User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index5.80

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

| QUANTUM METAL Review Summary | |

| Founded | 2012 |

| Registered Country/Region | Malaysia |

| Regulation | No regulation |

| Trading Product | Precious metals |

| Demo Account | / |

| Leverage | Up to 1:10 |

| Trading Platform | / |

| Minimum Deposit | RM 10 |

| Customer Support | Phone: +60 3-8605 3611 |

| Email: info@quantummetal.com | |

| Social Media: YouTube, Facebook | |

| Address: 4, Jalan Residensi, 10450 George Town, Pulau Pinang | |

Quantum Metal, established in 2012 and registered in Malaysia, is an unregulated precious metals corporation that specializes in digital gold investment. It provides 24/7 access to LBMA-certified 99.99% physical gold, with options for storage, cash conversion, and leveraged gold exposure. However, it is not licensed by Bank Negara Malaysia or the Securities Commission Malaysia.

| Pros | Cons |

| Multiple account types | Not regulated |

| Low minimum deposit | Limited payment options |

Quantum Metal is not a regulated financial company. It is registered in Malaysia, but the Securities Commission Malaysia (SC) or Bank Negara Malaysia (BNM) do not give it permission to do business there. Please be aware of the risk!

WHOIS records show that the domain quantummetal.com was registered on July 10, 2012. It is still live, and its registration will end on July 10, 2026. The last time the domain was changed was on June 20, 2025. It has the status “client transfer prohibited” and “client update prohibited.”

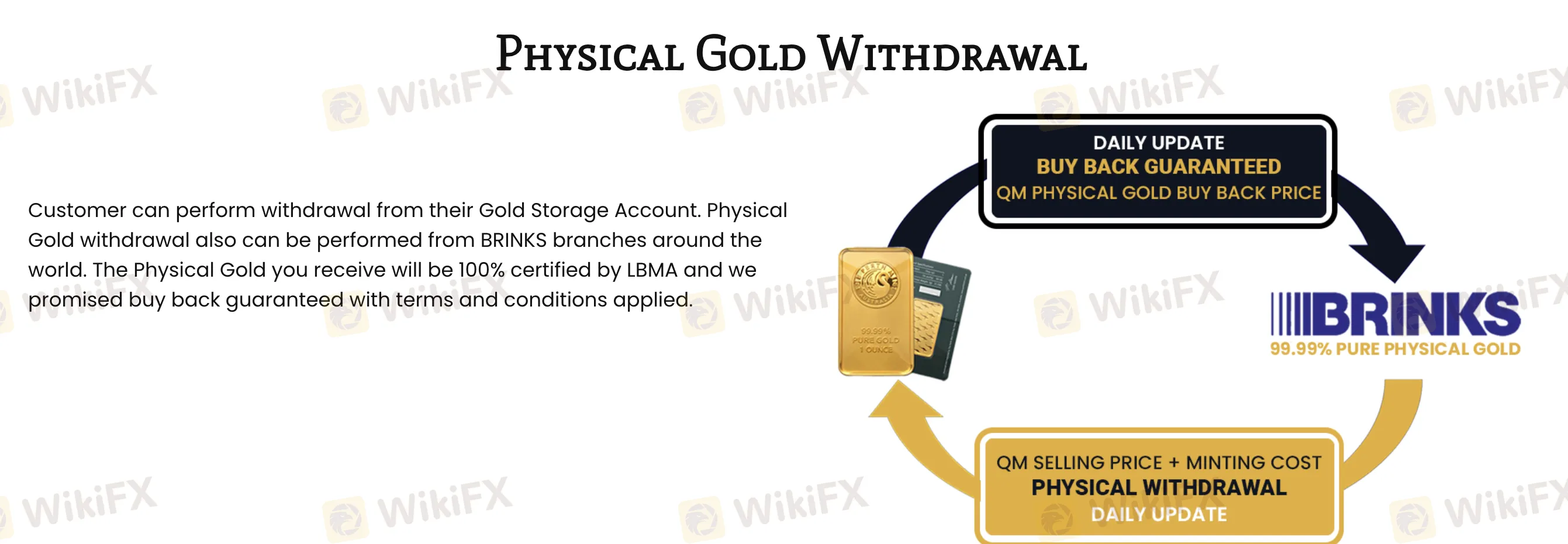

Quantum Metal provides digital gold investment services. The company provides a safe 24/7 gold storage platform backed by 99.99% LBMA-certified physical gold kept at Brinks Singapore. Clients can buy, store, convert, and increase their gold holdings with additional liquidity and leverage options.

Quantum Metal has three primary types of live accounts or gold investment products. All of these are linked to its Gold Storage Account (GSA) platform.

| Account Type | Feature | Supporting Physical Gold Withdrawal |

| Gold Storage Account (GSA) | Base product for buying/storing physical gold | ✔ |

| Gold Convert Account (GCA) | Convert up to 85% of gold holding to cash | ✔ |

| Gold Asset Enhance (GAE 5×/10×) | Asset‑multiplying products without extra top‑ups | ❌ (hours held as gold grams) |

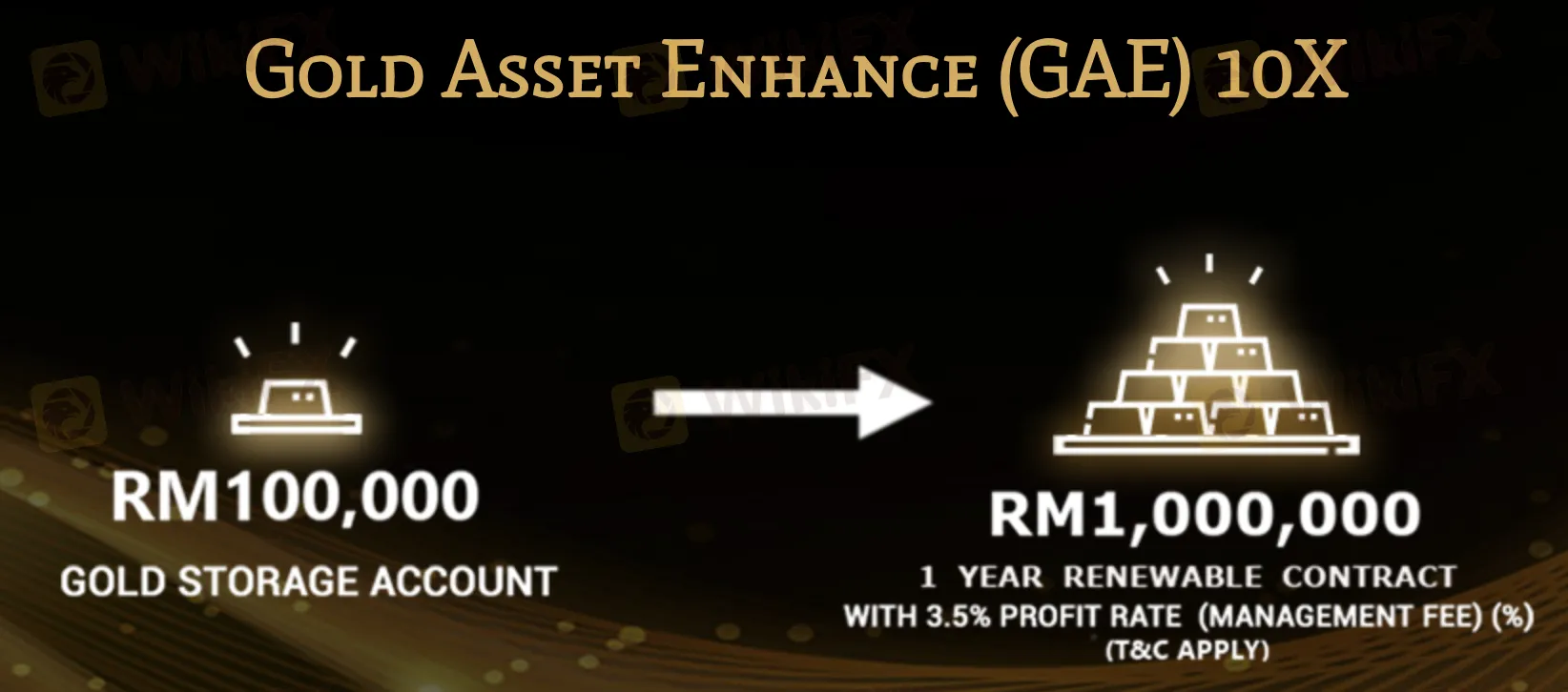

Quantum Metal's Gold Asset Enhance (GAE) products, GAE 5× and GAE 10×, provide clients with leveraged gold investment opportunities worth up to 5 or 10 times their capital.

Quantum Metal does not impose explicit deposit fees, however withdrawing real gold may result in handling and minting expenses, which are removed in grams from your gold balance. The minimum initial purchase for a Gold Storage Account is RM 10 worth of gold.

| Method | Minimum Deposit | Minimum Withdrawal | Fees (to QM) | Processing Time / Notes |

| Bank Payment | RM 10 equivalent | At least 1 g balance | No deposit fee; withdrawal minting fee deducted in grams | Deposit added same day upon proof of payment; physical withdrawal up to 7 business days to collect at an Ar Rahnu TEKUN branch |

| Physical Gold Collection | / | Minimum 1 g (≈1.3 g purchase) | Handling/minting/shipping fee | Collection arranged within 5–10 days; must collect within 15 working days or QMSB sells and refunds in grams |

| Gold Transfer (to other QM account) | RM 10 equivalent | At least 1 g remains | Transfer fee deducted in grams | Instant within QM system; sender must leave ≥1 g post-transfer |

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment