User Reviews

More

User comment

2

CommentsWrite a review

2023-10-12 11:44

2023-10-12 11:44 2023-10-11 11:12

2023-10-11 11:12

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index6.29

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

| Aspect | Information |

| Registered Country | Not provided |

| Founded Year | Not provided |

| Company Name | ForexTrade Platform |

| Regulation | Lacks proper regulation |

| Minimum Deposit | Not provided |

| Maximum Leverage | Up to 1:1000 |

| Spreads | See provided examples |

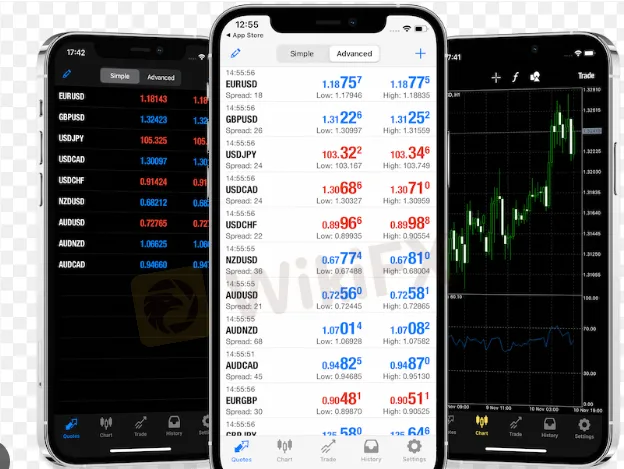

| Trading Platforms | MetaTrader 4, Web-based, Mobile Apps |

| Tradable Assets | Forex, Commodities, Indices, Stocks, Cryptocurrencies |

| Account Types | Standard, Premium, Islamic (Based on the provided information) |

| Demo Account | Not provided |

| Islamic Account | Available |

| Customer Support | Reports of poor customer support |

| Payment Methods | Bank Wire Transfer, Credit/Debit Card, E-wallets (Based on the provided information) |

| Educational Tools | Not provided |

ForexTrade Platform is a broker that provides trading services to its clients. However, it is important to conduct thorough research and exercise caution when choosing a broker. Investors should prioritize regulated brokers to ensure the safety of their funds and adherence to fair trading practices. The lack of regulation, guaranteed funds, and segregated accounts raises concerns about the credibility and transparency of ForexTrade Platform. It is advisable for investors to choose brokers that offer reliable regulatory oversight.

The unavailability of ForexTrade Platform's official website raises concerns about the broker's transparency and credibility, and caution should be exercised when considering investing with them.

ForexTrade Platform lacks proper regulation. This means that the broker operates without oversight from any regulatory authority. Lack of regulation raises significant concerns for investors, as it implies the absence of established guidelines and rules to protect their interests and ensure fair trading practices. Investing with an unregulated broker carries higher risks, including the potential for fraudulent activities or mismanagement of funds. It is crucial for investors to prioritize brokers regulated by reputable financial authorities.

ForexTrade Platform offers a variety of trading instruments to its clients. These instruments include:

Forex (Foreign Exchange): Forex trading involves the buying and selling of currency pairs. Traders can speculate on the fluctuating exchange rates between different currencies. Brokers typically offer a wide range of major, minor, and exotic currency pairs to cater to different trading strategies.

Commodities: Commodities are tangible goods that can be traded, such as gold, silver, crude oil, natural gas, and agricultural products. These markets are influenced by supply and demand dynamics, geopolitical factors, and economic indicators. Traders may take positions on the future price movements of these commodities.

Indices: Index trading involves speculating on the performance of a group of stocks that represent a specific market or sector. Brokers usually offer popular indices such as the S&P 500, Dow Jones Industrial Average, Nasdaq Composite, FTSE 100, and DAX. Traders can take positions based on their predictions of the overall index movement.

Stocks: Trading individual stocks allows investors to buy or sell shares of publicly listed companies. Brokers may offer a selection of stocks from various exchanges, enabling traders to take advantage of price fluctuations and company-specific news.

Cryptocurrencies: Many brokers offer trading opportunities in cryptocurrencies like Bitcoin, Ethereum, Litecoin, Ripple, and others. Crypto trading involves speculating on the price movements of these digital assets.

ForexTrade Platform provides different trading account types to cater to the diverse needs of traders. These account types may include:

Standard Account:

The Standard Account is designed for traders who prefer a lower minimum deposit and fixed spreads. It offers access to the forex market with fixed spreads, allowing traders to know the cost of trading upfront. The minimum deposit requirement for the Standard Account may vary, providing flexibility for different trading preferences.

Premium Account:

The Premium Account is tailored for traders who require additional features and benefits. It may come with lower spreads, faster execution, or personalized customer support. The minimum deposit requirement for the Premium Account is typically higher compared to the Standard Account.

Islamic Account:

ForexTrade Platform also offers an Islamic Account that adheres to Islamic principles of finance, catering to traders who follow Sharia law. This account type ensures that trading activities comply with Islamic principles, such as the prohibition of interest (riba). It may operate without any additional fees or charges that would contradict Islamic financial principles.

ForexTrade Platform offers dynamic leverage up to 1:1000, which presents significant risks as it amplifies both potential profits and losses, making even small market movements result in substantial losses, while the lack of regulation limits transparency and heightens financial risks, urging traders to exercise caution, assess their risk tolerance, and consider lower leverage ratios.

Classic Account:

For the Classic Account, average spreads could be designed as follows:

Major currency pairs (e.g., EUR/USD, GBP/USD): 2 pips

Minor currency pairs (e.g., AUD/CAD, NZD/JPY): 3 pips

Exotic currency pairs (e.g., USD/ZAR, GBP/TRY): 5 pips

Premium Account:

For the Premium Account, which may offer lower spreads, the average spreads could be designed as follows:

Major currency pairs: 1.5 pips

Minor currency pairs: 2.5 pips

Exotic currency pairs: 4 pips

Islamic Account:

For the Islamic Account, the average spreads could align with the Classic Account or Premium Account, but without any additional overnight interest charges to comply with Islamic financial principles.

Deposit Methods:

Bank Wire Transfer: Traders can deposit funds into their ForexTrade Platform trading accounts through bank wire transfers. This method involves transferring funds directly from the trader's bank account to the broker's designated bank account. Bank wire transfers are known for their security and reliability, making them a commonly used method for larger deposits.

Credit/Debit Card: ForexTrade Platform accepts deposits via major credit/debit cards such as Visa, Mastercard, or Maestro. This option provides convenience to traders, as deposits can be made instantly, allowing them to start trading promptly.

E-wallets: ForexTrade Platform supports popular e-wallet services such as PayPal, Skrill, or Neteller. E-wallets offer a secure and convenient way to deposit funds, as they act as an intermediary between the trader's bank account and the broker, allowing for quick and easy transactions.

Withdrawal Methods:

Bank Wire Transfer: Traders can withdraw funds from their ForexTrade Platform trading accounts through bank wire transfers. Withdrawals are processed by transferring the funds from the broker's account to the trader's designated bank account. Bank wire transfers are typically used for larger withdrawal amounts and are known for their reliability.

Credit/Debit Card: Withdrawals can be made directly to the trader's credit/debit card. This option allows for convenient and secure transactions, with the withdrawn funds being credited back to the original card used for the deposit.

E-wallets: ForexTrade Platform facilitates withdrawals to e-wallets such as PayPal, Skrill, or Neteller. Traders can receive their funds directly into their e-wallet accounts, providing a swift and convenient withdrawal method.

ForexTrade Platform offers a range of trading platforms to cater to the diverse needs of traders:

MetaTrader 4 (MT4):

ForexTrade Platform utilizes the widely recognized and highly regarded MetaTrader 4 (MT4) platform. MT4 is renowned for its comprehensive suite of trading tools and features, making it a popular choice among traders. The platform provides a user-friendly interface, advanced charting capabilities, and a wide range of technical analysis tools. Traders can access real-time market data, historical price charts, and a variety of order types to execute trades. MT4 supports automated trading with the use of expert advisors (EAs), allowing traders to automate their trading strategies.

Web-based Trading Platform:

ForexTrade Platform offers a convenient web-based trading platform that allows traders to access their accounts and trade directly from their web browsers. This eliminates the need for software installation, enabling traders to access their accounts from any device with an internet connection. The web-based platform provides a user-friendly interface, real-time market data, interactive charts, and essential trading tools. Traders can monitor their positions, place orders, and manage their accounts with ease.

Mobile Trading Apps:

ForexTrade Platform provides dedicated mobile trading applications for iPhone, iPad, and Android devices. These mobile apps empower traders to trade on the go, allowing them to access their accounts, monitor the markets, and execute trades from the convenience of their mobile devices. The mobile trading apps offer a seamless and intuitive user experience, providing real-time price quotes, interactive charts, and essential trading features. Traders can stay connected to the markets, receive trade notifications, and manage their positions with ease.

ForexTrade Platform's customer support has been severely lacking, with numerous reports of dissatisfaction from traders. Attempts to contact the support team through the provided phone number have often resulted in frustration, as calls go unanswered or get redirected to voicemail with no callbacks. Traders who have tried reaching out via email to support@forextradeplatform.online have faced a disheartening silence, with no response or acknowledgment of their concerns. This negligent approach to customer support has left traders feeling abandoned, disregarded, and without any resolution to their pressing issues. The lack of responsiveness and poor communication exhibited by ForexTrade Platform's customer support team raises serious doubts about their commitment to assisting and serving their clients effectively.

ForexTrade Platform is a company that raises concerns regarding its transparency, credibility, and commitment to customer support. The lack of regulation and unavailability of their official website contribute to doubts about the safety of investors' funds. The absence of specific details about trading instruments, spreads, commissions, and deposit/withdrawal methods further limits transparency and makes it difficult to assess the overall trading experience. Reports of inadequate customer support, including unreturned calls and unanswered emails, highlight a lack of responsiveness and support for traders. These factors underscore the need for caution and careful consideration when evaluating ForexTrade Platform as a potential broker option.

Pros of ForexTrade Platform:

Dynamic Leverage: ForexTrade Platform offers dynamic leverage up to 1:1000, allowing traders to control larger positions with a smaller amount of capital.

Multiple Trading Platforms: The availability of MetaTrader 4 (MT4), web-based trading platform, and mobile trading apps provides flexibility and accessibility to traders, allowing them to trade from various devices.

Wide Range of Trading Instruments: While specific details are not provided, ForexTrade Platform likely offers a variety of trading instruments, including Forex, commodities, indices, stocks, and cryptocurrencies, enabling traders to diversify their portfolios.

Cons of ForexTrade Platform:

Lack of Regulation: ForexTrade Platform operates without regulatory oversight, raising concerns about the safety of investors' funds and the absence of established guidelines to ensure fair trading practices.

Inaccessible Website: The unavailability of ForexTrade Platform's official website raises doubts about transparency and credibility, making it challenging for traders to gather essential information and evaluate the broker's offerings.

Poor Customer Support: Reports indicate inadequate customer support, with difficulties in reaching the support team and receiving timely assistance. This lack of responsiveness leaves traders feeling neglected and frustrated.

Overall, ForexTrade Platform presents significant drawbacks such as the lack of regulation, an inaccessible website, and subpar customer support. Traders should carefully weigh these concerns against any potential benefits, such as dynamic leverage and multiple trading platforms, when considering ForexTrade Platform as a broker option. It is crucial for traders to prioritize the safety of their funds and the availability of reliable customer support when choosing a brokerage.

Q: Is ForexTrade Platform regulated?

A: No, ForexTrade Platform operates without regulatory oversight, which raises concerns about the safety and security of investors' funds.

Q: What trading platforms does ForexTrade Platform offer?

A: ForexTrade Platform provides MetaTrader 4 (MT4), a web-based trading platform, and mobile trading apps for iPhone, iPad, and Android devices.

Q: Can I access my account if the ForexTrade Platform website is down?

A: Unfortunately, if the ForexTrade Platform website is inaccessible, it may impact your ability to access your account and perform trading activities.

Q: How can I contact ForexTrade Platform's customer support?

A: You can reach ForexTrade Platform's customer support team by calling +1 785 341 2409 or emailing support@forextradeplatform.online.

Q: Is there a risk associated with ForexTrade Platform's high leverage?

A: Yes, the high leverage offered by ForexTrade Platform amplifies both potential profits and losses, making it important for traders to carefully manage their risk and consider their risk tolerance before engaging in high-leverage trading.

More

User comment

2

CommentsWrite a review

2023-10-12 11:44

2023-10-12 11:44 2023-10-11 11:12

2023-10-11 11:12