User Reviews

More

User comment

1

CommentsWrite a review

2024-03-08 15:31

2024-03-08 15:31

Score

5-10 years

5-10 yearsRegulated in Canada

Derivatives Trading License (EP)

Medium potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index6.32

Business Index7.29

Risk Management Index8.90

Software Index5.69

License Index6.32

Single Core

1G

40G

More

Company Name

RBC Direct Investing Inc.

Company Abbreviation

RBC

Platform registered country and region

Canada

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

| RBC Review Summary | |

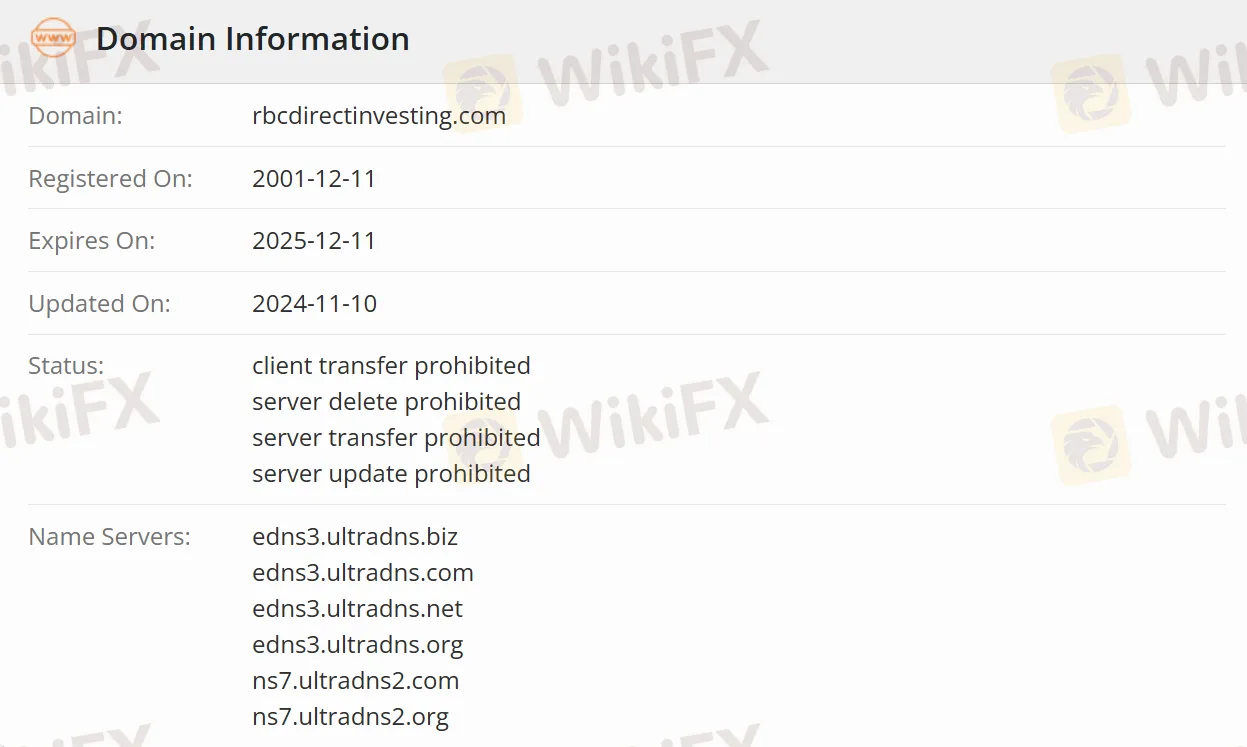

| Registered On | 2001-12-11 |

| Registered Country/Region | Canada |

| Regulation | Regulated |

| Investment Products | Stocks, Options, New issues/IPOs, ETFS, Mutual Funds, GICs, Bonds, Gold, and Silver |

| Trading Platform | Online investment platform, RBC Mobile App (Mobile) |

| Customer Support | Toll-Free: 1-800-769-2560 |

| Overseas: 1-416-977-1255 | |

| Cantonese and Mandarin: 1-800-667-8668 or 416-313-8611 | |

| Fax: 1 (888) 722-2388 | |

RBC Direct Investing is a self-directed investment platform under the Royal Bank of Canada (RBC), strictly regulated. It offers various investment services, including stocks, options, ETFs, mutual funds, and bonds, covering 18 global markets such as Canada and the United States. Supporting three trading methods—the online platform, mobile app, and professional trading dashboard—it caters to all types of investors, from beginners to seasoned traders.

| Pros | Cons |

| Regulated | Unspecific account information |

| Low commission structure (as low as $6.95 per trade) | Maintenance fee threshold |

| Clear fee information | Spread as high as 1.6% (USD-CAD) |

| Flexible trading platforms |

The Canadian Investment Regulatory Organization regulates RBC, with its license number being unreleased, and RBC strictly adheres to Canadian securities regulations.

RBC offers Canadian and U.S. stocks, including common and preferred shares, newly issued stocks, options, rights and warrants, equity, fixed income, and money market mutual funds, exchange-traded funds (ETFs), and fixed income investments such as treasury bills, bonds, and guaranteed investment certificates (GICs).

| Products | Tradable Instruments | Supported |

| Equity Investments | Stocks | ✔ |

| Options | ✔ | |

| New issues/lPOs | ✔ | |

| Built-in Diversification | ETFs | ✔ |

| Mutual Funds | ✔ | |

| Fixed-Income Investments | GICs | ✔ |

| Bonds | ✔ | |

| Precious Metals | Gold and Silver | ✔ |

RBC offers registered accounts with tax benefits and non-registered accounts.

Registered Accounts

TFSA (Tax-Free Savings Account)

RRSP (Registered Retirement Savings Plan)

FHSA (First-Time Home Savings Account)

RESP (Registered Education Savings Plan)

RRIF (Registered Retirement Income Fund)

Non-Registered Accounts

Cash accounts, margin accounts, and corporate/trust accounts for institutional investors (supporting corporate/partnership structures).

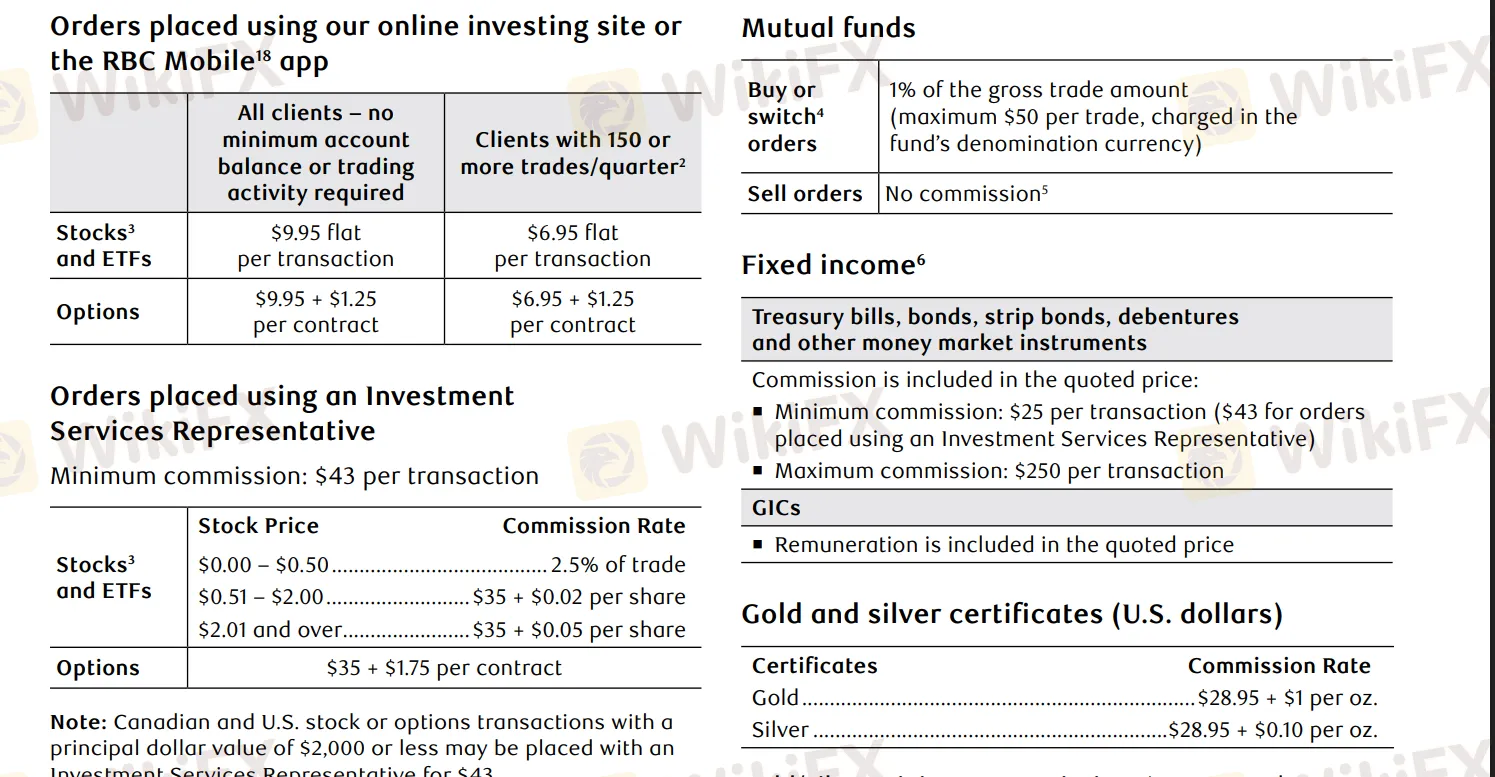

commossion

| Assets | Commission Details |

| Stock/ETF Trading | Online: $9.95 per trade (fewer than 150 trades per quarter), $6.95 per trade (150+ trades per quarter) |

| Options Trading | Online: $9.95 per trade + $1.25 per contract (low frequency), $6.95 per trade + $1.25 per contract (high frequency) |

| Mutual Fund Purchases | 1% commission ($50 maximum) |

| Gold | $28.95 + $1 per ounce |

| Silver | $28.95 + $0.10 per ounce |

| Fixed Income | Starting from $25 per transaction |

Foreign Exchange Spread Rates

| Transaction Amount (USD) | Spread (bps) | Spread (%) |

| $0 to $24,999 | 230 | 1.6% |

| $25,000 to $99,999 | 145 | 1.0% |

| $100,000 to $499,999 | 85 | 0.6% |

| $500,000 to $999,999 | 50 | 0.4% |

| $1,000,000 to $1,999,999 | 25 | 0.2% |

| $2,000,000.01 plus | No more than 10 bps | 0.1% |

If the assets are less than $15,000, a quarterly maintenance fee of $25 is required (waiver available). Additionally, wire transfers within Canada or the U.S. cost $45 per transaction.

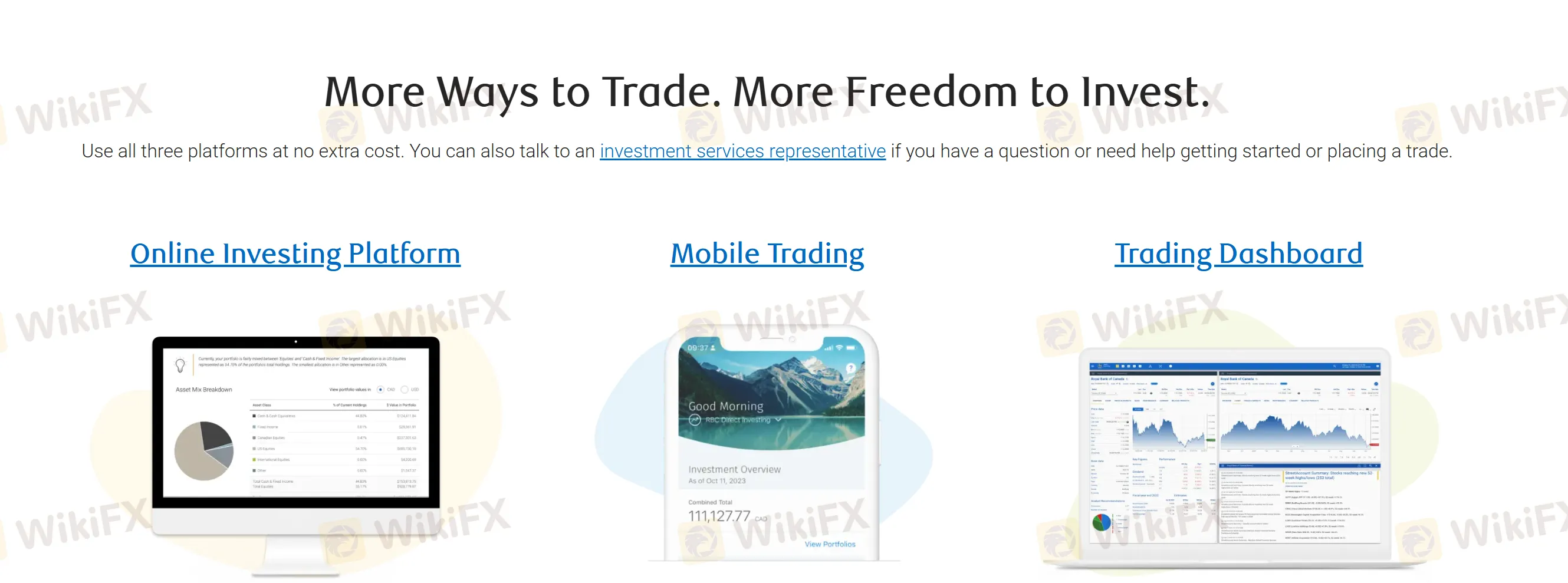

RBC offers an online investment platform suitable for comprehensive analysis, providing a demo account. Additionally, the RBC Mobile App enables convenient mobile trading, while the professional-grade Trading Dashboard tools are tailored for high-frequency traders and institutional investors.

Traders who transfer assets of ≥ $15,000 will be reimbursed up to $200 for the account transfer fees from their original brokerage.

More

User comment

1

CommentsWrite a review

2024-03-08 15:31

2024-03-08 15:31