User Reviews

More

User comment

3

CommentsWrite a review

2023-11-08 10:30

2023-11-08 10:30

2023-11-07 10:43

2023-11-07 10:43

Score

Scam Brokers

Scam Brokers2-5 years

Suspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Quantity 5

Exposure

Score

Regulatory Index0.00

Business Index5.94

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

Ameriprise Financial, Inc

Company Abbreviation

Ameriprise Financial

Platform registered country and region

Japan

Company website

Company summary

Pyramid scheme complaint

Expose

| Aspect | Information |

| Registered Country/Area | Ameriprise Financial is based in Japan. |

| Founded Year | The company was established within the last year. |

| Company Name | The full name is Ameriprise Financial Inc. |

| Regulation | Regulated by the NFA (National Futures Association) with concerns about its effectiveness and operating outside permitted regions. |

| Minimum Deposit | A minimum deposit of 100 yen is required to start trading. |

| Maximum Leverage | The company has moderate financial leverage with a debt-to-equity ratio of 1.43. |

| Spreads | Fixed spreads for market instruments, e.g., 0.2 pips for USD/JPY. Commission fees for specific trades. |

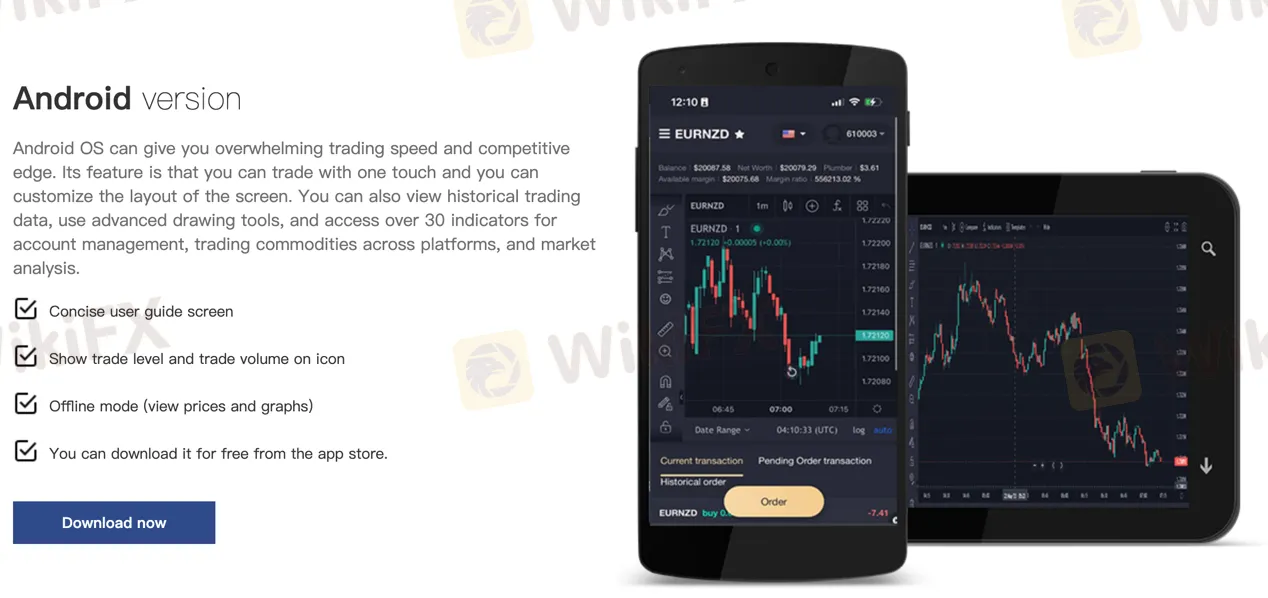

| Trading Platforms | Offers a trading app for iOS and Android with various features, including offline mode. |

| Tradable Assets | Offers Forex pairs, CFDs on stocks (e.g., AAPL, AMZN, GOOGL), spot trading assets, and margin-traded assets. |

| Account Types | Provides options such as Individual Brokerage Account, IRA (traditional and Roth), Joint Brokerage Account, Trust Account, Custodial Account. |

| Demo Account | Availability not provided in the information. |

| Islamic Account | Availability not provided in the information. |

| Customer Support | Contactable at +81 03 6824 7682, located at 17-1 虎ノ門ヒルズ ビジネスタワー. |

| Payment Methods | Accepts deposits through check, cash, or wire transfer, with fees and limits depending on the method and account type. |

| Educational Tools | Specific information about educational tools is not available. |

Overview of Ameriprise Financial

Ameriprise Financial Inc. is a financial services provider operating in Japan. While it is regulated by the National Futures Association (NFA) in the United States, concerns exist regarding the effectiveness of this regulation. The NFA's regulatory status is noted as “No authority,” and Ameriprise Financial is mentioned as operating outside the permitted region, raising compliance concerns. Potential clients should exercise caution and be aware of associated risks when considering this provider.

Ameriprise Financial offers various market instruments, including forex pairs, CFDs on stocks, spot trading, and margin trading. They provide fixed spreads and commission fees for trading, establishing straightforward cost structures. The company's financial leverage is moderate, with a debt-to-equity ratio of 1.43. Additionally, Ameriprise Financial offers a range of account types, including individual brokerage accounts, IRAs, joint brokerage accounts, trust accounts, and custodial accounts, catering to different investment needs.

The minimum deposit requirement is 100 yen, and while the provider offers cost-effective fee structures for account opening, maintenance, deposits, and withdrawals, fees are incurred for loss cuts and forced settlements. Ameriprise Financial also offers a trading app for iOS and Android devices, providing trading features and accessibility for traders on the go. Customer support can be reached at +81 03 6824 7682, with the company's address located at 17-1 虎ノ門ヒルズ ビジネスタワー.

Pros and Cons

Ameriprise Financial presents a mixed landscape of advantages and disadvantages. On the positive side, the company is regulated by NFA (0558308), offering a level of oversight. It also boasts a low minimum deposit requirement and a user-friendly trading app with advanced features. Additionally, the straightforward commission fee structure and free account opening and maintenance can be appealing. However, there are concerns regarding regulatory effectiveness and compliance. The firm's limited diversity in account types and the variety of fees for different instruments might be restrictive for some traders. Moreover, the selection of market instruments is somewhat limited, and commission fees could impact overall trading costs. Multiple deposit and withdrawal options are available, but certain methods may incur fees and have limits.

| Pros | Cons |

| Regulated by NFA (0558308) | Concerns about regulatory effectiveness and compliance |

| Low minimum deposit requirement | Varying fees for different instruments |

| Trading app with advanced features | Limited diversity in account types |

| Straightforward commission fees | Limited types of market instruments |

| Free account opening and maintenance | Commission fees may apply, impacting trading costs |

| Multiple deposit and withdrawal options | Fees and limits for certain withdrawal methods |

Is Ameriprise Financial Legit?

Ameriprise Financial is regulated by the National Futures Association (NFA) in the United States, with a regulation number of 0558308. However, it's important to note that according to the provided information, there are concerns about the effectiveness of this regulation. The NFA has an abnormal state of regulation, and there is a note indicating “No authority” regarding their regulatory status. Additionally, it is mentioned that Ameriprise Financial is operating outside the permitted region, which raises concerns about compliance. Therefore, potential clients should exercise caution and be aware of the associated risks when considering Ameriprise Financial as a financial service provider.

Market Instruments

FOREX PAIRS: Ameriprise Financial offers a wide range of currency pairs for forex trading. Examples include popular pairs like EUR/USD, GBP/JPY, and AUD/CAD, each with its respective spreads and fees.

CFDs ON STOCKS: Within their CFD offerings, Ameriprise Financial provides access to various stocks. Examples of these stocks may include well-known companies like Apple Inc. (AAPL), Amazon.com Inc. (AMZN), and Alphabet Inc. (GOOGL), with different fees associated with each CFD.

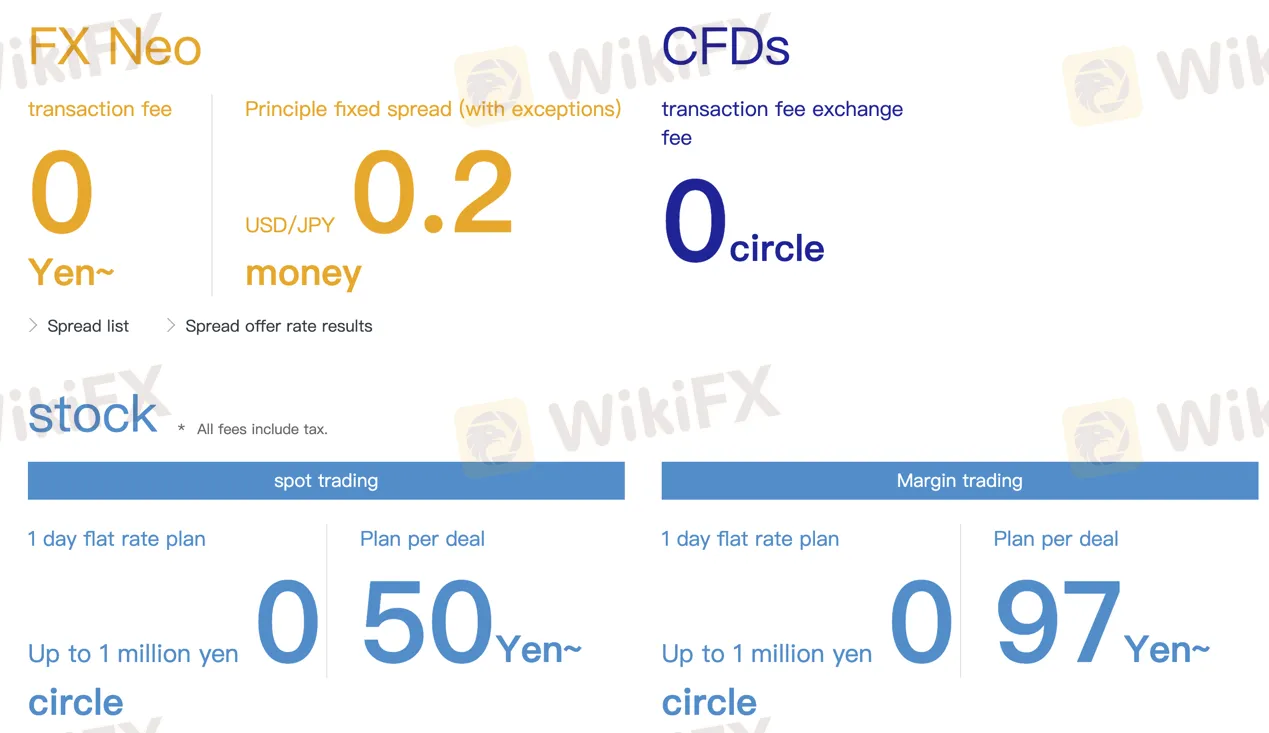

SPOT TRADING: Ameriprise Financial's spot trading options allow traders to engage in short-term trades. This includes 1-day flat rate plans for transactions up to 1 million yen. Examples of assets available for spot trading encompass currency pairs, commodities like gold and oil, and stock indices.

MARGIN TRADING: For those interested in leveraging their investments, Ameriprise Financial offers margin trading. Similar to spot trading, they provide a 1-day flat rate plan for transactions up to 1 million yen. Examples of margin-traded assets encompass major currency pairs, stock indices like the S&P 500, and select commodities.

Pros and Cons

| Pros | Cons |

| Wide range of forex pairs with various options | Different fees associated with CFDs on stocks |

| Access to well-known stocks through CFD offerings | Limited explanation of spot trading options and fees |

| Margin trading available for leveraging investments | Information about margin trading is relatively limited |

Account Types

Individual Brokerage Account: This type of account is designed for individuals who want to invest in stocks, bonds, mutual funds, and other securities.

IRA: An IRA is a retirement savings account that offers tax advantages. There are two main types of IRAs: traditional IRAs and Roth IRAs.

Joint Brokerage Account: This type of account is designed for two people who want to invest together.

Trust Account: A trust account is a type of account that is used to hold assets for the benefit of another person.

Custodial Account: A custodial account is a type of account that is used to hold assets for a minor child.

Leverage

Ameriprise Financial's financial leverage is moderate, with a debt-to-equity ratio of 1.43. This means that the company has $1.43 in debt for every $1 in equity.

Spreads & Commissions

Ameriprise Financial provides fixed spreads for its market instruments, such as a fixed spread of 0.2 pips for the USD/JPY currency pair, along with commission fees for specific trades, like CFDs starting at 0circle and spot trading with fees beginning at 50Yen. These fixed spreads and commission fees establish straightforward cost structures for traders.

Fees

Ameriprise Financial offers cost-effective fee structures for traders. They provide free account opening and maintenance, as well as free deposits and withdrawals. However, it's important to note that fees are incurred for loss cuts and forced settlements, and they operate on a 1-day flat-rate plan, applicable up to a total contract price of 1,000,000 yen per day.

Minimum Deposit

Ameriprise Financial requires a minimum deposit of 100 yen to start trading.

Deposit & Withdraw

Deposits can be made by check, cash, or wire transfer. Withdrawals can be made by writing a check, using an ATM, or transferring money to another account. There are some limits and fees associated with withdrawals, depending on the type of account and the withdrawal method.

Pros and Cons

| Pros | Cons |

| Multiple deposit options (check, cash, wire) | Withdrawal limits and fees can apply |

| Various withdrawal methods (check, ATM, transfer) | Fees and limits depend on the account and method |

| Some methods may incur additional charges |

Trading Platforms

Ameriprise Financial offers a range of trading platforms, including a trading app available for iOS and Android devices. The app provides users with features such as one-touch trading, customizable screen layouts, access to historical trading data, advanced drawing tools, and over 30 indicators for market analysis. It is compatible with both iOS and Android devices, providing fast trading speeds and options in screen layout customization. Additionally, users can access the app in offline mode for viewing prices and graphs. The app is available for free download from the respective app stores, ensuring accessibility for traders on the go.

| Pros | Cons |

| User-friendly trading app for iOS and Android devices | Limited information on platform stability and uptime |

| Advanced features such as one-touch trading and over 30 indicators | No popular trading platforms available |

| Accessibility with offline mode and free app download | Lack of information on customer support availability |

Customer Support

Ameriprise Financial's customer support can be reached at +81 03 6824 7682, and their company address is 17-1 虎ノ門ヒルズ ビジネスタワー.

Conclusion

In conclusion, Ameriprise Financial, though regulated by the National Futures Association, raises concerns about the effectiveness of its regulation, as it lacks clear authority and operates outside the permitted region. The company offers various market instruments, account types, and trading platforms, but potential clients should be cautious due to compliance risks. Ameriprise Financial's financial leverage is moderate, and it provides fixed spreads and commission fees, establishing straightforward cost structures. While they offer cost-effective fee structures for certain services, fees are incurred for loss cuts and forced settlements. The minimum deposit requirement is 100 yen, and there are limitations and fees associated with deposits and withdrawals. The trading app provides options for traders. However, clients should exercise due diligence and consider the associated risks before engaging with Ameriprise Financial.

FAQs

Q1: What is the full name of Ameriprise Financial?

A1: The full company name of Ameriprise Financial is Ameriprise Financial Inc.

Q2: Is Ameriprise Financial a legitimate financial service provider?

A2: Ameriprise Financial is regulated by the National Futures Association (NFA) in the United States, but there are concerns about the effectiveness of this regulation, and the company is operating outside the permitted region. Caution is advised when considering their services.

Q3: What market instruments does Ameriprise Financial offer?

A3: Ameriprise Financial offers forex pairs, CFDs on stocks, spot trading, and margin trading, providing access to various assets like currency pairs, stocks, commodities, and stock indices.

Q4: What types of accounts are available with Ameriprise Financial?

A4: Ameriprise Financial offers Individual Brokerage Accounts, IRAs (traditional and Roth), Joint Brokerage Accounts, Trust Accounts, and Custodial Accounts.

Q5: What is the minimum deposit requirement for trading with Ameriprise Financial?

A5: Ameriprise Financial requires a minimum deposit of 100 yen to start trading.

Q6: What trading platforms are offered by Ameriprise Financial?

A6: Ameriprise Financial offers a trading app for iOS and Android devices, providing trading features, customization options, historical data access, and over 30 market analysis indicators.

Q7: How can I contact Ameriprise Financial's customer support?

A7: You can reach Ameriprise Financial's customer support at +81 03 6824 7682, and their company address is 17-1 虎ノ門ヒルズ ビジネスタワー.

More

User comment

3

CommentsWrite a review

2023-11-08 10:30

2023-11-08 10:30

2023-11-07 10:43

2023-11-07 10:43