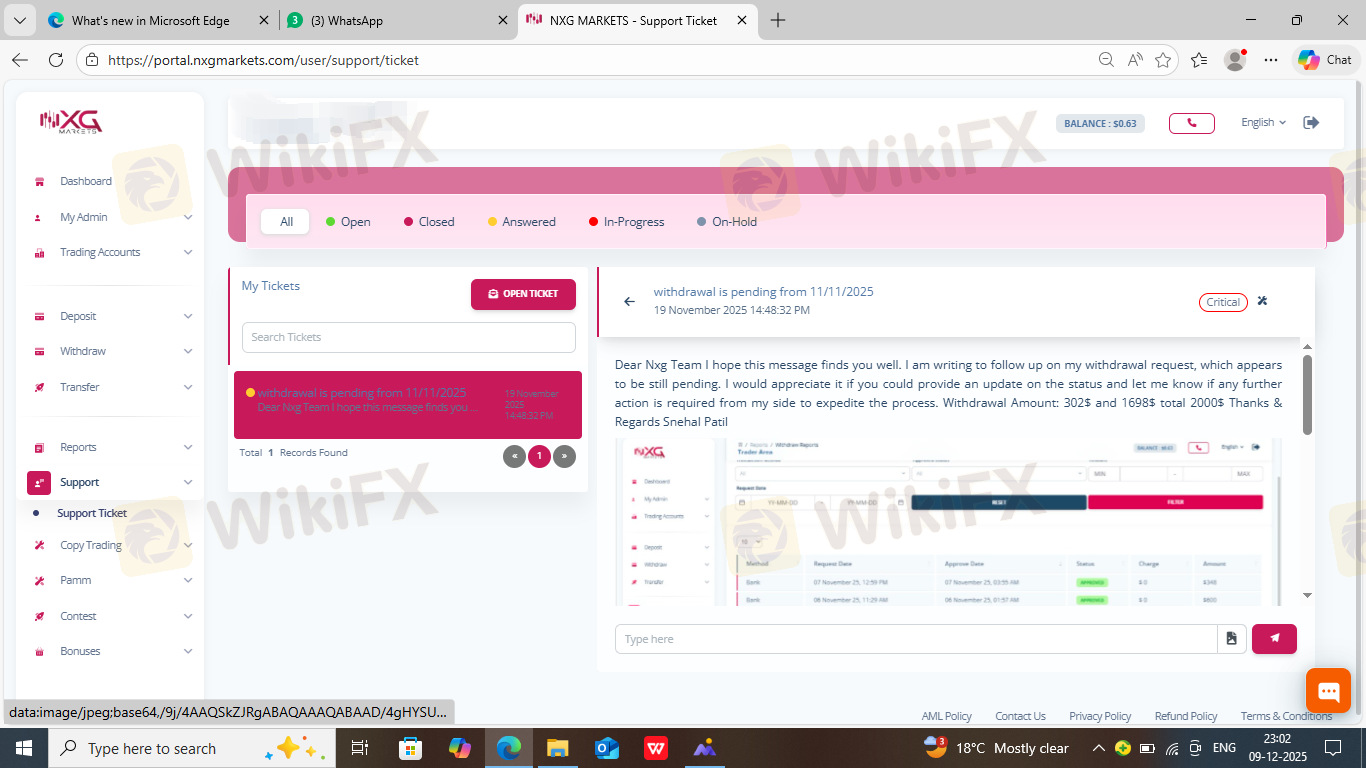

NXG Markets offers a variety of deposit and withdrawal methods globally, all with no fees and processing times of up to one hour. These methods include Ethereum, Altcoins, Perfect Money, Net Banking, Neteller, Skrill, UPI, and traditional Bank Transfer. All transactions require uploading a screenshot in the CRM.

NXG Markets offers multiple trading platforms. The broker provides access to the industry-standard MetaTrader 5 (MT5) platform, renowned for its advanced features and robust trading capabilities. Additionally, NXG Markets supports the user-friendly cTrader platform, which combines a sleek design with powerful trading tools.

NXG Markets offers comprehensive customer support through multiple channels:

- Physical Address: #806, AL SERKAL BUILDING 2 PORT SAEED, DUBAI, U.A.E.

- Registered Address: BONOVO ROAD, FOMBONI ISLAND OF MOHELI, COMOROS UNION.

- Principal Business Address: L36 1 MACQUARIE PL, SYDNEY NSW 2000.

- Phone: +043432219 for calls.

- Messaging: +61-480-037-361 for text messages.

- Email: info@nxgmarkets.com for support queries.

- Online Chat: Available on their website for real-time assistance.

NXG Markets provides a range of educational resources designed to support traders at all levels. These resources include instructional videos, live webinars, and in-person seminars, offering comprehensive learning opportunities for both beginners and advanced traders.

NXG Markets offers advanced trading tools, including the integration of Autochartist, a top automated technical analysis tool. This enhancement provides traders with sophisticated analytics to identify promising trading opportunities efficiently.

NXG Markets Copy Trading allows you to automatically copy the trades of expert traders, making it easy to increase profits and diversify your portfolio. Simply choose from top-performing traders and follow their strategies across over 100 assets.

Conclusion

NXG Markets offers a comprehensive trading environment, combining robust regulatory oversight from ASIC with a broad spectrum of tradable assets and advanced technological platforms like MetaTrader 5 and cTrader.

What kind of regulatory framework does NXG Markets operate under?

NXG Markets is regulated by the Australian Securities & Investment Commission (ASIC).

What are the types of assets available for trading at NXG Markets?

Traders at NXG Markets can engage in trading a variety of asset classes including forex pairs, cryptocurrencies like Bitcoin and Ethereum, precious metals, global indices, and stocks.

What trading platforms does NXG Markets support?

NXG Markets utilizes the MetaTrader 5 (MT5) and cTrader platforms, both renowned for their powerful trading capabilities and user-friendly interfaces.

What are the account types available at NXG Markets, and what are their features?

NXG Markets offers several account types including the Start, Pro, Prime, and ECN accounts.

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors.

More

User comment

10

CommentsWrite a review

2025-12-10 02:32

2025-12-10 02:32

2025-12-10 02:00

2025-12-10 02:00