User Reviews

More

User comment

12

CommentsWrite a review

2024-03-22 16:54

2024-03-22 16:54

2023-12-06 10:34

2023-12-06 10:34

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Self-developed

High potential risk

Influence

Add brokers

Comparison

Quantity 9

Exposure

Score

Regulatory Index0.00

Business Index7.25

Risk Management Index0.00

Software Index5.04

License Index0.00

Single Core

1G

40G

Danger

More

Company Name

Rynat Capital (Pty) Ltd

Company Abbreviation

XTrend Speed

Platform registered country and region

South Africa

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

my entry time was at 6:27 am. up and down maeket was at 6:19-6:20.

I've been using this app for a long time, but recently I created a new account and made a deposit to complete the mission. There were many interesting missions on Xtrend speed, but after withdrawing a few days later several features and missions were removed from the account. There was no notification or clear reason from SC Xtrend speed. I checked on my grandmother's account, and the feature was still there but on other accounts, it was removed. I traded on the old account again and managed to do WD once, but a few days later several features and missions on my account disappeared. There were still no warnings or notifications. Based on conversations with the personal manager, he couldn't explain a rational reason. He just said, "The event has ended". I checked my friend's account, and the features and missions were still there. I think the service on this app is no longer transparent and has a detrimental game and that is what decided me to stop trading on this app.

I WAS NEVER ABLE TO WITHDRAW ANY OF THE CAPITAL PRIZES OR RECEIVE ANY OF THE AMOUNTS FROM THE SWEEPSTAKES OR USE THE CREDITS YOU WIN IN THE CONTESTS.

I hate scammers really, I made profit and I awoke to my funds being taken from me.

Withdrawals are always rejected for unclear reasons. Fraudulent site.

This is my customers id 62301107 I am ritesh shah Sir, my further complaint of 18th Oct. has not been resolved and t 26th Oct am facing new issue. Due to your system falut. And your system close my 2 trade. This time, to keep the margin of the trade in balance, I made the deposit. Deposit channel working. Even so, you people have not closed my trade. It is your company's policy to harass customers. Even today I saw a loss of 1471 usd due to your system failure. This is the way to play with your customers. On 18 Oct I saw a loss of round 5000 usd. And saw a loss of 1471 usd today on 26 Oct Due to the malfunction of your system. I want refund my amount due to your system falut Am attaching today sceen short. Your relevant department working on my complaint or not ? They dont have time replied to customer is this the company's way of cheating? This company earn money by this system They close deposit chennal when customer marzinge leval is low. Customer want to deposit but they do not add money by their xtrend earning system. They make folish to customer I have all proof. And uploading hear. And you want to talk with customer care. Those people will make us wait for 7 hours up. Is this company providing service? This is cheat company. Dont trust

They require a proof of my address issued by my company, otherwise the payment will not be made. My address is recognized by the government, banks, etc. But the platform still requires the company to prove my address, and even if I provide the company's certificate, there is still no guarantee that I can withdraw money.

I made 8 withdrawal requests, all rejected!! They justify themselves by saying that my bank rejects the request! BEWARE. IT'S A SCAM.

| XTrend Speed Review Summary | |

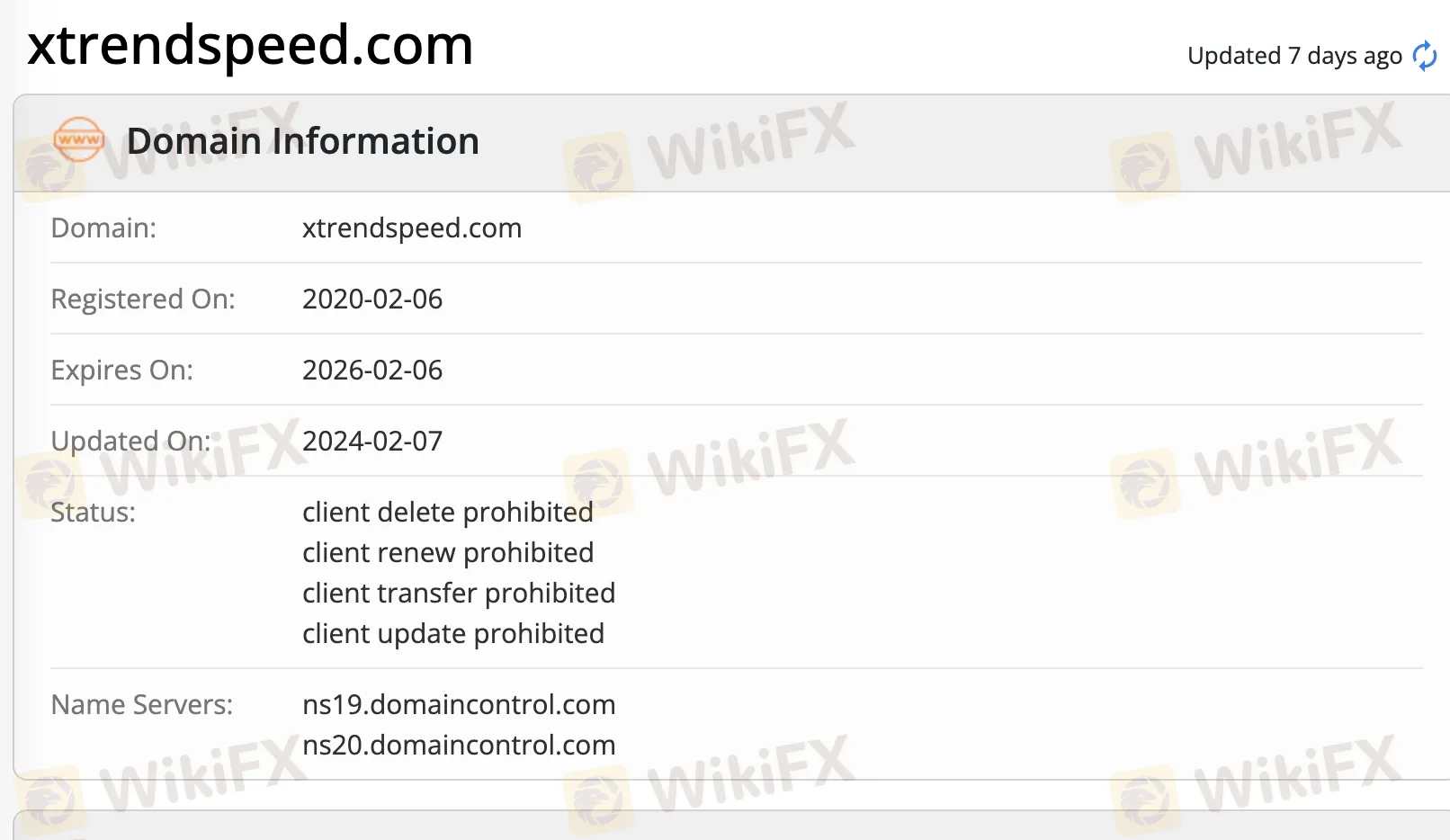

| Founded | 2020 |

| Registered Country/Region | South Africa |

| Regulation | CySEC/FSCA (Suspicious clone) |

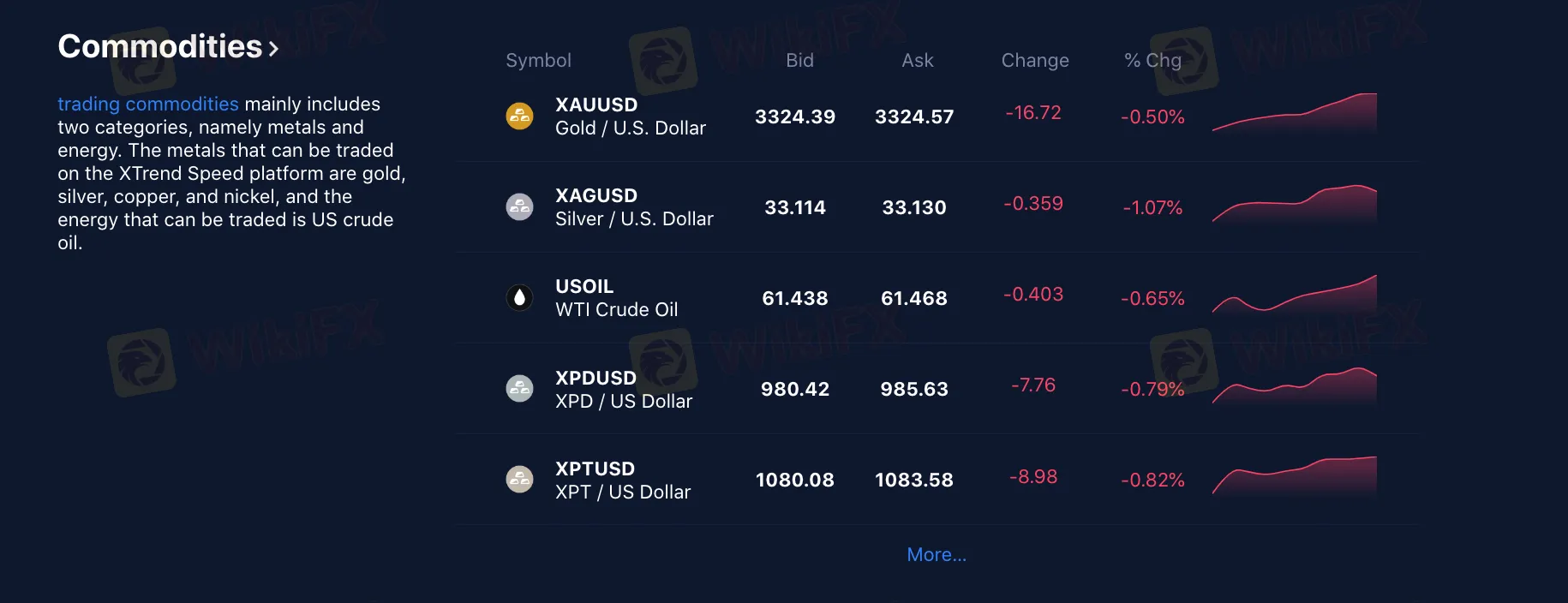

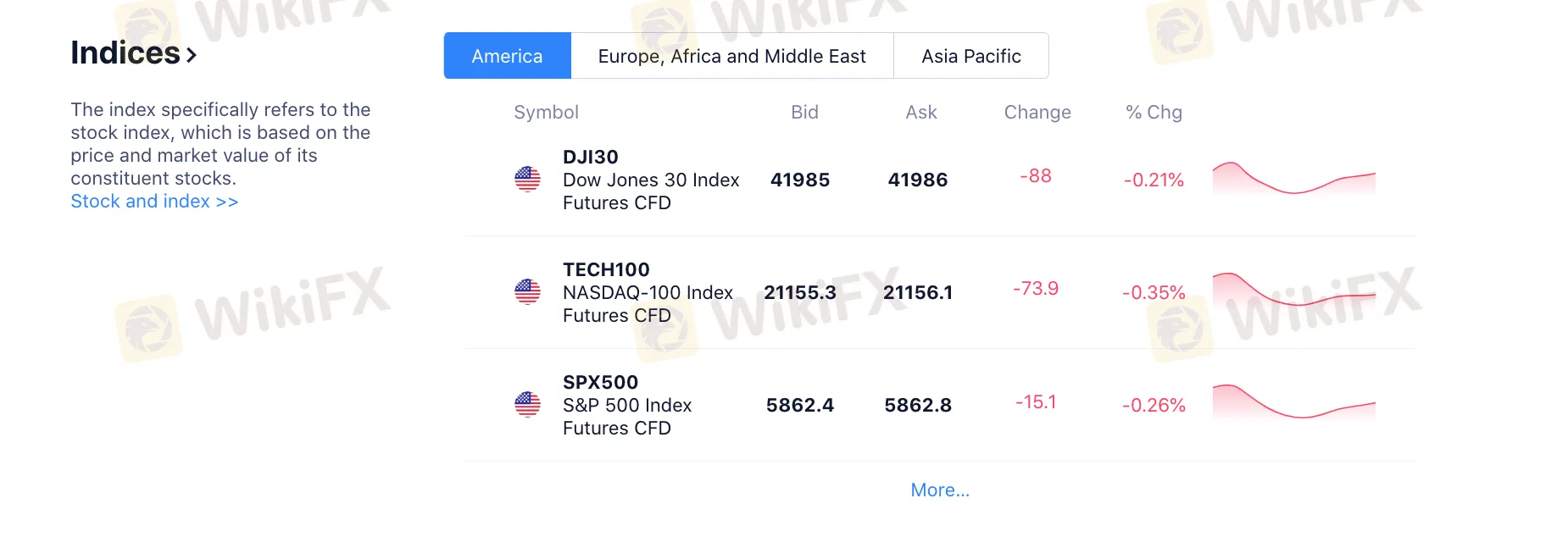

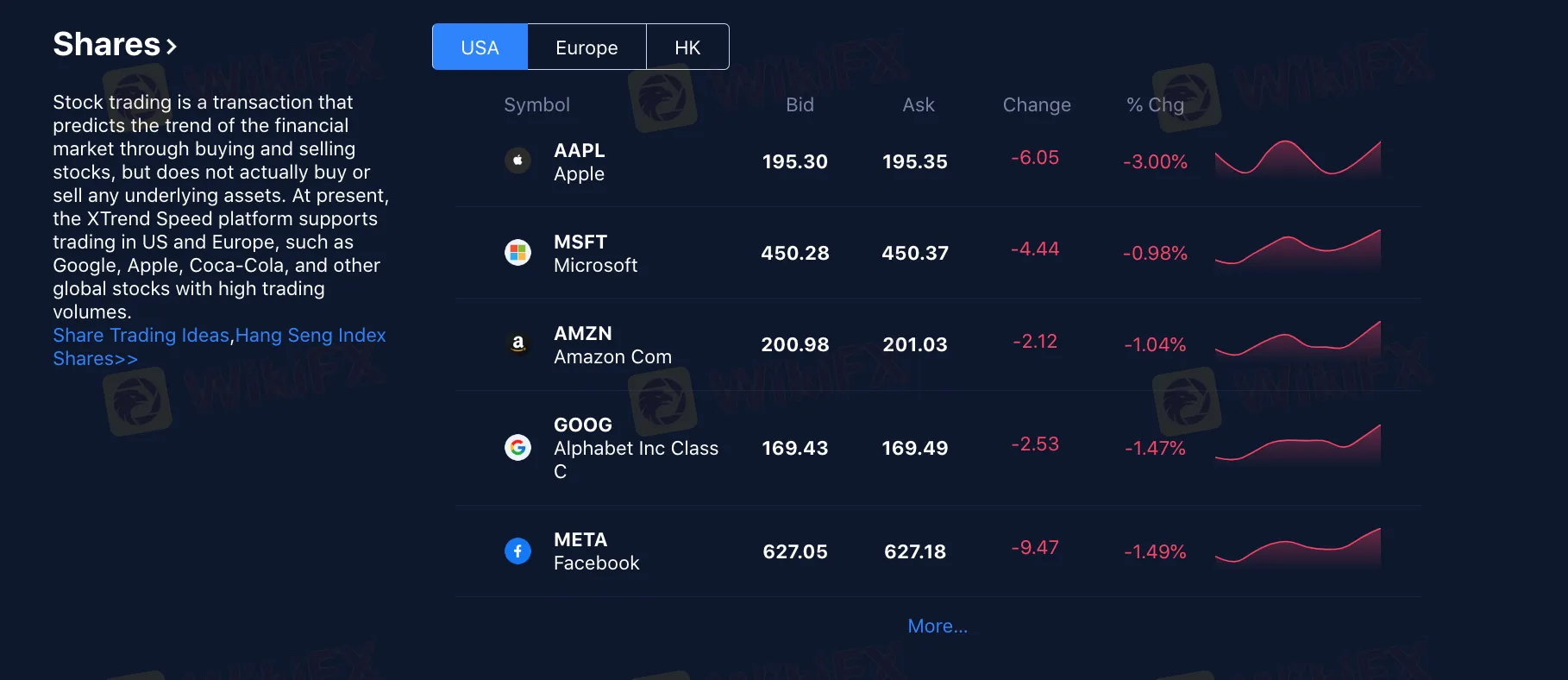

| Market Instruments | Forex, commidities, indices, shares |

| Demo Account | ✅ |

| Leverage | 1:30-1:300 |

| Spread | Floating |

| Trading Platform | XTrend Speed |

| Copy/Social Trading | ✅ |

| Minimum Deposit | / |

| Customer Support | 22/7 support |

| Live chat, contact form | |

| Email: complaints@rynatcapital.com | |

| Social media: WhatsApp, Telegram, Facebook, X, Linked, Youtube, Trading View | |

| Regional Restrictions | Afghanistan, Albania, United States, Bahamas, Barbados, Belarus, Belgium, Botswana, Burkina Faso, Burundi, Cambodia, Canada, China, Cyprus, North Korea, Democratic Republic of Congo, Republic of Congo, Ghana, Gibraltar, Iceland, Iran, Jamaica, Jordan, Mali, Mongolia, Morocco, Mozambique, Myanmar, Nicaragua, Pakistan, Panama, Senegal, Sudan, Syria, Tanzania, Trinidad and Tobago, Uganda, Ukraine, Venezuela, Yemen, Zimbabwe, Rusia clients are not allowed |

XTrend Speed is a suspicious clone broker, offering trading on forex, commidities, indices and shares with leverage up to 1:300 and floating spreads on XTrend Speed trading platform.

| Pros | Cons |

| Demo accounts | Suspicious Clone licenses |

| Copy/social trading | No MT4/MT5 platform |

| Multiple payment options | |

| Live chat support |

No. XTrend Speed is currently a suspicious clone broker. Please be aware of the risk! It also offers negative balance protection.

| Regulated Country | Regulator | Current Status | Regulated Entity | License Type | License No. |

| Cyprus Securities and Exchange Commission (CySEC) | Suspicious Clone | Rynat Trading Ltd | Market Maker (MM) | 303/16 |

| Financial Sector Conduct Authority (FSCA) | Suspicious Clone | Rynat Capital (Pty) Ltd | Financial Service Corporate | 23497 |

XTrend Speed offers trading on forex, commidities, indices and shares.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Shares | ✔ |

| Cryptos | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

XTrend Speed offers leverage from 1:30 to 1:300. Since leverage, can amplify both profits as well as losses, choosing the right amount is a key risk determination for traders.

XTrend Speed does not charge clients any additional fees for deposits, however there are charges for withdrawals. Further information is not specified.

3.5% fee is charged on Withdrawals by E-wallet/ Credit Card/Debit Card.

Fees for withdrawals via Sofort and wire transfer will be charged depending on the withdrawal amount and country and currency of the bank account.

More detailed info can be found via https://www.xtrendspeed.com/en-US/more/faq

| Trading Platform | Supported | Available Devices | Suitable for |

| XTrend Speed | ✔ | Mobile, PC, web | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

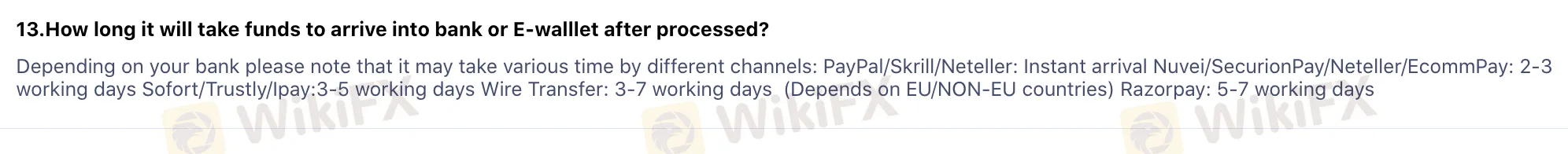

| Payment Methods | Minimum Withdrawal | Withdrawal Processing Time |

| PayPal/Skrill/Neteller | $20 | Instant |

| Nuvei/SecurionPay/Neteller/EcommPay | 2-3 working days | |

| Sofort/Trustly/Ipay | 3-5 working days | |

| Wire Transfer | $100 | 3-7 working days (Depends on EU/NON-EU countries) |

| Razorpay | $20 | 5-7 working days |

When evaluating the safety of a forex broker, the primary metric to consider is its regulatory standing and its track record with existing clients. Fin Trend presents an immediate red flag with an alarmingly low WikiFX Score of 1.51 out of 10.00. This score is a definitive indicator that the broker lacks the necessary legal qualifications and safety mechanisms required to operate legitimately in the financial markets.

WikiFX

WikiFX

Do you have to go through numerous checks when withdrawing funds from XTrend Speed? Is constant deposit pressure annoying you? Are you constantly losing trades despite following strategies? Before you get scammed, take necessary measures to recover your funds. Many traders have expressed their disappointment on review platforms. In this article, we will share trader reviews against XTrend speed. Time for you to look at such reviews and act accordingly.

WikiFX

WikiFX

The stock market faced significant setbacks in September, with the S&P 500 Index, a broader seen since early June. Despite this, a market strategist remains optimistic about the medium- term outlook.

WikiFX

WikiFX

The Dow closed lower Friday, snapping a four- week win streak on mixed quarterly earnings ahead of results from big tech next week. The Dow Jones Industrial Average was 0.1%, or 22 points higher, the Nasdaq rose 0.1%, and the S&P 500 added 0.1%.

WikiFX

WikiFX

More

User comment

12

CommentsWrite a review

2024-03-22 16:54

2024-03-22 16:54

2023-12-06 10:34

2023-12-06 10:34