User Reviews

More

User comment

9

CommentsWrite a review

2025-04-07 19:52

2025-04-07 19:52

2024-07-19 17:05

2024-07-19 17:05

Score

2-5 years

2-5 yearsSuspicious Regulatory License

MT5 Full License

Regional Brokers

High potential risk

Add brokers

Comparison

Quantity 1

Exposure

Score

Regulatory Index0.00

Business Index6.56

Risk Management Index0.00

Software Index7.94

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

MBFX Global Limited

Company Abbreviation

MBFX

Platform registered country and region

Saint Lucia

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

| MBFX Review Summary | |

| Founded | 2022 |

| Registered Country/Region | Saint Lucia |

| Regulation | Unregulated |

| Market Instruments | 300+, Forex, Metals, Energies, Indices, Stocks, and Crypto |

| Demo Account | ✔ |

| Leverage | 1:500 |

| EUR/USD Spread | 1.0 pips (Standard account) |

| Trading Platform | MT5 |

| Copy Trading | ✔ |

| Minimum Deposit | $50 |

| Customer Support | 24/7 - live chat, contact form |

| Phone: +44 20 3290 5333 | |

| WhatsApp: +44 79 2755 5692 | |

| Email: support@mbfx.co | |

| Regional Restrictions | Australia, USA, Brazil, Curacao, Indonesia, Sint Eustatius, Tahiti, Saipan, Turkey, Guinea-Bissau, Japan, Bonaire, East Timor, Liberia, Micronesia, Northern Mariana Island, Jan Mayen, South Sudan, Svalbard |

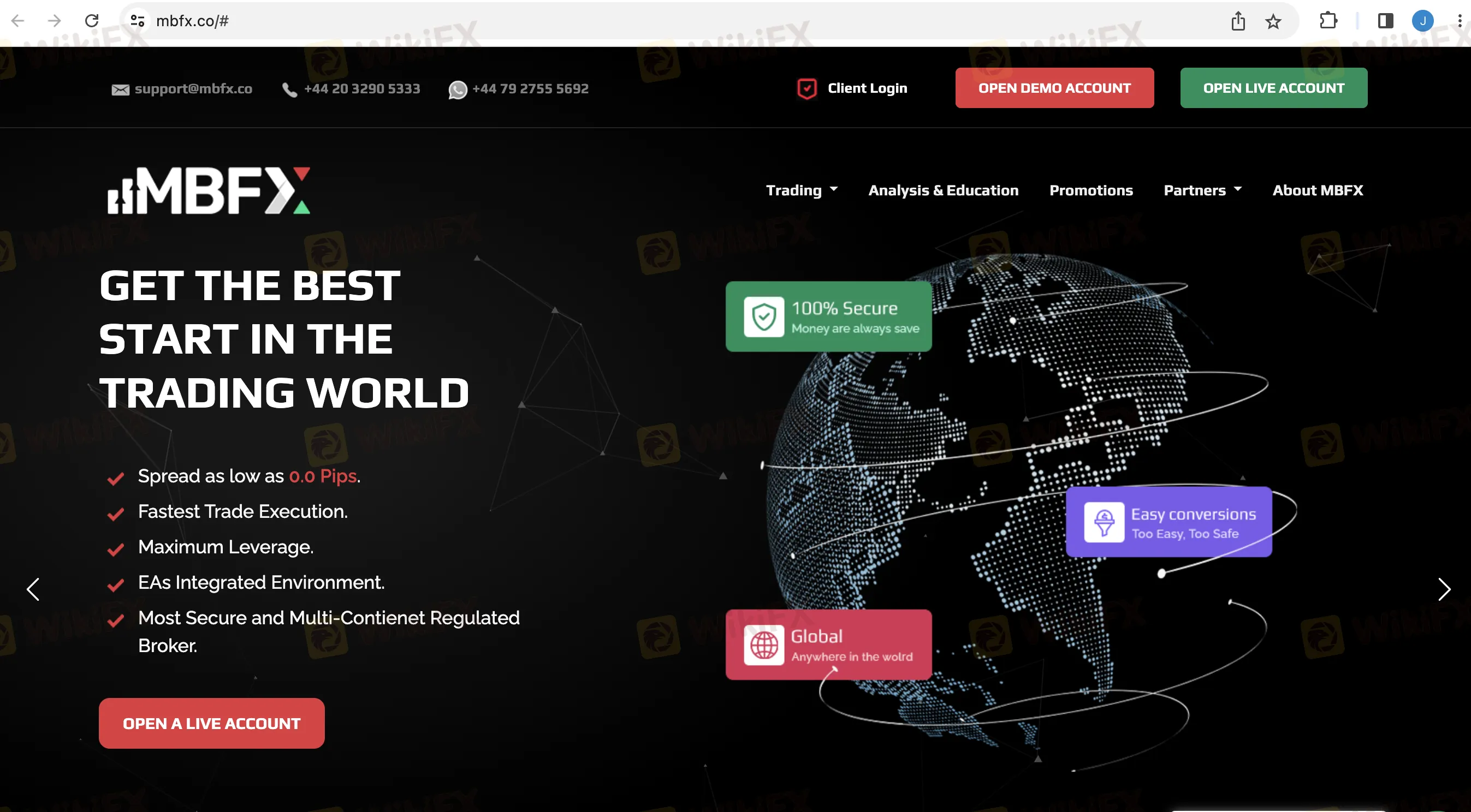

MBFX is a regulated brokerage firm registered in Saint Lucia that offers a range of trading instruments across various asset classes, including Forex, Metals, Energies, Indices, Stocks, and Crypto. It provides demo and live trading accounts to its clients. The broker also supports the popular MT5 trading platform, which can be accessed through multiple devices.

| Pros | Cons |

| • Regulated by FinCEN | • Limited Industry Experience |

| • Multiple Account Types | |

| • Diverse Trading Instruments | |

| • Competitive Trading Conditions | |

| • MetaTrader 5 (MT5) Platform Supported | |

| • Copy Trading | |

| • Low Minimum Deposit Requirement | |

| • Various Payment Options | |

| • Multiple Contact Channels |

No, it is unregulated by any regulatory authorities.

MBFX offers 300+ market instruments, allowing traders to engage in various types of trading. Clients can trade forex pairs, including major, minor, and exotic currency pairs, as well as precious metals like gold and silver. Additionally, they can access energies such as oil and natural gas, trade indices representing different stock markets, invest in stocks of prominent companies, and participate in cryptocurrency trading.

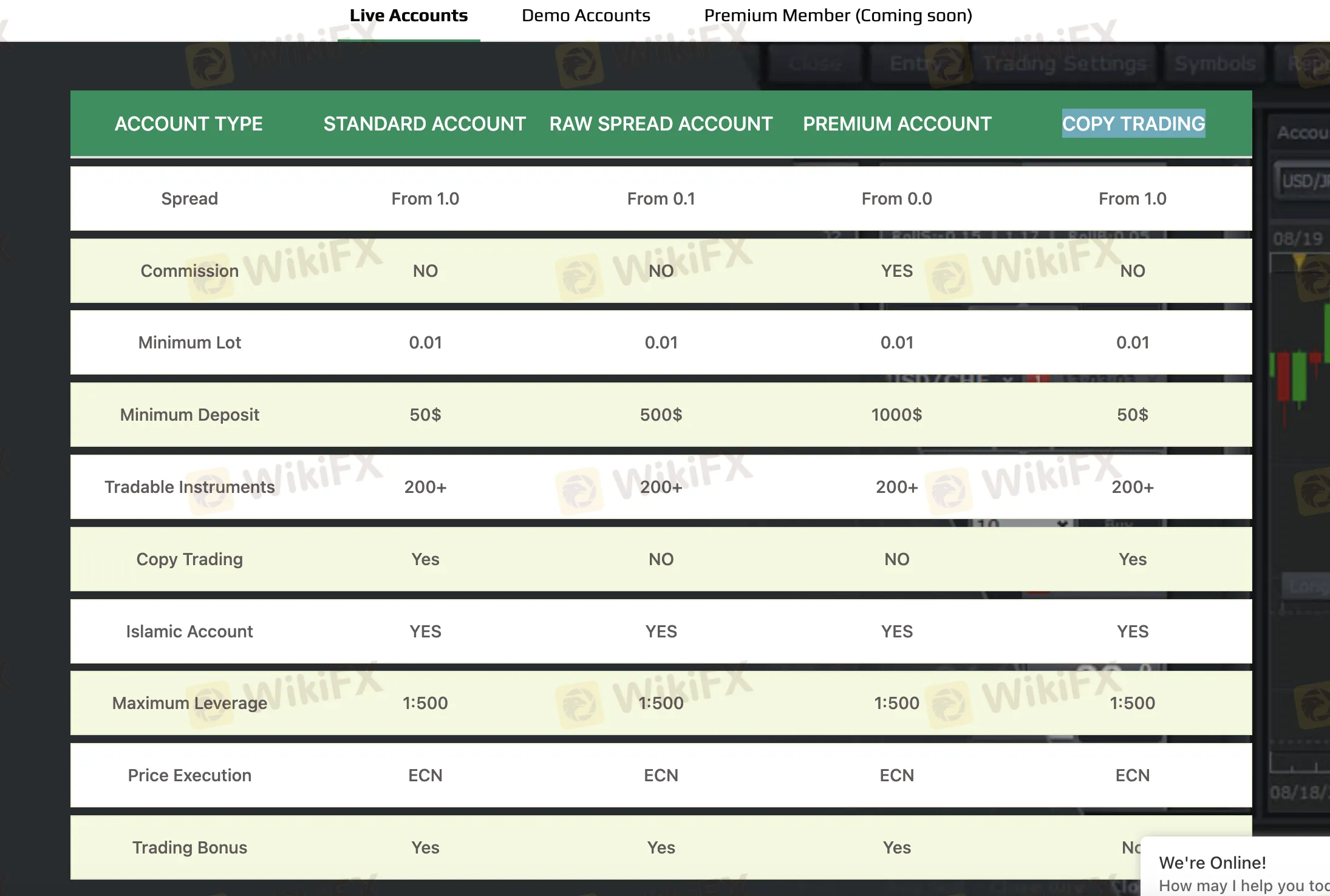

MBFX offers four different types of live accounts, including Standard, Raw Spread, Premium, and Copy Trading accounts. Each account type has its own distinct features and benefits.

The Standard account is designed for traders who prefer a straightforward trading experience. It requires a minimum deposit of $50, making it accessible to traders with smaller capital.

For traders seeking tighter spreads, the Raw Spread account may be a suitable option. With a minimum deposit requirement of $500. This account type is particularly appealing to traders who prioritize low-cost trading and require more precise execution in their trading strategies.

The Premium account is tailored for traders who require additional features and benefits, with a minimum deposit of $1000. It provides enhanced trading conditions, including lower spreads, faster execution, and potentially improved trading tools and analysis.

Additionally, MBFX offers a Copy Trading account, allowing traders to automatically replicate the trades of experienced and successful traders. With a minimum deposit requirement of $50, this account type provides an opportunity for less experienced traders to benefit from the expertise of others.

In addition to the live trading accounts, MBFX also provides a Demo account. This account allows traders to practice and familiarize themselves with the trading platform and its features without risking real money.

| Account Type | Minimum Deposit |

| Standard | $50 |

| Raw Spread | $500 |

| Premium | $1,000 |

| Copy Trading | $50 |

MBFX offers a maximum leverage of 1:500 for all its account types. Leverage allows traders to amplify their trading positions with borrowed funds. However, it's crucial to recognize that leverage also comes with increased risk. While it offers the potential for greater profits, it equally magnifies potential losses. The higher the leverage used, the greater the exposure to market volatility and price fluctuations. If the market moves against a leveraged position, losses can accumulate quickly, potentially surpassing the initial investment.

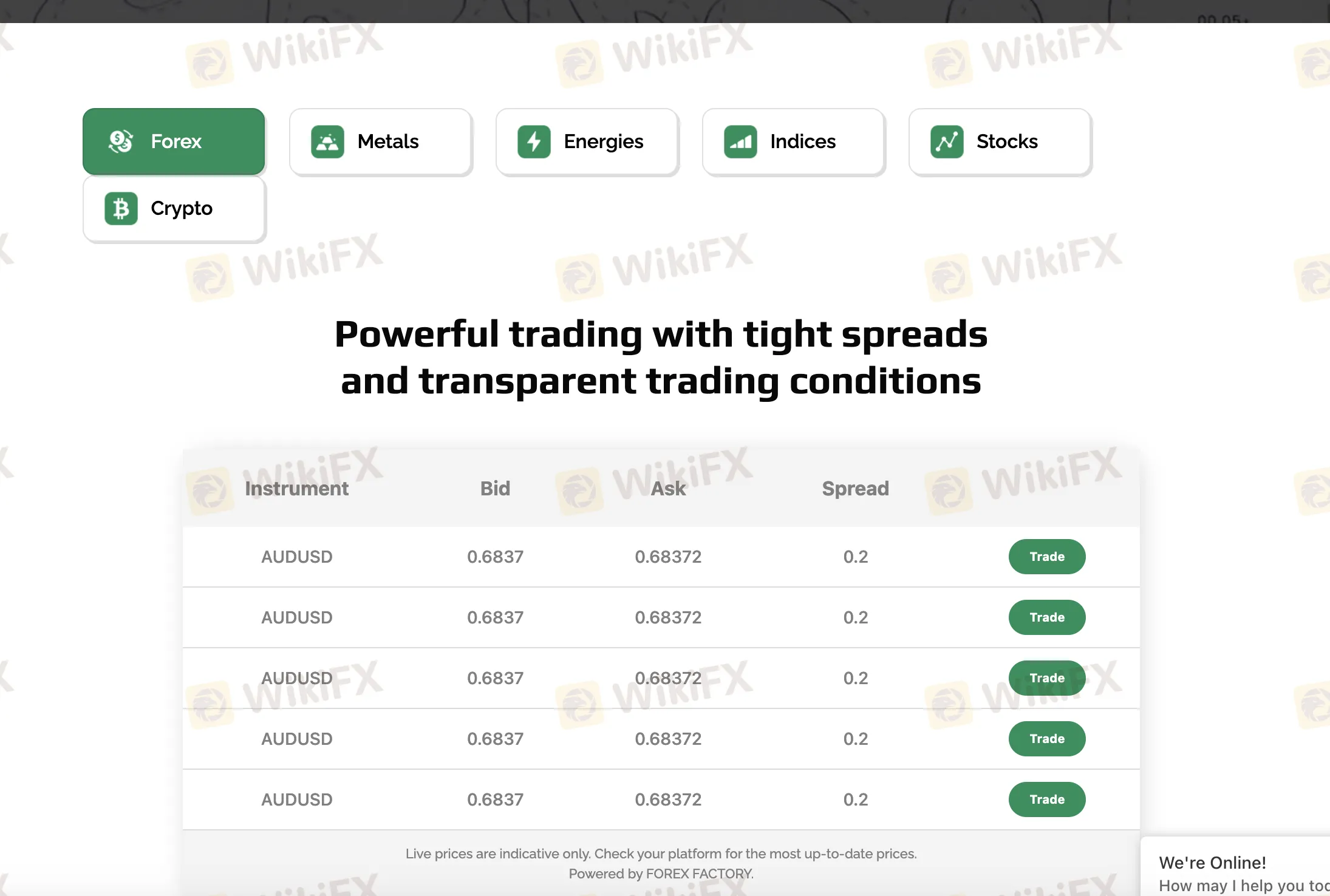

The spreads offered by MBFX vary depending on the account type. The Standard account has spreads starting from 1.0 pips, while the Raw Spread account offers spreads as low as 0.1 pips. The Premium account provides spreads starting from 0.0 pips, and the Copy Trading account has spreads of 1.0 pips. Notably, Standard, Raw Spread, and Copy Trading accounts have no commission charges, whereas Premium account holders are subject to commissions.

MBFX offers the popular MetaTrader 5 (MT5) trading platform to its clients. The platform is accessible through various devices, including iOS/MAC, Android, desktop, and web versions. Traders can choose the platform that best suits their needs and access the market instruments offered by MBFX. The trading platform operates based on Eastern Time (ET) Time, but from 30 October 2022, it will switch to Eastern European Time (EET), which is two hours ahead of UTC.

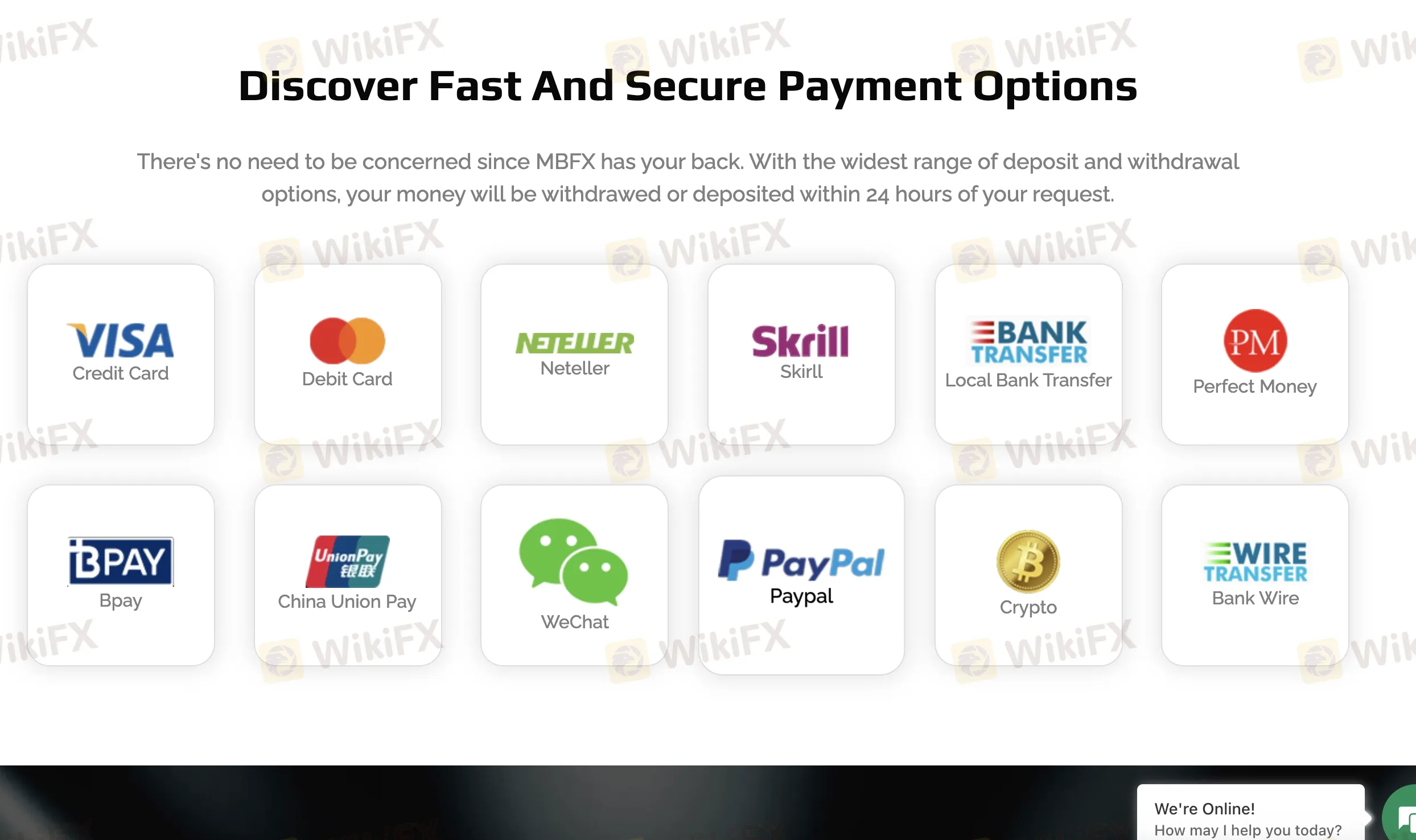

MBFX accepts deposits and withdrawals through various methods, including VISA, Debit Card, Neteller, Skrill, Local Bank Transfer, Perfect Money, Bpay, China Union Pay, WeChat, PayPal, Crypto, and Bank Wire. The minimum deposit requirement is $50, allowing traders with different budget sizes to participate in the markets.

| MBFX | Most other | |

| Minimum Deposit | $50 | $100 |

MBFX provides customer support 24/7 through multiple channels. Traders can reach out to the broker via email at support@mbfx.co, telephone at +44 20 3290 5333, WhatsApp at +44 79 2755 5692, live chat, and contact form. Additionally, MBFX maintains a presence on social media platforms such as Facebook, Twitter, Instagram, and YouTube, where clients can connect with the broker and stay updated with its offerings.

Registered address: Ground Floor, The Sotheby Building, Rodney Village, Rodney Bay, Gros-Islet, Saint Lucia

Physical address: OFFICE F-74 SABHA BUILDING DUBAI UNITED ARAB EMIRATES

What is the minimum deposit requirement for each type of live account?

The minimum deposit requirements for MBFX's live accounts are as follows: $50 for Standard account, $500 for Raw Spread account, $1,000 for Premium account, and $50 for Copy Trading account.

What is the maximum leverage offered by MBFX?

MBFX provides a maximum leverage of 1:500 for all its account types.

Does MBFX offer demo accounts?

Yes.

Are there any regional restrictions at MBFX?

Yes. MBFX Global Limited and their affiliates also, do not work in the respective areas of Australia, USA, Brazil, Curacao, Indonesia, Sint Eustatius, Tahiti, Saipan, Turkey, Guinea-Bissau, Japan, Bonaire, East Timor, Liberia, Micronesia, Northern Mariana Island, Jan Mayen, South Sudan, Svalbard and all other restricted Countries.

Online trading is dangerous, and you could potentially lose all of your investment funds. Not all investors and traders are suitable for it.

More

User comment

9

CommentsWrite a review

2025-04-07 19:52

2025-04-07 19:52

2024-07-19 17:05

2024-07-19 17:05