User Reviews

More

User comment

7

CommentsWrite a review

2024-07-18 17:45

2024-07-18 17:45

2024-06-27 18:33

2024-06-27 18:33

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Quantity 3

Exposure

Score

Regulatory Index0.00

Business Index6.32

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

MCC Markets

Company Abbreviation

MCCM

Platform registered country and region

Bahamas

Company website

Company summary

Pyramid scheme complaint

Expose

Note: MCCMs official website: https://mcc-markets.com is currently inaccessible normally.

| MCCM Review Summary | |

| Founded | 2020 |

| Registered Country/Region | Bahamas |

| Regulation | Unregulated |

| Market Instruments | Forex, Indices, Cryptocurrencies, Precious Metals, Commodities |

| Demo Account | / |

| Leverage | Up to 1:500 |

| Spread | / |

| Trading Platform | MetaTrader 5 (MT5) |

| Min Deposit | $50 |

| Customer Support | Email: cs@mcc-markets.com |

Founded in 2020, MCC Markets is a Bahamas-based unregulated financial services company. Accessible through the extensively utilized MetaTrader 5 platform, it provides Forex, indices, cryptocurrencies, precious metals, and commodities among other trading tools. Notwithstanding its range of trading choices, absence of regulatory control and inaccessibility of its website could lead problems for possible traders.

| Pros | Cons |

| Multiple trading instruments | Unregulated |

| Different account types available | Inaccessible website |

| MetaTrader 5 platform available | Limited customer support |

MCCM is unregulated. The lack of oversight means MCC Markets does not follow financial regulatory guidelines or regulations. Therefore, the company's activities, practices, and interactions are unregulated.

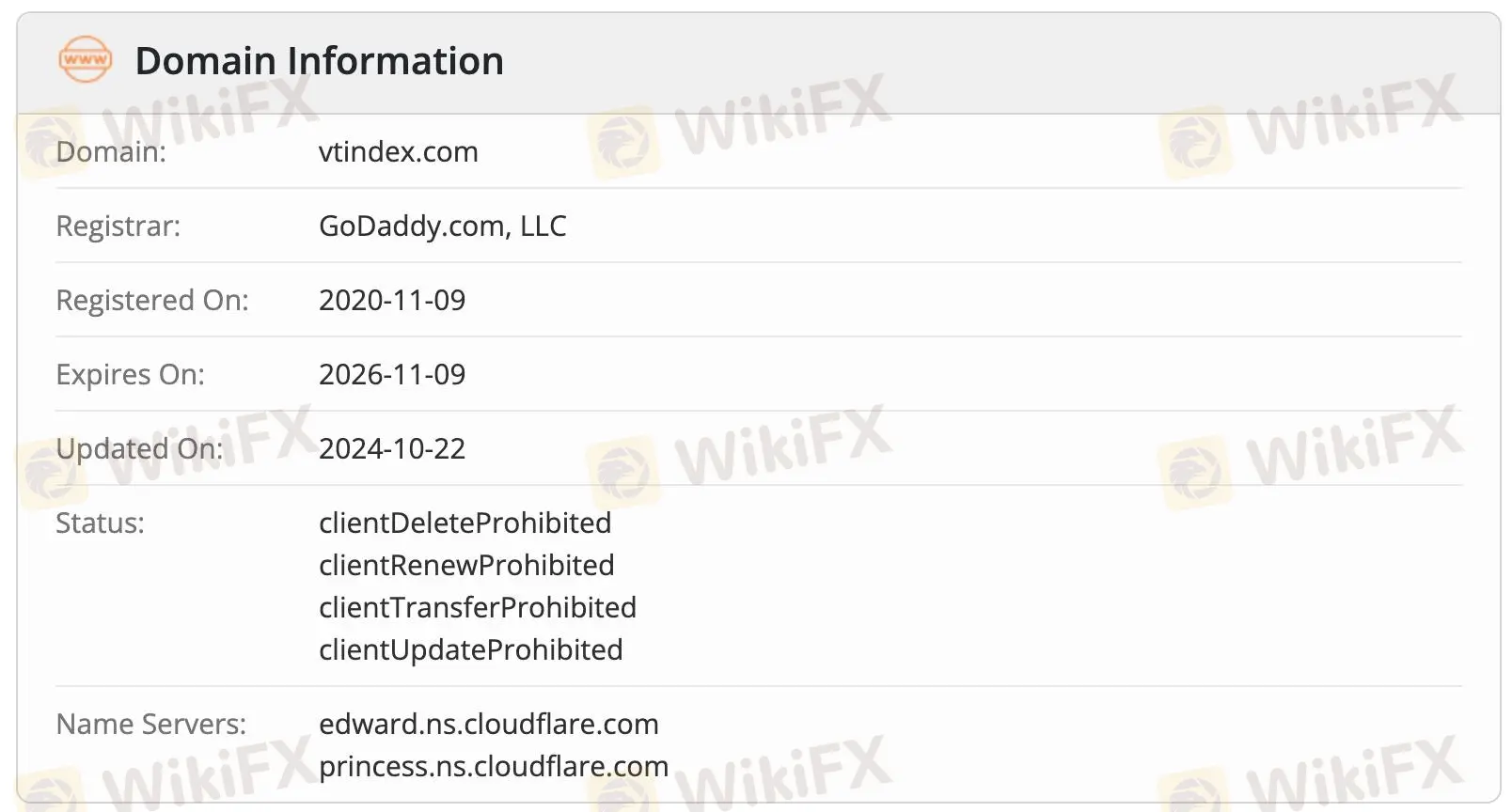

Originally registered November 9, 2020, the domain vtindex.com expires November 9, 2026. Last update date was October 22, 2024. Currently under limited state with prohibitions on deletion, renewal, transfer, and alterations. Although the domain is used actively, users interacting with the connected entity run probable risks because of insufficient control of regulations.

MCCM's trading instruments include commodities, indices, cryptocurrencies, precious metals, major, minor, and exotic currency pairs.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| Precious Metals | ✔ |

| Commodities | ✔ |

Four live trading accounts are available from MCCM: STD, STP, VIP, and ECN accounts.

| Account Type | Minimum Deposit | Maximum Leverage | Features | Suitable For |

| VIP Account | $10,000 | Up to 1:500 | Premium services, tighter spreads | Professional and institutional traders |

| ECN Account | $500 | Up to 1:500 | Direct market access, competitive spreads | Experienced traders |

| STP Account | $100 | Up to 1:30 | Straightforward trading, market execution | Intermediate traders |

| STD Account | $50 | Up to 1:30 | Basic features, accessible for beginners | Beginner traders or those with low capital |

MCCM offers leverage of up to 1:500 for Forex and a number of other instruments, opening the door to larger holdings. However, as excessive leverage can compound both benefits and losses, it highlights the importance of rigorous risk management.

| Trading Platform | Supported | Available Devices | Suitable for what kind of traders |

| MetaTrader 5 (MT5) | ✔ | Web, Desktop, Mobile Apps | Advanced tools and analysis for all traders |

| Method | Min Deposit/Withdrawal | Fees | Processing Time |

| Bank Transfer | $50 | Free | 1-3 Business Days |

| Visa/MasterCard | $50 | Free | Instant |

| Skrill/Neteller | $50 | Free | Instant |

| Tether (USDT) | $50 | Free | Instant |

More

User comment

7

CommentsWrite a review

2024-07-18 17:45

2024-07-18 17:45

2024-06-27 18:33

2024-06-27 18:33