User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

Suspicious Overrun

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.12

Risk Management Index0.00

Software Index4.00

License Index0.00

Single Core

1G

40G

| Amymax | Basic Information |

| Company Name | Amymax |

| Founded | 2018 |

| Headquarters | United Kingdom |

| Regulations | Not regulated (Regulatory claims suspect) |

| Tradable Assets | Forex, stocks, commodities, indices |

| Account Types | Standard, Premium, Professional |

| Minimum Deposit | $100 |

| Maximum Leverage | Up to 1:1000 |

| Spreads | Varies by account type and instrument |

| Commission | $0.01 per share for stock trading |

| Deposit Methods | Credit card, debit card, wire transfer, Skrill, Neteller |

| Trading Platforms | MetaTrader 4 (MT4), MetaTrader 5 (MT5) |

| Customer Support | Live chat, email, phone (Weekdays, business hours) |

| Education Resources | Articles, webinars, video tutorials |

| Bonus Offerings | None |

Overview of Amymax

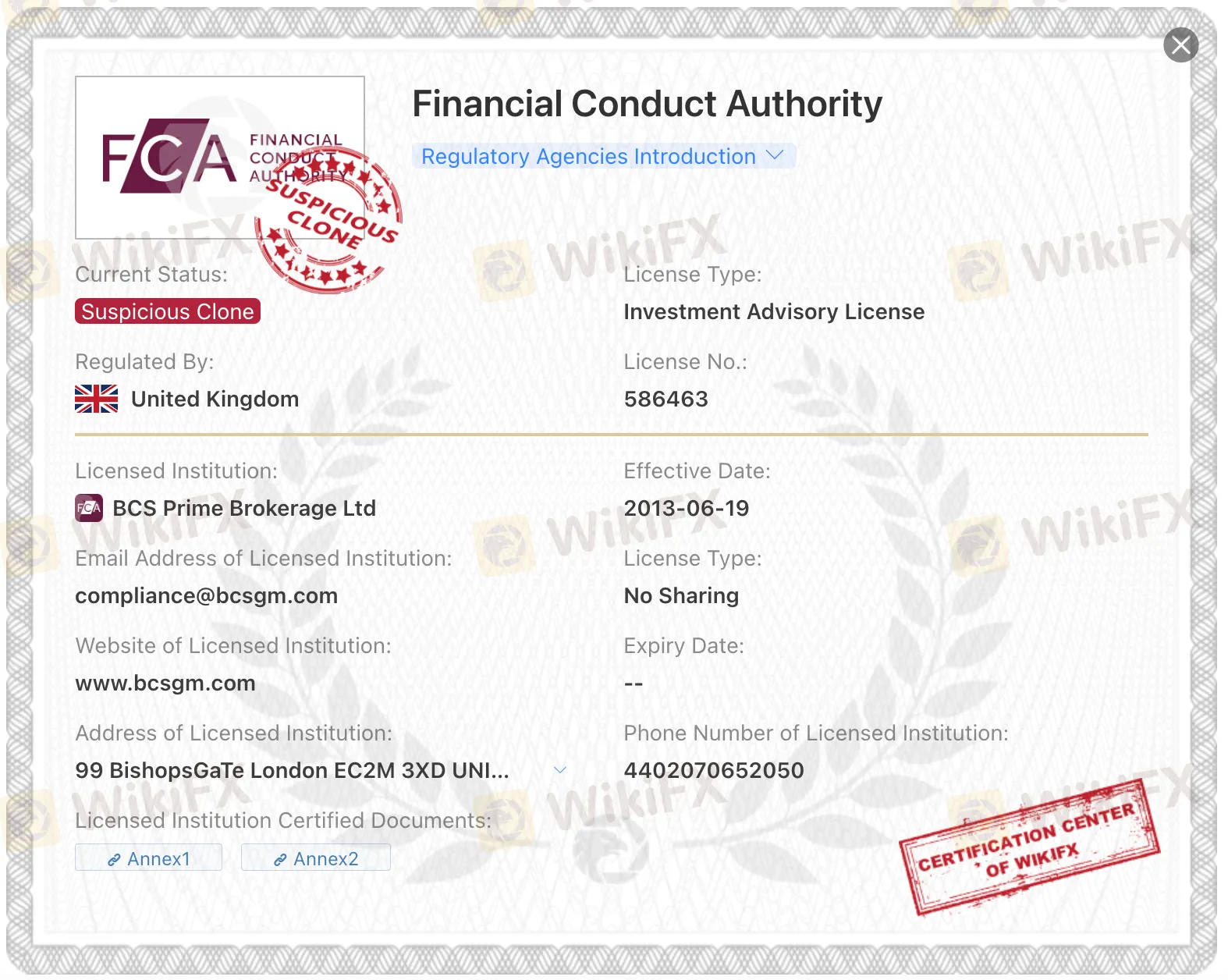

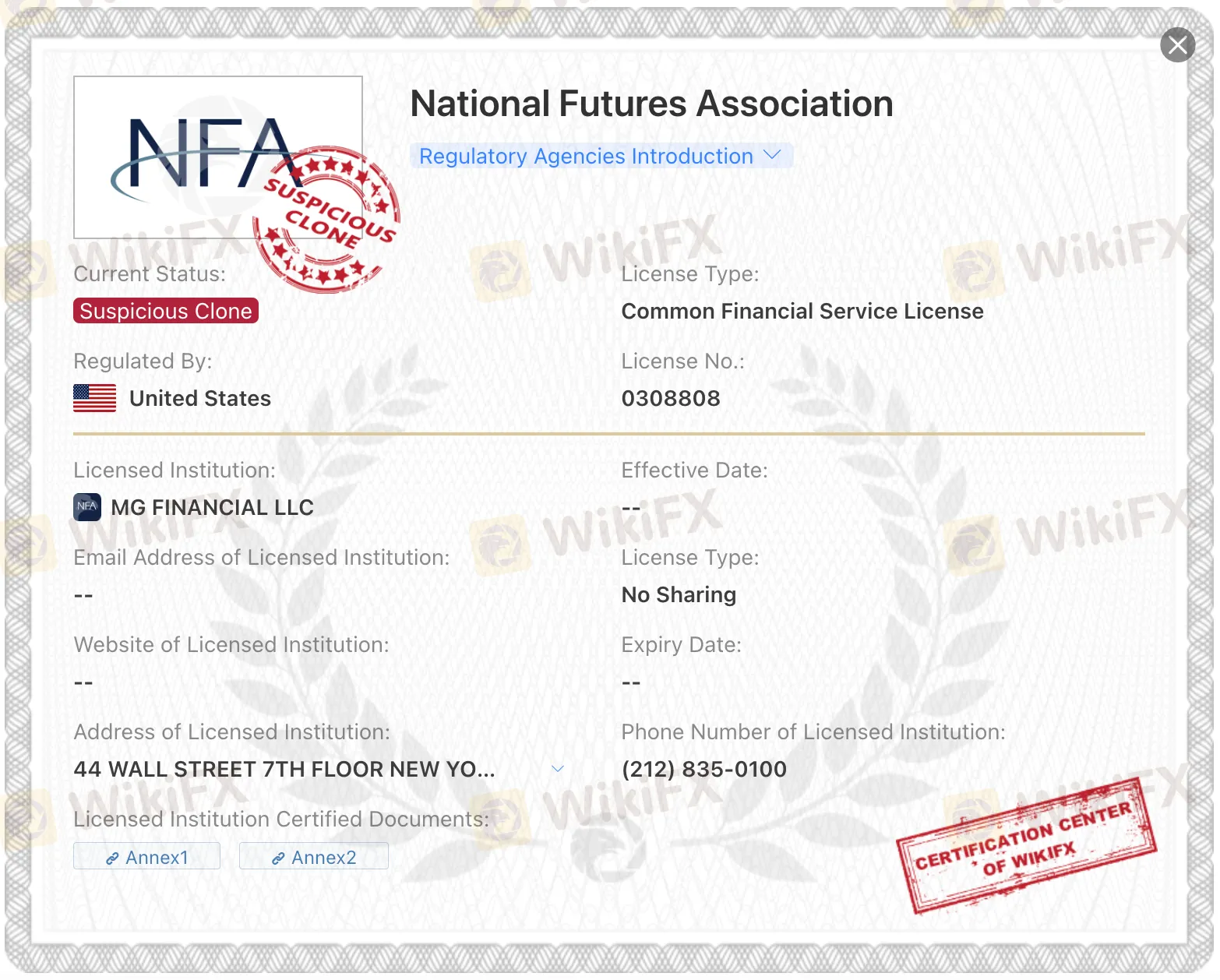

Amymax, established in 2018 and headquartered in the United Kingdom, positions itself as an online trading company that provides access to various financial markets. However, one of the most significant concerns surrounding Amymax is its regulatory status, or lack thereof. The broker claims to be regulated by both the United States NFA (license number: 0308808) and the United Kingdom FCA (license number: 586463). Still, there is no concrete evidence of these regulatory claims on the respective regulators' websites, raising suspicions about the legitimacy of Amymax's regulatory status. The company offers a diverse range of tradable assets, including forex, stocks, commodities, and indices, with different account types to suit various trading preferences. Clients can start trading with a minimum deposit of $100 and access leverage of up to 1:1000. However, the absence of regulatory oversight and questions about the legitimacy of the claimed regulations remain significant drawbacks for Amymax.

Is Amymax Legit?

Amymax is not regulated. The broker currently does not have valid regulation, and there are concerns that the regulatory claims it has made, such as the United States NFA regulation (license number: 0308808) and the United Kingdom FCA regulation (license number: 586463), may be suspect or cloned. Traders and investors are advised to be cautious and aware of the associated risks when considering trading with an unregulated broker like Amymax.

Pros and Cons

Amymax has come under scrutiny as a suspicious clone, which raises significant concerns about its credibility and operations. Due to these concerns, potential traders and investors should exercise caution and thoroughly research before engaging with this platform.

| Pros | Cons |

| None | Suspicious clone |

| Lack of transparency | |

| Potential risks for investors |

Trading Instruments

Amymax offers a comprehensive selection of trading instruments, allowing traders to diversify their portfolios and explore various markets. These instruments include:

1. Forex: Traders can access a vast array of currency pairs, with over 60 options to choose from. This includes major pairs like EUR/USD, GBP/USD, and USD/JPY, as well as minor and exotic pairs.

2. Stocks: Amymax provides access to more than 1,000 stocks from the US, UK, and EU stock markets. This covers a wide range of industries and sectors, enabling traders to invest in companies they are familiar with.

3. Commodities: The platform offers trading opportunities in commodities such as gold, silver, oil, and more. Commodity trading allows investors to hedge against inflation or take advantage of global supply and demand dynamics.

4. Indices: Traders can participate in the performance of major stock market indices like the Dow Jones Industrial Average, S&P 500, and FTSE 100. These indices represent the overall health and performance of specific stock markets.

Here is a comparison table of trading instruments offered by different brokers:

| Broker | Currency | Stocks | Indices | Crypto | Commodities |

| Amymax | Yes | Yes | Yes | No | Yes |

| FXTM | Yes | Yes | Yes | Yes | Yes |

| FP Markets | Yes | Yes | Yes | Yes | Yes |

| XM | Yes | Yes | Yes | Yes | Yes |

Account Types

Amymax provides three distinct account types to cater to the diverse needs of its clients:

1. Standard Account: This is the entry-level account that offers basic features. It's suitable for beginners or those who prefer a simpler trading experience.

2. Premium Account: The Premium account comes with more advanced features, including higher leverage and access to a broader range of trading instruments. This is suitable for intermediate traders looking for more options.

3. Professional Account: The Professional account offers the most comprehensive features, including the highest available leverage and access to all trading instruments. It's designed for experienced traders who require maximum flexibility.

Leverage

Amymax offers its clients access to leverage, a key feature in the world of online trading. Leverage essentially allows traders to control a larger position with a relatively smaller amount of capital. The maximum leverage provided by Amymax is up to 1:1000 for forex and CFD (Contract for Difference) trading.

The concept of leverage can significantly amplify both potential profits and potential losses. While it allows traders to engage in larger positions and potentially increase their earnings, it also means that the risk of substantial losses is equally high. Therefore, it's vital for traders to understand and manage leverage effectively. Responsible use of leverage is crucial, and traders should consider their risk tolerance, risk management strategies, and overall trading plan when deciding how much leverage to apply to their trades.

Traders should keep in mind that while high leverage may offer substantial rewards, it can also lead to substantial losses if not used wisely. This is particularly important for beginners and inexperienced traders who may not be accustomed to the risks associated with leveraged trading. It is advisable to start with lower leverage levels and gradually increase it as you gain more experience and confidence in your trading abilities.

Here is a comparison table of maximum leverage offered by different brokers:

| Broker | Amymax | eToro | XM | RoboForex |

| Maximum Leverage | 1:1000 | 1:400 | 1:888 | 1:2000 |

Spreads and Commissions

Amymax applies flexible fees based on spreads and commissions, which can vary depending on the account type and trading instruments. Spreads represent the difference between buying and selling prices and may fluctuate with market conditions. For instance, the EUR/USD pair has a 2-pip spread for Standard accounts and a 1.5-pip spread for Premium accounts. Commissions are charged at $0.01 per share for stock trading. These costs influence trading expenses and should be considered when making trading decisions, especially for stock traders. Account types and chosen instruments affect fee structures, so it's important to select options aligned with your trading preferences and strategy.

Deposit & Withdraw Methods

Amymax aims to provide clients with convenient options for depositing and withdrawing funds. The brokerage offers several methods for these financial transactions. Clients can choose to use credit cards, debit cards, or opt for wire transfers to move their funds. Moreover, the availability of e-wallet services like Skrill and Neteller offers added flexibility to accommodate a variety of client preferences. This diverse array of deposit and withdrawal methods allows clients to select the most suitable option based on their individual needs and regional availability. It's important to review each method's associated fees, processing times, and any restrictions to make well-informed choices when managing your trading account with Amymax.

Trading Platforms

Amymax provides access to two prominent trading platforms:

1. MetaTrader 4 (MT4): This popular platform is available for desktop, web, and mobile devices. MT4 offers a user-friendly interface, advanced charting tools, technical indicators, and automated trading features via Expert Advisors (EAs).

MetaTrader 5 (MT5): MT5 is an advanced trading platform also available for desktop, web, and mobile devices. It offers more features and advanced capabilities compared to MT4, making it an ideal choice for traders who require a more sophisticated trading environment.

Customer Support

Amymax prioritizes providing customer support to address client inquiries and concerns. Clients can access assistance through multiple communication channels, including live chat for real-time interactions, email for written correspondence, and phone support for direct verbal communication. While these channels offer versatility in reaching out for help, it's important to be aware that customer support is available exclusively on weekdays during regular business hours. This limited availability might pose challenges for clients situated in different time zones or those who require assistance outside of standard business hours. Consequently, it's advisable for clients to consider the timing of their interactions and plan accordingly to ensure timely and efficient support when trading with Amymax.

Educational Resources

Amymax provides various educational resources, including articles, webinars, and video tutorials. These materials aim to enhance traders' knowledge and understanding of the financial markets, technical and fundamental analysis, and trading strategies. While they offer valuable information, the educational resources may not be as comprehensive as those provided by some other brokers.

Trading Tools

Amymax offers a range of trading tools to assist traders in making informed decisions:

1. Economic Calendar: This tool provides information on upcoming economic events and announcements that could impact the financial markets. Traders can plan their strategies around these events.

2. News Feed: A real-time news feed that keeps traders updated on the latest developments and news relevant to their trading activities. Staying informed about current events is essential for making informed trading decisions.

3. Charting Tools: Amymax provides various charting tools that allow traders to conduct in-depth technical analysis. These tools include multiple timeframes, indicators, and drawing tools for analyzing market data and identifying potential trends and entry/exit points.

Conclusion

In conclusion, Amymax, an online trading company founded in 2018 and headquartered in the United Kingdom, offers a diverse range of tradable assets and account types, making it accessible to traders with varying levels of experience. However, a significant drawback is the absence of regulatory oversight, raising concerns about the authenticity of its regulatory claims. While it provides a low minimum deposit requirement and high leverage options, traders should be cautious given the risk involved. Limited customer support availability and less comprehensive educational resources further add to its disadvantages. Traders are encouraged to carefully evaluate these factors and exercise caution when considering Amymax as a trading platform.

FAQs

Q: Is Amymax regulated?

A: Amymax is not regulated, and there are concerns that its regulatory claims, including the United States NFA and United Kingdom FCA regulations, may be questionable.

Q: What is the minimum deposit required to open an account with Amymax?

A: The minimum deposit to open an account with Amymax is $100.

Q: What is the maximum leverage offered by Amymax?

A: Amymax offers a maximum leverage of up to 1:1000 for forex and CFD trading.

Q: What trading platforms are available with Amymax?

A: Amymax provides access to two trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5), available for desktop, web, and mobile devices.

Q: What kind of customer support does Amymax offer?

A: Amymax offers customer support through live chat, email, and phone. However, customer support is available on weekdays during regular business hours.

Q: Does Amymax provide educational resources?

A: Yes, Amymax offers educational resources, including articles, webinars, and video tutorials. These materials are designed to enhance traders' knowledge of the financial markets and trading strategies.

Q: Are there any bonus offerings from Amymax?

A: The information available does not mention any specific bonus offerings from Amymax. Traders should check with the broker for any ongoing promotions or bonuses.

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment