User Reviews

More

User comment

11

CommentsWrite a review

2025-10-03 10:58

2025-10-03 10:58

2025-05-19 21:05

2025-05-19 21:05

Score

2-5 years

2-5 yearsSuspicious Regulatory License

MT5 Full License

Regional Brokers

High potential risk

Influence

Add brokers

Comparison

Quantity 2

Exposure

Score

Regulatory Index0.00

Business Index6.52

Risk Management Index0.00

Software Index7.94

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

FXLink Corp Limited

Company Abbreviation

FXLINK

Platform registered country and region

Comoros

Company website

YouTube

Company summary

Pyramid scheme complaint

Expose

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| FXLINK Review Summary in 10 Points | |

| Founded | 2020 |

| Registered Country/Region | United Kingdom |

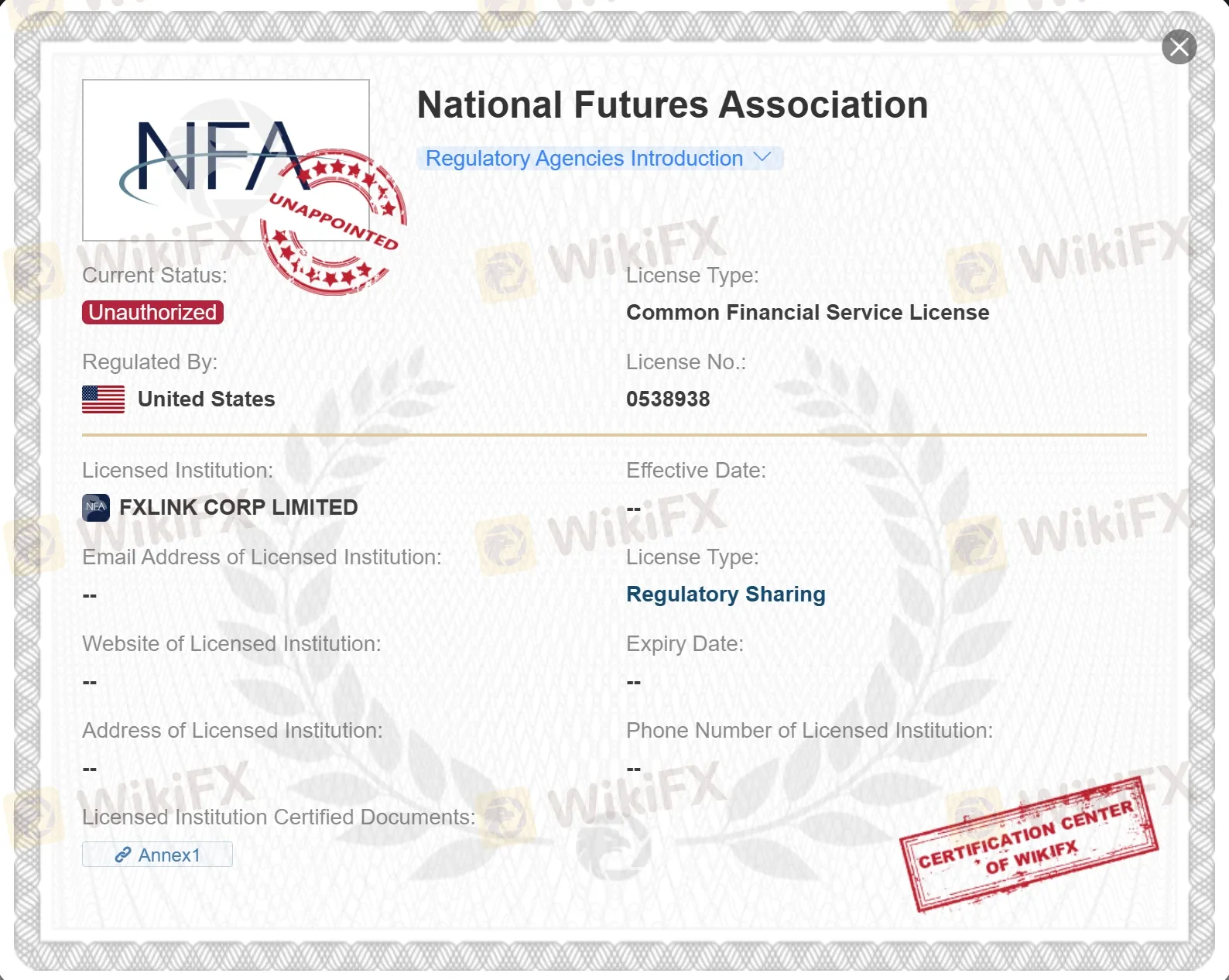

| Regulation | NFA (Unauthorized) |

| Market Instruments | Forex, Indices, US-Stocks, Precious-Metals, Energy Futures, Cryptocurrencies CFD |

| Demo Account | Available |

| Leverage | 1:5000 |

| EUR/USD Spread | From 20 points (Std) |

| Trading Platforms | MT5 |

| Minimum Deposit | $50 |

| Customer Support | 24/7 live chat |

FXLINK is a multi-asset broker registered in the United Kingdom, offering diverse trading instruments with amazing trading conditions (flexible leverage up to 1:5000, wide spreads from 20 points, low minimum deposit of $50) through the MT5 platform. However, it currently has no valid regulation. Please be aware of the risks!

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

| Pros | Cons |

| • Diverse trading instruments | • NFA license is unauthorized |

| • Demo accounts available | • Lack of industry experience |

| • Multiple account types | • Not available in all countries |

| • No commissions on some account types | • Wide spreads |

| • MT5 supported | • Limited payment options |

| • Low minimum deposit ($50) | • Leverage risks (up to 1:5000) |

| • No fees on deposit and withdrawal | |

| • 24/7 live chat support |

There are many alternative brokers to FXLINK depending on the specific needs and preferences of the trader. Some popular options include:

OctaFX: a reputable broker known for its competitive trading conditions and user-friendly platforms, making it a reliable choice for traders of all levels.

Windsor Brokers: an established broker with a strong reputation for its personalized customer service and diverse range of financial instruments, making it a preferred option for traders seeking a comprehensive trading experience.

ForexMart: offers accessible account options, free VPS hosting, and a variety of trading instruments, making it an appealing choice for both beginner and experienced traders looking for a user-friendly and feature-rich trading environment.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

FXLINK appears to be operating without valid regulation, and their United States National Futures Association (NFA, No. 0538938) license is considered unauthorized. These factors raise significant concerns about the legitimacy and safety of the company.

A lack of proper regulation means that FXLINK may not be subject to oversight and compliance with reputable financial authorities' guidelines and regulations. This could potentially expose investors to higher risks and increase the likelihood of fraudulent activities.

Given these red flags, it is crucial to exercise extreme caution when dealing with FXLINK. Investors should refrain from engaging with unregulated financial entities, as they may pose a significant risk to funds and personal information.

To ensure safety and security in your financial transactions and investments, it is recommended to work with regulated and reputable brokers or financial institutions. Always conduct thorough research, check for valid licenses, and read customer reviews before dealing with any financial service provider. Seeking advice from trusted financial professionals is also advisable to protect yourself from potential scams and fraudulent schemes.

FXLINK provides a wide range of market instruments, offering traders access to over 2,000 financial products. The Forex market is available, allowing traders to participate in currency pairs trading and take advantage of global currency fluctuations. Additionally, FXLINK offers Indices, enabling traders to speculate on the overall performance of specific market segments. US-Stocks are available for those interested in trading the shares of well-known American companies.

Precious-Metals, such as gold and silver, are offered, providing a safe-haven option for investors seeking exposure to valuable commodities. Energy Futures enable traders to engage in the energy markets, including crude oil and natural gas. Moreover, Cryptocurrencies CFDs are available, allowing traders to tap into the fast-growing digital asset space and invest in popular cryptocurrencies like Bitcoin and Ethereum.

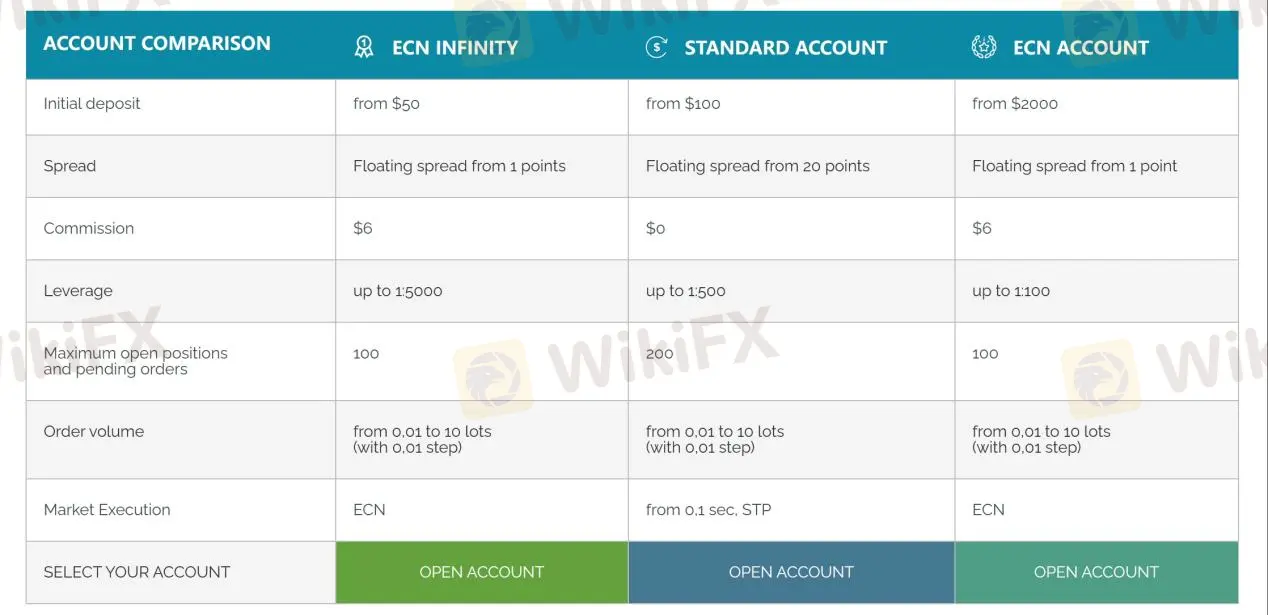

FXLINK provides traders with a range of account types to suit their trading needs and preferences. The ECN Infinity account requires a minimum deposit of $2,000 and is designed for experienced traders seeking ECN (Electronic Communication Network) execution and tighter spreads. The Standard account, with a minimum deposit of $100, is suitable for traders looking for standard trading conditions with a variety of trading instruments, including 35 currency pairs, 4 metals, and indices. The ECN account has a higher minimum deposit of $50 and offers ECN execution with competitive spreads. However, it supports a more limited range of trading instruments compared to the other accounts, including 35 currency pairs, 4 metals, and indices.

All account types come with the option to use MT4 or MT5 trading platforms, and traders can access demo accounts to practice and familiarize themselves with the platforms and the markets before engaging in live trading.

FXLINK offers varying leverage options for each of its account types, providing traders with flexibility based on their risk tolerance and trading strategies. The ECN Infinity account offers the highest leverage of 1:5000, allowing traders to access a significant amount of borrowing power for their trades. This level of leverage can amplify potential gains but also increases risk exposure, requiring prudent risk management.

The Standard account offers a leverage of 1:500, providing a balanced option for traders seeking standard trading conditions. Lastly, the ECN account provides a leverage of 1:100, suitable for traders who prefer more conservative trading with lower leverage levels.

With this range of leverage options, FXLINK aims to accommodate traders of different experience levels and trading preferences, ensuring a customized and efficient trading experience. However, it is essential for traders to understand the implications of leverage and use it responsibly to avoid excessive risk-taking.

FXLINK offers different spreads and commissions based on the account types, allowing traders to choose the most suitable option for their trading preferences. The ECN Infinity and ECN accounts boast competitive spreads, starting from as low as 1 point, providing traders with tight pricing and direct market access. These accounts do not charge any commissions, making them appealing for traders looking to avoid additional fees.

On the other hand, the Standard account features wider spreads, starting from 20 points, which may be more suitable for traders seeking standard trading conditions. The ECN account holders are subject to a commission of $6 per lot, which is a fixed cost associated with trading on this account type.

By offering these varying spreads and commission structures, FXLINK aims to cater to traders with diverse strategies and risk preferences, ensuring a comprehensive and customizable trading experience. Traders should consider both spreads and commissions when evaluating the cost of trading on different account types and choose the one that best aligns with their trading style and objectives.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| FXLINK | From 1 point (Std) | 0 (Std) |

| OctaFX | From 0.4 - 0.5 pips | 0 |

| Windsor Brokers | Typical 0.2 pips | 0 |

| ForexMart | Average 1.2 pips (Classic) | 0 (Classic) |

Note: The information presented in this table may be subject to change and it is always recommended to check with the broker's official website for the latest information on spreads and commissions.

FXLINK provides its traders with the MetaTrader 5 (MT5) platform, available across various devices for seamless and versatile trading experiences. Traders can access MT5 on desktop computers, offering a feature-rich interface with advanced charting tools, technical indicators, and automated trading capabilities through Expert Advisors (EAs). Additionally, the MT5 platform is compatible with Mac devices, catering to Apple users who want a reliable and efficient trading solution.

For traders on the go, FXLINK offers MT5 for both iOS and Android devices, empowering them to trade anytime, anywhere, with 24/7 access to the markets. The MT5 mobile app features user-friendly interfaces, real-time market data, and one-click order placement, ensuring a smooth and intuitive trading experience on smartphones and tablets.

With MT5 available on multiple platforms, FXLINK aims to provide traders with the flexibility to choose their preferred device for trading and stay connected to the markets at all times.

See the trading platform comparison table below:

| Broker | Trading Platform |

| FXLINK | MT5 |

| OctaFX | MT5 |

| Windsor Brokers | MT4 |

| ForexMart | MT4 |

FXLINK offers convenient and straightforward deposit and withdrawal options for its clients. Traders can fund their accounts using bank transfers or credit/debit cards, with no fees imposed on either deposits or withdrawals. The minimum deposit requirement to open an account is just $50.

| FXLINK | Most other | |

| Minimum Deposit | $50 | $100 |

The broker ensures a quick processing time for withdrawal requests, aiming to complete them within one working day. However, the time it takes for funds to reach the client's bank account may vary depending on the bank's policy. Bank withdrawals typically take 3-7 working days to reflect in the client's account, while credit/debit card withdrawals may take up to 8 working days.

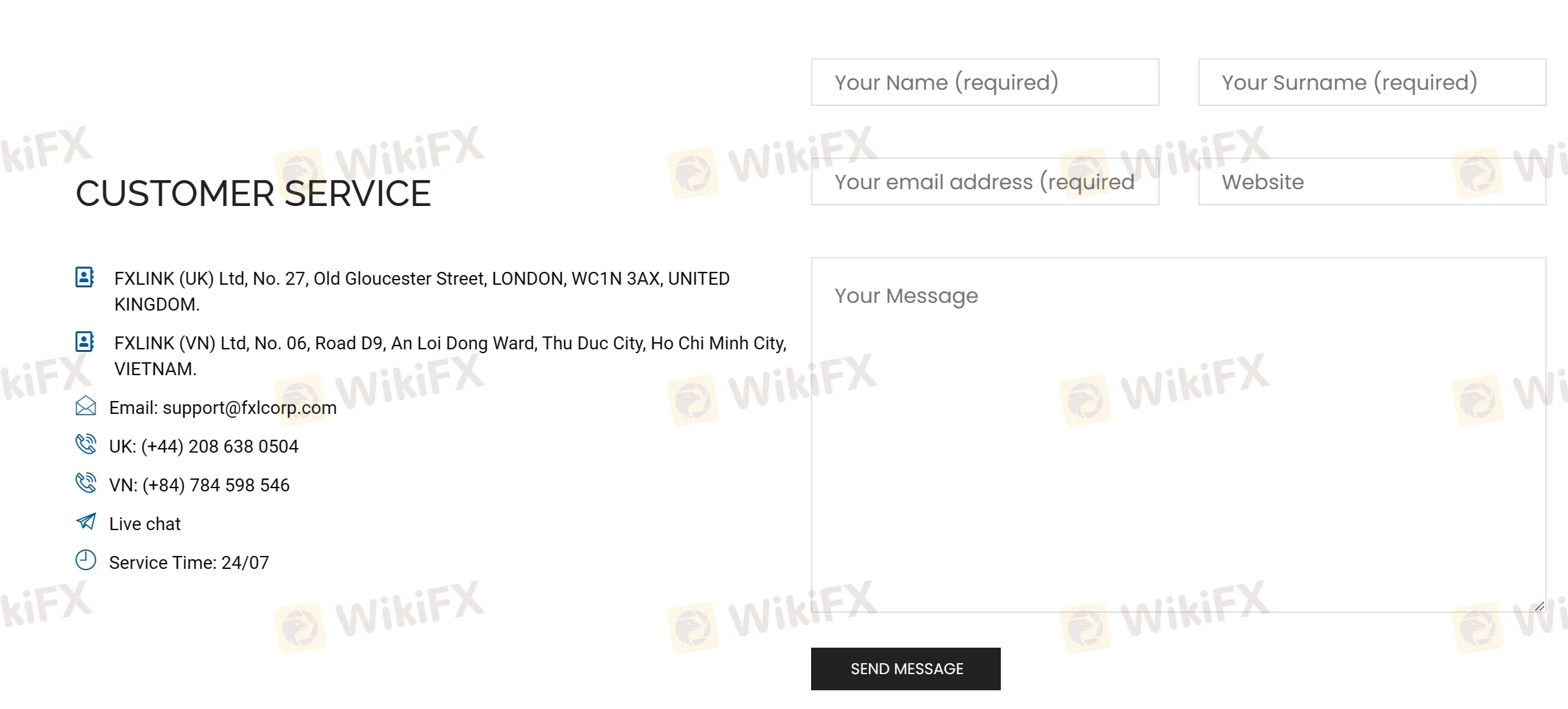

FXLINK offers a comprehensive and accessible customer service experience, providing multiple channels for traders to reach out for assistance. With 24/7 availability, the broker's customer support team is accessible through live chat and online messaging, ensuring prompt responses to queries and concerns at any time of the day or night.

Traders can also connect with FXLINK's support team via dedicated phone lines in the UK: (+44) 208 638 0504 and Vietnam: (+84) 784 598 546, providing convenient options for international clients. Additionally, support is available through email: support@fxlcorp.com, allowing for detailed inquiries and personalized assistance. Company address: FXLINK (UK) Ltd, No. 27, Old Gloucester Street, LONDON, WC1N 3AX, UNITED KINGDOM. FXLINK (VN) Ltd, No. 06, Road D9, An Loi Dong Ward, Thu Duc City, Ho Chi Minh City, VIETNAM.

The presence of an FAQ section further empowers traders to find quick answers to common questions.

Overall, FXLINK's customer service is considered reliable and responsive, with various options available for traders to seek assistance.

In conclusion, FXLINK is an unregulated forex broker that claims to offer a variety of trading instruments, including forex, cryptocurrencies, indices, stocks, and commodities with extremely high leverage up to 1:5000 and wide spreads from 20 points through the MT5 platform. Anyway, it is important to do your own research before opening an account with any forex broker.

| Q 1: | Is FXLINK regulated? |

| A 1: | No. Their United States National Futures Association (NFA, No. 0538938) is unauthorized. |

| Q 2: | At FXLINK, are there any regional restrictions for traders? |

| A 2: | Yes. The information in this content is not intended to be provided to residents of the United States, Canada, the European Union, Hong Kong, Australia, or Japan, and is not intended to be distributed or used by anyone in any country or jurisdiction area, as in the country or jurisdiction. Sending or using it will violate local laws and regulations. |

| Q 3: | Does FXLINK offer demo accounts? |

| A 3: | Yes. |

| Q 4: | Does FXLINK offer the industry leading MT4 & MT5? |

| A 4: | Yes. It supports MT5. |

| Q 5: | What is the minimum deposit for FXLINK? |

| A 5: | The minimum initial deposit to open an account is $50. |

| Q 6: | Is FXLINK a good broker for beginners? |

| A 6: | No. It is not a good choice for beginners. Though it offers wide range of trading instruments with competitive conditions and low minimum deposit through the MT5 platform, it lacks valid regulation. |

More

User comment

11

CommentsWrite a review

2025-10-03 10:58

2025-10-03 10:58

2025-05-19 21:05

2025-05-19 21:05