User Reviews

More

User comment

1

CommentsWrite a review

2025-09-03 06:07

2025-09-03 06:07

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Quantity 3

Exposure

Score

Regulatory Index0.00

Business Index6.13

Risk Management Index0.00

Software Index4.00

License Index0.00

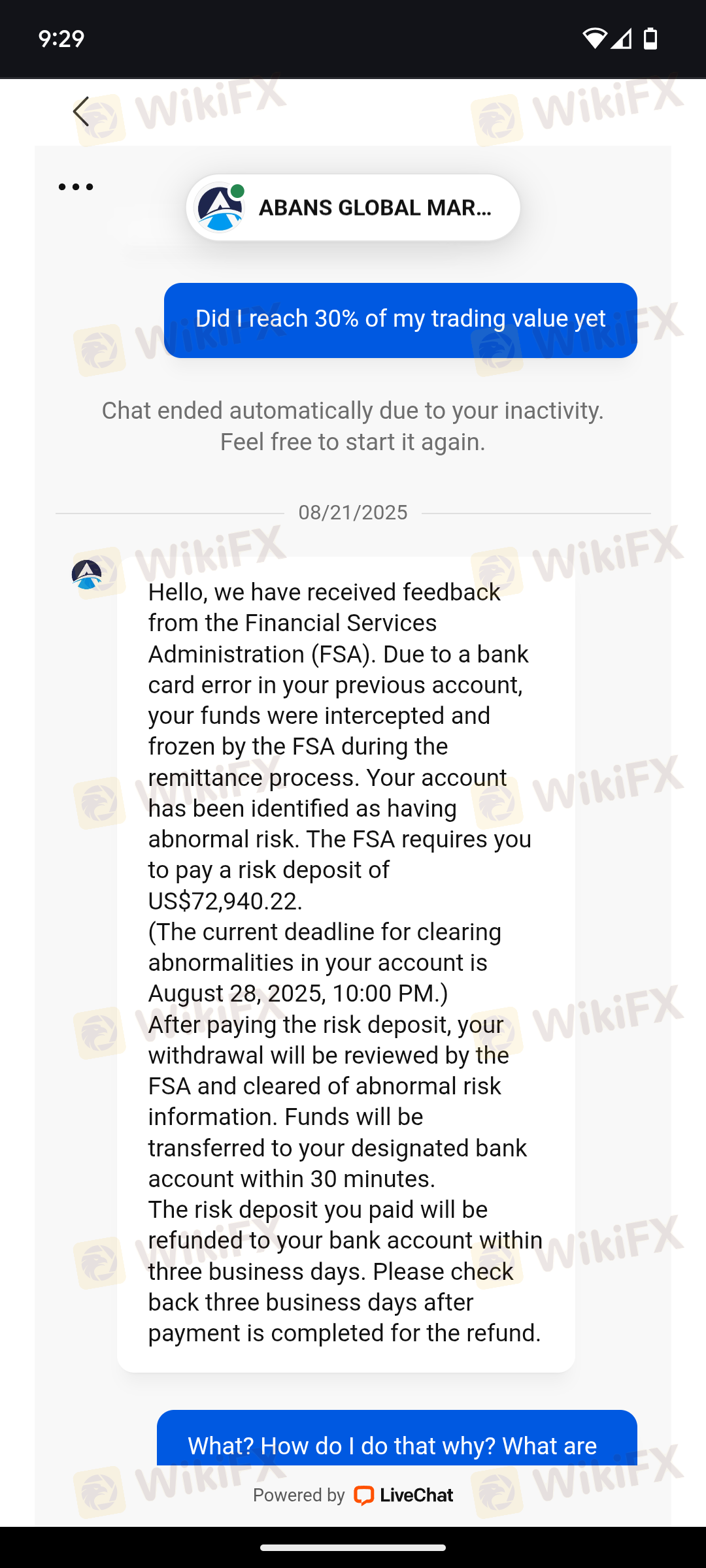

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

SUNDELL LIMITED

Company Abbreviation

SUNDELL LIMITED

Platform registered country and region

United Kingdom

Company website

Company summary

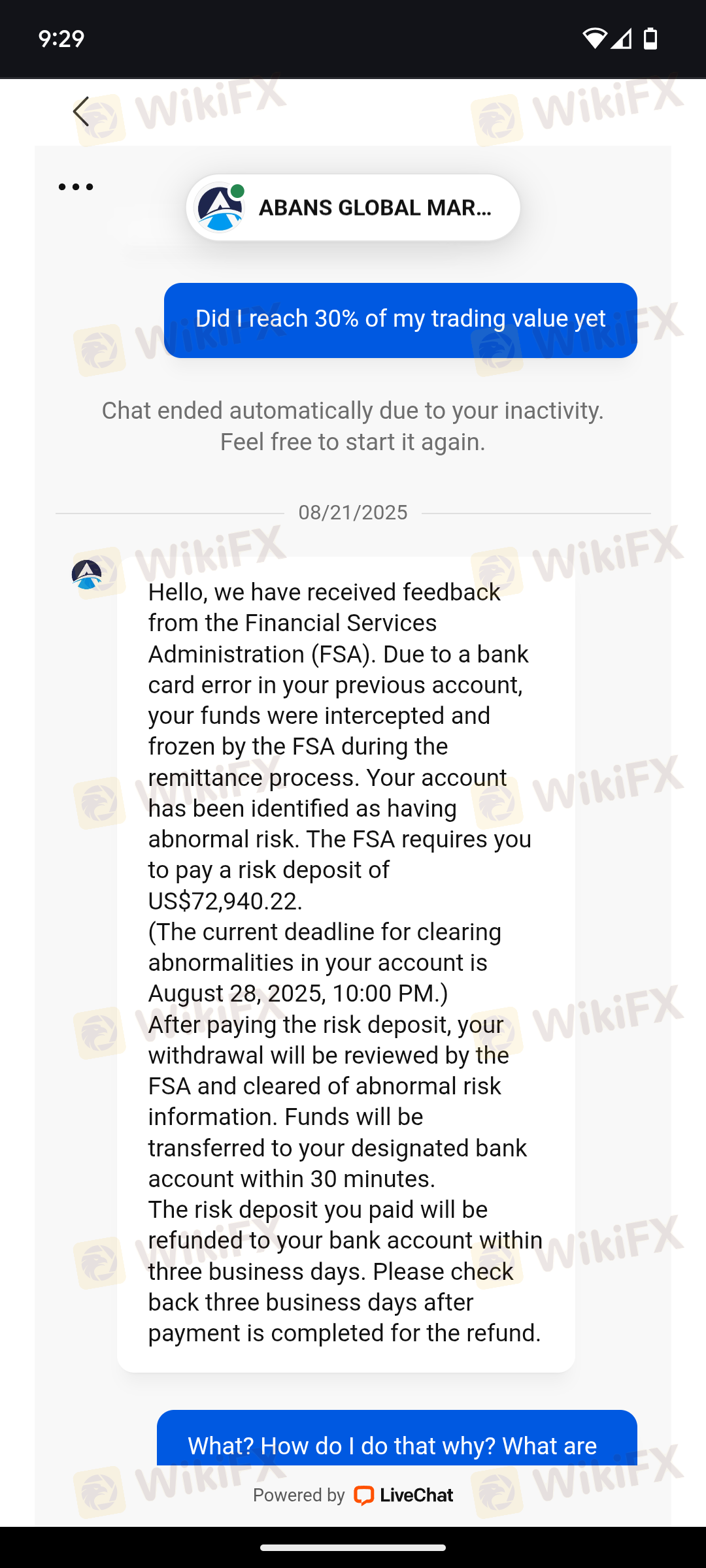

Pyramid scheme complaint

Expose

The official website of Sundell(https://www.sundell-fx.com/) is unable to open now.

| Sundell Limited Review Summary | |

| Founded | 2018 |

| Registered Country/Region | United Kingdom |

| Regulation | Unregulated |

| Market Instruments | Forex, Synthetic Indices, Stocks, Stock Indices, Cryptocurrencies |

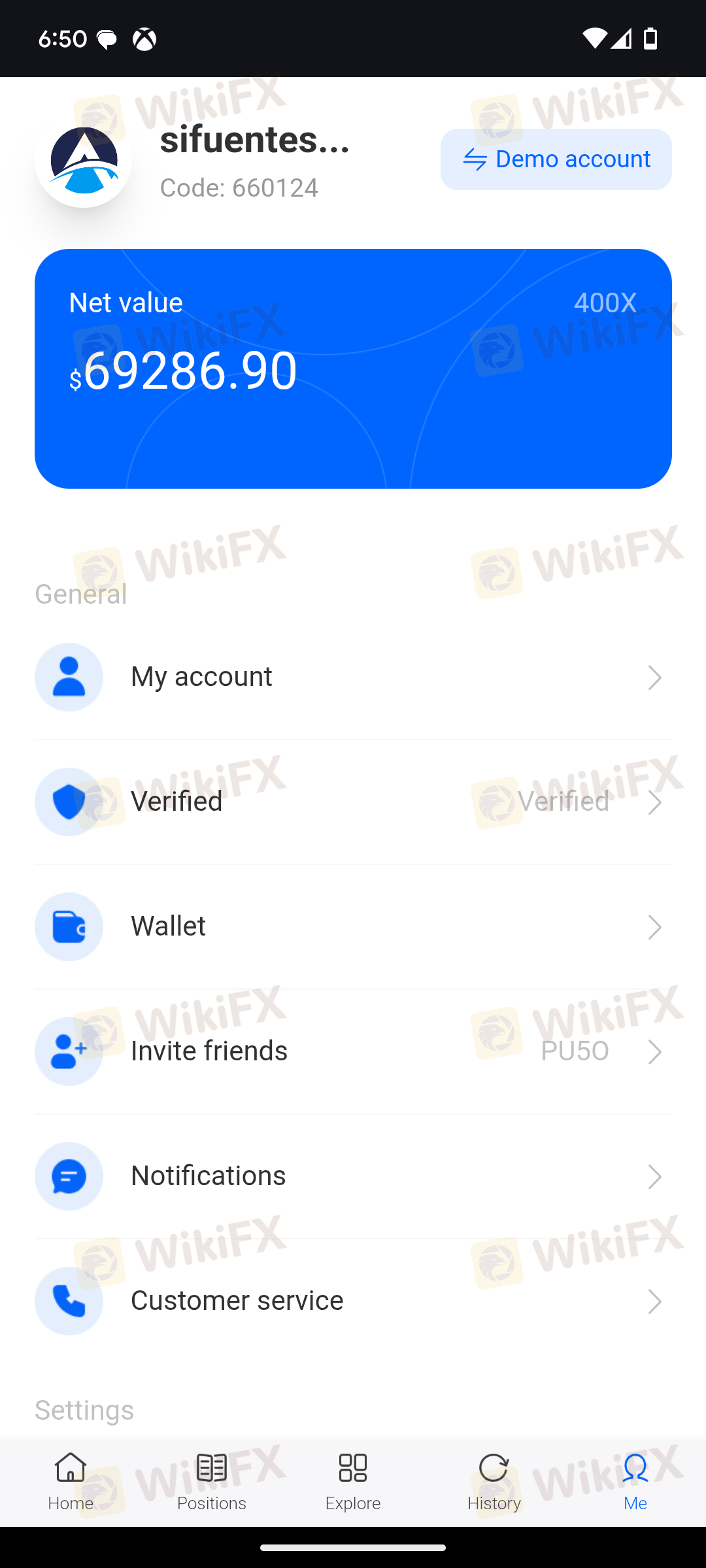

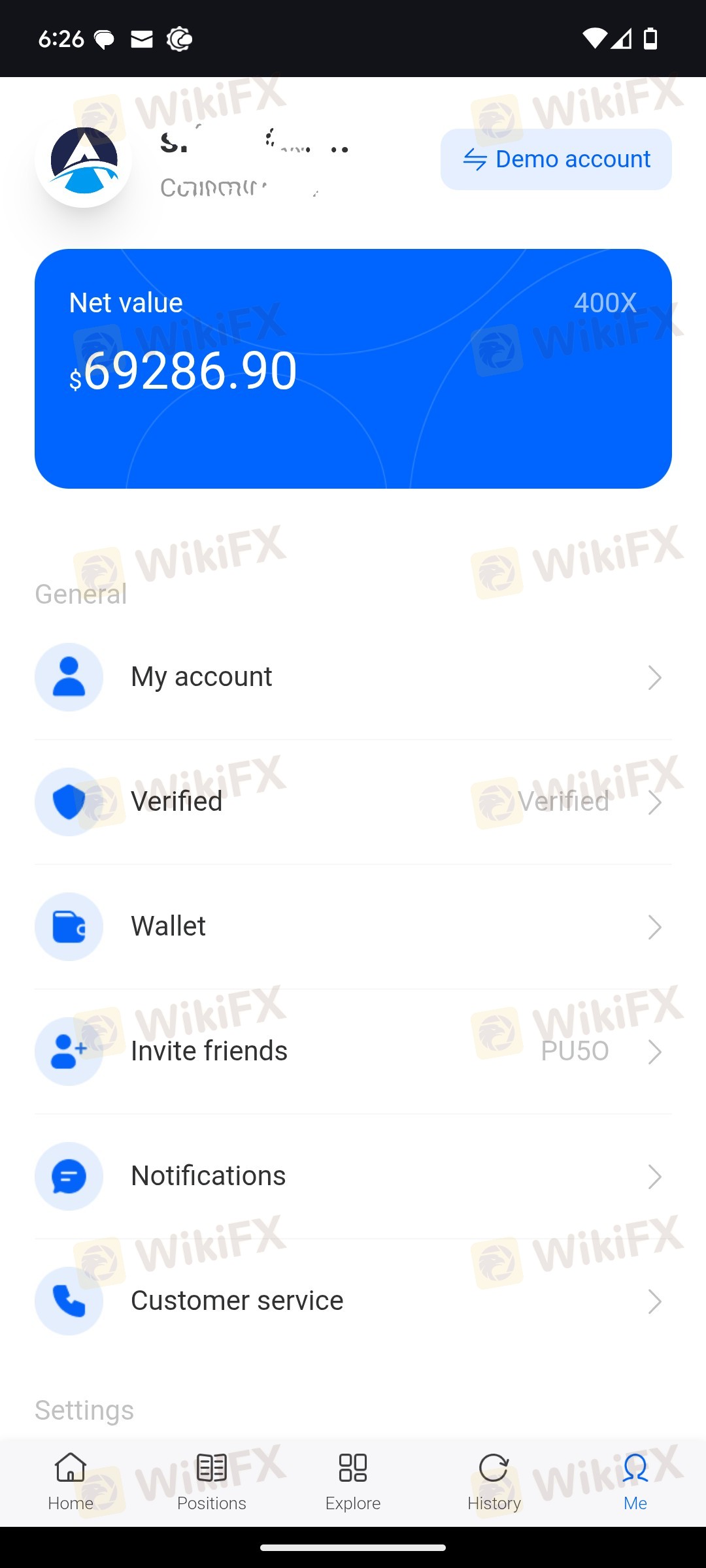

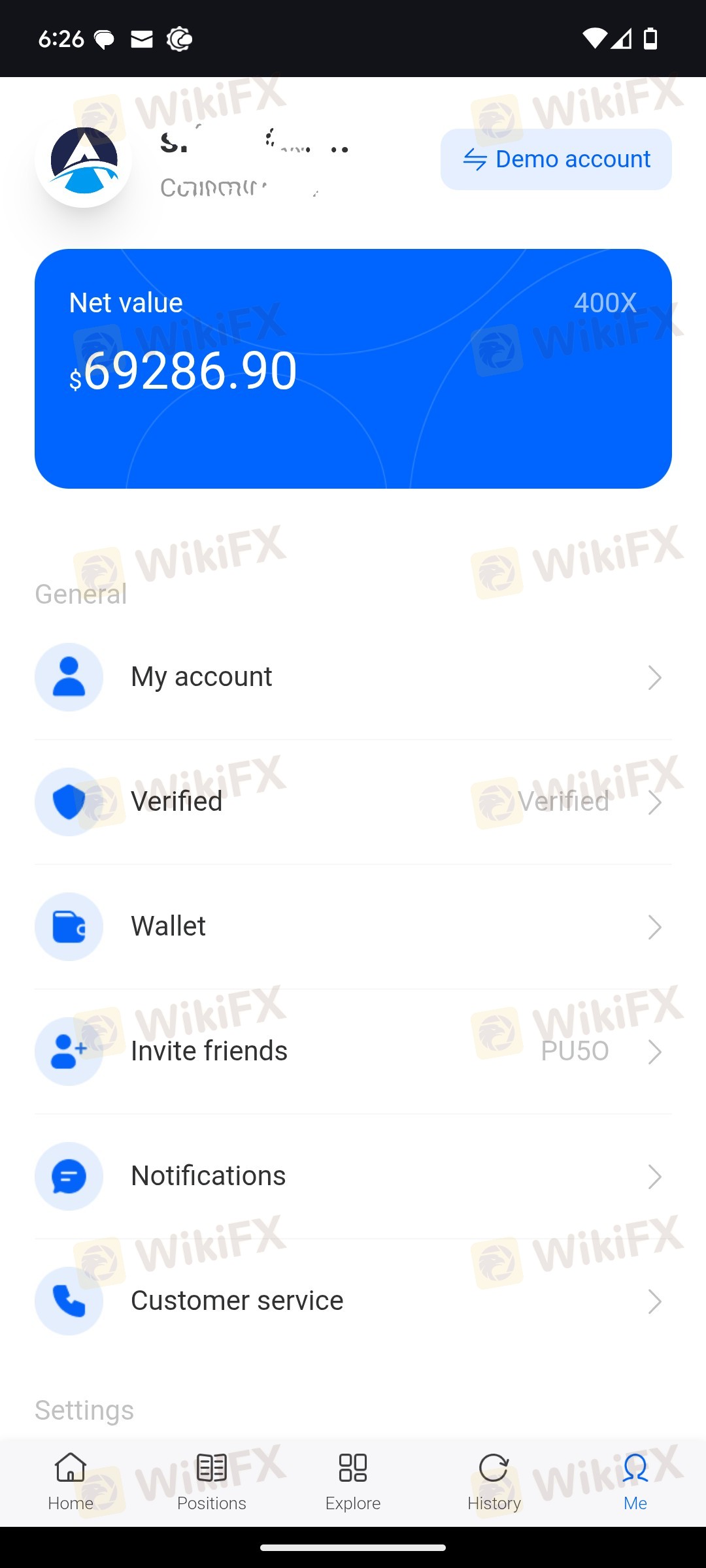

| Demo Account | ✔ |

| Leverage | Up to 1:400 |

| Spread | Not mentioned |

| Trading Platforms | Proprietary web trader platform |

| Min Deposit | Not mentioned |

| Customer Support | Email: sundellltd@gmail.com |

| Physical Address | Not provided |

Established in 2018, Sundell Limited is a trading broker providing access to stocks, synthetic indices, forex, bitcoin, and other financial instruments. The business facilitates trading with leverage of up to 1:400 and offers a bespoke web trader platform.

| Pros | Cons |

| Offers many trading instruments | Unregulated |

| Leverage up to 1:400 | Unclear fee structure |

| Demo account available for practice |

Sundell Limited does not hold any regulatory licenses.

Sundell Limited provides access to many trading products, across multiple markets.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Synthetic Indices | ✔ |

| Stocks | ✔ |

| Stock Indices | ✔ |

| Cryptocurrencies | ✔ |

Sundell Limited offers three main account types: Comprehensive Account, Finance Account, and Financial STP Account. A demo account is available for practice.

| Account Name | Details |

| Comprehensive Account | CFD-focused trading experience |

| Finance Account | Includes forex, commodities, cryptocurrencies |

| Financial STP Account | Optimized for speed and efficiency in trade execution |

Sundell Limited does not disclose its specific information.

Sundell provides max to 1:400 leverage.

| Trading Platform | Available Devices | Suitable for |

| Proprietary web trader | Desktop (Windows, macOS), Mobile (iOS, Android) | Experienced and novice traders |

Sundell doesn't provide detailed information about its deposit and withdrawal fees and methods.

More

User comment

1

CommentsWrite a review

2025-09-03 06:07

2025-09-03 06:07