User Reviews

More

User comment

1

CommentsWrite a review

2023-12-13 00:09

2023-12-13 00:09

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index6.01

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

| Aspect | Information |

| Company Name | Rockfort Markets |

| Registered Country/Area | China |

| Founded Year | Within 1 year |

| Regulation | Unregulated |

| Minimum Deposit | $200 |

| Maximum Leverage | Up to 1:500 |

| Spreads | Starting from 0.6 pips |

| Trading Platforms | MetaTrader 4 (MT4), Trader Workstation (TWS) |

| Tradable Assets | Stocks, options, indices, forex, ETFs, CFDs, futures contracts |

| Account Types | Standard, Pro, Islamic |

| Demo Account | Available |

| Customer Support | Telephone, Email, Online Live Chat |

| Deposit & Withdrawal | Bank Wire Transfer, Credit/Debit Cards (Visa, MasterCard), POLi, BitWallet |

| Educational Resources | Comprehensive education section, MT4 terminal lessons, trading tips, articles, collaboration with Trading Central |

| Bonuses | 20% deposit bonus (subject to change) |

Rockfort Markets, based in China, is an unregulated online trading broker offering a diverse range of financial instruments, including stocks, options, indices, forex, and exchange-traded funds (ETFs).

Simplifying trading, RockFort Markets provides the MetaTrader 4 and Trader Workstation trading platforms for desktop, online, and mobile trading, along with mobile apps for MetaTrader 4 and Trader Workstation.

Despite its relative newness compared to some other brokerages, Rockfort Markets Ltd. delivers exceptional services to its clients, encompassing favorable trading conditions, responsive customer service, and an extensive selection of banking methods for streamlined deposits and withdrawals.

Please be cautious as this broker lacks proper regulation, exposing you to risks. Unregulated brokers may not offer investor protection, transparency, or reliable services. They can engage in fraudulent activities and leave you with limited legal options in case of disputes.

It's safer to choose a regulated broker for a more secure and transparent trading experience.

Rockfort Markets exhibits several notable advantages. The broker offers a diverse array of financial instruments,with the availability of high leverage options. Customer service is responsive and attentive, ensuring that traders' inquiries are promptly addressed. It also accommodates varying trader preferences by offering different types of trading accounts.

However, there are certain drawbacks to consider. The absence of regulation raises concerns about investor protection, potentially exposing traders to unforeseen risks. Additionally, the possibility of fees associated with deposits and withdrawals, especially in foreign currencies, could impact the overall cost and convenience of using the platform.

| Pros | Cons |

| Diverse range of financial instruments | Unregulated |

| High leverage options (up to 1:500) | Fees for deposits |

| Mobile apps available | Fee for withdrawals in foreign currencies |

| Responsive customer service | |

| Different account types to suit traders' needs | |

| Various payment methods | |

| Extensive educational resources |

Rockfort Markets offers a diverse range of trading options:

Forex CFDs: Trade confidently with over 50 Forex CFDs, including major pairs like EURUSD, USDJPY, and GBPUSD, along with cross-currency and exotic pairs.

Commodity CFDs: Similar to Forex, trade commodities like Brent Crude oil, WTI Crude oil, Gold, and Silver CFDs.

Crypto CFDs: Explore a wide variety of cryptocurrencies, including Bitcoin, Bitcoin Cash, Ethereum, Litecoin, and Ripple, with 24/5 trading.

CFD Indices: Access a variety of index CFDs, such as Australia's ASX200, UK's FTSE100, Euro Stoxx 50, S&P500, and Dow Jones Industrials.

Rockfort Markets offers various types of trading accounts to suit traders' needs:

Standard Account: This is the broker's most popular option, requiring a $200 deposit to open. Experienced traders appreciate its low spreads and commission-free trading. The minimum spread is 0.8 pips.

Pro Account: Geared towards experienced traders dealing in significant amounts, the Pro Account demands a $2,000 minimum deposit. It offers ECN market spreads and a dedicated account manager. Spreads start at 0.0 pips, with a $6 per lot commission.

Islamic Account: For traders adhering to the Muslim faith, an Islamic Account is available with trading conditions similar to Standard and Pro Accounts. Notably, it excludes swap rates to align with Sharia law.

Whether you're a novice or seasoned trader, Rockfort Markets provides MT4 accounts tailored to individual preferences and skill levels.

Payment Methods

- Bank Wire Transfer (NZ and Intl.)

- Credit/Debit Cards (Visa, MasterCard)

- POLi

- BitWallet

2. Deposit and Withdrawal Fees

When making deposits at Rockfort Markets, you have a choice of three methods. On the deposit page, you will find the fees outlined for each payment option. Notably, deposits made using Visa and MasterCard incur a 3% fee.

For withdrawals, if you're withdrawing New Zealand dollars to a New Zealand bank, no fee applies. However, a nominal fee of $15 is levied for withdrawals in foreign currencies or transfers to accounts in other countries. This transparent fee structure ensures clarity and enables you to manage your transactions with confidence.

3. Processing Time

Withdrawal requests undergo thorough validation by the team. You can initiate quick withdrawals via the online form. Compliance with anti-money laundering rules requires funds in your name.

Withdrawal processing takes a day or two, and timing varies with payment methods. Bank transfers take a few days, while some options are instant. Your convenience and adherence to regulations are central to our services.

When evaluating brokers, understanding fees is crucial. Rockfort Markets generates revenue through spreads instead of commissions.

For standard accounts, major forex pairs have spreads of 0.9 to 1.4 pips, and minor pairs range from 1.2 to 5.0 pips.

In the pro account, major pairs average a 0.6-pip spread, while minor pairs average 1.0 pip. This reflects competitive pricing for traders.

Leverage, a robust asset, empowers traders with amplified positions and market exposure beyond deposits.

European, U.S., Canadian, and Japanese regulations curtail retail traders, imposing leverage caps below 1:100.

Rockfort Markets offers exceptional flexibility. Standard and Pro accounts provide substantial leverage, up to an impressive 1:500.

This boon benefits high-leverage or modest-capital traders. Yet, akin to a dual-edged sword, leverage magnifies gains and losses, necessitating astute risk management. While leverage enhances profits, vigilance is vital. Acknowledging leverage's potential, traders must tread judiciously, recognizing the rewards and risks it brings.

Presently, RockFort Markets extends a 20% deposit bonus to new traders opting for a live account. It's important to note that these bonuses and promotions are subject to change. Keeping abreast with the broker's website is advised to stay informed about new and upcoming offers.

A trading platform is essential software for executing trades. Brokers often offer their own proprietary platforms. RockFort Markets provides two platforms: MT4 and Trader Workstation.

MT4 Platform:

Popular for Forex and CFD trading, MT4 offers an intuitive interface, diverse charting tools, indicators, and algorithmic trading support. It supports bar, candlestick, and line charts, with 30+ indicators. Mobile app available.

Trader Workstation:

For multi-market trading, use TWS. It offers stocks, metals, ETFs, commodities, and CFDs on a variety of instruments. Access real-time news, research, and market scanners. TWS Mobile app available.

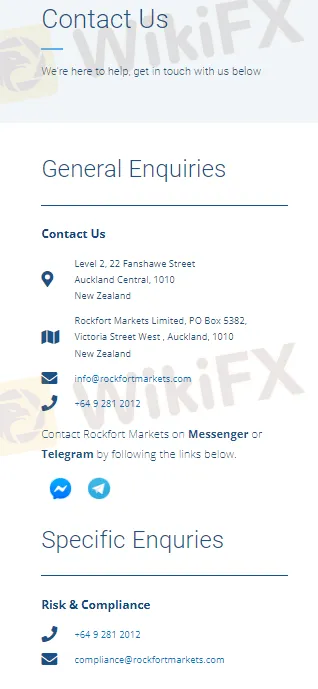

A proficient customer service team is readily accessible to promptly address traders' inquiries, spanning general, technical, and account-related matters. Reachable through Telephone, Email, and Online Live Chat, they ensure courteous and timely assistance.

Furthermore, the broker maintains an active presence on various social media platforms including Facebook, Twitter, YouTube, and LinkedIn. This expansive network allows traders to connect and seek assistance from Rockfort Markets' customer service department around the clock, utilizing any of the mentioned communication avenues.

Education is crucial for traders, especially beginners, providing essential knowledge for success. Rockfort Markets offers a comprehensive education section catering to both novices and experienced traders.

This education hub covers diverse resources, including MT4 terminal lessons, trading tips, and insightful articles about financial markets. Notably, Rockfort Markets collaborates with Trading Central, benefiting advanced traders.

Access to Trading Central is exclusive to live account holders, requiring account validation and funding. It offers advanced analysis and trading signals, enhancing traders' capabilities.

Rockfort Markets, an online broker headquartered in New Zealand, empowers traders with an extensive array of financial instruments and advanced trading tools. The platform supports online trading across diverse asset classes, including stocks, options, foreign exchange, ETFs, CFDs, and futures contracts, all accessible through MetaTrader 4 and Trader Workstation.

With a modest minimum deposit of $200, Rockfort Markets adopts the STP execution mechanism, ensuring swift and direct order processing. Furthermore, traders can tailor their experience through a range of flexible account settings, enhancing their trading journey.

Q: What types of financial instruments can I trade with Rockfort Markets?

A: Rockfort Markets offers a diverse range of tradable assets, including stocks, options, indices, forex, and exchange-traded funds (ETFs).

Q: Is Rockfort Markets regulated?

A: Rockfort Markets is currently not regulated.

Q: Are there fees associated with deposits?

A: Yes, certain deposit methods may incur fees. Visa and MasterCard deposits, for example, have a 3% fee.

Q: How does Rockfort Markets handle withdrawals?

A: Withdrawals are processed promptly, usually within a day or two. However, there may be a $15 fee for withdrawals in foreign currencies or transfers to accounts in other countries.

Q: What trading platforms does Rockfort Markets offer?

A: Rockfort Markets provides traders with the MetaTrader 4 (MT4) and Trader Workstation (TWS) platforms, both available for desktop, online, and mobile trading.

Q: Are there any bonuses for new traders?

A: Yes, currently Rockfort Markets offers a 20% deposit bonus to new traders opening live accounts, but it's important to check for any changes or updates to this promotion.

More

User comment

1

CommentsWrite a review

2023-12-13 00:09

2023-12-13 00:09