User Reviews

More

User comment

1

CommentsWrite a review

2023-12-12 19:03

2023-12-12 19:03

Score

2-5 years

2-5 yearsSuspicious Regulatory License

MT5 Full License

Regional Brokers

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index5.49

Risk Management Index0.00

Software Index7.73

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

Preferred Capital Limited

Company Abbreviation

Preferred Capital Limited

Platform registered country and region

Mauritius

Company website

Company summary

Pyramid scheme complaint

Expose

| Feature | Details |

| Registered Country | Mauritius |

| Year(s) of Establishment | Within 1 year |

| Company Name | Preferred Capital Limited |

| Regulation | No regulation |

| Minimum Deposit | $50 |

| Leverage | 1:500 |

| Min. Spreads | Variable, from 0.2 pips ( ECN account) |

| Commission | Starting from $7 per lot ( ECN account) |

| Trading Platforms | MetaTrader 5 |

| Tradable assets | Forex, Indices, Futures, Commodities, Cryptos |

| Account Types | ECN & STP ( Forex trading), Individual, Joint, Corporate |

| Demo Account | None |

| Islamic Account | Yes |

| Customer Support | Email, Whatsapp |

| Payment Methods | VISA, MasterCard, Skrill, Neteller, PayPal |

| Educational Tools | A FAQs section |

Preferred Capital Limited, a financial institution based in Mauritius, emerged in the market within the past year. Operating under the name Preferred Capital Limited, it is vital to note that the company functions without any form of regulatory oversight or formal regulation. With access to various tradable assets, including forex, indices, futures, commodities, and cryptocurrencies, clients are provided with an extensive range of opportunities to diversify their portfolios.

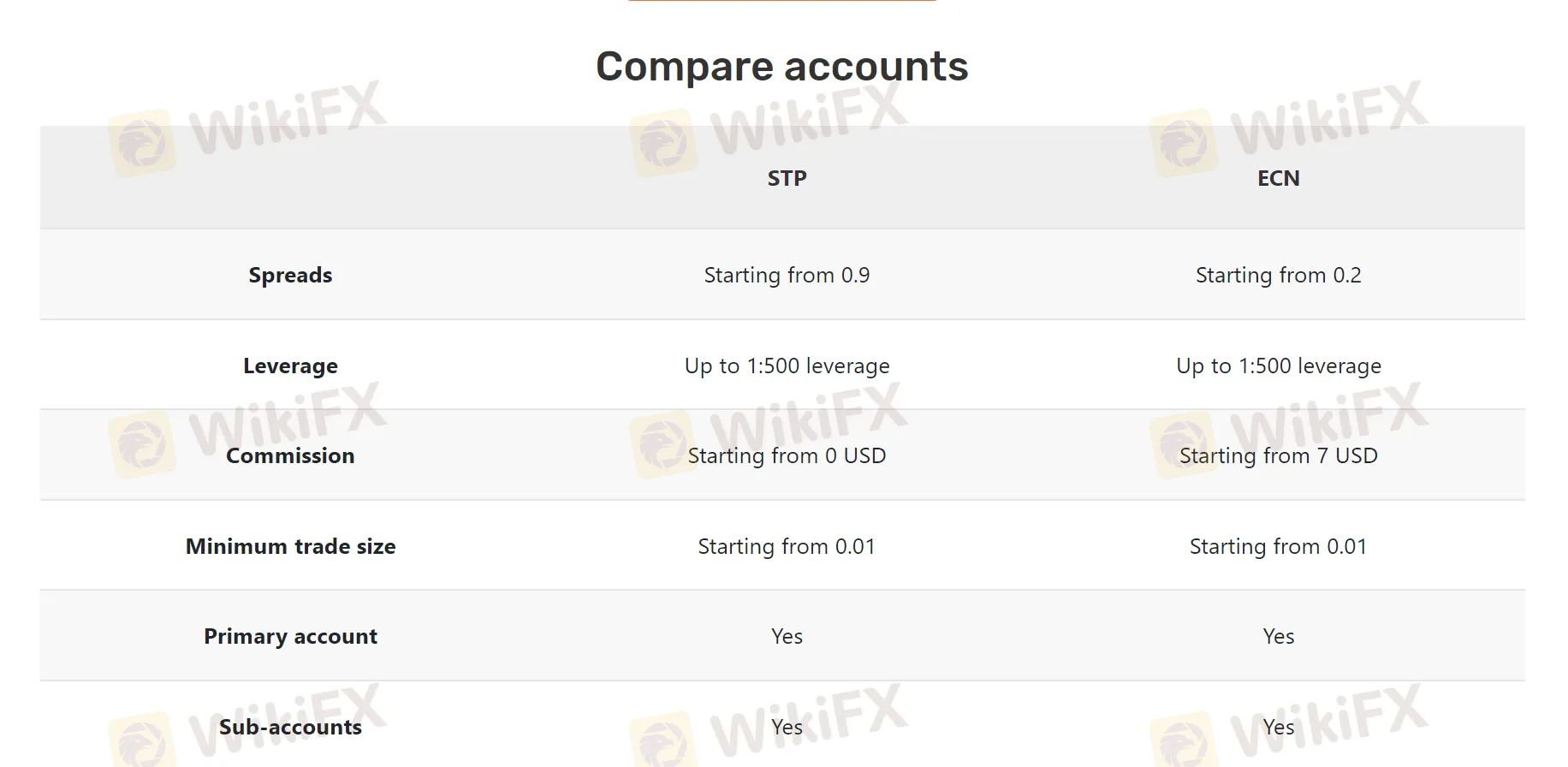

Preferred Capital Limited offers a range of account types to suit different trading preferences. The ECN and STP accounts are specifically designed for clients engaged in forex trading. Additionally, individual, joint, and corporate account options are available for traders involved in other forms of trading, offering flexibility to meet the specific needs of different clients. With a modest minimum deposit requirement of $50, Preferred Capital Limited offers clients the opportunity to engage in trading activities with a leverage of up to 1:500. This leverage allows for increased market exposure and potential returns, even with a relatively small initial investment. The minimum spreads are variable, with the ECN account option boasting spreads that can start from as low as 0.2 pips. Clients trading via the ECN account should be aware that a commission fee will be applied. Starting from $7 per lot. While Preferred Capital Limited does not provide a demo account for users to practice trading, the firm does offer an Islamic account option. This account adheres to Islamic principles and ensures that clients can engage in trading activities that align with their religious beliefs.

Preferred Capital Limited presents traders with the popular and highly regarded MetaTrader 5 trading platform. This platform provides a comprehensive suite of advanced trading tools alongside a user-friendly interface. In terms of customer support, Preferred Capital Limited provides assistance through email and Whatsapp, ensuring that clients can easily contact the firm with any inquiries or concerns they may have. Numerous payment methods, including VISA, MasterCard, Skrill, Neteller, and PayPal, are accepted to facilitate smooth transactions.

Preferred Capital Limited, a financial institution based in Mauritius, operates without any form of regulatory oversight or formal regulation. As an offshore investment firm, this lack of regulation poses significant concerns and makes it unsafe for traders to engage in transactions with this broker.

By choosing to forego regulation, Preferred Capital Limited operates in a regulatory grey zone, which significantly increases the risk for traders. Investing with a non-regulated broker like Preferred Capital Limited means that clients do not have any external body to turn to in case of disputes, fraudulent activities, or insolvency.

Here is a table featuring the distinct advantages and disadvantages of Preferred Capital Limited:

| Pros | Cons |

| Wide range of tradable assets | Lack of regulatory oversight |

| Option for Islamic accounts | New establishment, limited track record |

| Low of minimum deposit of $50 | Limited availability of demo accounts |

| Generous leverage | Sparse information on company background |

| No additional educational resources mentioned | |

| ony two types of trading accounts |

Preferred Capital Limited offers a diverse range of trading instruments across five distinct classes, including forex, indices, futures, commodities, and cryptocurrencies.

The forex market, also known as the foreign exchange market, is one of the key offerings by Preferred Capital Limited. This market allows clients to trade various currency pairs, facilitating transactions involving the buying and selling of different global currencies.

Indices represent another notable market instrument offered by Preferred Capital Limited. These indices are composed of stocks from different companies, and their performance represents the overall performance of a specific segment of the market.

Futures trading is yet another opportunity provided by Preferred Capital Limited. Futures contracts are agreements to buy or sell a particular asset at a predetermined price and date in the future.

Commodities trading encompasses a wide range of tangible goods, including agricultural products, energy resources, precious metals, and more. Preferred Capital Limited allows clients to participate in this market by trading various commodities.

Lastly, Preferred Capital Limited also provides access to the exciting world of cryptocurrencies. Cryptocurrencies have gained significant popularity in recent years, becoming an alternative investment avenue for traders seeking exposure to digital currencies like Bitcoin, Ethereum, and many others.

Preferred Capital Limited provides a variety of account types to cater to the diverse needs and preferences of their clients. For forex trading, clients can choose between two types of trading accounts: STP (Straight Through Processing) and ECN (Electronic Communication Network) accounts. In addition to the specific account types for forex trading, Preferred Capital Limited offers primary accounts and sub-accounts for other forms of trading. The primary account serves as the main trading account, while sub-accounts can be created and personalized to suit specific trading needs.

Furthermore, Preferred Capital Limited caters to a wide range of client profiles by offering different types of accounts. Individual accounts are available for traders who wish to engage in personal trading activities. Joint accounts provide an option for individuals who want to trade collectively with another party, such as a spouse or business partner. Lastly, corporate accounts are specifically tailored to meet the requirements of corporate entities, facilitating trading activities on behalf of companies or organizations.

In line with its commitment to inclusivity, Preferred Capital Limited also offers Islamic accounts for clients who adhere to Islamic principles. These accounts are designed to ensure compliance with Shariah law, which prohibits certain financial activities, such as earning interest. Islamic accounts provide an alternative for clients seeking to engage in ethical and Shariah-compliant trading practices.

Opening an account with Preferred Capital Limited involves a clear and straightforward process. Here are five key steps to highlight:

Registration: The first step is to visit the Preferred Capital Limited website and navigate to the account opening section. Clients are usually required to provide their personal information, including name, contact details, and relevant identification documents.

2. Documentation Submission: In this step, clients are required to submit specific documentation to complete the account opening process. These documents typically include proof of identity, proof of address, and any additional documentation required by the broker for regulatory purposes.

3. Verification and Approval: Once the necessary documentation has been submitted, Preferred Capital Limited will verify the provided information.

4. Account Funding: After the account has been approved, clients can proceed with funding their trading account.

Preferred Capital Limited offers clients the opportunity to trade with leverage of up to 1:500. With leverage of up to 1:500, Preferred Capital Limited provides traders with significant flexibility and an increased capacity to allocate larger positions in the market.

Here is a table showing leverage offered by this broker and another three forex brokers, FP Markets, IC Markets, and Exness, for your reference:

| Broker | Leverage Offered |

| Preferred Capital | Up to 1:500 |

| FP Markets | Up to 1:500 |

| IC Markets | Up to 1:500 |

| Exness | Up to 1:2000 |

The spreads on FX pairs offered by this broker start from a minimal 0.2 pips, while for CFDs, the spreads begin at 0.4 pips. In terms of commissions, stock trading incurs a flat fee of $3,whereas commodities trading bears a commission of $1.25. However, it is worth noting that both spreads and commissions are contingent upon the type of trading account selected. The Standard account boasts spreads beginning at 0.9 pips, imposing no additional commission charges. Conversely, the ECN account showcases spreads as low as 0.2 pips, but demands a commission that initiates from $7 per lot.

Apart from trading-related costs, it is essential to consider the non-trading fees associated with Preferred Capital Limited.

Firstly, there is a withdrawal fee that applies when clients request to withdraw funds from their trading account. This fee varies depending on the withdrawal method.

Another non-trading fee is the inactivity fee, which is imposed on dormant accounts. If an account remains inactive for an extended period, Preferred Capital Limited reserves the right to charge this fee.

In addition, there may be currency conversion fees for those traders who transact in a currency different from their account's base currency. Such fees can potentially impact the overall profitability of trades, especially for those who frequently engage in cross-currency transactions.

Furthermore, Preferred Capital Limited may charge an account maintenance fee to cover the administrative costs of managing and maintaining trading accounts.

Preferred Capital Limited provides traders with the widely acclaimed MT5 trading platform. The MT5 platform is known for its advanced features and functionality, catering to the needs of both novice and experienced traders alike.

The platform offers a user-friendly interface, allowing traders to navigate seamlessly through various trading tools and options. Moreover, the platform boasts extensive charting capabilities, providing traders with a comprehensive view of price movements and trends. Traders can access a wide range of chart types, timeframes, and technical indicators, empowering them to make informed trading decisions with greater precision and accuracy.

The MT5 platform also supports automated trading through the use of Expert Advisors (EAs). Traders can utilize and customize EAs to implement pre-determined trading strategies, execute trades automatically, and optimize their trading efficiency.

Traders can start their trading journey with a minimum deposit requirement of $50. While the specific fees and processing times associated with these transactions are not mentioned, the broker accepts payment methods such as VISA, Mastercard, Skrill, Neteller, and PayPal. However, the details regarding fees and processing times are not provided. It is important to note that the availability of funds and the speed of transactions may depend on external factors, such as the chosen payment method and the policies of financial institutions involved.

Preferred Capital Limited offers multiple customer support options to ensure that clients can easily reach out for assistance and guidance. For clients who prefer written communication, email at support@preferredlimited.com is easily available to connect with the broker's support team.

For more immediate assistance, Preferred Capital Limited provides access to customer support through messaging applications such as WhatsApp. In addition to these direct communication channels, Preferred Capital Limited maintains a presence on various social media platforms, such as Twitter, Facebook, YouTube, and Instagram.

Preferred Capital Limited provides clients with limited educational resources. A FAQs section is provided by this broker, which covers essential topics that clients may have questions about.

Based on the three aspects mentioned, lack of regulation, no demo accounts, no educational resources, and a non-user-friendly interface web trader – it can be concluded that Preferred Capital Limited may not be the most suitable choice for beginners.

Regulation is an important aspect to consider when choosing a broker, and the absence of regulation raises concerns about the credibility and security of the broker, making it potentially risky for novice traders.

Demo accounts are crucial for beginners to practice trading in a risk-free environment. The lack of demo accounts in Preferred Capital Limited means that beginners may not have the opportunity to gain hands-on experience and understand the dynamics of the market before risking their real funds.

Educational resources play a vital role in helping beginners learn the basics of trading and develop essential skills. The limited educational resources provided by Preferred Capital Limited may hinder beginners' ability to acquire the necessary knowledge and information needed for successful trading.

Additionally, a non-user-friendly interface web trader can further complicate the trading process for beginners. An intuitive and user-friendly platform is crucial for beginners to navigate easily, monitor their trades, and execute transactions efficiently. A complex or unfriendly interface can lead to confusion and frustration for novice traders.

Based on the three aspects mentioned - generous leverage, ECN accounts, and an industry-leading MT5 trading platform - it can be concluded that Preferred Capital Limited may be suitable for experienced traders.

Generous leverage offered by Preferred Capital Limited, up to 1:500, can be advantageous for experienced traders who are well-versed in managing risks and understand the implications of using high leverage.

The offering of ECN (Electronic Communication Network) accounts by Preferred Capital Limited is another attractive feature for experienced traders. ECN accounts provide direct access to liquidity providers, resulting in potentially lower spreads, faster execution, and increased transparency.

The industry-leading MT5 trading platform offered by Preferred Capital Limited is another positive factor for experienced traders. The MT5 platform is known for its advanced technical analysis tools, customizable interface, and a wide range of trading instruments. Experienced traders often rely on sophisticated charting capabilities and advanced trading features, which the MT5 platform can provide. This allows them to analyze the markets comprehensively and execute strategies efficiently.

In this case, it can be inferred that Preferred Capital Limited presents a mixed profile. While the provision of generous leverage, ECN accounts, and an industry-leading MT5 trading platform may attract experienced traders seeking advanced tools and opportunities, certain limitations warrant consideration. The absence of regulatory oversight, limited availability of demo accounts for practice, an inadequate array of educational resources, and a less intuitive user interface potentially pose challenges for beginners. Prospective clients should exercise prudence by carefully evaluating their individual trading needs and level of expertise before engaging with Preferred Capital Limited.

Q: Is Preferred Capital Limited a regulated broker?

A: No, Preferred Capital Limited is not currently regulated by any financial authority.

Q: What is the maximum leverage offered by Preferred Capital Limited?

A: Preferred Capital Limited provides generous leverage options, reaching up to 1:500.

Q: Does Preferred Capital Limited offer ECN accounts?

A: Yes, Preferred Capital Limited offers ECN accounts.

Q: What trading platform does Preferred Capital Limited offer?

A: Preferred Capital Limited offers the widely recognized and industry-leading MT5 trading platform, which includes advanced tools and features for traders.

Q: Does Preferred Capital Limited offer educational resources for traders?

A: Preferred Capital Limited's offering of educational resources is limited, only a FAQ section provided.

More

User comment

1

CommentsWrite a review

2023-12-12 19:03

2023-12-12 19:03