User Reviews

More

User comment

5

CommentsWrite a review

2023-02-24 17:29

2023-02-24 17:29 2023-02-15 12:04

2023-02-15 12:04

Score

10-15 years

10-15 yearsSuspicious Regulatory License

Suspicious Scope of Business

Cyprus Market Making License (MM) Revoked

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index8.00

Risk Management Index0.00

Software Index4.00

License Index0.00

Single Core

1G

40G

More

Company Name

OBR Investments Limited

Company Abbreviation

OBRinvest

Platform registered country and region

Cyprus

Company website

Company summary

Pyramid scheme complaint

Expose

| Obrinvest Review Summary | |

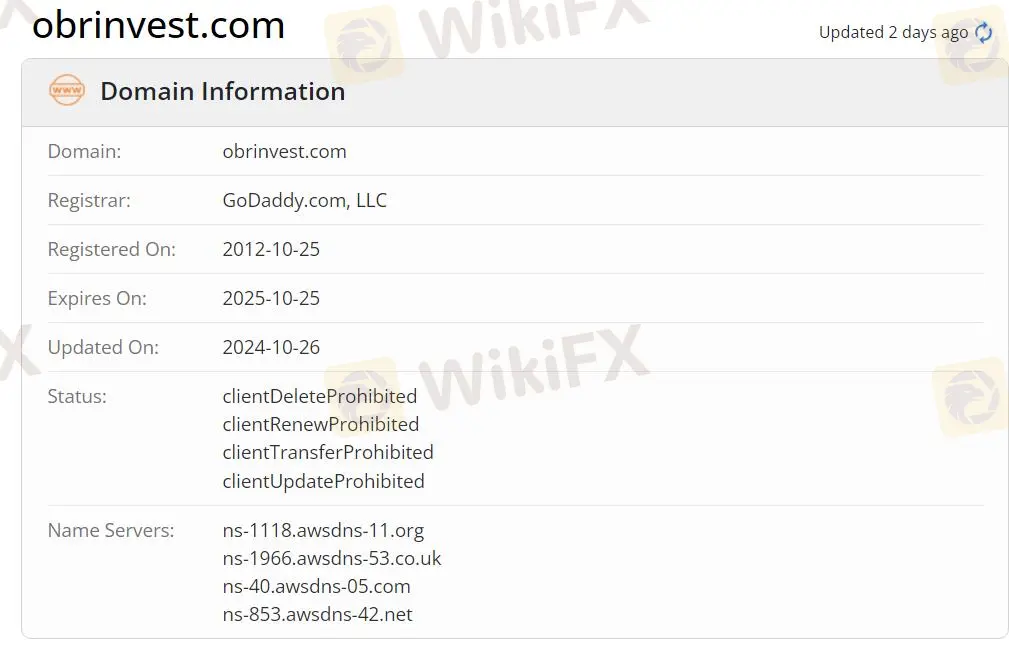

| Founded | 2012 |

| Registered Country/Region | Cyprus |

| Regulation | CYSEC |

| Market Instruments | Cryptos, Currencies, Commodities, Stocks, Indices |

| Demo Account | ✅ |

| Leverage | Up to 1:400 |

| EUR/USD Spread | 3 pips (Basic account) |

| Trading Platform | Webtrader |

| Min Deposit | €250 |

| Customer Support | Tel: +357 25763605 |

| Email: info@obrinvest.com | |

| Address: 12 Archiepiskopou Makariou Avenue III, Office No. 201, ZAVOS KRISTELLINA TOWER, 4000, Mesa Geitonia, Limassol, Cyprus | |

| Restricted Regions | Only available within the European Economic Area (excluding Belgium) and Switzerland |

OBrinvest is an online forex and CFDs broker, owned and operated by OBR Investments Limited, a Cyprus Investment Firm, authorized and regulated by the Cyprus Securities and Exchange Commission with CIF licence number 217/13. OBrinvest offers various financial instruments, including Cryptos, Currencies, Commodities, Stocks, and Indices.

| Pros | Cons |

| Regulated by CySEC | Restricted regions |

| Diverse market instruments | Wide spreads |

| Multiple account types | No MT4/5 |

| Demo accounts | High minimum deposit |

| Unknown payment methods |

Yes. Obrinvest is regulated by Cyprus Securities and Exchange Commission (CySEC).

| Regulated Country | Regulated Authority | Current Status | Regulated Entity | License Type | License Number |

|---|---|---|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | Regulated | OBR Investments Ltd | Market Making (MM) | 217/13 |

| Tradable Instruments | Supported |

| Cryptos | ✔ |

| Currencies | ✔ |

| Commodities | ✔ |

| Stocks | ✔ |

| Indices | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

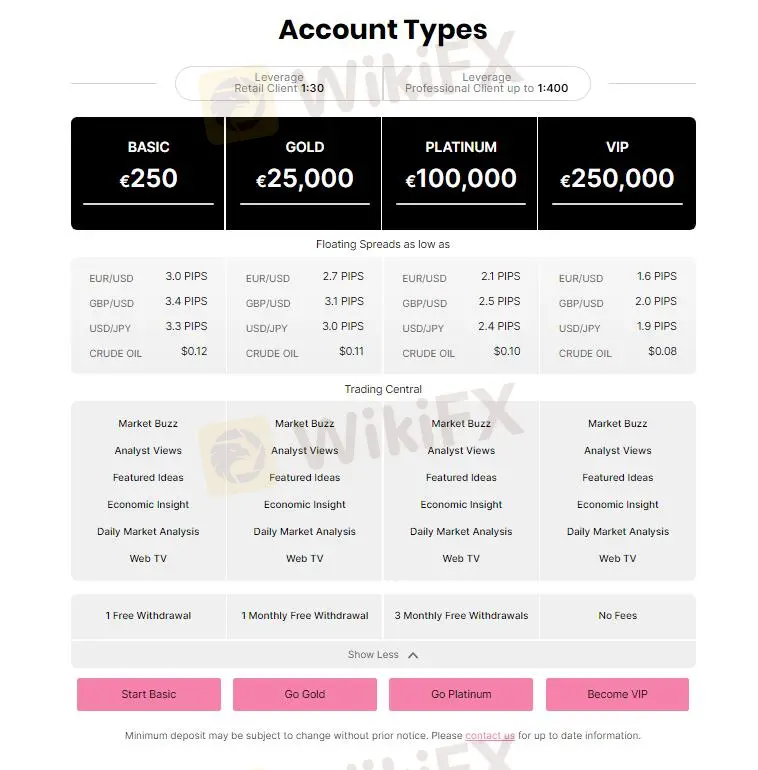

| Account Type | BASIC | GOLD | PLATINUM | VIP |

|---|---|---|---|---|

| Min Deposit | €250 | €25,000 | €100,000 | €250,000 |

Obrinvest offers leverage up to 1:400, which can potentially bring high returns, but it also comes with high risks.

| Account Type | BASIC | GOLD | PLATINUM | VIP |

|---|---|---|---|---|

| EUR/USD Spread | 3.0 pips | 2.7 pips | 2.1 pips | 1.6 pips |

| GBP/USD Spread | 3.4 pips | 3.1 pips | 2.5 pips | 2.0 pips |

| USD/JPY Spread | 3.3 pips | 3.0 pips | 2.4 pips | 1.9 pips |

| Crude Oil Spread | $0.12 | $0.11 | $0.10 | $0.08 |

| Trading Platform | Supported | Available Devices | Suitable for |

| Webtrader | ✔ | Web | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

| Account Type | BASIC | GOLD | PLATINUM | VIP |

|---|---|---|---|---|

| Free Withdrawal Times | 1 Free Withdrawal | 1 Monthly Free Withdrawal | 3 Monthly Free Withdrawals | No Fees |

After the withdrawal of CIF Licence No. 217/13, what is the current status of OBRInvest? A regulatory review and risk assessment.

WikiFX

WikiFX

OBR Investments Limited, which operates under the "OBRinvest" brand, is an EU registered brokerage firm. Investors can trade forex, commodities, equities, cryptocurrencies, and indices using the company's 300+ CFDs, which are licensed and authorised by CySEC. Trade on the world-renowned, sophisticated MT4 platform or OBRinvest's own fully-loaded WebTrader, which comes with all the tools you'll need to achieve your trading objectives. Trade at home or on the move using our trading app, which allows you to trade from any device. OBRinvest provides trading education, 0% trading commissions, and no hidden costs, so no matter what your trading style is, we have everything you need to take on the global financial markets.

WikiFX

WikiFX

More

User comment

5

CommentsWrite a review

2023-02-24 17:29

2023-02-24 17:29 2023-02-15 12:04

2023-02-15 12:04