User Reviews

More

User comment

2

CommentsWrite a review

2023-01-22 12:10

2023-01-22 12:10 2022-11-23 10:32

2022-11-23 10:32

Score

15-20 years

15-20 yearsRegulated in Hong Kong

Derivatives Trading License (AGN)

Regional Brokers

Medium potential risk

Influence

Add brokers

Comparison

Quantity 2

Exposure

Score

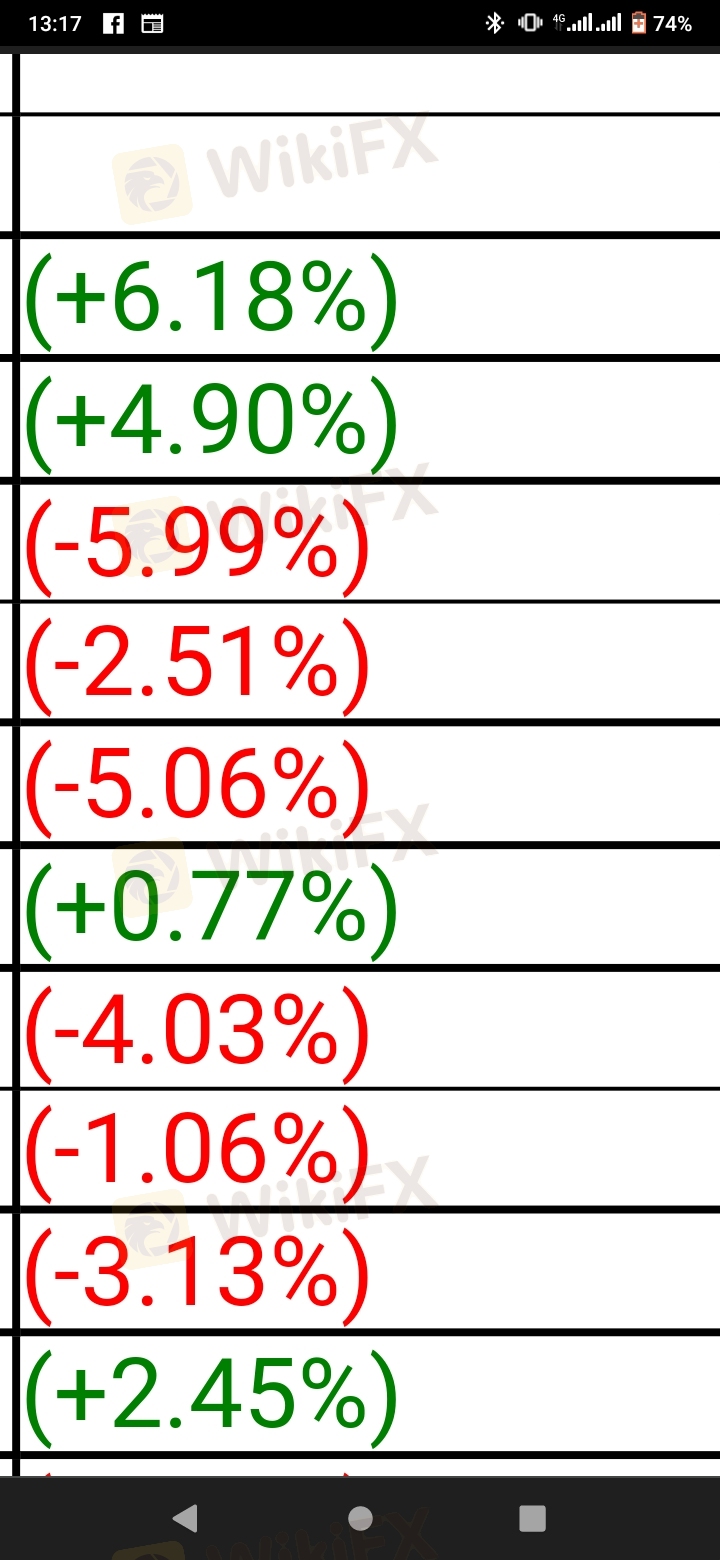

Regulatory Index6.54

Business Index8.00

Risk Management Index8.90

Software Index5.89

License Index6.58

Single Core

1G

40G

More

Company Name

IMC

Company Abbreviation

IMC

Platform registered country and region

Netherlands

Company website

YouTube

Company summary

Pyramid scheme complaint

Expose

| IMC Review Summary | |

| Founded | 1989 |

| Registered Country/Region | Netherlands |

| Regulation | SFC |

| Products and Services | Quant Research, Trading Technology, Institutional Trading, Crypto Solutions, ETF Market Making |

| Demo Account | / |

| Customer Support | New York: 100 Park Ave, Suite 3215, New York, NY 10017, United States |

| Hong Kong: +852 (3) 658 9888, contact.hongkong@imc.com, Unit 1702, 17/F, 100 Queen's Rd Central, Hong Kong | |

| Seoul: 40F, FKI Tower, 24 Yeoui-daero, Yeongdeungpo-gu, Seoul 07320, Korea | |

Founded in 1989 in the Netherlands, IMC is a well-established, tech-driven proprietary trading and market-making company. Operating worldwide with main headquarters in New York, Hong Kong, and Seoul, it is governed by the SFC in Hong Kong. IMC emphasizes quantitative research, sophisticated trading methods, and liquidity services across more than 90 exchanges.

| Pros | Cons |

| Regulated by the SFC (Hong Kong) | Does not offer retail trading or demo accounts |

| Over 35 years of market-making and trading experience | No public trading platform like MT4/MT5 |

| Strong presence across 90+ exchanges and multiple asset classes | Limited information on account features |

IMC is a Hong Kong Securities and Futures Commission (SFC)-licensed financial company. It has a valid futures trading license (ANR402) since March 12, 2007. This status verifies IMC's Hong Kong financial regulatory compliance.

Technology-driven financial services from IMC include quantitative analysis, complex trading methods, and new technology. Artificial intelligence, machine learning, and high-performance computers help the organization compete in global financial markets.

| Product / Service | Details |

| Quant Research | Creates and optimizes trading strategies using AI and ML |

| Technology & Engineering | Automates trading and builds high-performance infrastructure |

| Trading | Applying unique trading tactics with 35 years of market expertise |

After 35 years, IMC is a trusted liquidity provider with steady pricing and deep market access on 90+ exchanges. The company provides fast, cheap quotes and customized financial solutions to equity, crypto, and ETF counterparties. IMC excels in automation-driven pricing, geographic and product coverage, and product reliability in all markets.

| Liquidity Service | Details |

| Institutional Sales | Direct, off-screen trading with IMC for buy-side firms across Europe, US, and Asia-Pacific |

| Options Wholesaling | Advanced connectivity to all OCC venues for U.S. listed options trading |

| Crypto Solutions | Global access to crypto products, including spot, perps, futures, and options |

| ETF Market Making | Lead Market Maker in over 150 U.S.-listed ETFs, supporting liquidity and efficiency |

More

User comment

2

CommentsWrite a review

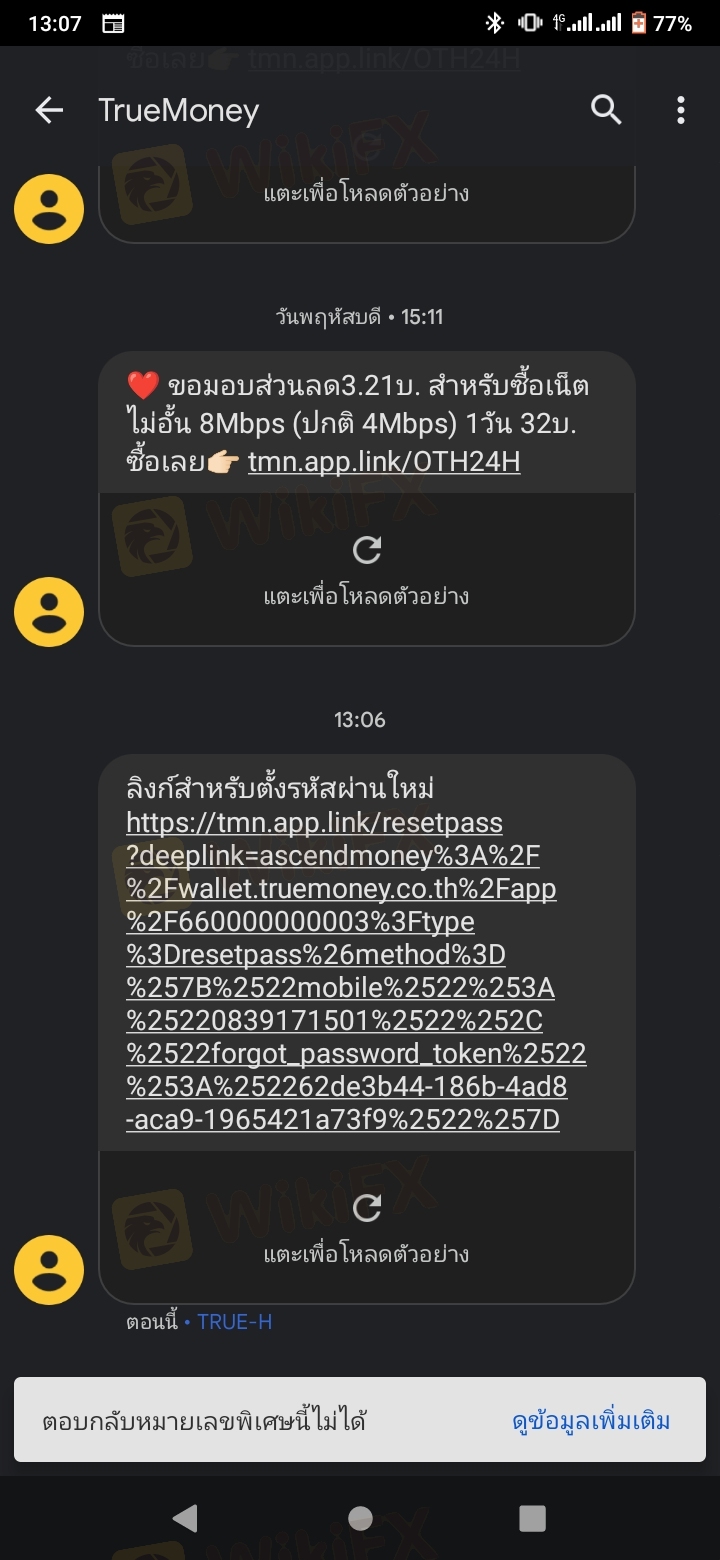

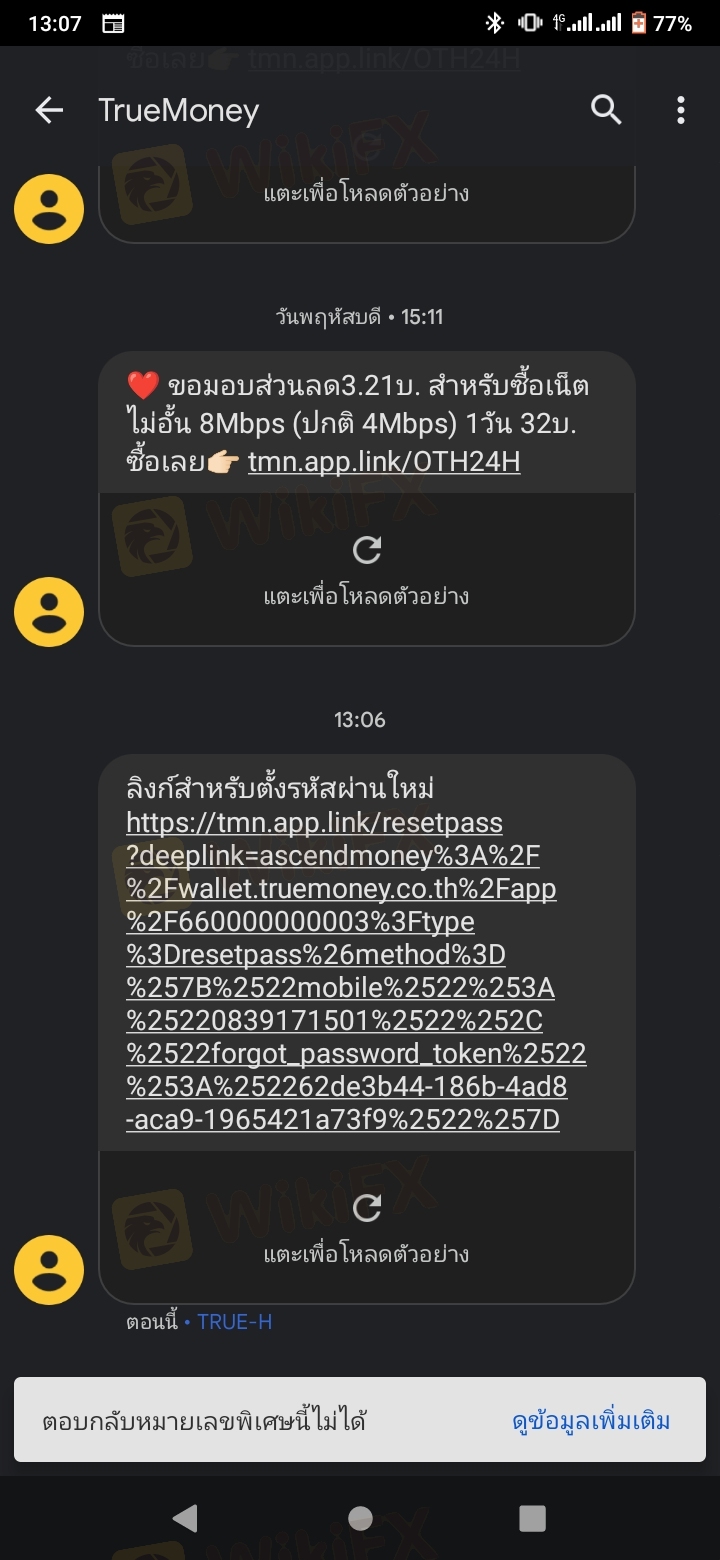

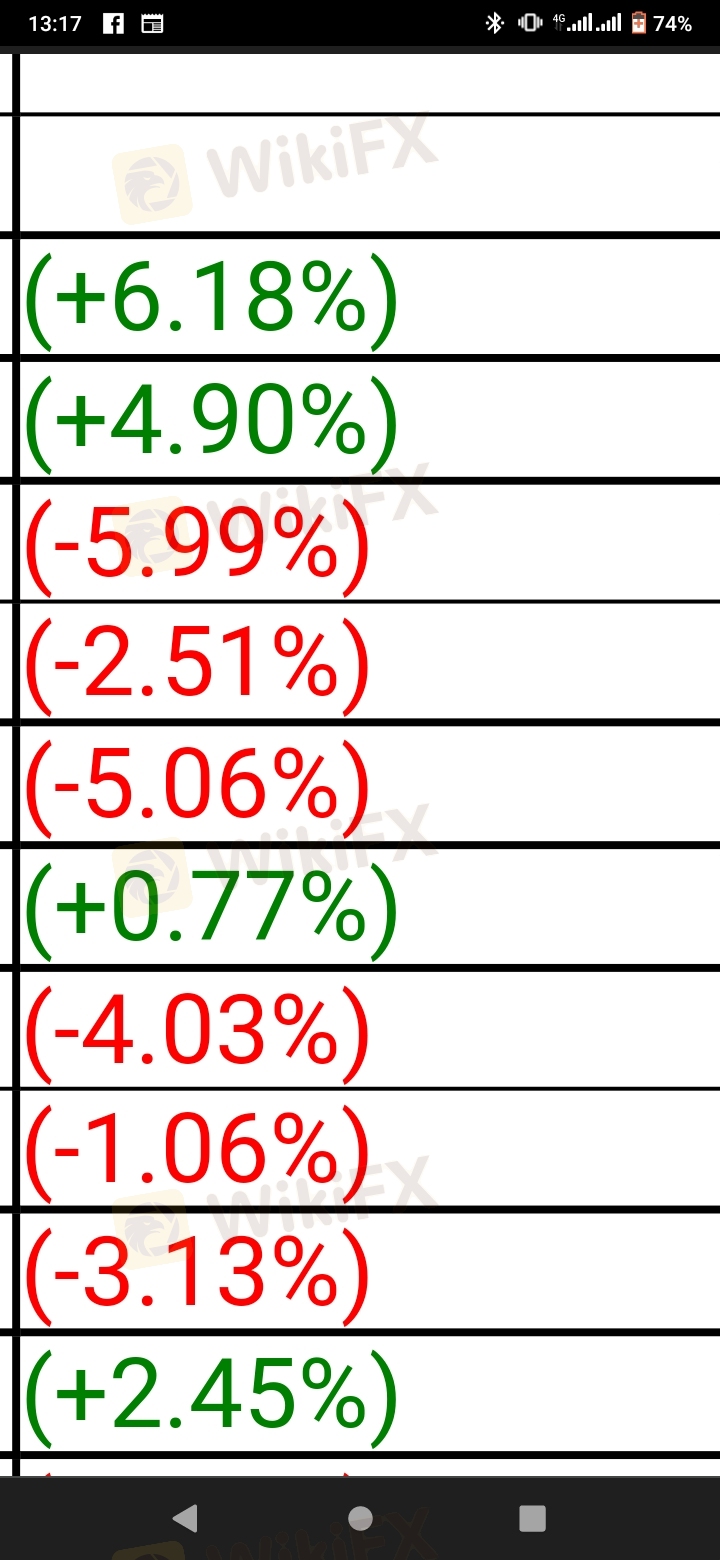

2023-01-22 12:10

2023-01-22 12:10 2022-11-23 10:32

2022-11-23 10:32