User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

5-10 years

5-10 yearsRegulated in Taiwan

Derivatives Trading License (AGN)

Medium potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index6.90

Risk Management Index8.90

Software Index4.00

License Index0.00

Single Core

1G

40G

| IBF Securities Review Summary | |

| Founded | / |

| Registered Country/Region | Taiwan |

| Regulation | TPEx |

| Trading Products | Stocks, derivative products, and fixed-income products |

| Demo Account | / |

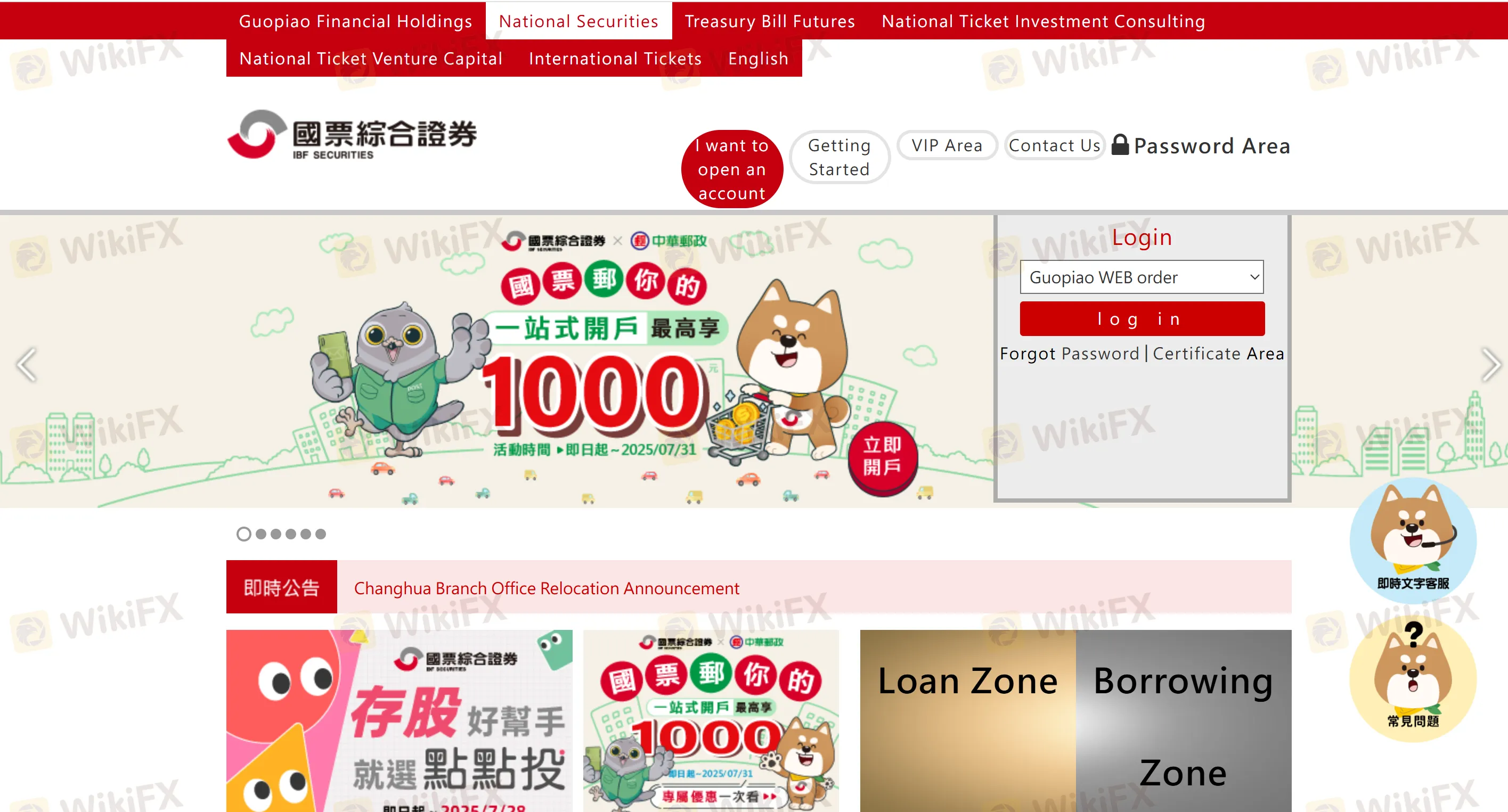

| Trading Platform | IBF Super Trader, IBF Win-at-Will |

| Minimum Deposit | / |

| Bonus | ✅ |

| Customer Support | Live chat |

| Tel: 02-8502-0568 | |

| Address: 5F, No. 128, Lequn 3rd Road, Zhongshan District, Taipei City 104 | |

IBF Securities is a securities company based in Taiwan, China, and is a subsidiary of the International Bill Financial Holding Group. It provides multi-market investment services for Taiwan stocks, US stocks, Hong Kong stocks, etc., covering tradable products such as stocks, warrants, futures, ETFs, and structured products. IBF Securities is suitable for local Taiwanese investors and Chinese-speaking long-term stock accumulators and conservative investors.

| Pros | Cons |

| Regulated by TPEx | Lack of multilingual support |

| Various trading products | Unclear fee structure |

| Abundant promotional activities | No info on deposit and withdrawal |

| Live chat support |

IBF Securities is a member of the Taiwan Stock Exchange (TWSE) and the Over-The-Counter (OTC) Market, holding a legitimate securities business license and regulated by the Financial Supervisory Commission (FSC) of Taiwan.

| Regulated Authority | Current Status | Licensed Entity | Regulated Country | License Type | License No. |

| Taipei Exchange (TPEx) | Regulated | 國票證券 | Taiwan | Dealing in securities | Unreleased |

The tradable products of IBF Securities include stocks, derivative products such as warrants, futures, ETFs, exchange-traded notes (ETNs), and fixed-income products such as foreign bonds (self-trading business).

| Tradable Instruments | Supported |

| Stocks | ✔ |

| Warrants | ✔ |

| Futures | ✔ |

| ETFs | ✔ |

| ETNs | ✔ |

| Fixed-income products | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| Type | Name/Platform | Functional Features |

| Mobile APP | Financial e-Butler | Account management, online signing, market quote inquiry |

| IBF Super Trader / IBF Win-at-Will | Primarily trading functions (order placement, bidding auctions, options tutorials) | |

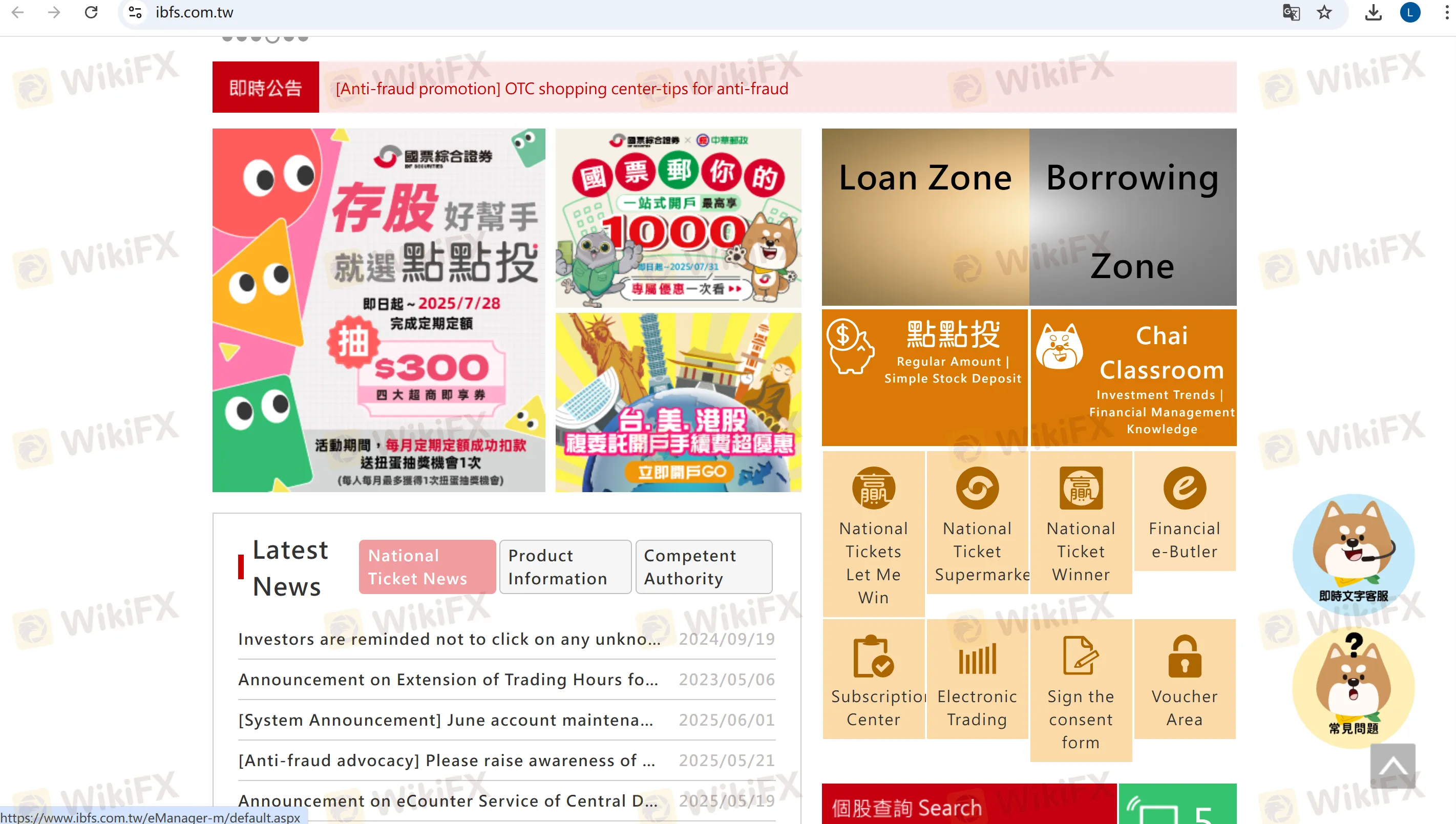

| Web Version | IBF Comprehensive Securities Website | System announcements, investment trend analysis, and electronic trading services |

| Special Tools | DianDianTou | Regular fixed-amount stock accumulation tool |

| Smart Stock Subscription | Patent system (presumed to be intelligent stock selection or automated subscription) |

| Activity Name | Activity Period | Reward/Offer |

| Stock Accumulation Lottery | 2025/5/1 - 2025/7/28 | Prize: NT$300 convenience store cash vouchers |

| Account Opening Bonus | Now - 2025/7/31 | Up to NT$1,000 exclusive benefits (may include commission discounts or cashback) |

| Commission Discount | Unspecified (to be confirmed upon account opening) | Enjoy “super preferential” commissions; specific discounts to be confirmed upon opening |

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment