User Reviews

More

User comment

6

CommentsWrite a review

2024-07-25 18:26

2024-07-25 18:26

2024-06-04 14:09

2024-06-04 14:09

Score

10-15 years

10-15 yearsRegulated in Cyprus

Forex Execution License (STP)

Self-developed

Suspicious Scope of Business

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index5.50

Business Index8.00

Risk Management Index9.79

Software Index4.95

License Index5.50

Single Core

1G

40G

More

Company Name

EDR FINANCIAL LIMITED

Company Abbreviation

TrioMarkets

Platform registered country and region

Cyprus

Company website

Company summary

Pyramid scheme complaint

Expose

| TrioMarketsReview Summary | |

| Founded | 10-15 years |

| Registered Country/Region | Cyprus |

| Regulation | CYSEC (Regulated) |

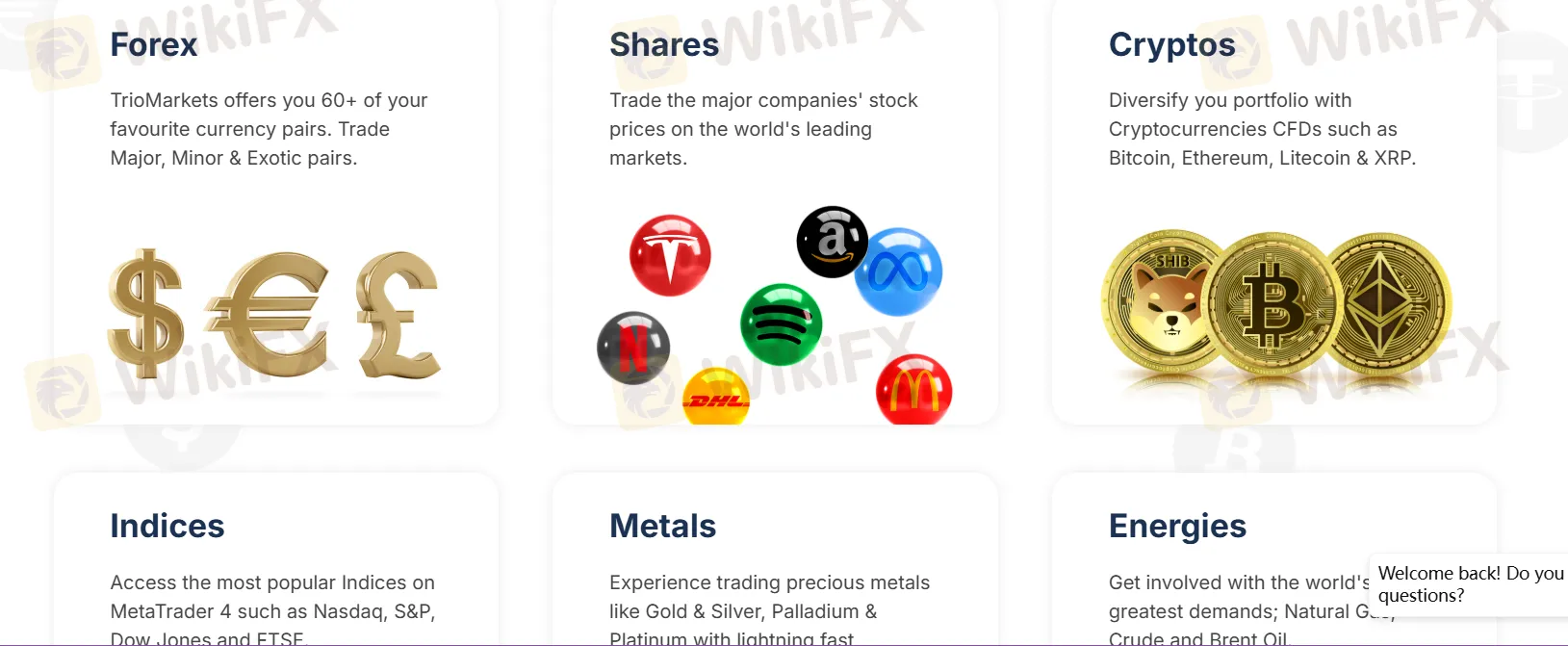

| Market Instruments | Forex, shares, cryptos, indices, metals, and energies |

| Demo Account | ❌ |

| Leverage | Up to 1:30 |

| Spread | From 0.0 pips |

| Trading Platform | MT4 |

| Minimum Deposit | $100 |

| Customer Support | Email: info@triomarkets.eu |

| Tel: +357 22 222737 | |

| Live chat | |

TrioMarkets is a broker that is registered in Cyprus. The tradable instruments with a maximum leverage of 1:30 include forex, shares, cryptos, indices, metals, and energies. The broker also provides four accounts. The minimum spread is from 0.0 pips, and the minimum deposit is $5. Although TrioMarkets is regulated by CYSEC, risks cannot be avoided completely.

| Pros | Cons |

| MT4 available | Demo account unavailable |

| 24/5 customer support | Unclear swap fee |

| Regulated | No MT5 |

| Spread as low as 0.0 pips | |

| Commission free | |

| Various tradable instruments | |

| Popular payment options |

TrioMarkets is regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 268/15, making it much safer than unregulated brokers.

| Regulated Country | Regulated Authority | Current Status | Regulated Entity | License Type | License Number |

| Cryprus | Cyprus Securities and Exchange Commission (CYSEC) | Regulated | EDR Financial Ltd | Straight Through Processing(STP) | 268/15 |

TrioMarkets offers a wide range of market instruments, including forex, shares, cryptos, indices, metals, and energies.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Indices | ✔ |

| Shares | ✔ |

| Cryptos | ✔ |

| Metals | ✔ |

| Energies | ✔ |

| Futures | ❌ |

| ETFs | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

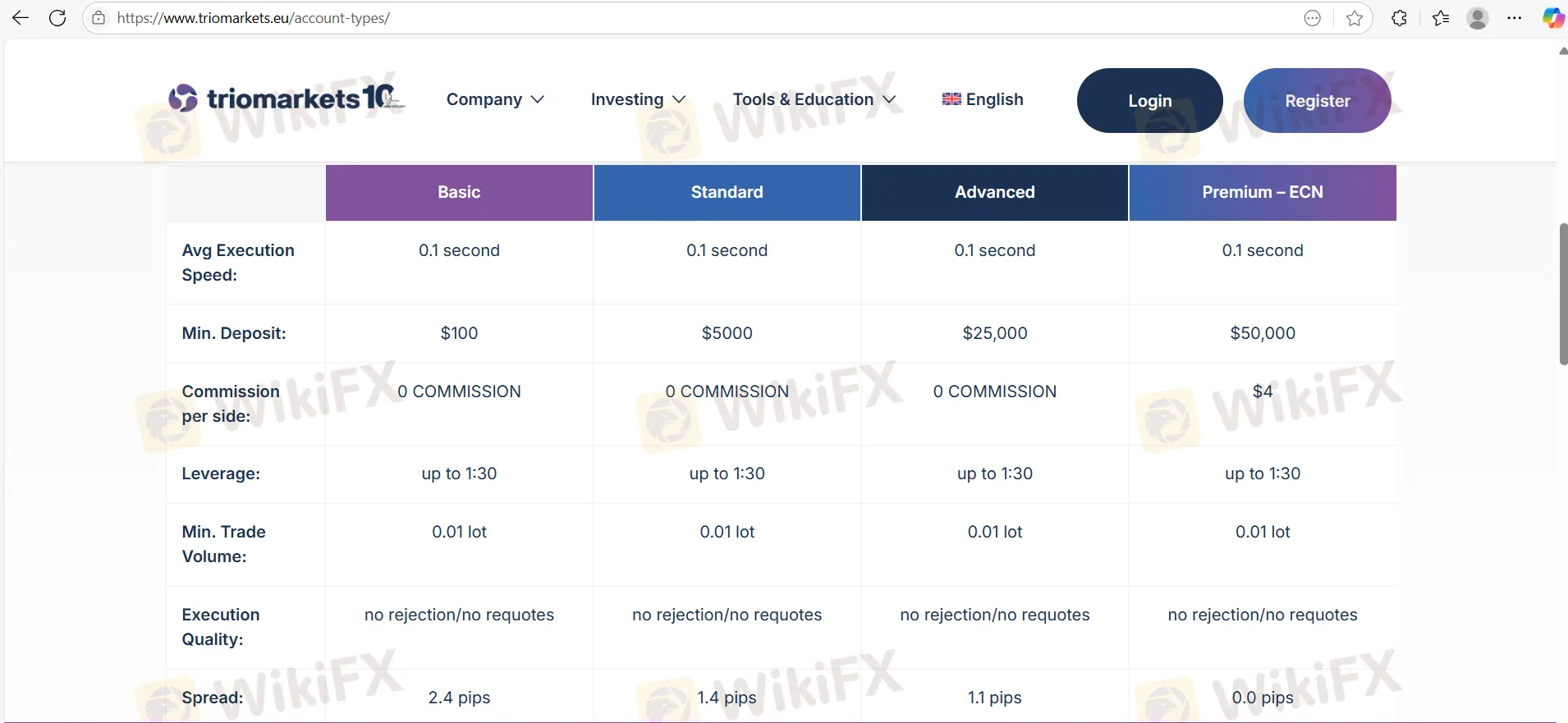

TrioMarkets has four account types: basic, standard, advanced, and premium-ECN. Traders who want low spreads and low leverage can choose a premium-ECN account, while those with a small budget can open a basic account.

| Basic | Standard | Advanced | Premium-ECN | |

| Minimum Deposit | $100 | $5000 | $25000 | $50000 |

| Leverage | Up to 1:30 | Up to 1:30 | Up to 1:30 | Up to 1:30 |

| Commission | 0 | 0 | 0 | $4 |

| Spread | 2.4 pips | 1.4 pips | 1.1 pips | 0.0 pips |

The maximum leverage is 1:30, meaning that profits and losses are magnified 30 times.

TrioMarkets cooperates with the authoritative MT4 trading platform available on PC, Mac, and mobile(Android/iPhone) to trade. Junior traders prefer MT4 over MT5. MT4 and MT5 not only provide various trading strategies but also implement EA systems.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | PC/Mac/Mobile | Begginers |

| MT5 | ❌ | / | Experienced traders |

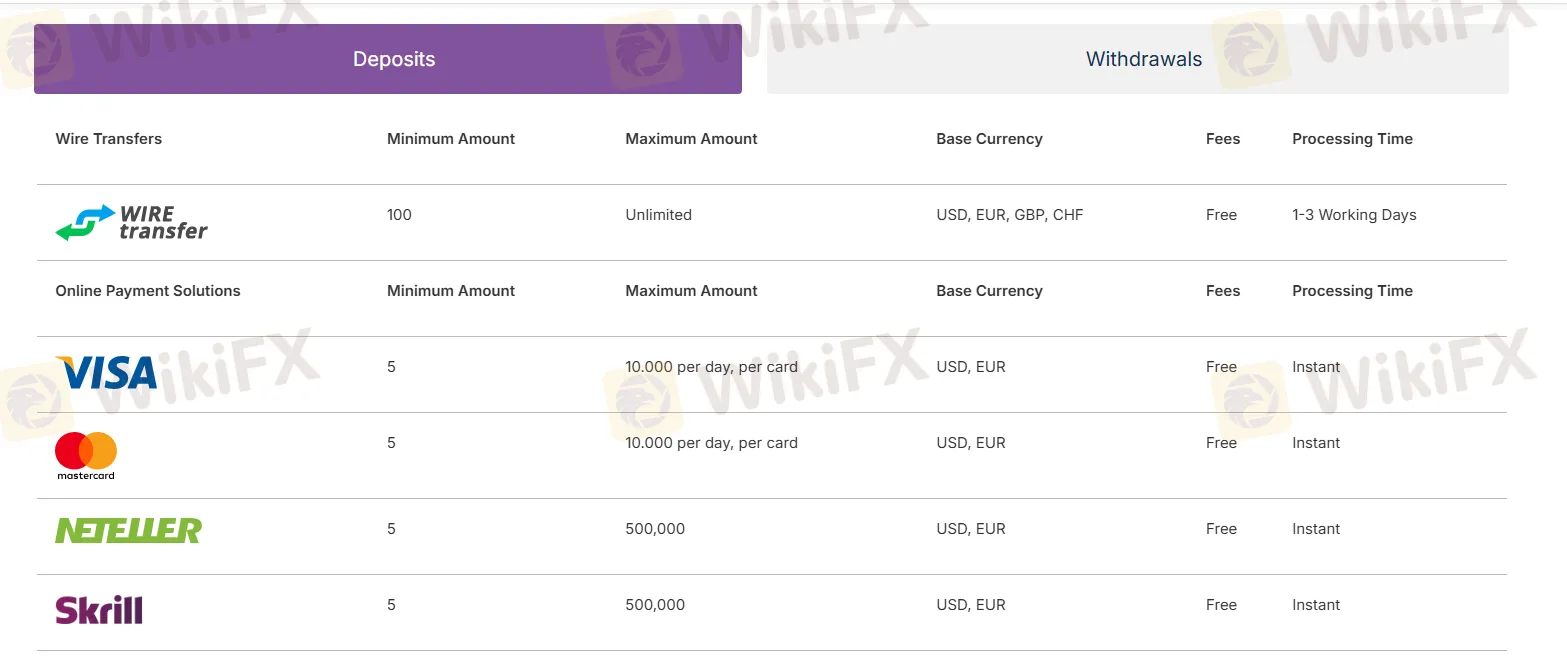

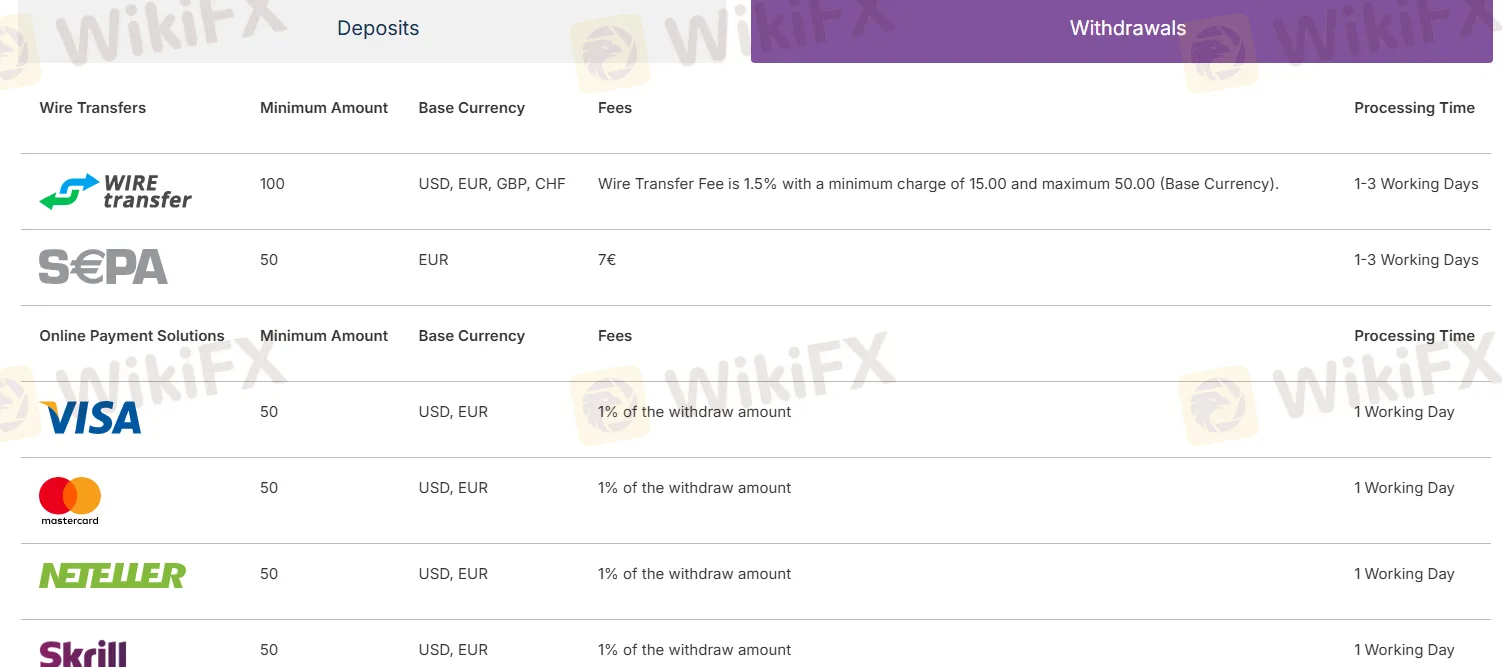

The minimum deposit is $5. TrioMarkets accepts Visa, Mastercard, Wire transfer, Neteller, Skrill, and more for deposits and withdrawals. The withdrawal process time varies depending on the type of account you have, from 24 hours to as little as 6 hours. TrioMarkets™ charges a fee of 1% of the withdrawal amount for Visa/Mastercard/Neteller/Skrill. Wire Transfer Fee is 1.5% with a minimum charge of 15.00 and a maximum of 50.00 (Base Currency).

| Deposit Options | Minimum Deposit | Base Currency | Fees | Processing Time |

| Wire transfer | 100 | USD, EUR, GBP, CHF | Free | 1-3 Working Days |

| Visa | 5 | USD, EUR | Free | Instant |

| Mastercard | 5 | USD, EUR | Free | Instant |

| Neteller | 5 | USD, EUR | Free | Instant |

| Skrill | 5 | USD, EUR | Free | Instant |

| Withdrawal Options | Minimum Withdrawal | Base Currency | Fees | Processing Time |

| Wire transfer | 100 | USD, EUR, GBP, CHF | Wire Transfer Fee is 1.5% with a minimum charge of 15.00 and a maximum of 50.00 (Base Currency). | 1-3 Working Days |

| SEPA | 50 | EUR | 7€ | 1-3 Working Days |

| Visa | 50 | USD, EUR | 1% of the withdrawal amount | Instant |

| Mastercard | 50 | USD, EUR | 1% of the withdrawal amount | Instant |

| Neteller | 50 | USD, EUR | 1% of the withdrawal amount | Instant |

| Skrill | 50 | USD, EUR | 1% of the withdrawal amount | Instant |

Have you had a terrible TrioMarkets withdrawal experience? Did the broker executive delay your fund withdrawals for days without any clear explanation? Have you found contradictions between the deposit and withdrawal experience? Lost all your profits due to the illegitimate closing of trades by TrioMarkets? You have probably made the wrong choice of a broker for forex trading! Many traders have opposed the broker on several review platforms. We have highlighted some of their comments when writing this TrioMarkets review article. Take a look!

WikiFX

WikiFX

Nigerian Professional Football League club Enyimba FC has announced a significant partnership with TrioMarkets, a retail FX and CFDs broker. This new collaboration designates TrioMarkets as the club’s official global trading partner for the 2024/25 season. The deal will see the TrioMarkets logo prominently displayed on Enyimba FC's kits and across various touchpoints.

WikiFX

WikiFX

TrioMarkets has recently appointed Natasha Kasaar as the new CEO of TrioMarkets. The new CEO has a proven track record of success in the industry and is expected to lead Trio to new heights.

WikiFX

WikiFX

More

User comment

6

CommentsWrite a review

2024-07-25 18:26

2024-07-25 18:26

2024-06-04 14:09

2024-06-04 14:09