User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

1-2 years

1-2 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index4.92

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

TRENDIFYFX LTD

Company Abbreviation

Trendify

Platform registered country and region

United Kingdom

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

| Trendify Review Summary | |

| Founded | 2024 |

| Registered Country/Region | United Kingdom |

| Regulation | Not Regulated |

| Market Instruments | 75+, Forex, Shares, Indices, Commodities, Cryptocurrencies, Energies, Futures, Metals, ETFs |

| Demo Account | ✅ |

| Leverage | Up to 1:1000 |

| Spread | 2.7 pips (Standard account) |

| Trading Platform | Trendify Platform |

| Minimum Deposit | $10 |

| Customer Support | Contact Form |

| Social Media: Facebook, WhatsApp, YouTube, Twitter | |

| Bonus | ✅ |

Founded in 2024, Trendify operates as a trading platform. It operates without regulatory oversight and offers access to over 75 market instruments, including forex, shares, indices, commodities, cryptocurrencies, energies, futures, metals, and ETFs. Trading is conducted on the Trendify Platform, and the minimum deposit required to open an account is $10. Trendify offers three types of live accounts: Standard, Premium, and VIP.

| Pros | Cons |

| Multiple market offerings | Not regulated |

| Demo accounts available | No MT4/MT5 |

| Various account types | Limited payment methods |

| No commission | No direct contact channel |

| Low minimum deposit requirement |

No. Trendify has not been regulated by any notable authorities. Please be aware of the risk!

Trendify offers trading in over 75 market instruments, including forex, shares, indices, commodities, cryptocurrencies, energies, futures, and metals.

| Trading Assets | Available |

| forex | ✔ |

| shares | ✔ |

| indices | ✔ |

| commodities | ✔ |

| energies | ✔ |

| metals | ✔ |

| cryptocurrencies | ✔ |

| futures | ✔ |

| bonds | ❌ |

| options | ❌ |

| ETFs | ❌ |

| funds | ❌ |

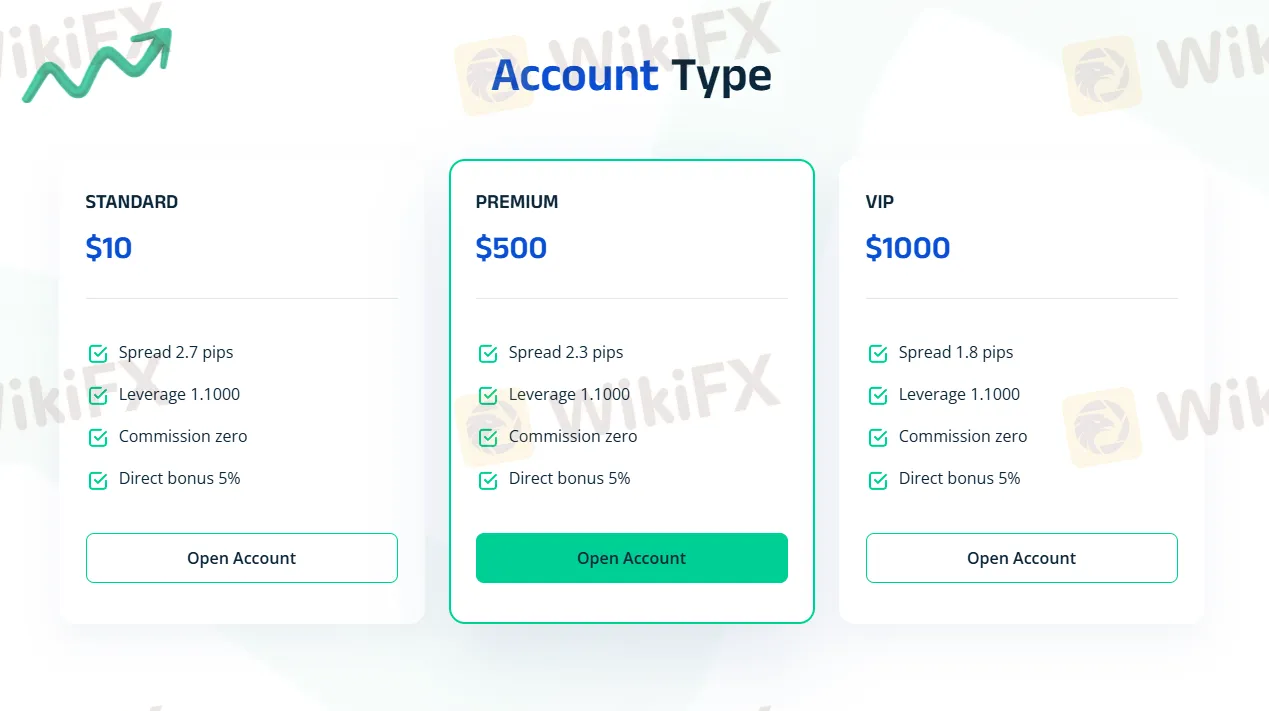

There are three account types available on Trendify: Standard, Premium, and VIP. Meanwhile, Trendify offers a demo account for practicing.

This table provides a clear comparison of the features and benefits for each account type.

| Account Type | Standard | Premium | VIP |

| Minimum Deposit | $10 | $500 | $1,000 |

| Maximum Leverage | 1:1000 | 1:1000 | 1:1000 |

| Spread | 2.7 pips | 2.3 pips | 1.8 pips |

| Commission | Zero | Zero | Zero |

| Direct Bonus | 5% | 5% | 5% |

Trendify offers its proprietary trading platform. It's available on multiple devices.

| Trading Platform | Supported | Available Devices | Suitable for |

| Trendify Platform | ✔ | Desktop, Mobile, Web | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

Trendify provides a diverse selection of payment methods, including WUSD, USDT, and Bank Wire. And Trendify claims that Debit/credit cardoptions will be available soon.

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment