User Reviews

More

User comment

2

CommentsWrite a review

2024-08-07 11:41

2024-08-07 11:41

2024-03-26 15:33

2024-03-26 15:33

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Quantity 4

Exposure

Score

Regulatory Index0.00

Business Index5.79

Risk Management Index0.00

Software Index4.00

License Index0.00

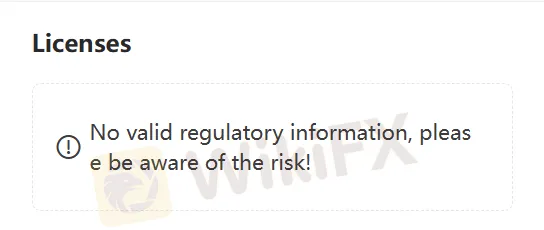

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

GO MARKETS Limited

Company Abbreviation

GO MARKETS

Platform registered country and region

China

Company website

Company summary

Pyramid scheme complaint

Expose

| GO MARKETS Review Summary | |

| Registered Country/Region | China |

| Regulation | No Regulation |

| Market Instruments | Forex, Metals & Commodities, Indices |

| Demo Account | Available |

| Leverage | Up to 1:500 |

| Spread | From 0 pips |

| Trading Platforms | MetaTrader 4 |

| Minimum Deposit | $200 |

| Customer Support | Email: info@mcgomarkets.com |

GO MARKETS is a broker registered in China that offers a range of financial instruments for online trading. The platform offers a demo account for users to practice trading strategies and gain familiarity with the platform's features. With leverage up to 1:500 and competitive spreads starting from 0 pips, GO MARKETS aims to provide a competitive trading environment. However, GO MARKETS operates without valid regulation.

| Pros | Cons |

|

|

|

|

|

|

|

Diverse Financial Instruments: GO MARKETS offers a wide range of financial instruments for trading, including forex, metals & commodities, and indices. This allows traders to diversify their portfolios and take advantage of various market opportunities.

Demo Account Availability: The platform provides a demo account for users to practice trading strategies and get familiar with the platform's features. This is particularly beneficial for new traders who want to gain experience without risking real money.

Competitive Trading Environment: With leverage up to 1:500 and competitive spreads starting from 0 pips, GO MARKETS aims to provide a competitive trading environment.

User-Friendly Platform: GO MARKETS uses the MetaTrader 4 trading platform, which is known for its user-friendly interface and advanced trading tools.

Lack of Regulation: One of the main drawbacks of GO MARKETS is that it operates without valid regulation. This means that the platform is not subject to regulatory oversight, which indicates risks to the safety and security of funds.

Limited Customer Support Options: Customer support is only available via email, which is not as convenient or responsive as live chat or phone support.

GO MARKETS' safety is difficult to definitively say as a yes or no. While GO MARKETS may offer attractive trading conditions, the absence of regulation and risks associated with unregulated brokers warrant careful consideration.

GO MARKETS, as one of the fastest-growing retail financial service providers, offers high-quality trading services with a diverse range of over-the-counter CFD financial products.

Forex: GO MARKETS provides trading opportunities in various currency pairs, including AUDUSD, EURUSD, USDJPY, and more. Forex trading allows traders to speculate on the exchange rate between two currencies.

Commodities: The platform offers trading in both hard and soft commodities. Hard commodities include natural resources like oil, gold, and rubber, which are often mined or extracted. Soft commodities consist of agricultural products such as coffee, wheat, or corn.

Indices: GO MARKETS offers trading in indices, which represent a portfolio of stocks or securities from a particular market or sector. Some of the indices available include NAS100, UK100, US30, and more.

GO MARKETS offers two main account types to suit different trading needs: the Standard Account and the ECN Account. Both of them require a minimum deposit of $200.

| Aspects | Standard Account | ECN Account |

| Products | 250+ Currency pairs, Indices, Commodities, Share CFDs | |

| Leverage | Up to 1:500 | |

| Min Spread | From 1.0 pip | From 0.0 pip |

| Commission | $0 Commission | $6 commission per round trade |

| Min. Deposit | $200 | |

The Standard Account is their most popular option. This account is designed to meet the needs of a wide range of traders and provides a stable trading environment.

The ECN Account is ideal for traders who prefer instant market execution and access to institutional-grade liquidity.

GO MARKETS offers leverage of up to 1:500 for both its Standard Account and ECN Account. Leverage allows traders to control larger positions in the market with a relatively small amount of capital. However, while leverage can amplify profits, it also increases the potential for losses.

GO MARKETS offers competitive spreads and commissions for both its Standard Account and ECN Account:

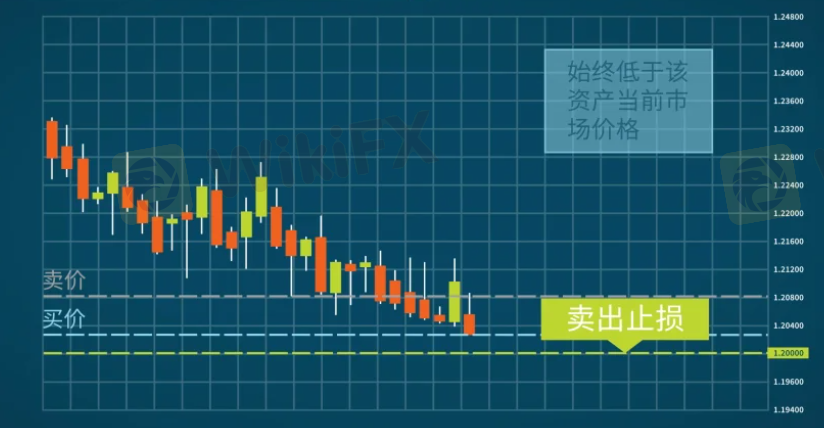

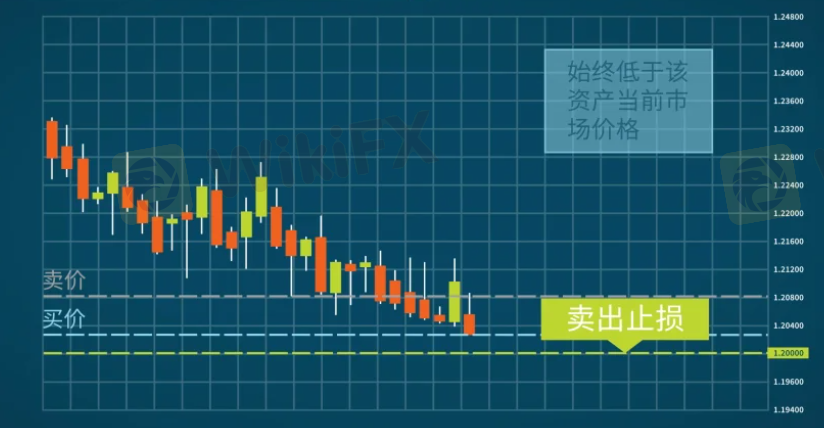

Spreads: Spreads start from 1 pip, providing traders with competitive pricing on their trades.

Commission: There is no commission charged on trades in the Standard Account.

Spreads: Spreads in the ECN Account can go as low as 0.0 pips, offering traders tight pricing and lower trading costs compared to the Standard Account.

Commission: A commission of $6 per round trade is charged in the ECN Account

The trading platform of GO MARKETS is based on MetaTrader 4 (MT4), one of the most popular trading platforms widely used in the world of retail trading. MT4 is highly customizable, allowing users to customize charting methods to suit their trading needs. Whether on PC or mobile, traders can access a range of features and tools to analyze markets, place trades, and manage their positions effectively.

GO MARKETS accepts a variety of payment methods for deposits and withdrawals, including MasterCard, Visa, Neteller, Skrill, and Bank Transfer. These payment options provide traders with flexibility and convenience when funding their accounts or withdrawing funds.

GO MARKETS provides customer service via email at info@gomarkets.com. Their customer support team is available to assist traders with any inquiries or issues they may have regarding their accounts, trading platform, or other services.

In conclusion, GO MARKETS provides a user-friendly platform and a demo account, making it attractive for new traders. However, the absence of regulation is a significant risk to be aware of. We advise you to research carefully and explore other options before making a decision.

Q: Is GO MARKETS regulated?

A: No, GO MARKETS operates without valid regulation.

Q: What trading platforms does GO MARKETS offer?

A: GO MARKETS provides access to MetaTrader 4 (MT4).

Q: What payment methods does GO MARKETS accept?

A: GO MARKETS accepts deposits and withdrawals via MasterCard, Visa, Neteller, Skrill, and Bank Transfer.

Q: What is the minimum deposit required to open an account with GO MARKETS?

A: GO MARKETS requires a minimum deposit of $200 to open a trading account.

Q: Is there a demo account available on GO MARKETS?

A: Yes, GO MARKETS supports demo accounts.

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

More

User comment

2

CommentsWrite a review

2024-08-07 11:41

2024-08-07 11:41

2024-03-26 15:33

2024-03-26 15:33