User Reviews

More

User comment

7

CommentsWrite a review

2024-07-23 17:55

2024-07-23 17:55

2024-06-04 14:19

2024-06-04 14:19

Score

10-15 years

10-15 yearsRegulated in Cambodia

Derivatives Trading License (EP)

Suspicious Scope of Business

High potential risk

Offshore Regulated

Influence

Add brokers

Comparison

Quantity 17

Exposure

Score

Regulatory Index4.94

Business Index8.00

Risk Management Index0.00

Software Index4.44

License Index3.05

Single Core

1G

40G

More

Company Name

Axion Trade Limited

Company Abbreviation

AXION TRADE

Platform registered country and region

Seychelles

Company website

Company summary

Pyramid scheme complaint

Expose

Induce customers to deposit funds, do not unbind mam, maliciously liquidate positions

Ib Tang bind with mam and does not allow to unbind and maliciously liquidate the position. Lose $8465 and induce customer to deposit.

The account send email to platform to unbind for withdrawal on Jan. 14, but the customer service refused to do so by various reason which caused the maliciously wipe out

Axiontrade cooperated with this person to defraud in the form of mam, and asked the customer service to unbind mam to withdraw money on the way, refused by various reasons, and maliciously exploded all the customer's funds in the early morning tonight! A total of over $1 million was lost.

Fraud and maliciously liquidate the position. This company maliciously liquidate over 2.6 million dollars.

It does not allow to withdraw since Jan. 2 till now. All the accounts were wiped out on 18th. I hope that the customer service can address it for me.

The platform and traders do not approve the withdrawal until the traders deliberately liquidate the account. Complain to the platform and traders, and demand compensation for losses.

Transfer the funds from the commission account to the trading account without permission. Do not unbind the mam to withdraw for the customer and do not review. The ib personnel operate the account and maliciously liquidate the position. The picture is ib. I will reward a lot for the clues

The platform does not allow to withdraw since Jan. 2. Yesterday, all positions were liquidated. This platform is a scam.

The platform refuses to withdraw and the customer service never replies the message, and causing dealer to maliciously liquidate the postion at the end

Stcuking client's funds that are not allowed to be withdrawn, but only deposited. Then this person colludes with the platform and finally liquidate the position and takes profits from customer losses.

I applied for an Axiontrade trading account on 2023/03/29 and deposited 130 USD through USDT-TRC20 (as shown in the picture), and withdrew 129.58 USD through USDT-TRC20 on 2023/03/30 (as shown in the picture), and Axiontrade has not processed it for a long time Withdrawing funds, I wrote to the customer service mailbox and there was no reply (as shown in the attached picture), and on 2023/04/02, I found that the client directly displayed an invalid user when logging in in the background (as shown in the attached picture), and there was no response when I clicked the forgotten password

I haven’t profited for over two months. And there is no staff explaining. We may lose all the money invested. It’s a fraud company

Induced deposit fraud and malicious liquidation. Teng Kah Weng 911125145447 no 7,taman kok doh jalan segambut 51200 kalau lumpur Kuala Lumpur. This is the man

Axiontrade cooperates with the broker Malaysian, Tang, to induce customer to deposit and maliciously liquidate the postion, and scam their principle, and causes heavy loss to the customer. Everyone must be awere about this fraud Axiontrade platform and do not participate.

Thousands of dollars stolen by the broker as withdrawal was not processed. Upon multiple emails to the entity (no phone number provided), there has been ZERO replies. All attempts to contact via email and facebook direct messages have been ignored. This broker is not actually regulated and does not have apparent controls in place to manage customer funds. It is likely that they have lost all customer funds and gone silent on withdrawals.All proven with attached images:1) Multiple emails sent ignored by broker2) Detail of withdrawal transaction (18 Dec 2023) still pending as of today (27 Jan 2024)

| Axion TradeReview Summary | |

| Founded | 2020-05-05 |

| Registered Country/Region | United Kingdom |

| Regulation | Offshore regulated |

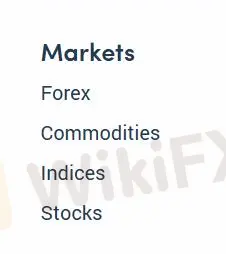

| Market Instruments | Forex/Commodities/Indices/Stocks |

| Demo Account | ✅ |

| Leverage | Up to 1:1000 |

| Spread | As low as 0 pips |

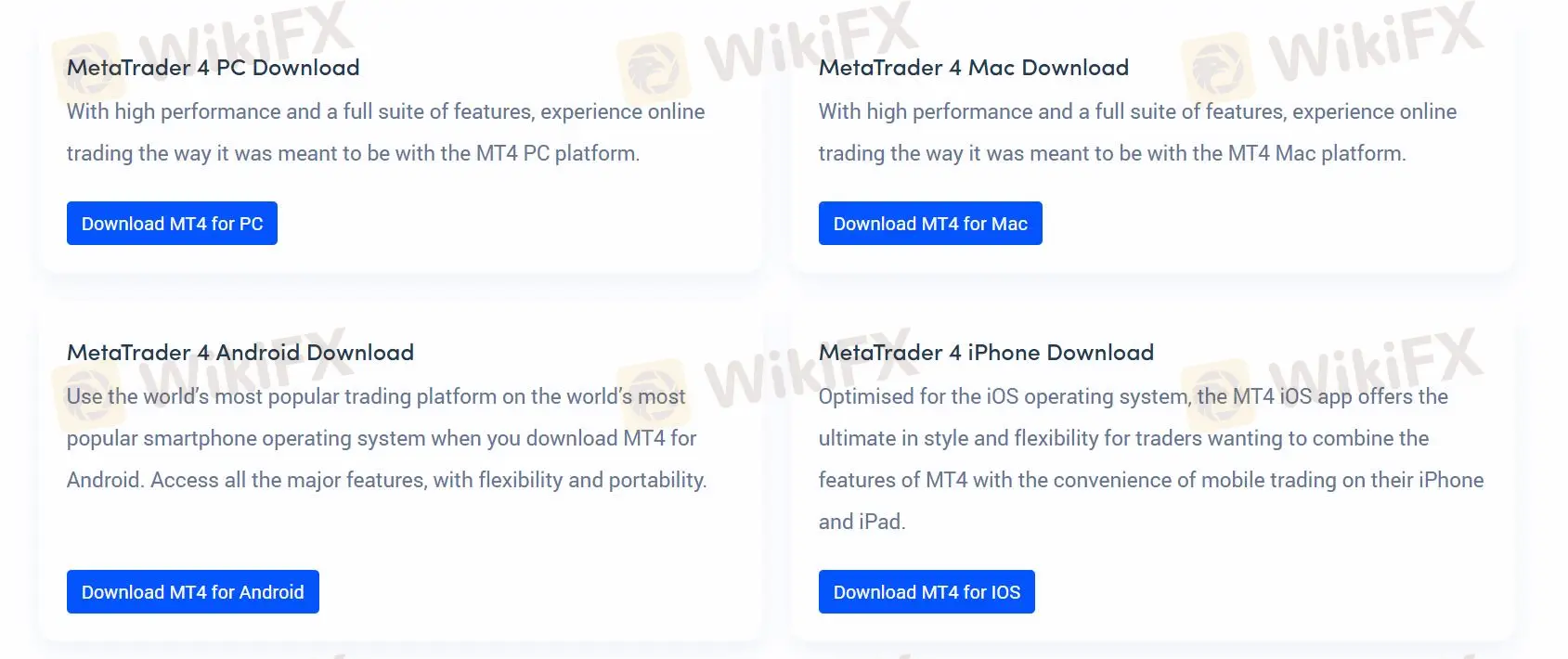

| Trading Platform | MT4(PC/Mac/Android/iOS) |

| Min Deposit | USD 10 |

| Customer Support | Email: support@axiontrade.net |

| Phone: +2484379846 | |

| Facebook/Instagram | |

Axion Trade is a broker. The tradable instruments include forex, commodities, indices, and stocks. The broker also provides nine accounts with a maximum leverage of 1:1000. The minimum spread is as low as 0 pips and the minimum deposit is USD 10. Axion Trade is still risky due to its offshore regulated status, high leverage, and bad reviews about difficulty withdrawing money.

| Pros | Cons |

| Various tradable instruments | Offshore regulated |

| MT4 available | High max leverage |

| Demo account available | Unspecific transfer time and fee information |

| Spread as low as 0 pips | No 24/7 customer support |

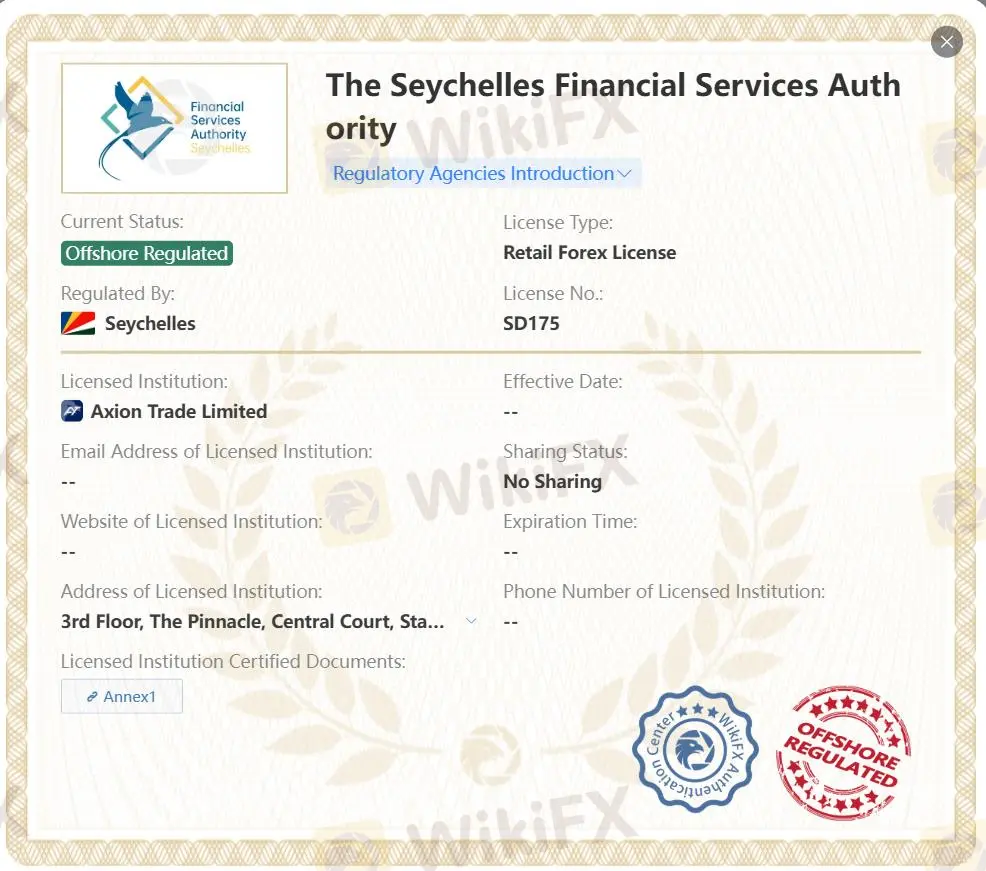

FSA offshore regulates Axion Trade with license number SD175, regulated by ASIC with a revoked status, license number 001293799, and SERC with license number 037, but the current status is exceeded.

Axion Trade offers 1000+ market instruments with Axion Trade, including over 50+ forex pairs, commodities, 14+ Indices, and stocks.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Stocks | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ❌ |

| Precious Metals | ❌ |

| Shares | ❌ |

| ETFs | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

Axion Trade has nine account types: Raw, Pro, Institutional, Standard, Islamic, Nano, X300, Elite, and VIP. Traders who want low spreads and low leverage can choose an ECN account, while those with a sufficient budget can open an institutional ECN account. The broker also provides an Axion Trader™ program. In addition, the demo account is predominantly used to familiarize traders with the trading platform and for educational purposes only.

| Account Type | ECN | Classic | Fixed Spread | ||||||

| Raw | Pro | Institutional | Standard | Islamic | Nano | X300 | Elite | VIP | |

| Leverage | Up to 1:500 | Up to 1:100 | Up to 1:100 | Up to 1:500 | Up to 1:500 | Up to 1:1000 | Up to 1:500 | Up to 1:500 | Up to 1:500 |

| Commissions | Yes | Yes | Yes | None | None | None | None | None | None |

| Spreads | As low as 0 pips | As low as 0 pips | As low as 0 pips | As low as 1.9 pips | As low as 1.9 pips | As low as 1.9 pips | As low as 3.1 pips | As low as 2.1 pips | As low as 1.1 pips |

| Minimum Deposit | USD 100 | USD 100000 | USD 1000000 | USD 100 | USD 100 | USD 10 | USD 100 | USD 1000 | USD 10000 |

The spread is as low as 0 pips, the commission is from 0. The lower the spread, the faster the liquidity.

The maximum leverage is 1:1000 meaning that profits and losses are magnified 1000 times.

Axion Trade cooperates with the authoritative MT4 trading platform available on PC, Mac, Android, and iOS to trade. Junior traders prefer MT4 over MT5. MT4 provides various trading strategies and implements EA systems. In addition, Axion Mirror provides copy trading services for beginner traders.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | PC/Mac/Android/iOS | Junior traders |

| Axion Mirror | ✔ | - | Beginners |

The minimum deposit is USD 10. However, transfer processing times, methods, and associated fees are unknown.

More

User comment

7

CommentsWrite a review

2024-07-23 17:55

2024-07-23 17:55

2024-06-04 14:19

2024-06-04 14:19