User Reviews

More

User comment

1

CommentsWrite a review

2023-12-20 21:22

2023-12-20 21:22

Score

5-10 years

5-10 yearsRegulated in China

Derivatives Trading License (AGN)

Suspicious Scope of Business

Medium potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index7.83

Business Index7.55

Risk Management Index8.90

Software Index7.05

License Index7.83

Single Core

1G

40G

More

Company Name

ShenYin & WanGuo Futures Co., Ltd

Company Abbreviation

SHENYIN & WANGUO FUTURES

Platform registered country and region

China

Company website

Company summary

Pyramid scheme complaint

Expose

| SHENYIN & WANGUO Review Summary | |

| Founded | 2007 |

| Registered Country/Region | China |

| Regulation | CFFEX |

| Market Instruments | Commodity Futures, Financial Index Futures, Bond Futures, Commodity Options, Financial Index Options, ETF Options, Spot ETFs |

| Demo Account | ✅ |

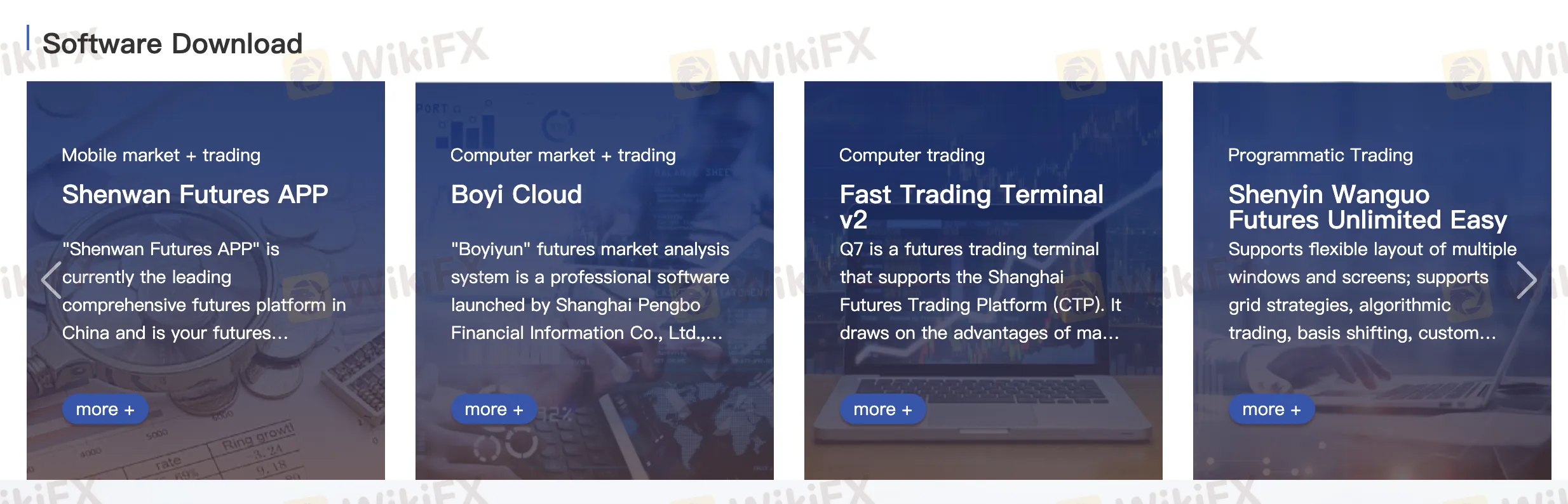

| Trading Platform | Shenwan Futures APP, Boyi Cloud, Fast Trading Terminal v2, Shenyin Wanguo Futures Unlimited Easy |

| Minimum Deposit | / |

| Customer Support | Tel: 021-5058-8811 |

| Fax: 021-5058-8822 | |

ShenYin & WanGuo, formed in 2007, is a Chinese futures broker with license No. 0131 from the China Financial Futures Exchange. It provides a wide range of futures, options, and spot market services, as well as advanced platforms for retail and institutional traders.

| Pros | Cons |

| Regulated by CFFEX | Primarily focused on the Chinese domestic market |

| Wide range of tradable instruments | Complex fee structure |

| Multiple professional trading platforms |

Yes, SHENYIN & WANGUO is regulated. It is the holder of a Futures License from the China Financial Futures Exchange (CFFEX), license number 0131. This demonstrates that the corporation is subject to formal regulatory control in China for futures-related operations.

ShenYin & WanGuo offers a lot of different trading products, like futures, options, and spot contracts, on a lot of Chinese exchanges. Clients can trade commodities, financial indices, metals, energy, agricultural products, and ETFs.

| Tradable Instruments | Supported |

| Commodity Futures | ✔ |

| Financial Index Futures | ✔ |

| Bond Futures | ✔ |

| Commodity Options | ✔ |

| Financial Index Options | ✔ |

| ETF Options (Shanghai/Shenzhen) | ✔ |

| Spot ETFs | ✔ |

| Forex | × |

| Stocks | × |

| Cryptocurrencies | × |

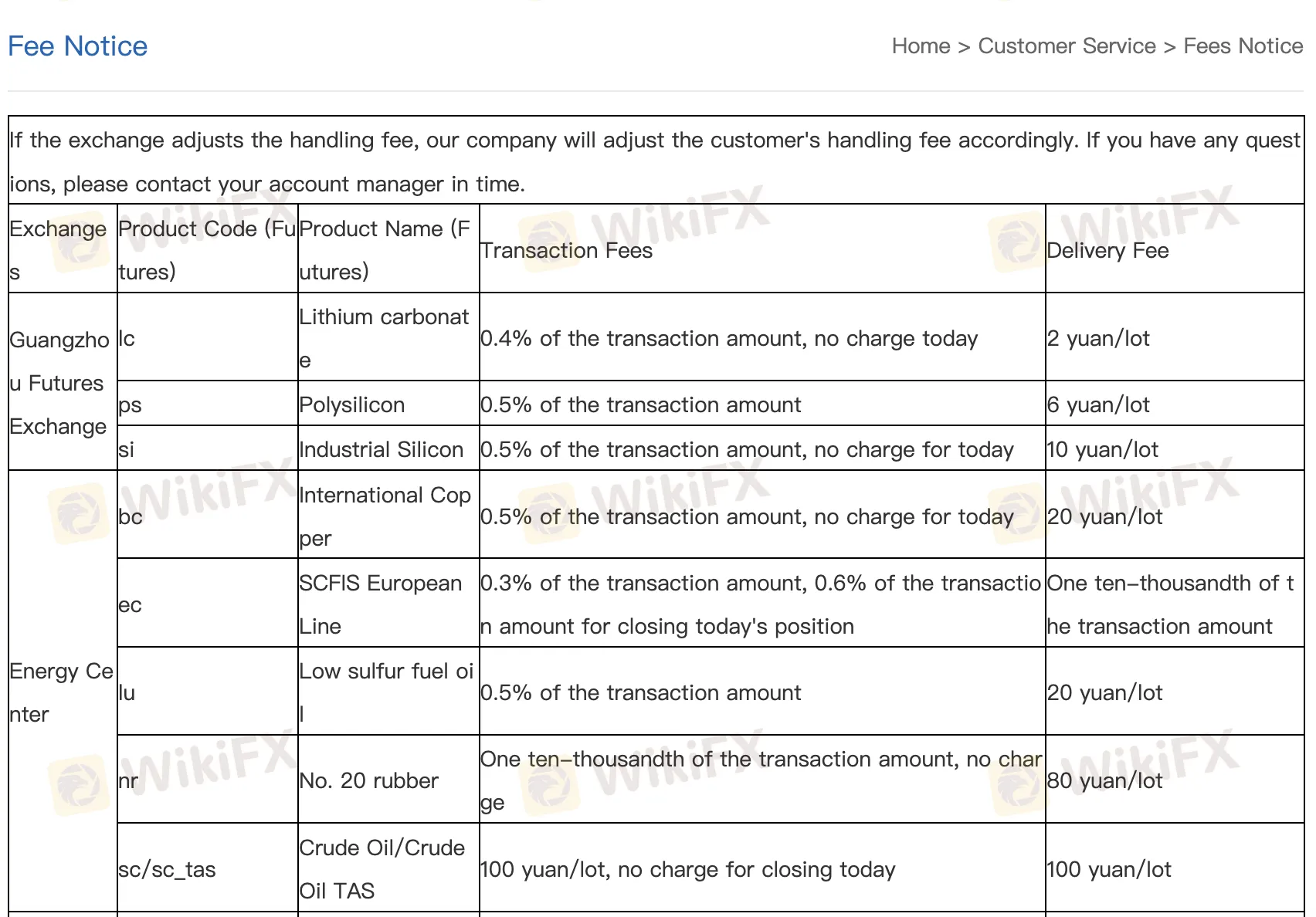

Overall, SHENYIN & WANGUO's fees are deemed moderate when compared to industry standards. Transaction costs vary per product and exchange, although they generally follow the standard prices established by Chinese futures markets. However, some instruments have special offers, such as waived closure fees, which may reduce costs for active traders.

| Fee Type | Typical Charge Example |

| Transaction Fee (Futures) | 0.25% – 1.15% of transaction amount OR fixed ¥5–¥100/lot |

| Delivery Fee (Futures) | ¥2 – ¥200 per lot |

| Transaction Fee (Options) | ¥1 – ¥75 per lot |

| Execution/Performance Fee (Options) | ¥2.5 – ¥750 per lot |

| ETF Options Fee | ¥8 per lot (buy/sell open/close), ¥10 execution fee |

| ETF Spot Fee | 0.003045 of transaction amount |

| Trading Platform | Supported | Available Devices |

| Shenwan Futures APP | ✔ | iOS, Android |

| Boyi Cloud | ✔ | Windows |

| Fast Trading Terminal v2 | ✔ | Windows |

| Shenyin Wanguo Futures Unlimited Easy | ✔ | Windows |

More

User comment

1

CommentsWrite a review

2023-12-20 21:22

2023-12-20 21:22