User Reviews

More

User comment

4

CommentsWrite a review

2025-06-21 03:59

2025-06-21 03:59

2025-05-08 23:00

2025-05-08 23:00

Score

1-2 years

1-2 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Quantity 5

Exposure

Score

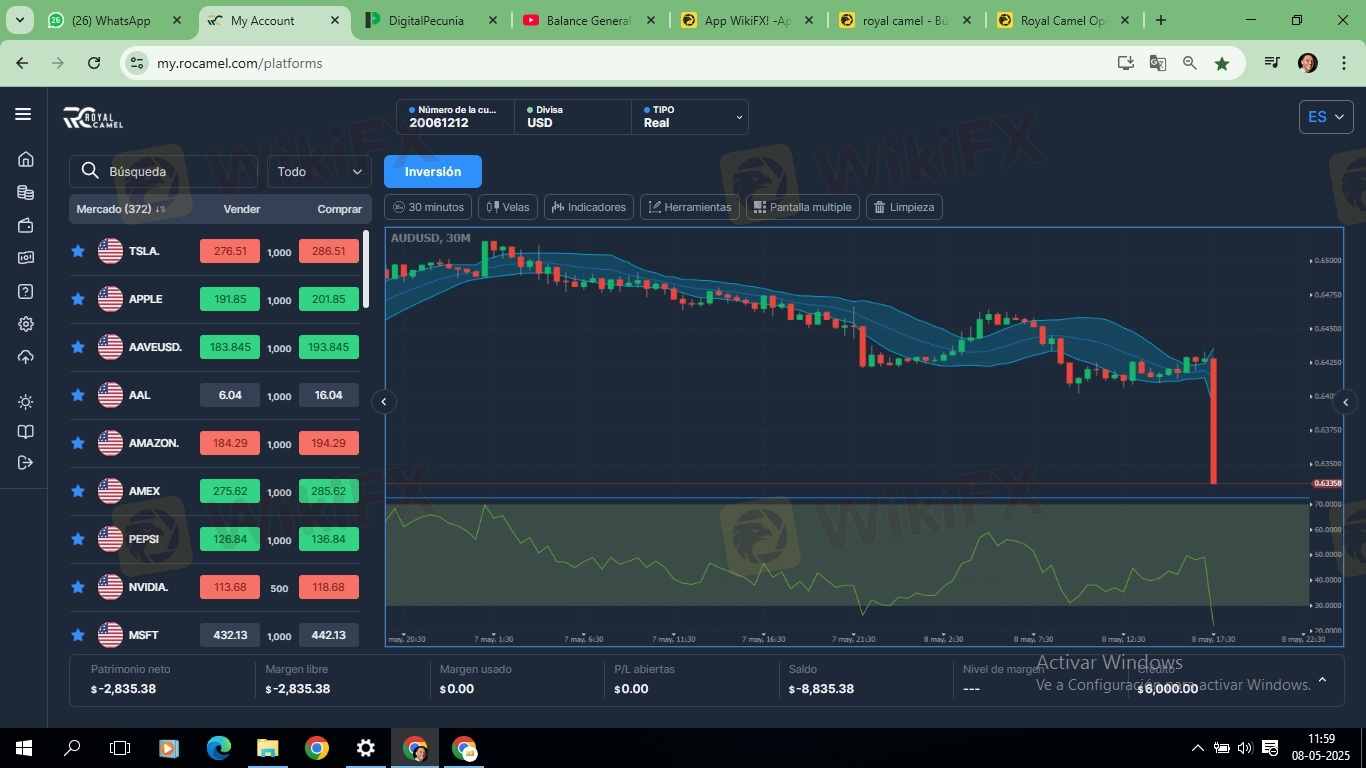

Regulatory Index0.00

Business Index4.87

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

Saudi Arabia Holdings Ltd

Company Abbreviation

Royal Camel

Platform registered country and region

Marshall Islands

Company website

Company summary

Pyramid scheme complaint

Expose

| Royal Camel Review Summary | |

| Founded | 2024 |

| Registered Country/Region | United Kingdom |

| Regulation | Unregulated |

| Market Instruments | Forex, indices, commodities, CFDs and ETFs |

| Demo Account | ❌ |

| Leverage | / |

| EUR/ USD Spread | / |

| Trading Platforms | Sirix Trader |

| Minimum Deposit | $200 |

| Customer Support | / |

In Royal Camel, you can engage as a trader in the major markets across Europe, Asia, the United States, and Latin America, investing in diverse assets including stocks, indices, bonds, and more. But as of now, it has no regulation.

| Pros | Cons |

| Diverse trading products | No regulation |

| High minimum deposits | |

| A newly established company with limited experience | |

| No contact channels provided |

Royal Camel operates their business under regulated situation. Besides, it was registered on 2024-03-12. Its current status is clientDeleteProhibited, clientRenewProhibited, clientTransferProhibited, and clientUpdateProhibited, which means that the domain is restricted from deletion, renewal, transfer, and updates by the client.

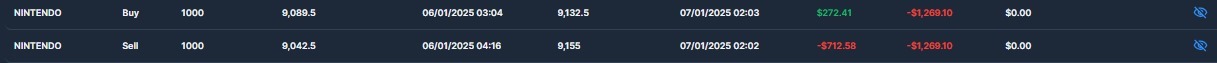

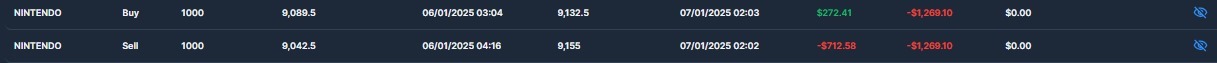

Royal Camel supports more than 3000 instruments including forex, indices, commodities, CFDs and ETFs.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ❌ |

| Shares | ❌ |

| ETFs | ✔ |

| CFDs | ✔ |

| Mutual Funds | ❌ |

In Royal Camel, you can choose three types of live accounts: the Classical, Silver and Gold accounts. But it is notable that they require the minimum deposits of $200, $1000, and $25,000 respectively, which are rather high compared with other brokers.

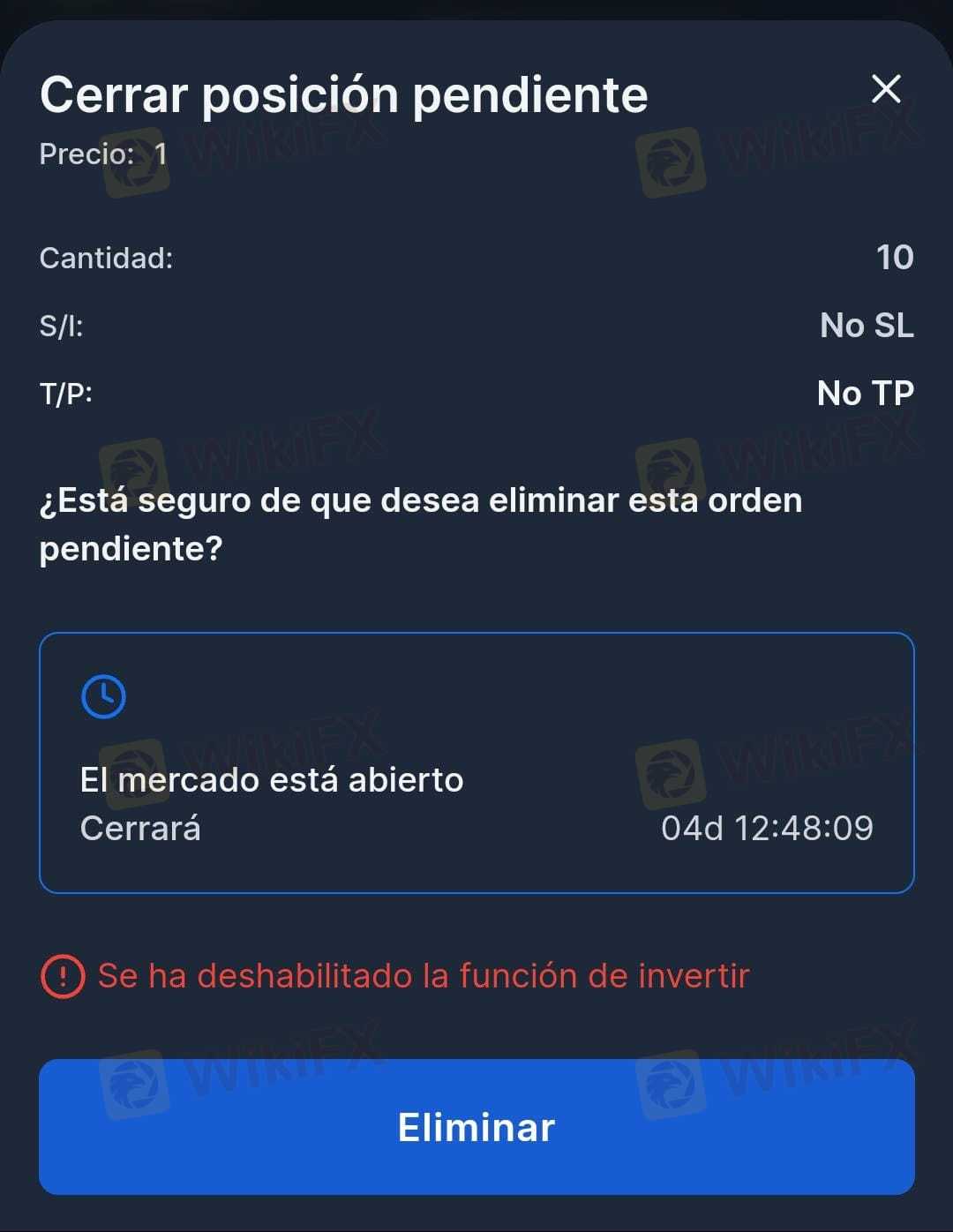

Royal Camel offers Sirix Trader trading platform. Traders can utilize the options menu to perform various actions, including locating assets to invest in, controlling operations, monitoring trades, reviewing history, managing open positions, displaying graphs with different indicators, and accessing trading signals.

In conclusion, Royal Came is a newly established forex broker offering many variety of trading products. But it is not suitable for novices because it is not regulated and require high minimum deposits.

Is Royal Camel safe?

No. It is not regulated well.

Is Royal Camel a good for beginners?

It does not offer a standard trading platform like MT4 or demo accounts to help users familiarize themselves with trading conditions.

Is Royal Camel good for day trading?

No.

At Royal Camel, are there any regional restrictions for traders?

No.

More

User comment

4

CommentsWrite a review

2025-06-21 03:59

2025-06-21 03:59

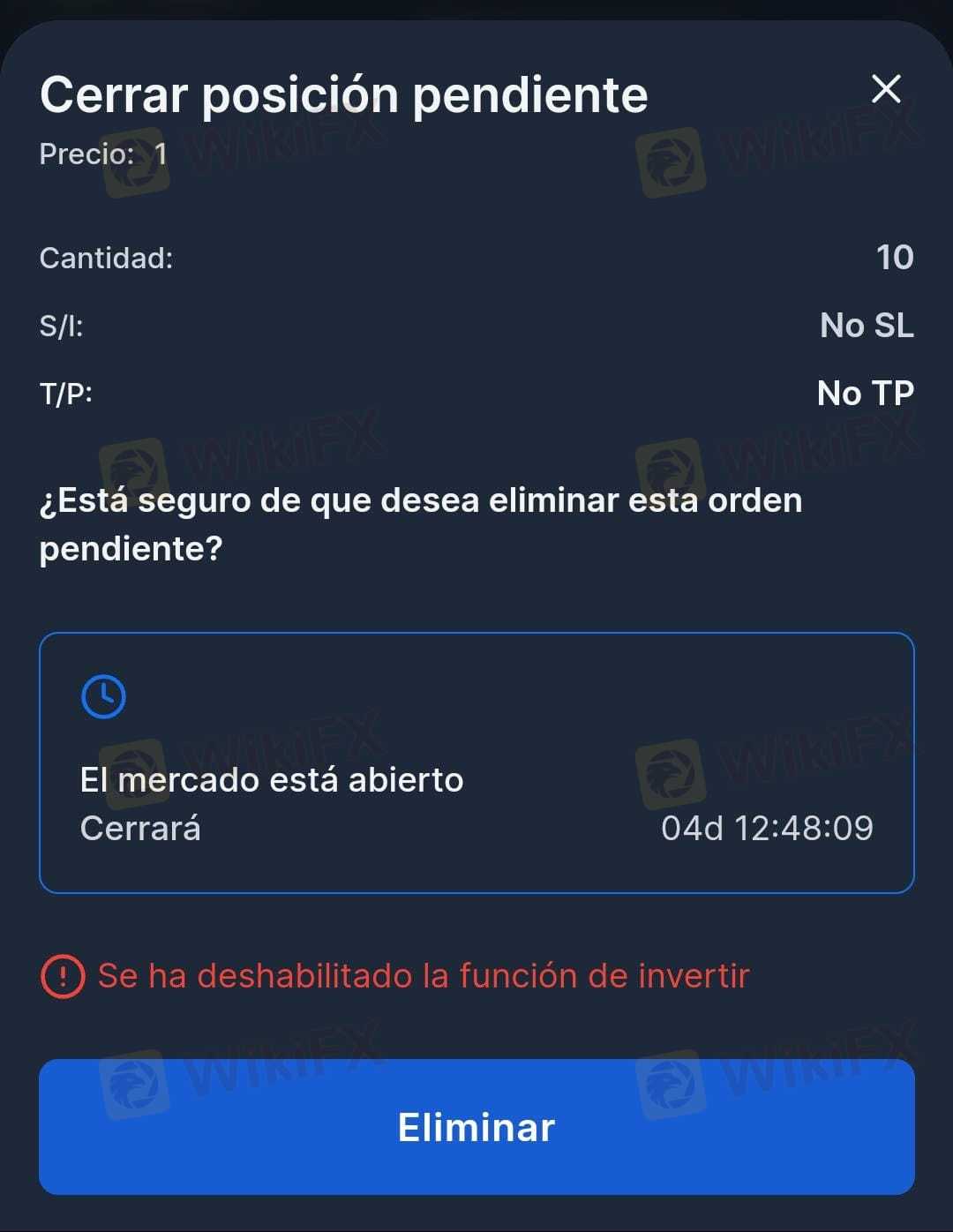

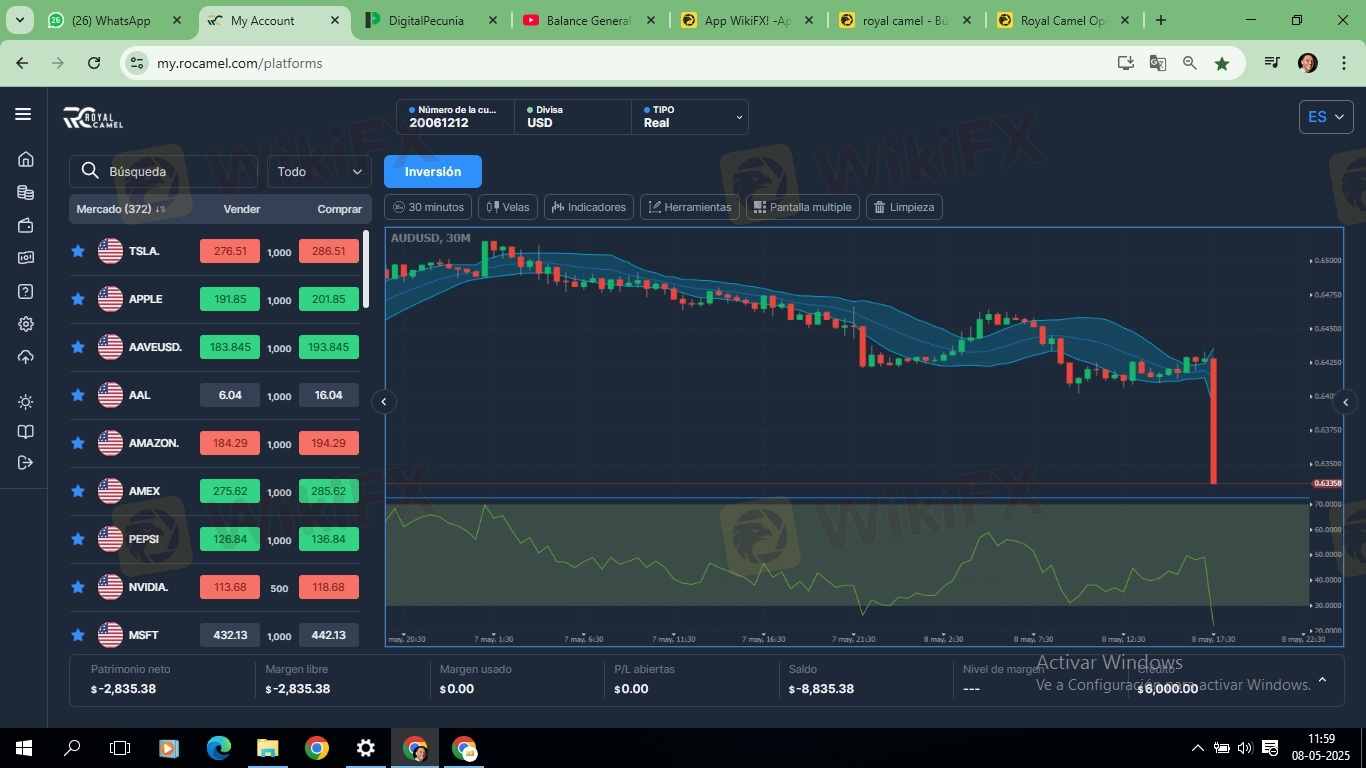

2025-05-08 23:00

2025-05-08 23:00