User Reviews

More

User comment

2

CommentsWrite a review

2023-03-23 18:14

2023-03-23 18:14

2023-02-22 11:17

2023-02-22 11:17

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Self-developed

High potential risk

Influence

Add brokers

Comparison

Quantity 2

Exposure

Score

Regulatory Index0.00

Business Index7.41

Risk Management Index0.00

Software Index4.86

License Index0.00

Single Core

1G

40G

More

Company Name

iBroker Global Markets SV, SA

Company Abbreviation

CLICKTRADE

Platform registered country and region

Spain

Company website

X

Company summary

Pyramid scheme complaint

Expose

| CLICK TRADE | Basic Information |

| Company Name | CLICK TRADE |

| Founded | 2016 |

| Headquarters | Spain |

| Regulations | Not regulated |

| Tradable Assets | Traditional equities, Forex trading, Futures contracts, CFDs on stocks, ETFs, Indices, Commodities, Cryptocurrencies |

| Account Types | Real Account, Demo Account |

| Minimum Deposit | Not specific |

| Maximum Leverage | Not specific |

| Spreads | Starting from 0 pips |

| Commission | Competitive commission |

| Deposit Methods | Not specific |

| Trading Platforms | Plataforma Web Acciones, Plataforma Web Derivados, Plataforma TradingView Derivados, Mobile Applications |

| Customer Support | Tel: 917 945 900, Email: clients@clicktrade.es |

| Education Resources | Free online trading courses, On-demand training videos, Regular webinars |

| Bonus Offerings | None |

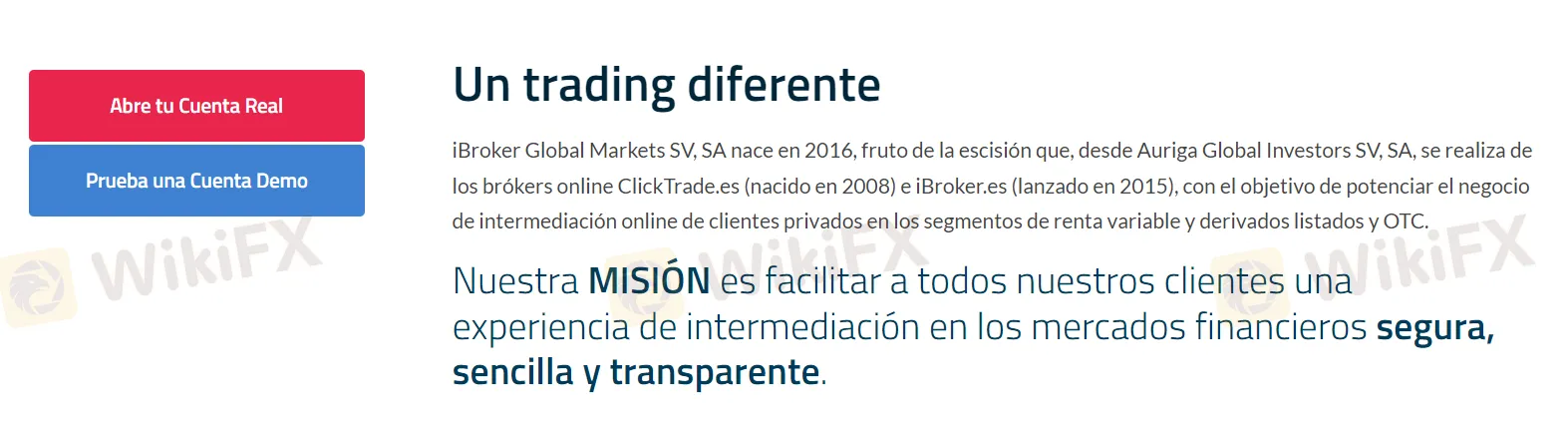

CLICK TRADE is a Spain-based financial services provider established in 2016, catering to traders with a variety of instruments including equities, Forex, and cryptocurrencies through several trading platforms, including web and mobile applications. Despite being unregulated, it provides comprehensive educational resources such as free online courses and on-demand webinars, low commissions, and customer support. The company offers both real and demo accounts, appealing to a range of traders from beginners to experienced.

CLICK TRADE is not regulated. Specifically, this broker does not have any valid regulation, which means it operates without oversight from recognized financial regulatory authorities. Traders should exercise caution and be aware of the associated risks when considering trading with an unregulated broker like PURECAPITALS, as there may be limited avenues for dispute resolution, potential safety and security concerns regarding funds, and a lack of transparency in the broker's business practices.

CLICK TRADE is recognized for its diverse trading offerings and user-friendly platforms, catering to a wide audience with varying asset preferences and experience levels. Its educational resources add significant value for traders looking to enhance their knowledge. On the flip side, the service‘s ambiguity concerning maximum leverage and minimum deposit requirements could pose challenges for traders who prefer well-defined trading parameters. Moreover, the absence of regulatory oversight is a notable concern, potentially impacting the platform's security and credibility. This combination of broad trading options and educational support, balanced with the need for more transparency and regulatory assurance, defines CLICK TRADE’s market position.

| Pros | Cons |

|

|

|

|

|

|

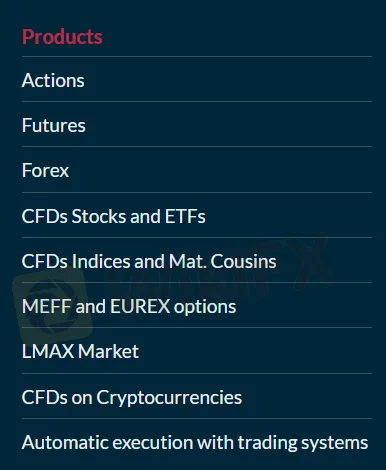

CLICK TRADE provides a comprehensive suite of trading products for diverse investment strategies. Their offerings encompass traditional equities and forex trading, as well as futures contracts. For those looking into derivatives, they offer CFDs on stocks, ETFs, indices, commodities, and cryptocurrencies. Additionally, they cater to options traders with access to MEFF and EUREX options, and they facilitate high-speed, automated trading through LMAX Market, enhancing execution efficiency for trader.

.

Here is a comparison table of trading instruments offered by different brokers:

| Broker | Forex | Metals | Crypto | CFD | Indexes | Stocks | ETFs |

| CLICK TRADE | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| LIMIT PRIME | No | Yes | Yes | Yes | Yes | Yes | No |

| Tickmill | Yes | Yes | Yes | Yes | Yes | Yes | No |

| STARTRADER | Yes | Yes | No | No | Yes | Yes | No |

Forex currency pairs offered by Click Trade include EUR, USD, JPY, cad, CHF. The average spread is said to start from 0 pips. A real-time spreads chart is displayed on the Click Trade website.

CLICK TRADE offers two main types of accounts: a “Real Account” for live trading, and a “Demo Account” for practice and simulation without financial risk.

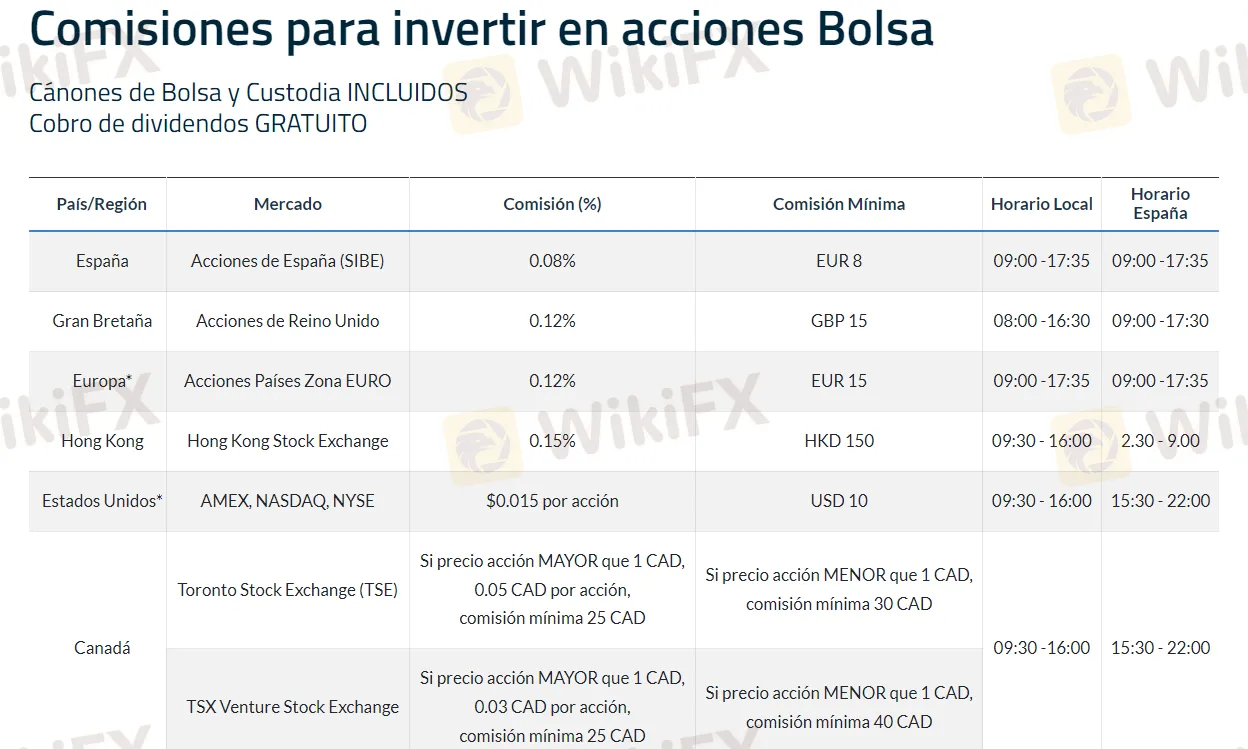

CLICK TRADE offerstrading conditions with a commission structure that varies by region and asset; for example, commissions range from 0.08% in Spain to 0.15% in Hong Kong for stock trading, and in the USA, a per-share fee of $0.015 with a minimum applies. They also offer a tiered commission for Canadian stocks based on the share price. Average spreads starting from 0 pips, suggesting tight trading costs. The comprehensive fee structure, combined with potentially low spreads, aligns with their aim to facilitate cost-effective trading for their clients.

CLICK TRADE offers sophisticated multi-device trading platforms with advanced charting capabilities. Their offerings include a web platform for stocks (Plataforma Web Acciones) that requires no downloads or installations, a web platform for derivatives (Plataforma Web Derivados) featuring free professional charts, and a TradingView integrated web platform for derivatives trading (Plataforma TradingView Derivados). They also provide Mobile Applications compatible with iPhone, iPad, and Android devices for trading on-the-go.

The customer support of CLICK TRADE is outlined as follows:

Telephone Support: Customers can reach out to CLICK TRADE for support via the phone number 917 945 900.

Email Assistance: For queries and support, customers can contact CLICK TRADE at the email address clients@clicktrade.es.

Physical Address: The company is located at Caleruega street, 102-104, Bajo A, 28033 - Madrid, providing a physical location for in-person inquiries or support.

ClickTrade offers free online trading courses, on-demand training videos, and regular webinars for educational purposes.

CLICK TRADE stands out with a broad spectrum of tradable assets and robust educational resources, appealing to traders of various interests and skill levels. The accessibility of its trading platforms is a significant advantage, enhancing user experience. However, the lack of clarity on financial prerequisites such as minimum deposit and maximum leverage, combined with the absence of regulatory oversight, are considerable disadvantages that could affect the platform's trustworthiness and the risk assessment for potential users. Overall, while CLICK TRADE offers comprehensive trading tools and learning opportunities, prospective clients must weigh these benefits against the risks associated with its regulatory status and account transparency.

Q: What kinds of financial instruments can I trade with CLICK TRADE?

A: You have access to a wide array of options including traditional stocks, forex, futures, CFDs, ETFs, indices, commodities, and cryptocurrencies with CLICK TRADE.

Q: Is there an educational support system for new traders at CLICK TRADE?

A: Yes, CLICK TRADE provides a suite of educational tools, such as complimentary online trading courses, video tutorials on demand, and regular webinars to support both novice and experienced traders.

Q: What types of accounts does CLICK TRADE offer?

A: Clients can choose between a live trading account for real transactions and a demo account for practice and learning without financial risk.

Q: How can I get in touch with CLICK TRADE's customer service?

A: The customer support team at CLICK TRADE can be reached via telephone at 917 945 900 or through email at clients@clicktrade.es for any inquiries or assistance needed.

Q: What platforms can I use to place trades with CLICK TRADE?

A: The company has several trading platforms, including a web platform for stocks, another for derivatives, TradingView integration for advanced charting, as well as mobile applications for trading on the go.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

More

User comment

2

CommentsWrite a review

2023-03-23 18:14

2023-03-23 18:14

2023-02-22 11:17

2023-02-22 11:17