User Reviews

More

User comment

3

CommentsWrite a review

2025-11-20 05:44

2025-11-20 05:44

2024-07-19 18:35

2024-07-19 18:35

Score

2-5 years

2-5 yearsSuspicious Regulatory License

MT5 Full License

Regional Brokers

High potential risk

Influence

Add brokers

Comparison

Quantity 1

Exposure

Score

Regulatory Index0.00

Business Index5.59

Risk Management Index0.00

Software Index7.73

License Index0.00

Single Core

1G

40G

Danger

More

Company Name

Raze Global Markets Ltd

Company Abbreviation

Raze Markets

Platform registered country and region

Saint Lucia

Company website

Company summary

Pyramid scheme complaint

Expose

| Raze Markets Review Summary | |

| Registered Country/Region | Saint Lucia |

| Regulation | No Regulation |

| Market Instruments | Forex, Metals, Energy, Indices, and Cryptos |

| Demo Account | Available |

| Leverage | Up to 1:1000 |

| Spread | From 0.0 pips |

| Trading Platform | MetaTrader 5, Raze Trader, and cTrader (Coming Soon) |

| Minimum Deposit | $50 |

| Regional Restrictions | Not available to residents of certain jurisdictions such as the United States, Singapore, China, North Korea and to jurisdictions on the FATF, OFAC and EU/UN sanctions lists |

| Customer Support | Phone: +44 (0) 7123 456 789 |

| Email: support@razemarkets.com, partnership@razemarkets.com, press@razemarkets.com, institutional@razemarkets.com | |

| Contact Form | |

| Instagram, Linkedin | |

Raze Markets is a Saint Lucia-registered forex and commodities broker offering trading in Forex, Metals, Energy, Indices, and Cryptos. It provides a demo account and leverage of up to 1:1000, with spreads starting from 0.0 pips. The broker supports MetaTrader 5, Raze Trader, and cTrader (coming soon). A minimum deposit of $50 is required, with no commissions on most account types. However, it is not available to residents of certain jurisdictions, including the US, Singapore, and countries under international sanctions.

| Pros | Cons |

|

|

|

|

| |

|

Raze Markets has a FSCA exceeded license.

Raze Markets provides access to a diverse array of market instruments and access over 1,000 CFDs, aiming to meet the trading needs of both retail and institutional investors and enable them to build diversified portfolios and pursue their investment objectives.

Forex: This is the largest and most liquid market globally, allowing you to trade currencies in pairs like EUR/USD (Euro vs US Dollar).

Metals: Precious metals like Gold, Silver, and Platinum are popular choices for trading, offering the potential for both investment and risk-hedging.

Energy: Trade energy products like Crude Oil and Natural Gas, which can be influenced by global events and economic factors.

Indices: Gain exposure to major stock exchanges worldwide through indices like the S&P 500 or FTSE 100, representing a basket of underlying stocks.

Cryptocurrencies: This relatively new asset class offers high volatility and potential for significant gains, but also carries substantial risk. Raze Markets allows trading in popular cryptocurrencies like Bitcoin and Ethereum.

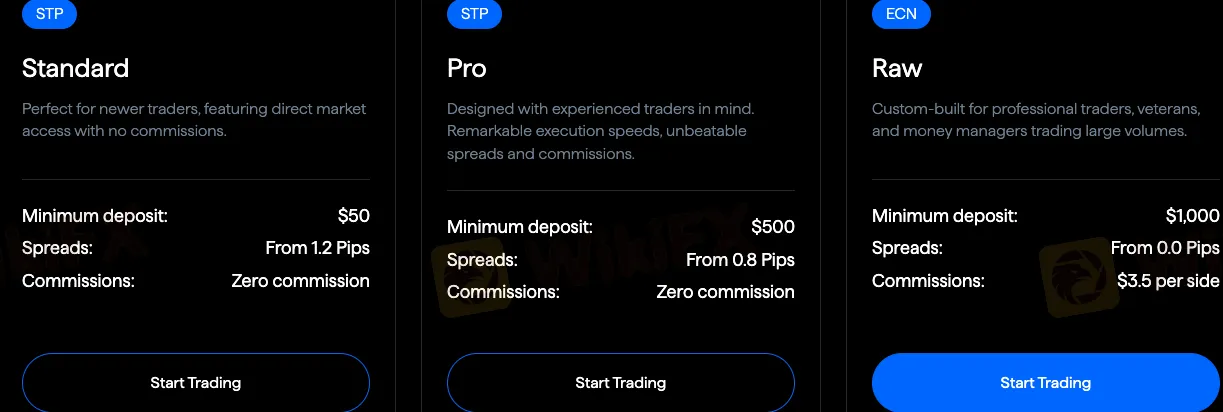

| Account Type | Suitable for | Minimum Deposit | Spreads | Commissions |

|---|---|---|---|---|

| STP Standard | Perfect for newer traders, featuring direct market access with no commissions. | $50 | From 1.2 Pips | Zero commission |

| STP Pro | Designed for experienced traders with fast execution speeds, unbeatable spreads, and zero commissions. | $500 | From 0.8 Pips | Zero commission |

| ECN Raw | Custom-built for professional traders, veterans, and money managers trading large volumes. | $1,000 | From 0.0 Pips | $3.5 per side |

Raze Markets offers leverage of up to 1:1000.

The spread refers to the difference between the buying (ask) price and the selling (bid) price of a financial instrument. It is a key measure of trading costs. A lower spread generally indicates lower costs for traders. For example, with ECN Raw accounts, spreads can start from 0.0 Pips, which means there is minimal difference between the buy and sell price, benefiting high-frequency traders and those seeking tight spreads.

Commissions are fees charged by the broker for executing a trade. For STP Standard and STP Pro accounts, there are no commissions, meaning the cost of trading is reflected solely in the spread. However, for ECN Raw accounts, a commission of $3.5 per side is charged, which is common for accounts with ultra-low spreads like 0.0 Pips.

Raze Markets offers a range of trading platforms.

The MetaTrader 5 (MT5) is the worlds most popular platform, featuring advanced tools, comprehensive charting options, and automated trading capabilities, combined with Raze Markets' innovative approach.

Raze Trader is a custom-built, all-in-one platform designed to provide new and experienced traders with a seamless, intuitive trading experience.

Lastly, cTrader (coming soon) offers a finely-tuned balance of simplicity and deep functionality, with easy-to-use features, advanced charting, and automated trading tools, making it ideal for traders seeking both user-friendliness and powerful capabilities.g trading experience. MT5 provides enhanced speed, efficiency, and a comprehensive set of features compared to its predecessor, MT4. Traders can access a wide range of financial markets, armed with powerful analytical tools, on desktop, web, or mobile devices.

Heres a more concise version in table format:

| Platform | Features |

|---|---|

| MetaTrader 5 (MT5) | Popular platform with advanced tools, charting, and automation. |

| Raze Trader | Custom-built, all-in-one platform for both new and experienced traders. |

| cTrader (Coming Soon) | Simple yet powerful platform with advanced charting and automation tools. |

Raze Markets offers instant deposits starting from just $50, with a wide range of deposit methods. Withdrawals are fast, processed quickly in your preferred currency, and there are no commission fees—you keep all the money you earn with no hidden charges.

More

User comment

3

CommentsWrite a review

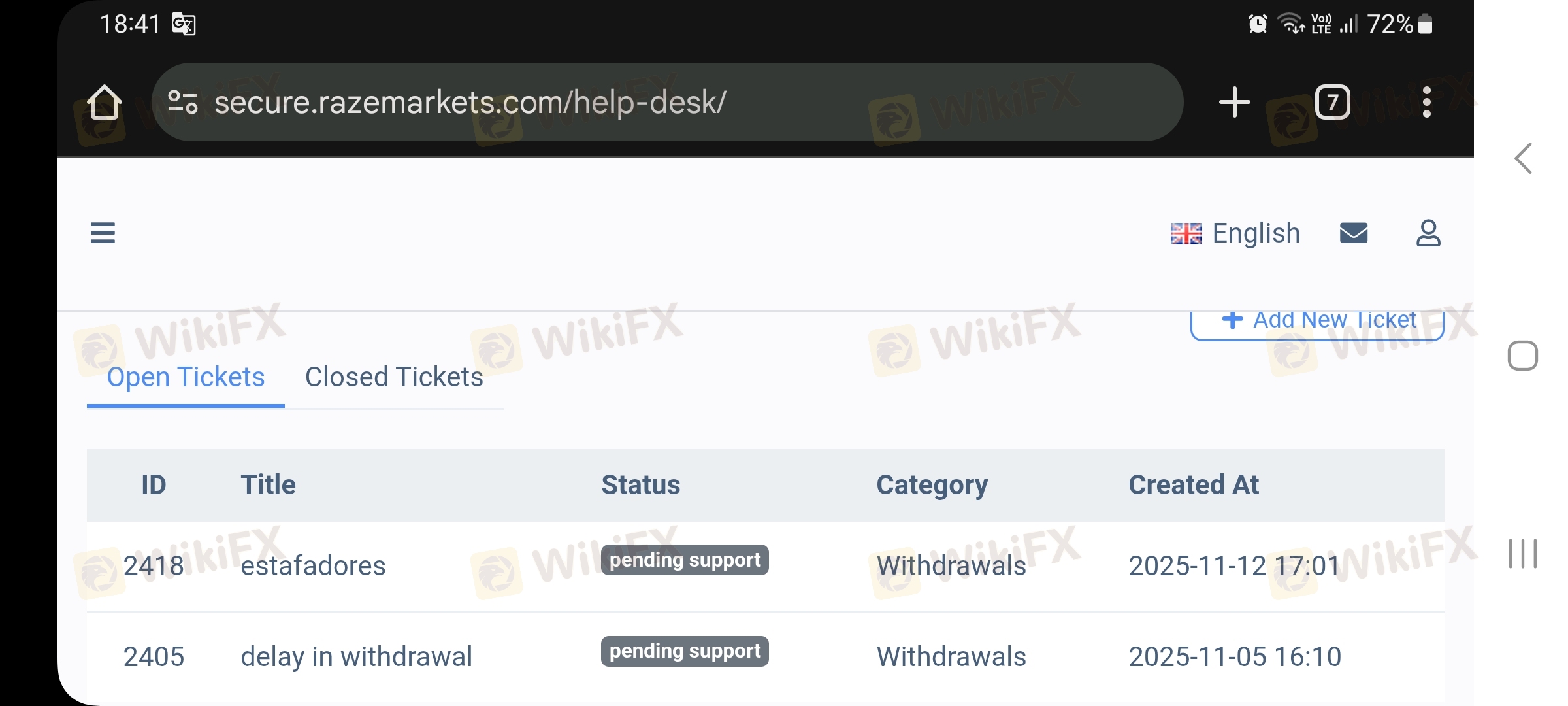

2025-11-20 05:44

2025-11-20 05:44

2024-07-19 18:35

2024-07-19 18:35