User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Quantity 2

Exposure

Score

Regulatory Index0.00

Business Index6.96

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

PLEXECOM LLC

Company Abbreviation

Celox

Platform registered country and region

Saint Vincent and the Grenadines

Company website

X

Company summary

Pyramid scheme complaint

Expose

| CeloxReview Summary | |

| Founded | 2024-05-31 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | Unregulated |

| Market Instruments | CFDs/Forex/Cryptocurrencies/Indices/Shares/Commodities |

| Demo Account | ❌ |

| Leverage | Up to 1:200 |

| Spread | Low spreads |

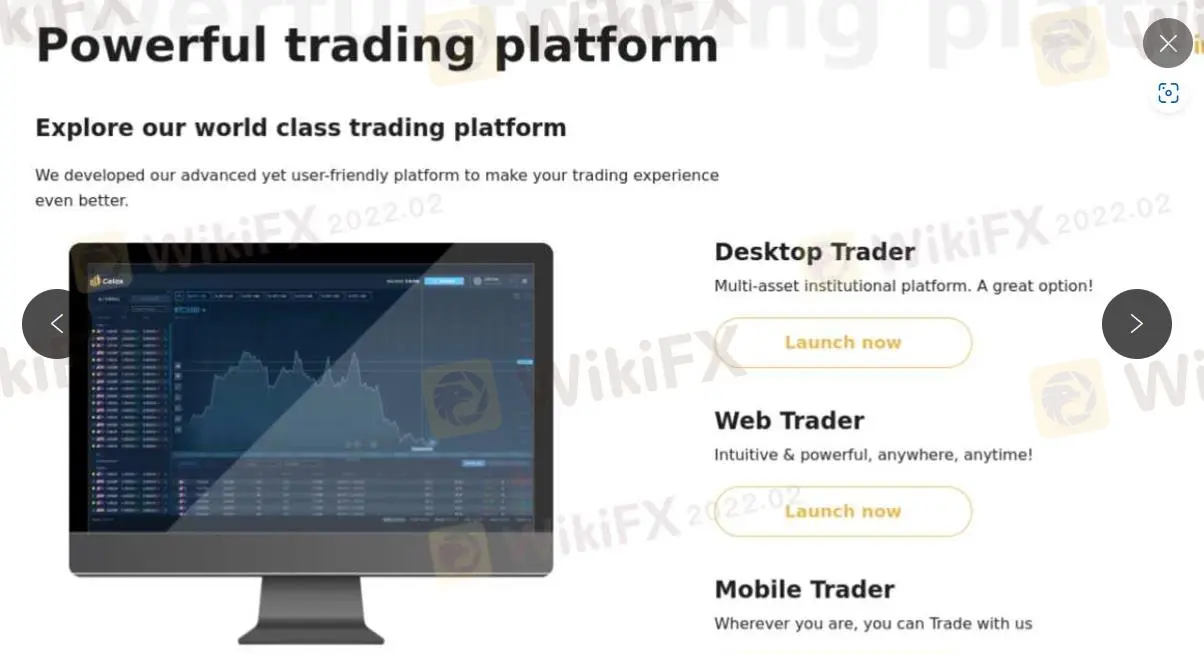

| Trading Platform | Desktop Trader/Web Trader/Mobile Trader |

| Min Deposit | / |

| Customer Support | Phone: +44 2035141442 |

| Email: support@celox.live | |

| Online chat | |

| Social Media: Facebook, Instagram, Twitter, LinkedIn | |

Celox is anunregulated broker registered in Saint Vincent and the Grenadines. The tradable instruments with a maximum leverage of 1:200 include forex, cryptocurrencies, indices, shares, commodities, and CDFs. The broker also provides 24/5 client support and free commission. Celox is still risky due to its unregulated status and negative reviews about difficulty withdrawing money.

| Pros | Cons |

| 24/5 customer support | Unregulated |

| Leverage up to 1:200 | MT4/MT5 unavailable |

| Various tradable instruments | Demo account unavailable |

| Commission free | Inaccessible official website |

| Negative reviews about difficulty withdrawing money |

Celox is not regulated, making it less safe than regulated brokers.

Traders can choose different investment directions because the broker provides forex, cryptocurrencies, indices, shares, commodities, and CDFs.

| Tradable Instruments | Supported |

| CFDs | ✔ |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| Shares | ✔ |

The commission is 0 and no hidden fees. The broker provides low spreads.

The maximum leverage is 1:200, meaning that profits and losses are magnified 200 times.

Celox provides Desktop Trader, Web Trader, and Mobile Trader. Traders can choose a convenient platform to invest.

| Trading Platform | Supported |

| Desktop Trader | ✔ |

| Web Trader | ✔ |

| Mobile Trader | ✔ |

The broker provides multiple payment methods, including Visa, Mastercard, Maestro, Wire Transfer, Bitcoin. However, due to the official website being inaccessible, transfer processing times and associated fees are unknown.

Celox provides 24/5 customer support; traders can contact the broker via phone and email.

Traders can also communicate via Facebook, Instagram, Twitter, and LinkedIn.

| Contact Options | Details |

| Phone | +44 2035141442 |

| support@celox.live | |

| Online Chat | ✔ |

| Social Media | Facebook, Instagram, Twitter, LinkedIn |

| Supported Language | English/Russian |

| Website Language | English/Russian |

| Physical Address | / |

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment