User Reviews

More

User comment

3

CommentsWrite a review

2024-10-22 09:24

2024-10-22 09:24

2024-09-17 02:39

2024-09-17 02:39

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Quantity 4

Exposure

Score

Regulatory Index0.00

Business Index5.74

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

Danger

More

Company Name

Imperial Trade

Company Abbreviation

Imperial Trade

Platform registered country and region

Spain

Company website

Company summary

Pyramid scheme complaint

Expose

Note:Imperial Trade's official website: https://imperialtrade.net is currently inaccessible normally.

| Imperial Trade Review Summary | |

| Founded | 2017 |

| Registered Country/Region | Spain |

| Regulation | Not regulated |

| Market Instruments | Indices, cryptocurrencies, metals, stocks, commodities, and CFDs |

| Demo Account | Not Mentioned |

| Leverage | Up to 1:400 |

| Spread | Starting from 0 pips |

| Trading Platform | Web Trader, Mobile Trader |

| Min Deposit | $200 |

Imperial Trade is a broker set up in 2017 in Spain, allowing many tradable assets, including indices, cryptocurrencies, metals, stocks, commodities, and CFDs. Such various account types include Basic, Pro, Master, and Elite, followed by leverage of your choice up to 1:400. Web Trader and Mobile Trader give you easy access to the platform, but it is not under any regulation.

| Pros | Cons |

|

|

|

|

|

|

Imperial Trade is not regulated by any regulatory authority.

Imperial Trade offers many trading instruments, including stock, indices, metals, cryptocurrencies, oil, multi-asset options, and CFDs on stocks.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Metals | ✔ |

| Stock | ✔ |

| Indices | ✔ |

| Cryptocurrency | ✔ |

Imperial Trade offers four account types: Basic, Pro, Master, and Elite. The table provides detailed features.

| Account Type | Minimum Deposit | Base Currencies | Spread | Leverage | Minimum Lot Size |

| Basic | 200 USD | USD, EUR | 6-60 pips | Up to 1:400 | 0.01 |

| Pro | 1,000 USD | USD, EUR | 4-50 pips | Up to 1:400 | 0.01 |

| Master | 3,000 USD | USD, EUR | 3-40 pips | Up to 1:400 | 0.01 |

| Elite | 20,000 USD | USD, EUR | 2-30 pips | Up to 1:400 | 0.01 |

Imperial Trade charges a minimum deposit of $200, which is relatively high for most investors. Information on withdrawal is not provided.

| Account Type | Minimum Deposit |

| Basic | 200 USD |

| Pro | 1,000 USD |

| Master | 3,000 USD |

| Elite | 20,000 USD |

| Trading Platform | Supported | Available Devices | Suitable for |

| Web Trader | ✔ | PC and Mobile | Investors of all experience levels |

| Mobile Trader | ✔ | PC and Mobile | Investors of all experience levels |

More

User comment

3

CommentsWrite a review

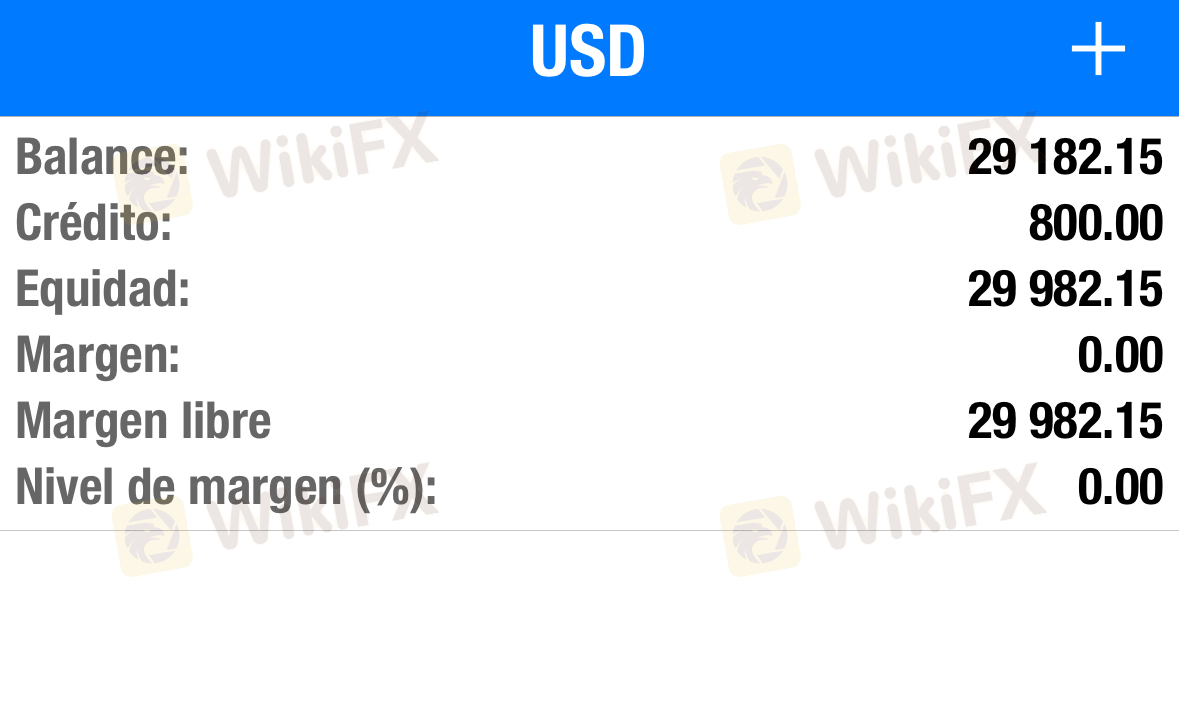

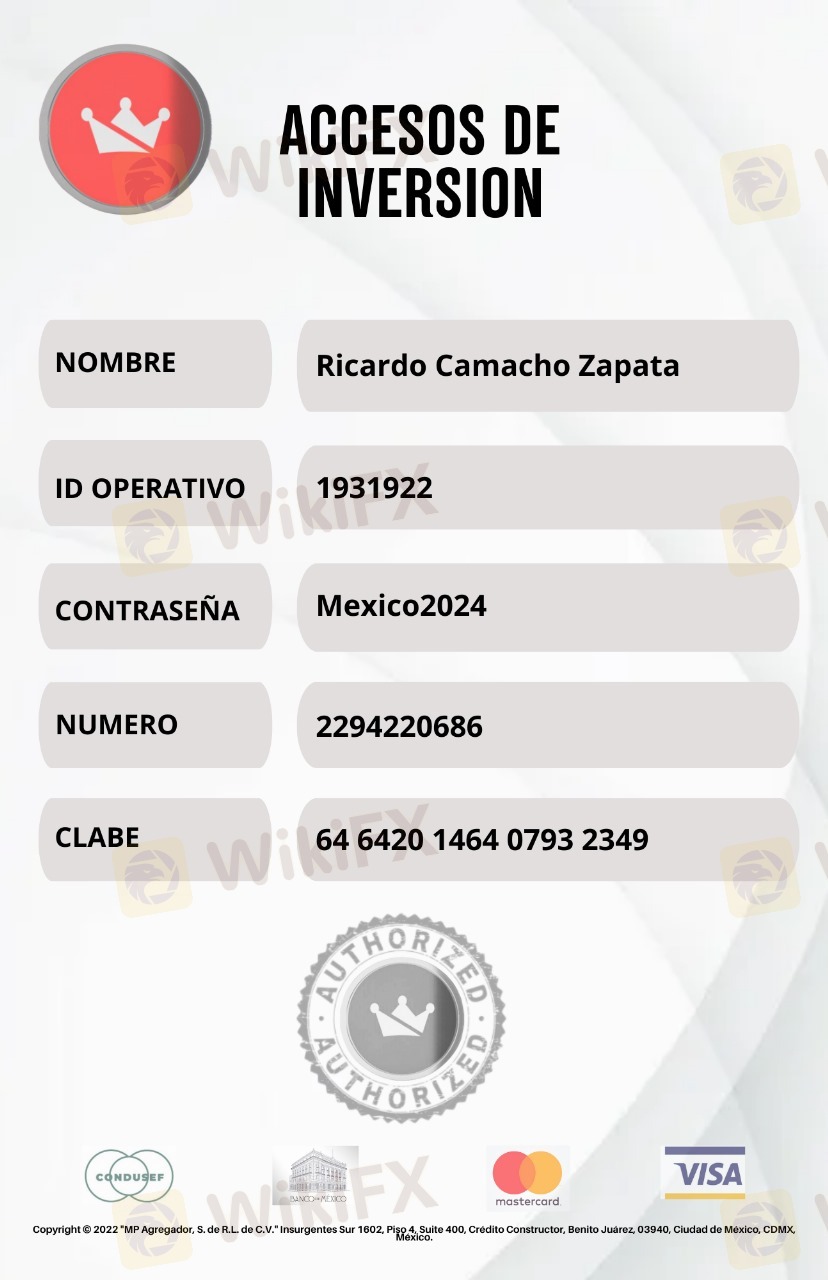

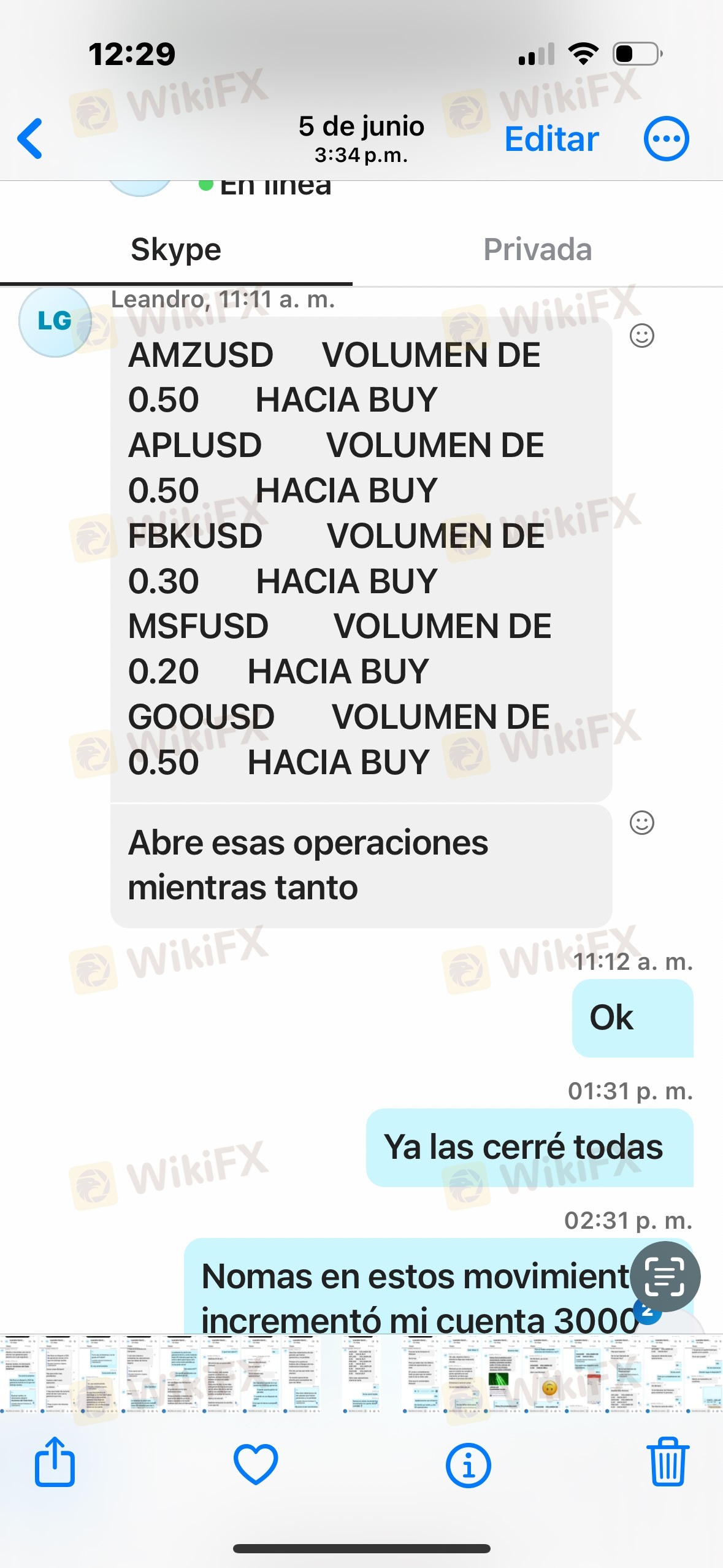

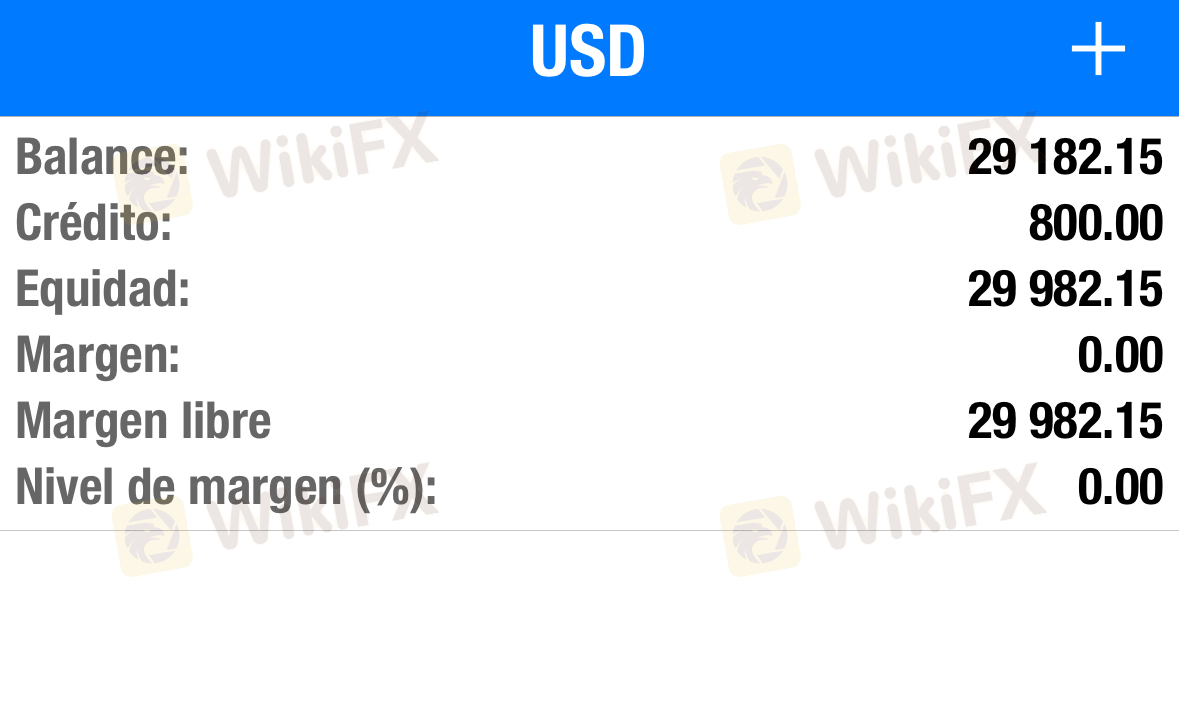

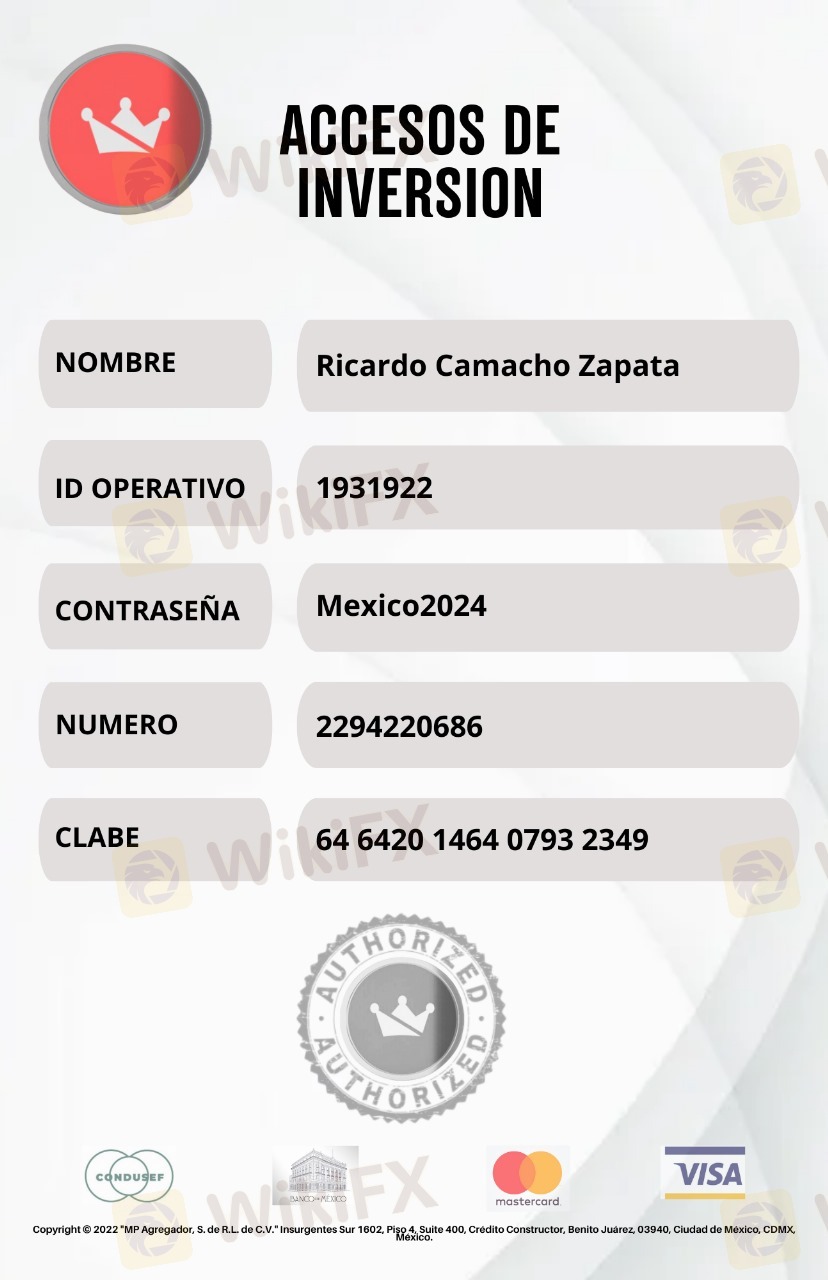

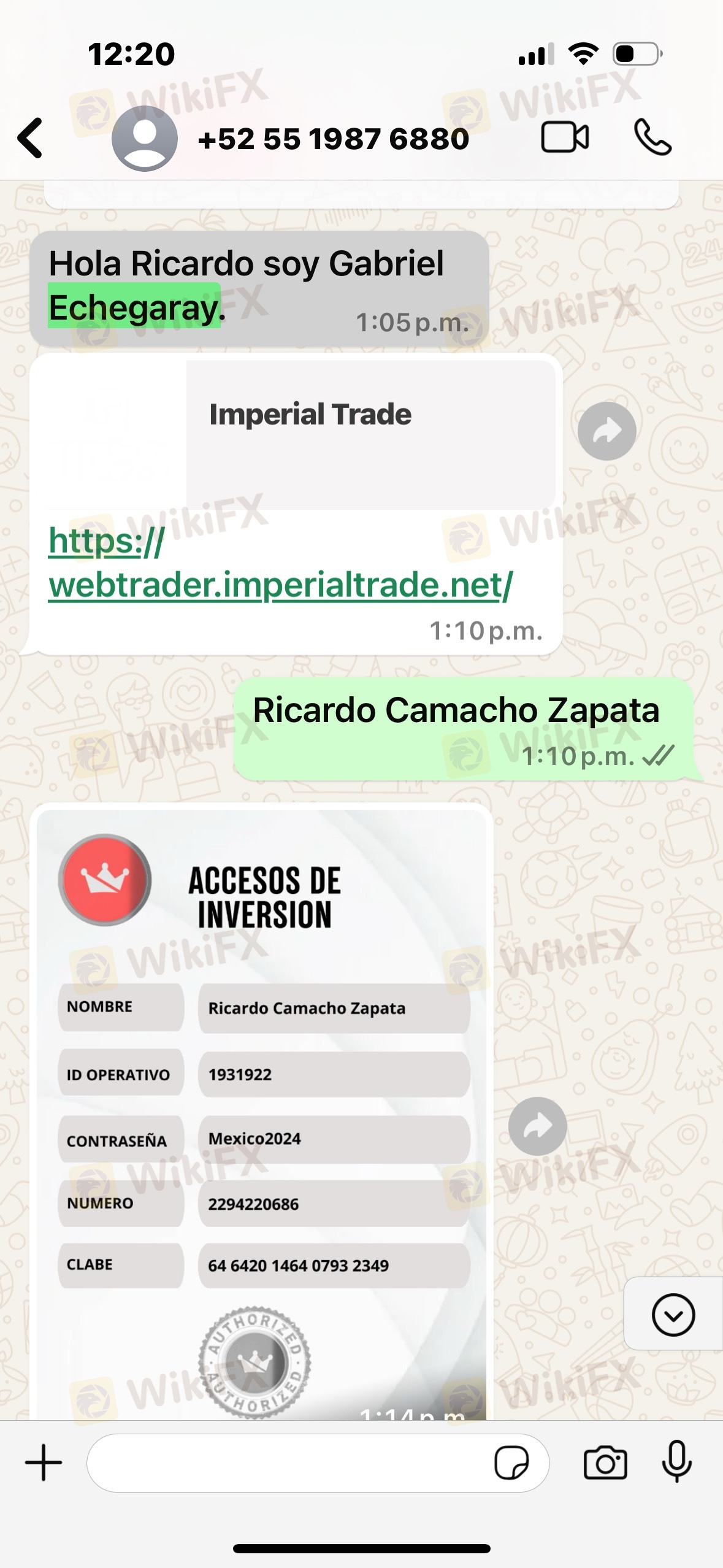

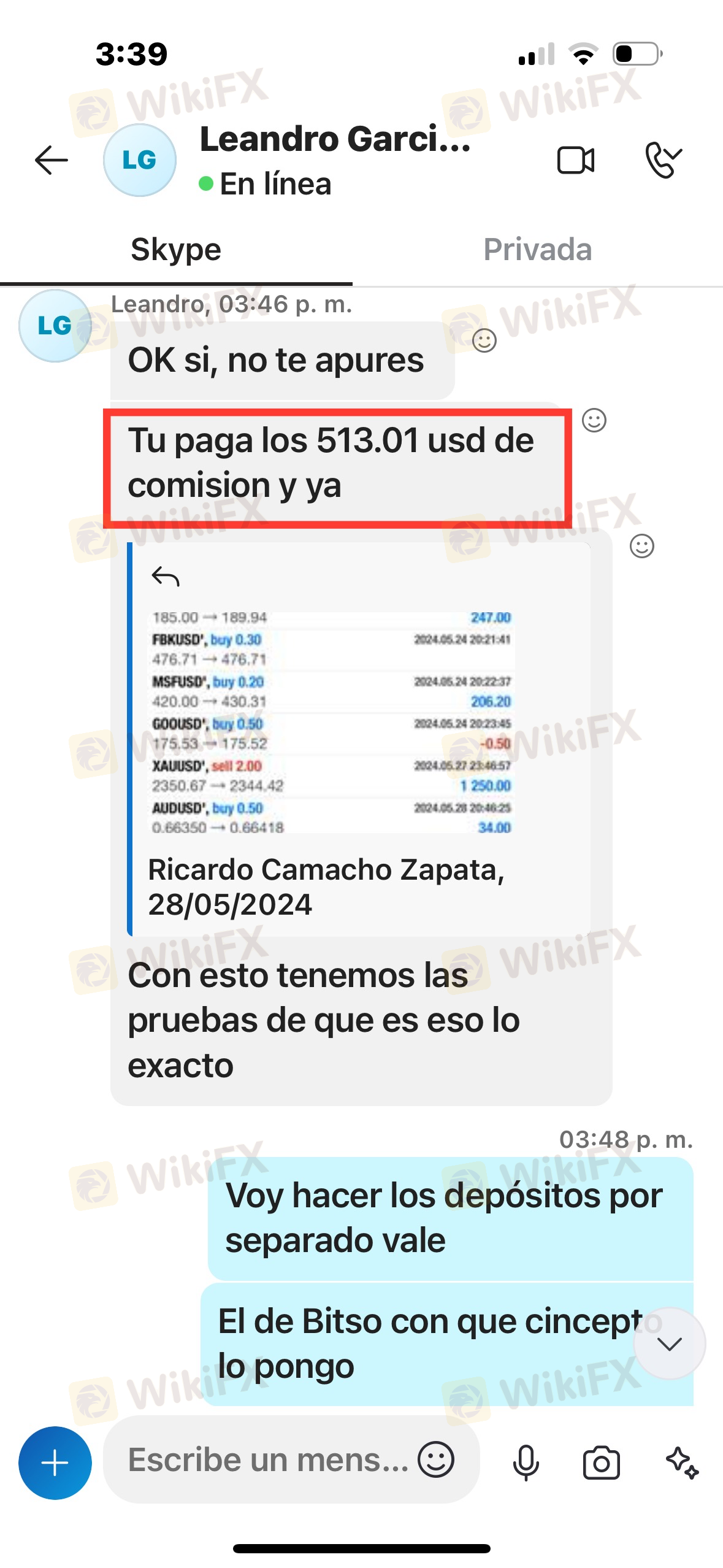

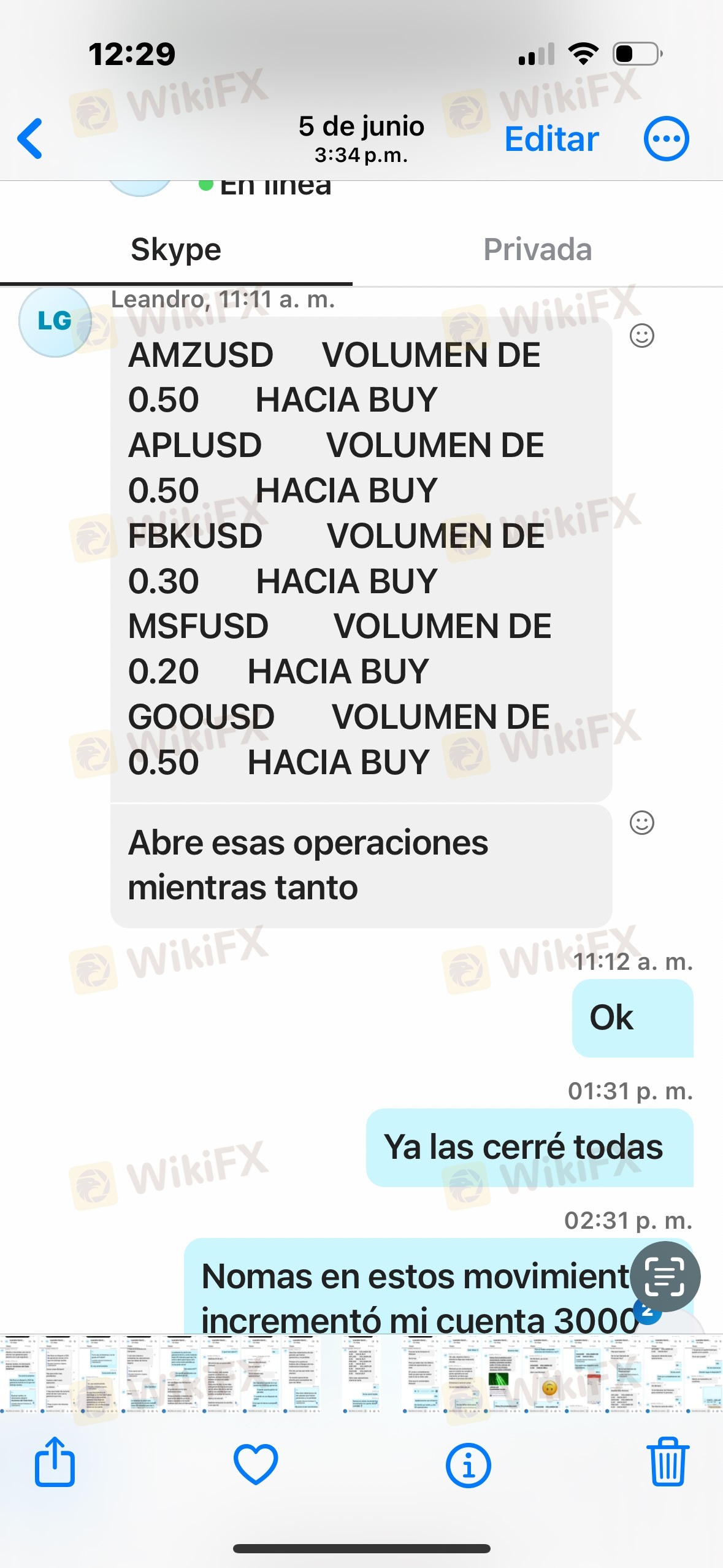

2024-10-22 09:24

2024-10-22 09:24

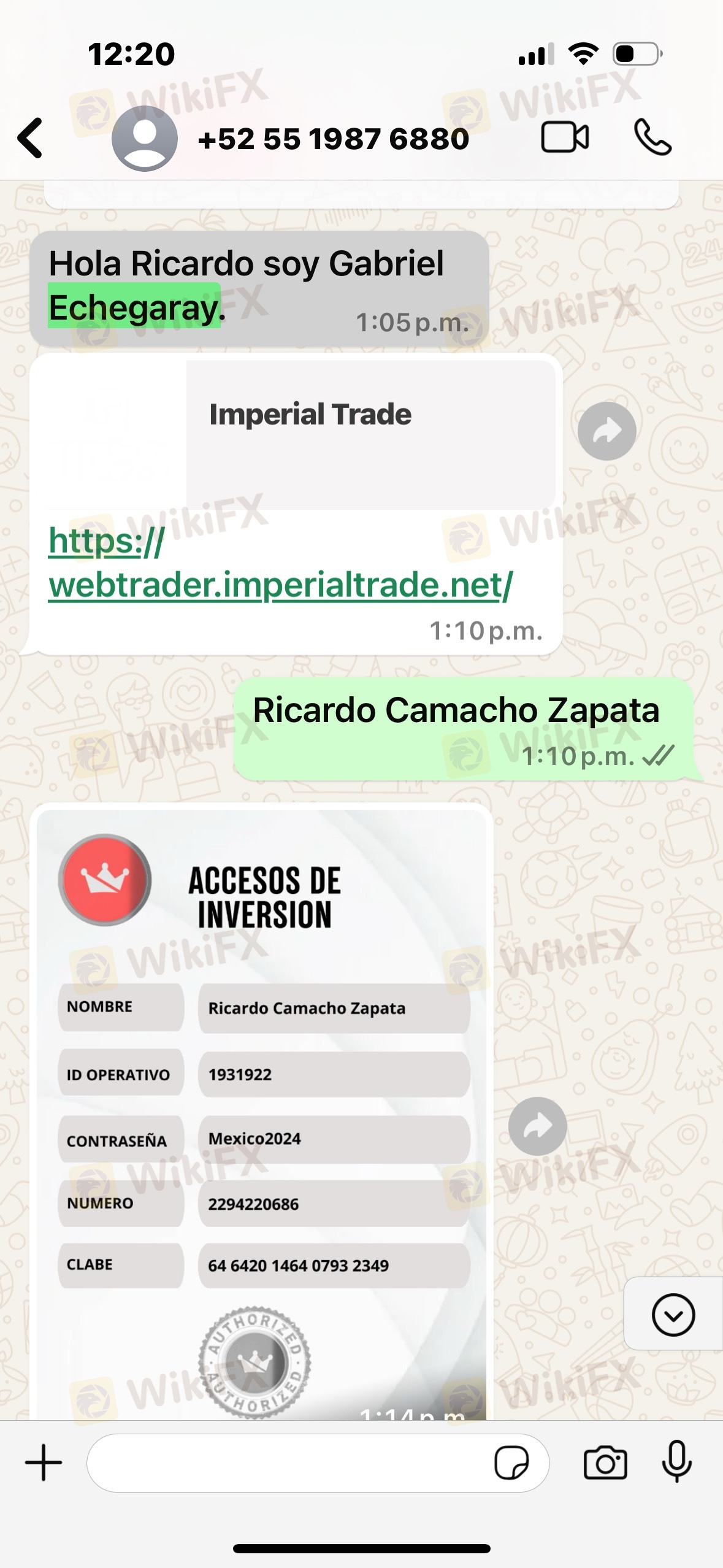

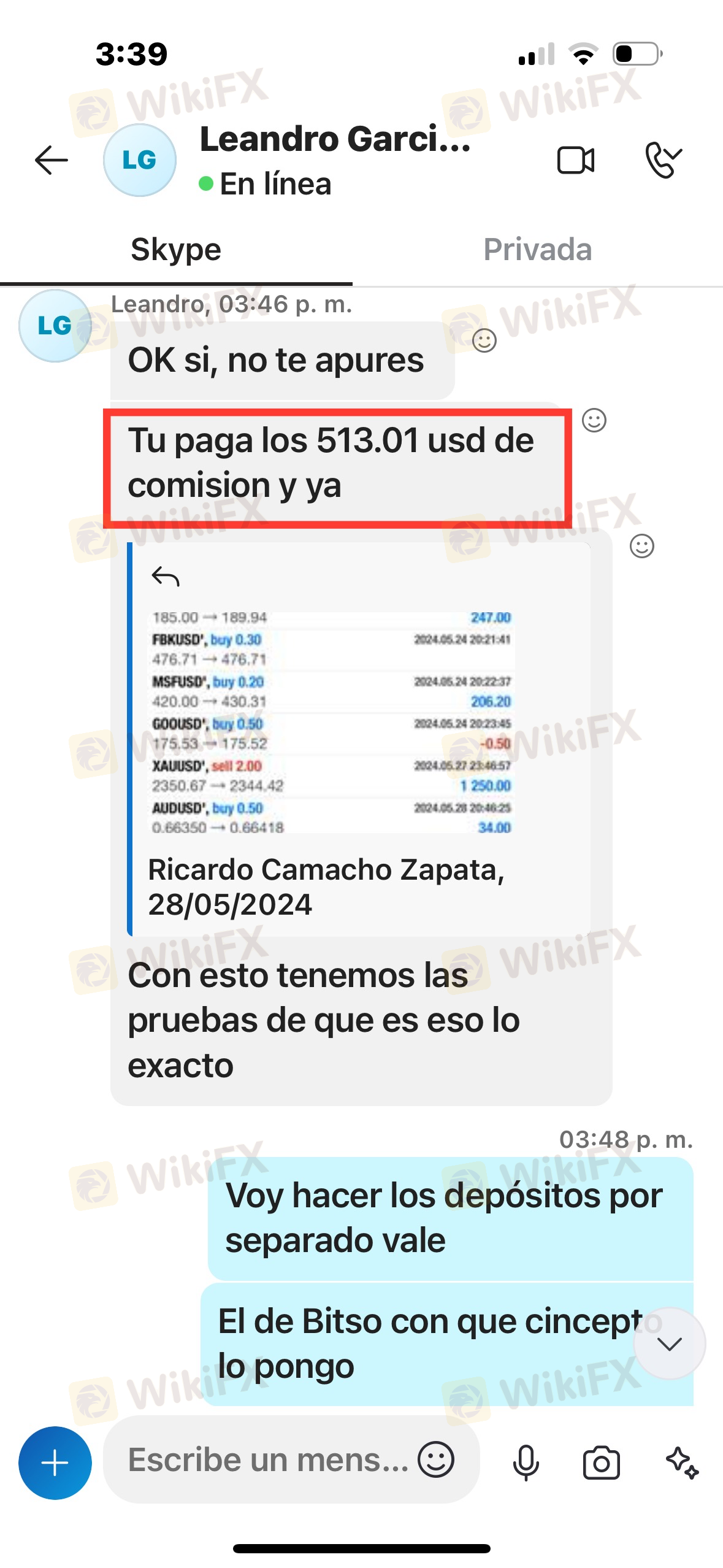

2024-09-17 02:39

2024-09-17 02:39